Here’s A General Overview

Business vehicles are cars, SUVs and pickup trucks that are used for business activities.

What does not qualify:

- Vehicles used as equipment, such as dump trucks

- Vehicles used for hire, such as taxi cabs or airport transport vans

Luxury Autos

Congress decided years ago that the taxpayers should not subsidize extravagant vehicles used by business. To prevent that, the law squeezes otherwise allowable depreciation deductions for luxury cars. But dont think Rolls Royce or Ferrari. Congress has a much less extravagant view of luxury.

For new and pre-owned vehicles put into use in 2022 :

- The maximum first-year depreciation write-off is $11,200, plus up to an additional $8,000 in bonus depreciation.

- For SUVs with loaded vehicle weights over 6,000 pounds, but no more than 14,000 pounds, 100% of the cost can be expensed using bonus depreciation in 2022.

Writing Off Car Loan Interest With The Standard Mileage Method

If you choose to take the standard mileage deduction, you can’t take any vehicle expenses as a separate write-off.

Instead, all of these write-offs are included in a standard mileage rate set by the IRS. You’ll get to write off that amount for every business mile you drive.

To use this method, you’ll need to keep good records for your business mileage using a mileage log. Pro tip: Commuting miles don’t count. For more information, check out our post on business vs. commuting miles!

Keep in mind that, with this method, there are some costs that aren’t included in the standard mileage rate: parking fees, tolls, DMV fees, and even car washes. That means you’ll still have to do some expense tracking, using Keeper or a manual expense-organizing system.

Here’s an example of how the standard mileage rate method works. Pretend I’m a self-employed personal shopper who has to visit clients for styling appointments.

For all these client visits, I racked up 5,000 miles in a year. To calculate my write-off, I take 5,000 and multiply it by the IRS standard mileage rate of $0.56. That yields a tax deduction of $2,800.

Who should use the standard mileage method?

In general, the standard mileage rate is the best method for writing off car expenses if you do a whole lot of driving for work. If you’re a more typical freelancer â and especially if you work out of a home office â taking actual expenses is likely to save you more on your tax bill.

Section 179 Deductions And Depreciation

Section 179 deductions work like depreciation. The purpose of depreciation is to spread the expense of owning a business asset like a car or truck over the life of that asset.

Normally, depreciation is deducted as an expense to the business over the life of the equipment or vehicle. But a section 179 deduction allows you to take more of the expense of the purchase in the first year.

You May Like: What Is A Classic Car

Should The Company Pay For Vehicle Repairs

An employee states that he needed to replace his car’s shocks due to constantly transporting materials to various events often. Due to this he’s looking for us to pay for the parts. Is this company responsible? The car is older and we know he has many other non work activity that he uses his vehicle to handle.

How To Write Off A Car Lease In Your Business

by Ryan Lasker |Updated Aug. 5, 2022 – First published on May 18, 2022

Image source: Getty Images

Ill leave it to the financiers at The Motley Fool to tell you whether youre better off leasing or buying a car. But regardless of how you got the keys in your hand, you can take a deduction for the business use of your car.

You May Like: How To Fix Car Mirror

How To Get A Section 179 Deduction For Buying A Business Vehicle

You can write off part or all of the purchase price of a new or “new to you” car or truck for your business by taking a section 179 deduction. This special deduction allows you to deduct up to the entire cost of the vehicle in the first year you use it if you are using it primarily for business purposes.

How To Buy A Car Under An Llc

Ready for your LLC to buy a car? Follow the steps outlined below:

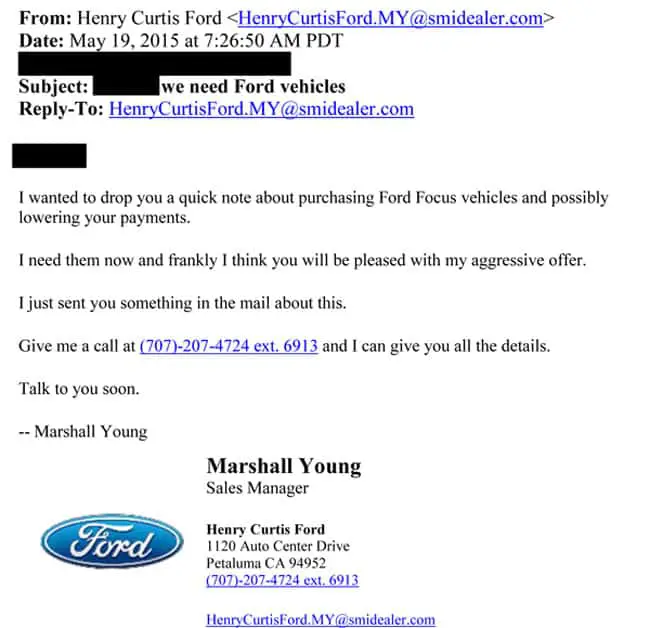

When an LLC purchases a car, the LLC must make all related payments. To establish a business bank account, youll likely need to provide your bank with a copy of your LLCs EIN and business formation documents. You can apply for an EIN through the IRS website. There is no fee.

You can get a loan through your dealership or shop around at local banks and credit unions. However, lenders may ask for copies of your personal credit historyespecially if youre a newer business. In addition, you might have to provide a personal guarantee, promising you or another individual will take fiscal responsibility for the loan if the LLC fails to make payments.

After purchasing a car, youll need to register the vehicle with your local DMV . Youll need to register the car under your LLCs namenot yours.

Registration fees will vary between states and are typically determined by the vehicles year, current value, and weight. In addition, your county may assess additional fees or taxes. For example, Texas has a base fee of $50.75. However, most counties assess a local fee that averages around $31.50. In addition, the state requires all vehicles to pass an inspection before registering.

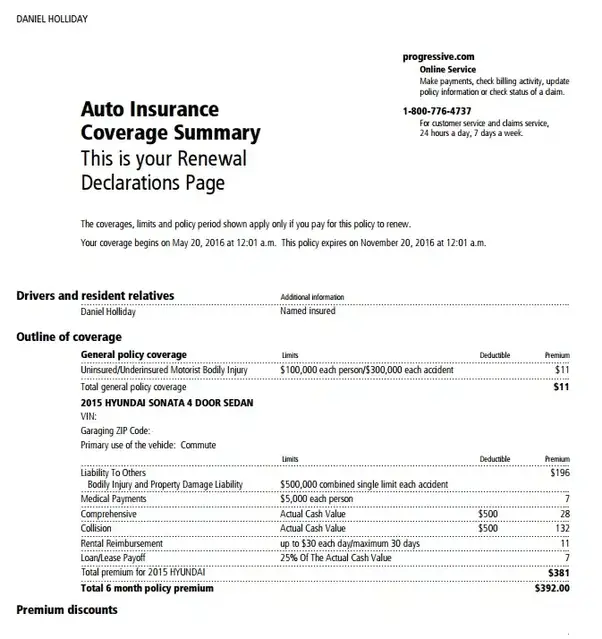

You will be required to get car insuranceregardless of where you live. However, youll want to purchase an auto policy under your LLCs namenot yours. Commercial auto plans cost between $900 and $1,200 a year.

Read Also: How To Fix Car Window

Calculating Motor Vehicle Expenses

If you use a motor vehicle or a passenger vehicle for both business and personal use, you can deduct only the portion of the expenses that relates to earning business income. However, you can deduct the full amount of parking fees related to your business activities and supplementary business insurance for your motor vehicle or passenger vehicle.

To support the amount you deduct, keep a record of both the total kilometres you drive, and the kilometres you drive to earn income.

Farming business use includes trips to pick up parts or farm supplies, and to deliver grain. If you did not live on your farm, the travel between the farm and your home is not considered business travel.

Fishing business use includes trips to pick up parts or boat supplies, and to deliver fish to markets. It also includes driving to and from the fishing boat if your home is your main place of business.

Below is an example of how to calculate motor vehicle expenses incurred to earn business income.

Restrictions On Deductible Expenses

There are certain expenses you can’t deduct as business costs. If you get a ticket for a traffic violation, you can’t deduct your fine, for example.

You also can’t deduct what are considered ordinary commuting miles or costs. For instance, if you own your own business and regularly drive to your office or shop, you can’t deduct that cost. You also can’t deduct costs related to parking at your regular place of business. Even if you’re bringing tools or equipment from home, you still can’t deduct commute costs.

You can deduct when you travel to a client site or when you go to a temporary place of business, even if you’re starting from home. If you’re going between multiple job sites, you can claim the cost of travel between them, but you need to exclude any personal side trips you make along the way if they boost your mileage. If you have a home office and leave it to go to a client site, you can claim the expense.

You May Like: What Credit Score Do You Need To Lease A Car

Can I Buy A Car Through My Business As A Sole Trader

Given the costs involved and potential tax savings, asking how you can buy a car through your business as a sole trader is pretty reasonable. After all, when you work for yourself the more expenses you can claim the less tax you pay.

In this guide, Ill show you the options available to you to help you decide how and if you can claim your car as an allowable expense.

This guide is for self-employed and sole traders. Different rules apply if you have a Limited Company.

Vehicle Expenses You Can Deduct

You can deduct expenses you incur to run a motor vehicle that you use to earn business income. However, several factors can affect your deduction.

The types of expenses you can claim on “Line 9281 Motor vehicle expenses ” of Form T2125 or Form T2121, or line 9819 of Form T2042 include:

- licence and registration fees

A Motor vehicle is an automotive vehicle designed or adapted for use on highways and streets. A motor vehicle does not include a trolley bus or a vehicle designed or adapted to be operated only on rails.

A Passenger vehicle is a motor vehicle that is owned by the taxpayer or that is leased, and is designed or adapted primarily to carry people on highways and streets. It seats a driver and no more than eight passengers. Most cars, station wagons, vans, and some pick up trucks are passenger vehicles.

Passenger vehicles and zero emission passenger vehicles are subject to limits on the amount of CCA, interest, and leasing costs that may be deducted.

A passenger vehicle does not include:

If you own or lease a passenger vehicle, there can be a limit on the amounts you can deduct for capital cost allowance , interest, and leasing costs.

A Zero-emission vehicle is a motor vehicle that is owned by the taxpayer where all of the following conditions are met:

- is a plug in hybrid with a battery capacity of at least 7kWh or is either fully:

- powered by hydrogen

You May Like: How To Pay Car Payment

Can You Write Off Car Payment Interest On Taxes

After learning that your monthly auto loan payment amount is not tax deductible, you might switch your thinking and wonder: can I write off my car interest? If the vehicle is for personal use, the answer is no. Just like your monthly car payment cannot be written off on taxes, the interest you pay on it cannot be written off, either.

The only exception here would be if your vehicle is a business car or a car that you use for both personal use and business use. In the latter case, you can only deduct the business use percentage of interest paid, as the interest paid on a car for personal use is never tax deductible.

Purchasing A Van Through Your Limited Company

Vans are classified as plant and machinery for tax purposes. As such they qualify for 100% allowances under the Annual Investment Allowance regime. This means you get a deduction for 100% of the cost to reduce your companys taxable profits.

The assessable van benefit if it is used regularly for private use is £3,500 in 2021/22 and the relevant fuel benefit is £669 in 2021/22 . Where there is an insignificant level of private use HMRC acknowledge that there is no benefit arising and these amounts do not apply.

Insignificant private use would be classed as, for example, calling at the dentist on the way home from an assignment. Using a van to do the weekly shopping would not qualify as insignificant private use. If there is an insignificant level of private use clearly there are substantial tax benefits in utilising a company van compared to a vehicle with high CO2 emissions.

Read Also: How To Buy A Car Online

Business Vehicle Write Off: Who Qualifies

The Internal Revenue Service identifies taxpayers who qualify to claim a business vehicle write off as:

- Self-employed individuals. Sole proprietors and owners of limited liability companies with a tax classification that allows pass-through income on Tax Form 1040 qualify for the write off.

- Certain types of employees. Qualified performing artists, reservists in the U.S. armed forces, and fee-basis state or local government officials qualify to claim the business vehicle write off.

- Individuals traveling for volunteer work or medical appointments. These individuals can write off miles only for specific trips if they itemize deductions on Schedule A.

For this post, well focus on the first type mentioned and cover how to write off a car as a business expense.

Note: You cant claim your car as a deduction if you use five or more cars. Thats considered a fleet. Also, if you are an employee and not the business owner, you cant claim a business vehicle write-off at all, even if you arent fully reimbursed at the standard mileage rate.

Have questions about whether you qualify for the deduction? Talk with a trusted Block Advisors certified small business tax pro to get the answers you need.

Can I Claim My Car As A Business Expense

Can my business deduct my car payments? Can I buy a Tesla Model X for my business? The answer is not as simple as you think. Lets start from the very beginning and explain how business use of your car could potentially be a business expense.

- If you use your car for business use only, you may deduct the full cost. There are some exceptions that will be discussed in part 2.

- If you use your car for both business and personal purposes, you may deduct only the cost of its business use. To do so, you will need to calculate the percentage of business use in one of the following two methods:

- Based on mileage

Each method involves nuances. Let’s tackle them one at a time.

The Standard Mileage Rate requires you to track your miles. Tracking your miles is key.

You get a tax deduction based on the number of miles youve driven for business-related travel. The IRS provides the standard mileage rate on an annual basis. In 2021, the amount you are eligible to deduct is 56 cents per mile for 2020, it was 57.5 cents per mile. For example, if you drove 4,500 miles in 2020, your deduction will be $2,587.50.

If you choose the standard mileage rate method, you cannot deduct the actual car expenses such as maintenance, repairs, gas, oil change, insurance, lease payments, and deprecation. These items are already factored into the mileage rate set by the IRS.

#2 The Actual Expenses Method

Which method is right for you?

Don’t Miss: How To Remove Lien From Car Title

What Are The Approved Mileage Allowance Payment Rates

The approved mileage allowance payment rates are:

|

First 10,000 business miles in the year |

Each business mile over 10,000 miles in the tax year |

|

|

Cars and vans |

||

If you have more than one job and your employers are not connected with each other, that is, the same people do not control each business, you can have a 10,000 mile limit for each job you hold.

If you have more than one job and your employers are connected with each other, you have only one 10,000 mile limit to be divided between all affected jobs.

The mileage rate covers the costs of running and maintaining the vehicle, such as fuel, oil, servicing, repairs, insurance, vehicle excise duty and MOT. The rate also covers depreciation of the vehicle.

If you are undertaking qualifying business travel in a company car, the rates that your employer can reimburse you up to on a tax/NIC free basis, are different. See HMRCs for further information.

Small Business Fleet Deductions

If you’re running a small business, a vehicle used exclusively for business can add to your yearly tax deductions as part of your operating expenses. While the cost of overhauling a business vehicle doesn’t qualify as a deduction , the cost of repair can be deducted. Keep clear records of repairs, because just claiming an estimated cost won’t go over well with the IRS.

Recommended Reading: How Much To Get Ac Fixed In Car

Annual Income Inclusion Amount

When the value of the leased vehicle is above a certain amount, you must also subtract an “income inclusion” amount from the deductible amount of your lease. This income inclusion rule is an attempt to equalize the tax benefits from leasing and owning business vehicles.

- For vehicles first leased in 2022, the threshold is $56,000.

- Income inclusion amounts vary depending on the lease amount and the number of tax years during which the leased vehicle was in use for business.

- The income inclusion amount increases each tax year for five years.

- The IRS releases income inclusion amounts each year for vehicles leased and put into use in that year.

- IRS Revenue Procedure 2022-17 includes the 2022 table of income inclusion amounts.

With TurboTax Live Full Service Self-Employed, work with a tax expert who understands independent contractors and freelancers. Your tax expert will do your taxes for you and search 500 deductions and credits so you dont miss a thing. Backed by our Full Service Guarantee.You can also file your self-employed taxes on your own with TurboTax Self-Employed. Well find every industry-specific deduction you qualify for and get you every dollar you deserve.

Is It Better To Lease Or Buy A Car Under A Business

Identifying the differences between buying or leasing a car under your business creates a better understanding of your options and how they best serve you and your business. One of the main differences between them is that buying grants the business complete ownership of the vehicle which means you wouldnt have to worry about mileage limits or wanting to customize the vehicle. On the other hand, as a lessee, your business can have lower monthly payments and other perks that are tailored to your business needs.

Here are a few other differences to consider:

| Leasing a car | |

| Penalties for higher mileage usage | No penalties on mileage |

| Typically comes with a warranty and maintenance included in your monthly payments along with minimal wear and tear | Maintenance expenses are covered solely by the owner |

Recommended Reading: How Often Should You Wax Your Car