Can You Transfer Car Finance To Someone Else

You may find yourself in circumstances when it would be beneficial for your car finance agreement to be in another name. You may need to apply for another form of credit, such as a mortgage, and wish to improve your affordability, or perhaps you cant afford the payments and wish to transfer the debt to someone who can. If youre asking yourself can you transfer car finance to someone else?, the answer is generally no – a specific car finance cannot be simply transferred to another person. However, there are solutions for different circumstances.

What You Need To Prepare For

If you still owe on the vehicle thats going to be sold, there are a few things you should do to prepare for the sale to the new owner.

First, you need to find out the payoff amount on your car. Contact your lender and request a 10-day payoff amount. The total will include the current balance plus 10 days of interest charges to allow time for the payoff check to clear.

Next, estimate the actual cash value of your vehicle. This can be done at various online valuation services, such as Kelley Blue Book or NADAguides. Compare this estimated ACV to your payoff amount. If your payoff amount is more than the ACV, you have equity if the opposite is true, you have negative equity.

If you have equity, this means that, depending on what you sell your car for, you may walk away from the sale with some leftover cash. If you sell your vehicle for less than the payoff amount, you must pay the difference to your lender in order to remove the lien from the title and move forward with the sale of the car.

Once you receive the release of lien letter, you give it to the buyer, along with the signed title, which enables the buyer to transfer the title at a DMV or Secretary of State office, depending on your state. The buyer then pays title and registration fees and plates the vehicle. If your buyer is financing the car, they also need to have full coverage auto insurance.

Settle Your Outstanding Debts

Theres another option available if youre a car buyer whos thinking of doing a car loan transfer to another person. What you can do is to settle outstanding debt first and then take out another car finance agreement, but this time, it will be in the name of the person whos going to make the monthly payments to the car finance company.

Before going down this route, its crucial that you talk to the lender first. Inform them of your situation and your intentions. Also, dont hesitate to ask for their help so they can facilitate the transfer process. If you havent been able to pay the monthly payments, the lender may prefer to make an arrangement for a car finance agreement transfer so that you can settle your obligations with them.

Apart from the lender, you should also explain all the essential details to the other person who will assume the responsibility. You may come up with an agreement so you can pay the outstanding debt together and when thats been settled, take out a new agreement with the car finance company in his or her name rather than yours.

Read Also: How Much Will Insurance Go Up After Totaled Car

Can I Get Someone To Take Over My Car Payments

If you can’t make your car payments, can you just find someone who can? Credit.com blog reader Carlos asks:

I have had my car for 5 months my payment is $330 but I will soon be getting married and getting my own place. I have tried to advertise my car and have someone take over loan on my car and everyone is just trying to get a notarized agreement and keep the car under my name. I won’t be able to make my next payment.

It sounds like Carlos is hoping is that someone will officially take over his payments and assume his loan. But that may not be possible. “In most cases, car loans are not assumable,” says Edmunds.com Senior Consumer Advice Editor Philip Reed. “When the registration and title are transferred to a new owner, the lender needs to be notified. The lender will then step in and require a to make sure the new owner can make the payments. This leads to the initiation of a new loan at the new owner’s credit level.”

Policies with regard to auto loan assumptions vary by lender. A representative from Wells Fargo said its car loans are not assumable, while a representative from Ally Financial said that it will “work with a customer to determine whether an assumption is an option for them. If the assumption is allowed, the person taking on the finance contract would need to fill out an application to see if they qualify to assume the responsibility of the vehicle and payments.”

Guarding His Own Credit

More from Credit.com

Who Issues Car Loans

Generally speaking, there are two ways that you can borrow money to buy a car direct lending or dealer financing.

- Direct lending Direct lenders include banks, and other financial institutions like online lenders. Borrowing from one of these lenders can give you the opportunity to comparison shop for the best loan terms for you and may give you the option to get preapproved for a specific loan before you shop. And when youre ready to buy, youll use this loan to pay for the car.

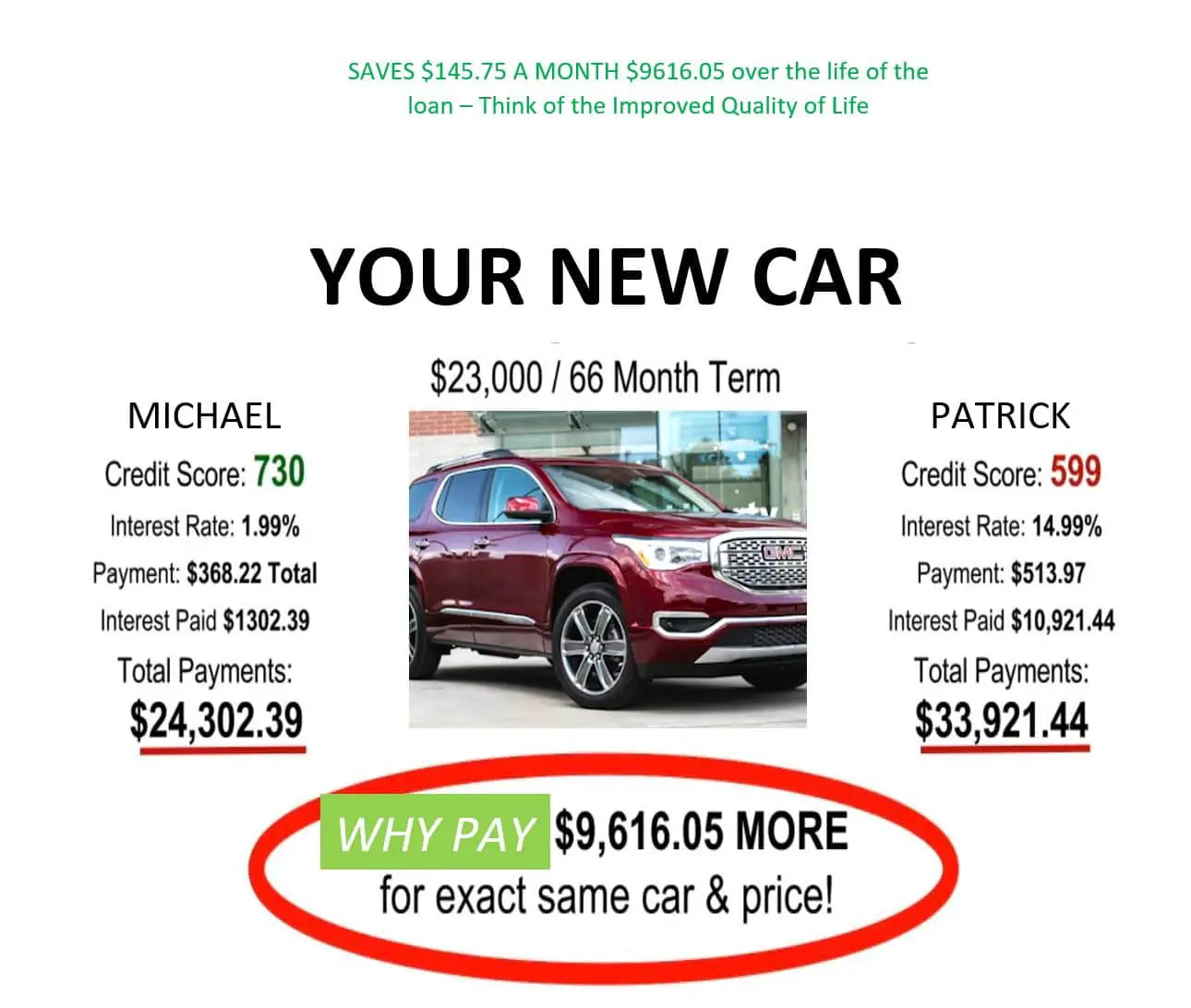

- Dealership financing This option, which is handled by your dealers finance department, makes it convenient to shop for your vehicle and auto loan in one place. Dealers generally have relationships with multiple lenders, so you may be able to compare terms and may even qualify for manufacturer-sponsored low rate or incentive programs. But be on the lookout for buy here, pay here dealers offering high-interest in-house auto loans to buyers who dont have great credit.

If you dont want to take out a traditional auto loan or dont qualify for approval, consider asking a family member to help you out or waiting until youve saved up enough cash. You can also look into an alternative loan option, like a personal loan from a peer-to-peer lender.

Also Check: What Car Does Elon Musk Drive

Cant Afford Car Payment What Are My Options

What To Do If You Cant Make Your Car Payments

- Modify Your Auto Loan. One of the best options if you cant make your payment and are in fear that youre going to default is to call your lender, Jones said.

- Refinance Your Vehicle Loan.

- Let Someone Assume Your Loan.

- Sell Your Vehicle.

- Let Your Car Be Repossessed.

- File for Bankruptcy.

How To Sell A Car With An Owner Finance Contract

When you find yourself no longer able to make your monthly car payments, you turn to ways to get out from under the vehicle. Many young couples might want to look to a third party to take over payments on their car. You cannot transfer an auto loan contract between people. You may consider a sub-lease, in which the vehicle owner leases their rights to you in exchange for you taking possession of the vehicle and the monthly payments. There are many risks associated with this type of informal arrangement and it may violate the terms of your original loan contract.

TL DR

Whether someone can take over the payments on your financed vehicle depends upon the agreement you have with your lender.

You May Like: How To Sleep In Car

What To Watch Out For

Transferring a car loan to another person comes with its fair share of drawbacks as well. These include the following:

- Difficult to find qualified buyers. It can be difficult to find a buyer with a solid credit score whos willing to take over your loan payments.

- Restrictions on certain transfers. Your lender can refuse to transfer a car loan which means youll need to explore other options to get rid of your loan.

- Youll lose any positive equity in the vehicle. Youll lose any money you put into your loan if you transfer it several years into your payments.

- Transfer fees. Youll likely need to pay a fee to transfer a car loan to another person in order to cover administrative costs for your lender.

Should You Ever Take Over Someone Elses Car Payments

The fast answer is a resounding no. Not only are the risks very high, but there must also be a high level of trust involved, even if you are trying to take over payments for a friend or family member. It is illegal in most places to do this without officially transferring ownership and most lenders consider subleasing a violation of the loan agreement, both situations potentially putting you in a worse place than before.

Co-signing for a new car is a good option if another party were to start helping you make monthly payments, but this is usually worked into the new loan paperwork when initially buying the car. Still, this can be risky for both parties since both are responsible for the total loan amount.

Despite the risks involved in taking over car payments for someone else or having someone else take over your payments, there are other options to officially reduce or remove any burdensome monthly car payments on your part that are also legal and less risky.

Recommended Reading: How To Deep Clean Car Carpet

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Transfer The Car Title

Upon approval, youll need to transfer the car title to your name as proof of ownership. You can visit the local Department of Motor Vehicles with the current owner of the vehicle and bring proof of identity, like a drivers license or passport. You may also need a bill of sale and proof of active insurance.

Don’t Miss: What Is The Cost Of Car Shield

How Do You Take Over An Existing Car Loan

One way to take over car payments from someone is by negotiating with both the used car seller and their lender to arrive at a common ground. In very rare cases, the lender may accept you taking over car payments especially if you have a good credit score.

If thats not possible, you can ask the seller to refinance and add you as a co-signer. After a few months, you can refinance once again and remove the seller from the loan. That will make you the sole borrower of the loan and will be equivalent to taking it over.

Car Loan Transfer Process

Your loan documents will clearly state if it is possible to transfer your loan to another person. If you are unable to find this information, you can contact your bank and get clarification on the options of transfer and the process. If your bank has specifically mentioned that the loan is not transferrable, then it will be extremely difficult to transfer it.

You will need to find a person who is willing to take on the loan and the ownership of your vehicle. Unless you make a good offer, people might generally not be interested in taking up a loan halfway through. Do your research on the used car rates and do your calculations to estimate a good price to sell your car. The fact that you are selling the loan along with the car will bring down the price of the vehicle. But this depends on how much of the loan is left for the new owner to handle.

The person who will be taking over your loan should have the same or better credit standing as you. He should have a steady source of income and a good credit score depicting clear repayment history of any prior loans or debts. The new borrower will have to submit the relevant documents to the lender.

The new borrower will have to submit the following documentation.

- A form requesting the transfer of the loan to their name

Don’t Miss: How Long To Recharge Car Battery

How Does Takeover Installments Work

If somebody wants to take over your vehicle instalments, accompany the person to the bank and cancel the bank’s current contract with you. Then get a new contract between the bank and the buyer for the balance on the vehicle. The bank will enter into a new contract with the buyer if it approves the buyer.

What Is A Car Payment

First and foremost, lets go over the definition of a car payment.

If you take out a loan to buy a vehicle, youll have a car payment. Its the amount of money you owe each month and is made up of principal, interest, and fees.

Your car payment will depend on factors like the amount on the loan, the loan term, and your interest rate. Once you make all your car payments in full and pay off your loan, youll own the vehicle outright.

Recommended Reading: How Far Can An Electric Car Go

How Can Someone Take A Loan Out In My Name

Someone Took Out a Loan in Your Name.Now What?

Find Out The Potential New Lessees Credit Score

It is crucial that you know what you are working with before you contact your financial institution. A credit score is the most crucial factor that financial institutions use to determine someones financial risk and creditworthiness for a good reasonthis is the best tool at their disposal to figure out the chances theyll ever get the money they loaned the other person back. If the new potential lessee has bad credit, its going to be a tough sell to your bank.

Recommended Reading: Where To Jack A Car

Be Upfront In Your Car Finance Application

Heres a common scenario where youd want to transfer your car finance to another person. Maybe you applied for car financing on behalf of someone else because they are not qualified to do so themselves. This is known as fronting and it is fraudulent – its illegal to get car finance for another person in this manner.

You need to be upfront about your intention when youre trying to secure car finance. Dont venture into the area of fraudulent acts, you don’t need to because there are actually lenders who can make arrangements for people who have poor or limited credit histories.

Parents, for example, can get car finance on behalf of their children, and they can act as the guarantor. Other lenders will also allow people who need car finance to add another person who can financially vouch for them. This is the safer way to secure good car finance.

Common Ways To Transfer A Car Loan To Another Person

Here weve outlined a few common ways to transfer your car loan to another person in Canada.

- Switch lenders. One common way to transfer a car loan to another person is by simply switching lenders. A new car loan will be issued by the new lender under the other persons name. Both the old and new lenders might even be able to communicate directly with each other to close out your loan.

- Transfer to another person with the same lender. If someone else wants to finish paying off your car, you can ask your current lender about switching your car loan into that other persons name. Keep in mind that your lender will require the other person to meet basic eligibility requirements, like a minimum credit score and income, in order to approve them taking over the loan.

- Sell your car. If you decide to sell your car, you may be able to transfer your car loan to the person buying your car. In that case, the process would be similar to the first two points above. Otherwise, you can use the money from the sale to pay off your car loan yourself, which eliminates the hassle of having to transfer it to another person. Realize that you may still end up owing money on your loan if you cant sell your car for the full amount.

You May Like: Why Do Police Touch The Back Of The Car