Criminal Penalties For Not Filing Irs Form 8300

- A person who willfully refuses to file a Form 8300 with credible and complete information is subject to Criminal sanctions. Such a person may be charged with a felony. This sanction includes a fine 0f $25,000 or a prison sentence of up to 5 years.

- Anyone who purposely files a false form can be fined up to $100,000 or a prison sentence of up to 3 years.

How To Pay A Car Dealer By Cash For Your Car

Usually, a car dealer will want you to either pay by debit card on the day, or transfer the amount electronically into their account before you collect your car. If a car dealer allows you to use a credit card, they will usually require you to pay the credit card merchant fee as well .

If you are reluctant to transfer your full payment via electronic transfer in advance, the best bet is to pay by debit card when you pick up your car. This will usually involve calling your bank in advance to advise that you intend to make a large transaction very soon, and they may well require you to call and confirm when the transaction is being processed, but it is a safe and secure way of paying for your car from a car dealer.

Should You Buy A Car With Cash

Most buyers dont, when it comes to new cars: Experians State of the Automotive Finance Market report from 2021 reported that 81.2% of new passenger vehicles are financed, while buyers only finance 34.5% of used vehicle purchases. According to Kelley Blue Book, the average price of a new car was about $46,000 in February, which is more than many people can afford to pay in cash. The average annual percentage rate on auto loans is relatively low, especially for buyers with good credit, making financing an attractive option. Some manufacturers even offer cash back incentives and 0% deals for buyers who finance their new car purchase.

If you choose to buy a car with cash, however, you get the peace of mind that comes with owning your car outright and not having a monthly payment. Your total cost to own is lower because you dont also have to pay interest. Despite the perks that can sometimes come with financing, buying a car with cash can make sense if you have the money to spare or if you dont qualify for a low APR.

The best rates generally go to those with the best credit, so do the math using an online loan calculator to see what works best for your situation. You could fill out a single form at LendingTree and receive up to five auto loan offers from lenders, depending on your creditworthiness.

Read Also: How Long Should Kids Be In Car Seats

How To Pay Cash For A Car

16 Min Read | Jul 18, 2022

In the market for a new car? Thats great! But before you drive off to your nearest dealership, have you thought about how youre going to pay for this new set of wheels? In this crazy world where debt is the payment method of choice, you need to know one thing: Cash is still king.

We cant go any further without saying it: Car payments are dumbwith a capital D. Thats right, if youre in the market for your next car, you need to know exactly how youre going to pay for it before you ever start looking. And if you want to drive your car off the lot without worry or regret, youve got to march in there with cash. Trust uswhen you pay cash for a car, youll have more buying power than you ever thought possible.

Grab a steaming hot cup of coffee and stay awhile because were about to show you how to pay cash for a carand then well cover why its the smartest way to pay. Lets dive in!

Frequently Asked Questions About Buying A Car With Cash

-

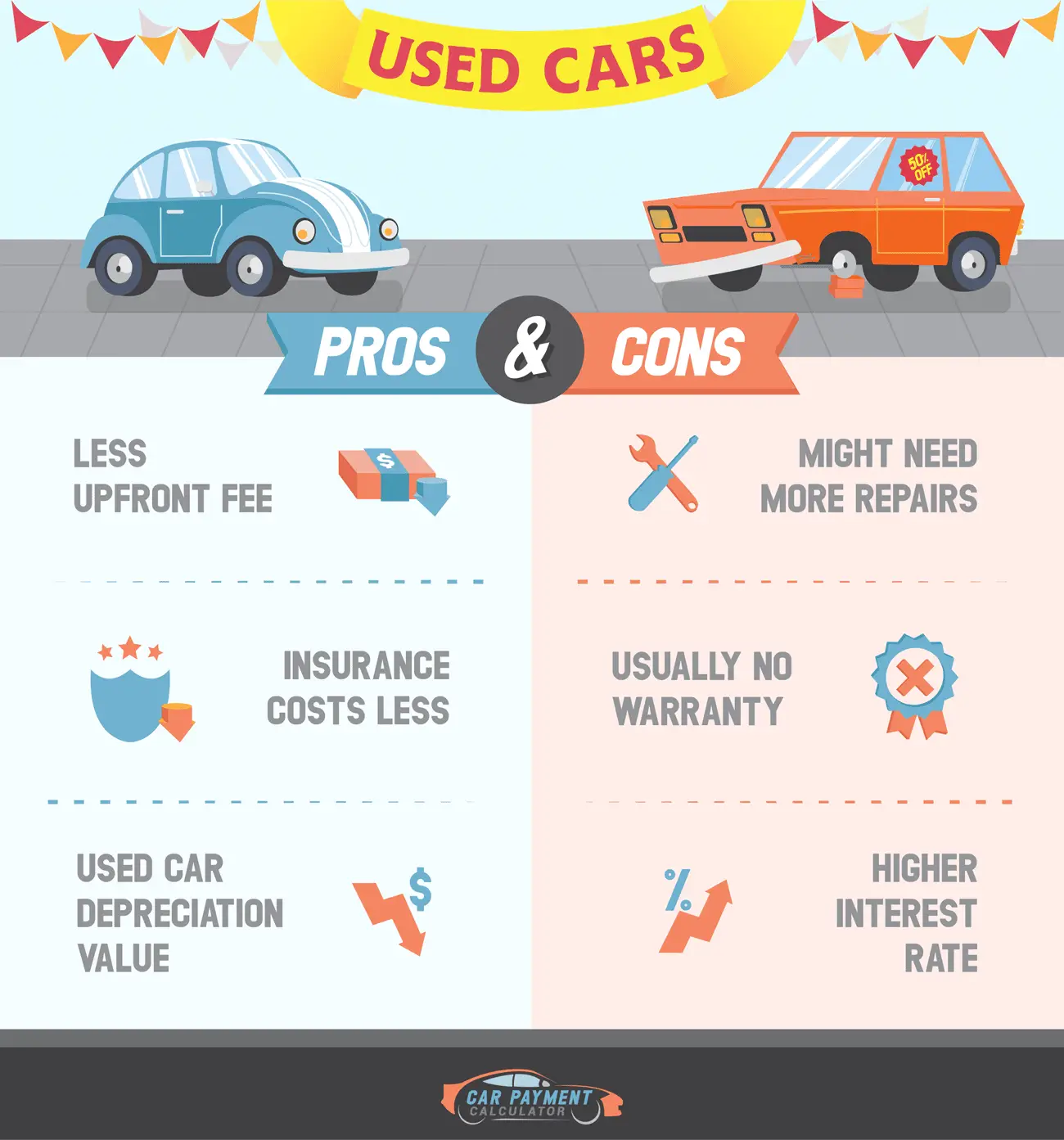

Is it better to buy a used or new car in cash?

It depends on how much it costs. Generally, used cars cost less, so it might be easier to afford the total cost than buying a new car. If youre not sure which is right for you, check out our guide to new versus used cars.

-

Can I pay for a car with a debit card?

It depends on how much the car costs and the sellers policies. But your car will likely cost more than your debit card allows you to spend in one day, which is why cashiers checks are a more common choice.

-

Can I use a personal cheque to pay for a car?

It depends on the seller. Generally, dealerships and some private sellers dont accept personal cheques for large amounts theres too much of a risk itll bounce. A money order is usually a safer choice for all parties.

Recommended Reading: Why Is My Car Battery Draining So Fast

Should You Pay For A Car In Full Or In Payments

In case you read this when car shortages arent a problem anymore, well answer this question. Generally, if you can pay for your new car in full, do it. There are still the benefits to paying in cash that we mentioned, and if car shortages cease to be a problem soon, it will allow dealers to more readily accept full payments. In addition, some lenders can prevent you from paying your loan in full early by having early pay-off penalties.

Are there any reasons not to pay in full if you have the money? Well, some of you may not want to pay in full if you hope to increase your credit score. You only improve it when you make on-time payments and decrease your credit utilization, not by paying for the car in cash.

The Irs Says You Are Not Paying Cash If Your Check Is Over $10000

That seems strange doesn’t it? Of course any cash over $10,000 requires IRS Form 8300 to be filled out which is how they trap cash buyers trying to illegally move money around. I call it structuring, where you have say $15,000 in cash, but you illegally structure the deal as say $7,500 cash and $7,500 in a check to avoid the $10,000 cash rule. But the IRS is on to you, they know what you did last summer.

It’s a strange game the government is playing here they are trying to trap people attempting to fly under the radar who are using cash or cash equivalents under $10,000. But the house always wins, they have traps set in place.

The IRS says that if you show up with a mixture of cash and a cashier’s check totaling over $10,000, they treat it all as cash and form IRS Form 8300 must be filled out. But for your personal checks and cashier’s checks larger than $10,000, which most car purchases are likely to be, the IRS does not consider those as cash, because presumably your bank has already filled out the required forms to the US Treasury’s FinCen via Form 112.

Don’t Miss: Who Will Buy My Junk Car

What To Do When This Happens To You And Pitfalls To Avoid

For years we have received questions from car buyers asking us why the car dealer wants them to fill out a credit application when they are paying for their car with cash or a cashier’s check. The customer wants to know why the dealer’s suspicious action is requiring them to fill out a credit application because after all you are paying cash and not applying for new car financing or any type of loan.

What Are The Penalties If A Dealership Does Not File A Form 8300

Transactions over $10000 require a dealership to file a form 8300. This form provides the government with an audit trail to investigate possible criminal activities such as tax evasion or money laundering.

When a dealership fails to file a form 8300 for these types of transactions, then they can be charged with non-compliance. This renders civil forfeiture or even criminal penalties depending on the case.

You May Like: How To Charge A Car Battery Without A Charger

Should You Use Your Credit Card To Buy A Car

| Yes, if | |

| Want to build your credit score or are working on improving it | |

| You can pay off the balance right away | You are being charged a high-interest rate |

| You have a promotional 0% APR or 0% balance transfer offer | You dont want to limit your cash flow or credit limit by making large purchases. |

| Your credit card offers a valuable rewards program and/or cash-back incentives | Youre planning to pay off your balance slowly |

Paying With A Debit Card

Can car buyers use a debit card to pay for a car? While some dealerships are fine with accepting a debit card as a form of payment, others wont.

In addition, car buyers can face transaction limitations when using this form of payment. Some financial institutions place transaction limitations as a form of fraud protection. Some limits could be as low as $500, and any transaction above this amount would be declined.

Debit cards are different from credit cards as they allow the transaction amount to be pulled from the account immediately. However, many banks allow debit cards to be swiped as a credit card. When swiping a debit card as a credit card, transactions remain on hold for a few days until they are verified these holds show as pending amounts. This provides a safeguard for account holders in case their card has been stolen or compromised.

Before considering the debit card as a means of payment, talk to the bank about any transaction limitations for debit purchases. This could save embarrassment, too!

You May Like: How Much Is My Car Worth To Sell

Drive Like No One Else

Are you ready to pay cash for a car and live a life free of car payments? You can do itit just takes hard work, patience and maybe even some changes to your behavior with money. Okay, that might sound like a lot. But if you take it one step at a time, you can totally get there.

Learn how with Financial Peace University. This nine-lesson course shows you the steps to save money, pay off debt, and build lasting wealth. Plus, it gets you hype to make better money moves.

Listen: You don’t have to drive like the majority of people, with a pile of debt under the hood holding you back. You can drive debt-free.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

What To Know About Paying Cash At A Car Dealer

One of the essential things to understand is that many dealers wont give you a better deal for paying cash because they make money by signing up a buyer with a loan. For example, they get you approved for a loan and tell you that its 4.5% for 60 months. In reality, the interest rate is 3.5%, but the dealer gets to keep the difference.

Its an entirely legal practice, and most car dealers do it. Plus, they usually run a credit check on the buyer during the process anyway.

The finance room of a car dealership is the profit center. Aside from profiting off the loan, they will also offer up warranties and protection packages, which are big money makers for the dealership.

Read Also: What Are Car Freshies Made Of

You May Like: How Long Does It Take To Get Car Insurance

The Easiest Payment: Cash

Buying a vehicle with cash might be the most simplistic way to pay. While many buyers might not have thousands of dollars sitting in the bank to purchase a vehicle outright, others may prefer cash payments and may have the amount they need stashed away in savings.

When paying for a car in cash, buyers might opt for the largest bills to make counting out the full amount a bit easier. Paying with cash also could be beneficial in the negotiating process. Buyers might only have so much cash on hand, and this cash might represent the budget bottom line.

However, buyers should not let the sales team see their hand this means that buyers paying with cash shouldnt come out and say just how much they have to purchase their vehicle. Give sales members a ballpark figure.

Some buyers just dont want to negotiate, and they bring cash to just secure the car they want. A little negotiation is expected, though.

Why You Should Never Tell A Dealer You’re Paying Cash

Saving up enough money to buy a car with cash is certainly more difficult than getting a loan, so people assume they should be rewarded for this achievement.

The reason it doesn’t work that way is because car dealers make money three different ways when you purchase a new car:

Most people know that dealers make a certain profit on the sale of the vehicle , but what most don’t realize is that dealers sometimes make the bulk of their profit on the financing – by charging a loan mark-up.

For example, the dealer will set you up with a car loan through one of their finance partners at 5% interest, and will tack on an extra 2% loan markup. You will be paying 7% interest with 2% of that going straight to the dealer’s pocket.

For this reason, most salesman will ask you upfront if you will be financing or paying cash.

NEVER tell them you’re paying cash!

When asked, just respond by saying “probably”. If they keep hounding you, tell them you’re interested in financing but that you want to agree on the price of the car first.

If you tell them you’re paying cash, they will automatically calculate a lower profit and thus will be less likely to negotiate a lower price for you.

If they think you’re going to be financing, they figure they’ll make a few hundred dollars in extra profit and therefore be more flexible with the price of the car.

Also Check: How To Deep Clean Cloth Car Seats

Disadvantages To Paying Cash For Cars

Not everyone can amass enough cash to avoid financing a car. Here are some common disadvantages to buying a car with no financing:

- It can take substantial time to grow the cash to buy a car

- Not having a car loan may hurt your credit as credit scores like it when you have a diverse profile

- Depleting cash reserves

- Less ability to negotiate

- You could earn more by investing the cash instead of financing the car

Financing vs. paying cash is a challenge for many people. It can be difficult to save enough money to buy a car outright, but financing gives us the idea we can purchase whatever we want.

*Related: Not certain if you should buy or lease? Read our leasing vs. buying a car guide to learn which is best for you.*

While true, that can negatively impact your financial livelihood if you finance for too long.

Should I Pay With Cash Or Finance A Car

First, you might wonder, should I pay cash or finance my vehicle?

Before we get into the question of cash versus financing, a little background is in order for shoppers who havent had much experience buying a new car.

Heres the deal, when it comes to buying a car, you can either finance the car with a loan and pay it off over time, or choose to pay cash. That means youre free and clear of interest and monthly loan payments.

One good reason why some people buy cars in cash is that they can afford to. And when it comes to knowing which is better to do, it comes down to knowing whats better for your personal situation and finances.

However, do weigh the parameters of the deal. The reason: Car dealers often offer special cash bonuses or low-interest rates for those with good credit. At times, dealers even offer 0% financing. If you think you can get more bang for your buck by investing the money that you would put toward a vehicle, its definitely a consideration, especially if your finances look good with ample cash flow.

For example, say you want to buy a $25,000 car and you can afford to purchase it with cash. If you want to spend your cash, thats great. It means no car payment for you. But lets say you shop around for a good interest rate and end up with 1% financing for 3 years after a $5,000 down payment.

Read Also: How To Jump Start Car With Battery Charger

Dealers Don’t Need Your Social Security Number To Check Ofac List

All they need is a name, not a number. As we showed you above, if you are paying cash and the car dealer checks your name against the OFAC list, you can easily see they don’t need your Social Security number, so this is why I say it’s bogus when they force you to fill out a credit application when you pay cash.

Other unscrupulous dealers lie and say the “Patriot Act requires you to fill out a credit application”, which is just a flat out lie. Also the OFAC requirements were in place years before the Patriot Act. Ever since the early 2000’s we here at CarBuyingTips.com have received complaints from car buyers telling us the dealer told them it is required by the Patriot Act when they pay cash.

We warned about this scam in a previous article called Patriot Act Car Dealer Financing Scam.

In that article we advised you how to get a downloadable copy of the Patriot Act and how to search it and there of course is nothing in that PDF file referring to car dealers and credit applications. It’s just a lie some of them like to make up because it sounds believable to most people.

We suspect that some of these morally challenged salespeople are just trying to trick car buyers into financing through the dealer and earn a little more profit and commission, or running an unnecessary credit check on cash buyers to sway them into car financing instead of paying cash. Don’t let this happen to you.