Driving Someone Elses Car

It is possible to modify, or add to an existing policy to give a driver the same policy terms they enjoy on their own car when they drive other cars â such as borrowed cars and rentals. This is ânon-owner coverage.â In provinces such as British Columbia, Manitoba, and Saskatchewan, a driver can buy this as a standalone policy. In other provinces such as Ontario, you can only buy this insurance as an add-on to your own auto insurance policy. Drivers who rent or borrow cars regularly might consider this option if they want to carry more liability coverage. Letâs say you visit a friend in BC, and youâre from Ontario, and you borrow their car and are in a car accident. If the damages cost more than their car insurance policy limits, the remaining costs will fall on the you. In such cases, additional non-owner coverage would be beneficial as an endorsement to your Ontario car insurance quotes.

Can I Drive My Friends Car If I Have Insurance

Similar to the scenarios above, if you drive your friends car and get into an accident that was your fault, it most likely will be their auto insurance coverage that will be affected. Remember, even if you have better insurance than them, the insurance usually follows the car. So theyll probably file the claim, pay the deductible and face the potential higher rates. Again, make sure you both are on the same page as far as who will pay the deductible if you get into an accident while driving their vehicle.

Can Someone Else Drive My Car

Discover what happens if someone else drives your car and gets into an accident.

There are times in life when we need to let someone borrow our car, but we hesitate allowing them to use it because we don’t know if we can, or if we should. We wonder:

- Can my babysitter use my car to drive my kids to the swimming pool?

- Can my friend drive my car?

- Can my brother-in-law or other family member borrow my car for the weekend?

- Can I drive someone else’s car?

- Will my friend’s insurance cover any damages I cause while driving their vehicle?

- Do irregular drivers need to be added to my policy?

At the heart of it, we want to know, “If we give them permission and they get into an accident, is it covered by my insurance? Is it legal for someone to drive my car who is not on my insurance policy?”

“Generally, it’s not a problem if they’re driving with your consent,” says Jeanne Salvatore, Senior Vice President of Public Affairs and consumer spokesperson for the Insurance Information Institute. “If it’s an occasional use, say I borrow your car to go pick up milk, and as long as permission has been verbally granted, you’ll typically be covered.”

“When you have someone you employ, such as a nanny or a nurse, who will be a regular, additional driver in your household, contact your insurance agent about your policy,” Salvatore recommends. “He or she may need to be added to it.”

Start a Quote

Read Also: What To Do If Someone Scratches Your Car While Parked

Someone Else’s Car: What Drivers Does Auto Insurance Cover

In the event that you find yourself in this situation, insurance coverage when driving someone else’s car is, in general, the coverage you carry for your own vehicle. Your personal auto insurance coverage will apply in most cases when you drive a vehicle not your own. This includes any uninsured motorist coverage you carry and the medical portions of your policy. Although not always, your property damage coverage might carry over while driving another’s car as well. As should be expected, if you drive your own car without insurance, do not expect that you are covered when driving another’s car.

When You Are CoveredIf you carry auto insurance for your own vehicle, when driving another’s car, typically you are covered by your own policy in the event that you get into an accident. Certain factors may be weighed including the reasons for driving a car other than your own, if you had permission or not or if it was a rental or dealership loaner. In each case, the individual circumstances will be investigated, but generally speaking you are covered by your own insurance.

With comprehensive insurance which covers almost everything, it is the car rather than the driver that is covered. This, however, requires many stipulations to be put in place such as who is allowed to drive the car. If you are driving a car with this type of insurance, if you are not listed as a driver–even if you have permission–you may not be covered in an accident.

Third Party Liability Coverage

Third party liability coverage provides legal protection if you injure someone else or cause property damage to another persons property on the road. This type of coverage can help pay for medical expenses associated with bodily injuries or repairs of damaged cars, as well as any applicable legal fees and settlements up to the coverage limit. In Ontario, G2 drivers are required to hold a minimum of $200,000 in third party liability coverage at all times.

Recommended Reading: How Can I Get Out Of My Car Loan

You Both Have Separate Insurance Policies

Chances are, you’re covered. But, which company will actually handle the claim and send payment for damages can vary based on the accident, damages, who is officially at fault, etc. Plus, coverages can vary at different insurance companies.

Next up: If you’d like to receive payment for the damages, then it’s best to contact both insurance companies to simply discuss the details of the accident. Then you’ll know whose insurance applies and which company to file the claim with.

Does Car Insurance Cover The Car Or The Driver

There are many variables as to whether insurance will follow the vehicle or if it will follow the driver. Generally, auto insurance will follow the vehicle rather than the driver, but some coverage types follow the driver too.

The realm of car insurance can often be confusing for those who don’t make it a part of their daily lives answering such questions of Can someone who is not on your insurance drive your vehicle, or if someone else can insure your financed vehicle. Another common question people ask is if auto insurance follows the vehicle or the driver.

Also Check: What Is A Differential On A Car

Pip Medical Payments And Uninsured/underinsured Motorist Coverage

Personal injury protection insurance, medical payments coverage, and uninsured/uninsured motorist coverage vary greatly from state to state. Some states require certain types of coverage, such as PIP, other states allow drivers to decline certain optional coverages , and still more states dont have any requirements.

The differences between states and policies can make it extremely confusing to sort out financial responsibility when it comes to injuries resulting from a collision. For example, the drivers PIP insurance might cover some medical expenses or other personal injury costs for the driver or passengers, depending on the state and policy. If the driver doesnt have PIP but you do, your insurance may pay for injury costs.

Contact your insurer to learn more about your coverage for injuries and collisions with uninsured drivers, and how it applies to someone else borrowing your car. Ask anyone borrowing your car to check with their insurer, too.

What If Someone Uses My Car For Business

When applying for a car policy, one of the questions youll be asked is, are you using your car for business purposes? The reason for that is because personal auto insurance is not the same as commercial. It offers more liability because businesses often have more valuable assets in play. This can lead to more damage if theres an accident.

With that said, if an insurer finds out you got into a car accident while conducting business, they may refuse your claim. The same goes for your friend. While you might not have a business yourself, if they make a delivery or do some other commercial purpose, this still counts as a business activity. So if they get in an accident, your insurance agent will likely deny coverage. If you have a home office, you might provide that information to your agent.

Read Also: What Car Companies Own Who

Most People Driving Your Car Are Covered But Some Policies Differ On Unlisted Drivers

Your car insurance company should cover other drivers, but you may need to list them on your policy to receive protection. While some companies cover friends or family even if theyre not named, not every company allows this benefit.

Read on to find out what you need to know about adding extra drivers to your insurance.

What Is A Named Driver

A named driver, also known as an additional driver, is a person whos insured to drive a car assuming its another person who does most of the driving. The named driver usually has the same amount of coverage as the cars main driver.

If you already have car insurance and youd like to add a driver, youll have to get in touch with your policy issuer to give them details of the new driver.

Recommended Reading: How Can I Sell My Car

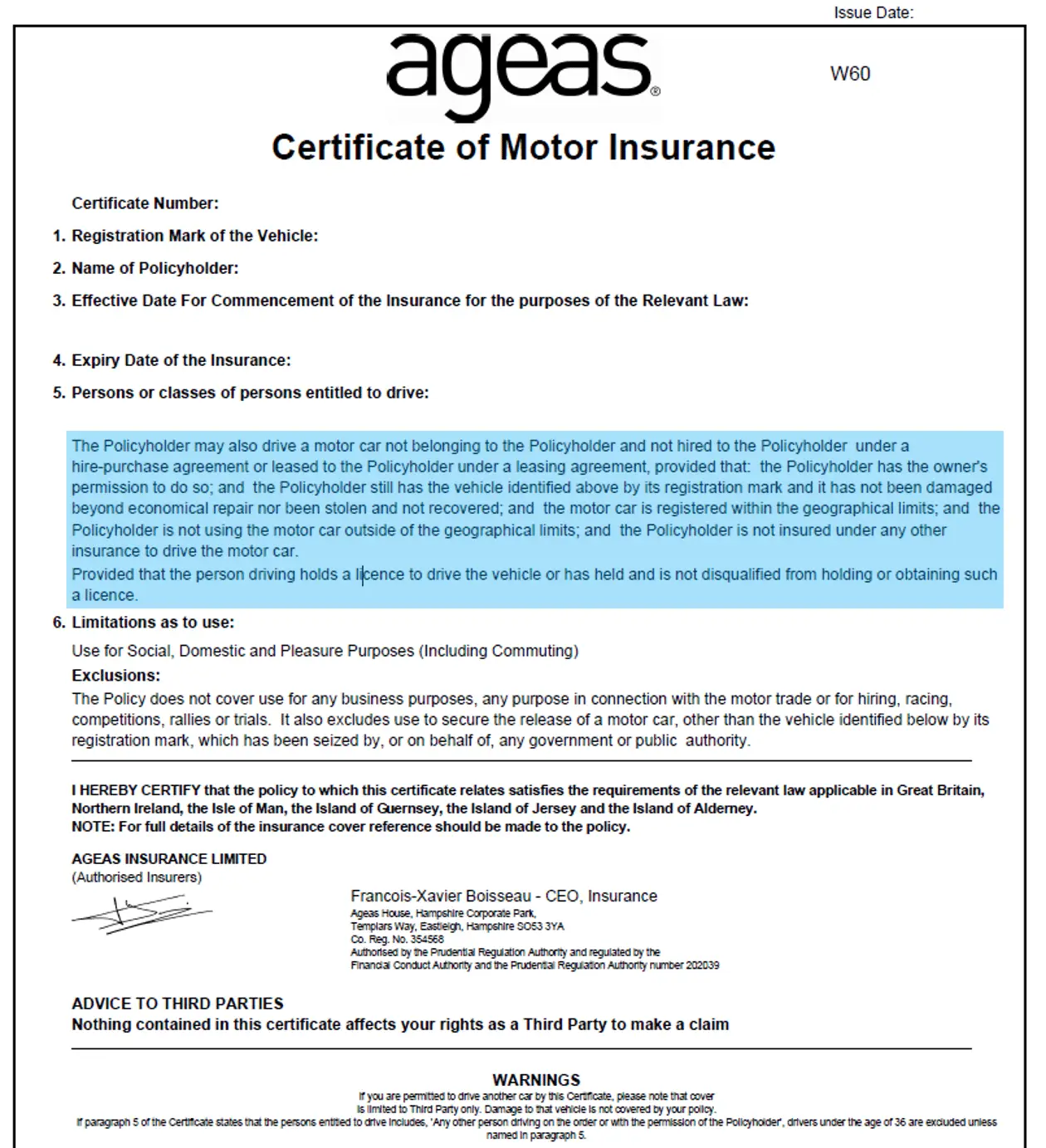

Not Sure If You Have The Right Cover To Drive Somebody Elses Car Don’t Drive

Before you get behind the wheel of the car you want to drive, make sure you have DOC cover. Or even better, temporary car insurance.

To find out if you have DOC call your provider and ask them. It might be worth checking your certificate of motor insurance, too.

If you’re pulled over by the police while youre driving another car and it turns out you dont have DOC cover, you could face serious consequences:

- You might get 6-8 points on your driving licence for being convicted of driving without insurance. This was one of the most common motoring convictions in 2021.

- If youre within your first 2 years of driving, thats enough to lose your licence even if your previous record was unblemished.

- You risk facing a fixed-penalty fine of £300, and if it goes to court you could be fined much more.

- It may increase the cost of your car insurance if you can even find an insurance provider to give you a quote in the first place. Many insurers dont cover drivers with this conviction as theyre considered to be too high risk.

Remember that DOC cover only insurers you for third party damage. You have to pay for the damage to the car youre driving yourself.

Can Someone Drive My Car And Be Covered On My Insurance

You let your friend borrow your pickup truck to move some furniture to his new apartment. He got into an accident on the way. Your car sustained major damage, and the driver in the other car was injured. Will your insurance cover the costs of the accident? Your auto insurance may cover someone else driving your car, but it can depend on several factors, such as your specific policy, the state you live in and more.

Also Check: How Much Do Car Salesmen Make Per Car

You Had Explicitly Excluded The Driver From Your Policy

In some states, you have the option to explicitly exclude anyone from your auto insurance policy. You might choose to do this in the case of people who have bad driving records or a history of drunk driving.

Whatever the reason, if you exclude an individual by name from your policy, your insurance will not cover a claim involving that person as a driver.

However, in New York, you cannot buy an auto insurance policy if you try to exclude a member of your household who is of driving age.

Does Fully Comprehensive Car Insurance Cover Driving Any Car

No. There was a time when many fully-comp policies automatically gave you third-party insurance to drive any car, but those days have gone.

So even if you’re fully covered for your own car, don’t assume you’re insured to drive other people’s cars otherwise you risk breaking the law.

Before getting behind the wheel of another car, speak to your insurer to find out what the situation is.

If necessary, ask them about adding a clause to your policy not all insurers offer that option, but many do.

Also Check: What Credit Bureau Does Car Dealers Use

Can I Drive A Van On My Doc Insurance

Technically this can be done, but DOC cover is rarely provided for driving a van.

This is partly because the definition of a van is broad – it can be nearer to being a lorry than being a car.

It also risks allowing the driver to stray from personal use to commercial use, which would require a different policy completely. DOC cover is not designed for commercial use.

Does Car Insurance Cover Other Drivers If They Take My Car Without My Permission

Probably not. Most policies define permissive use. Thats when you give someone consent to use your vehicle.

If a thief ends up taking your wheels on a joy ride and crashes, it falls under the non-permissive use category. You likely wont be held accountable for any damage they cause to other vehicles or property. That will be on their shoulders, or unfortunately, on the other drivers carrier .

That said, you may have to rely on your full coverage to foot the bill. This is where your personal collision and comprehensive might come in handy. You may be able to take legal action against the thief to recoup some of the repair costs, though.

Also Check: What Is The Cheapest Car Rental

Can The Driver Exclude Others From Their Policy Coverage

According to Cover, yes. The driver, or policyholder, is allowed to exclude others from their policy coverage. In some cases, car insurance companies might ask the policyholder to exclude certain drivers from driving their vehicles. These reasons include accidents, DUIs, a teenage driver, or someone who doesn’t have the greatest driving record. With an excluded driver, your coverage does not extend to them and you will save money on your premium.

Esurance says that there are a few states that don’t allow driver exclusions. These states are Kansas, Wisconsin, Michigan, Virginia, and New York. If you do allow another driver to access your vehicle, verbal permission is usually good enough and a formal letter is not required.

When Your Car Is Taken Without Permission

If someone takes your car without your express permission, this is called non-permissive use, as explained by Dave Ramsey. In such a situation, you generally can’t be held responsible for damages that result from accidents. If, for example, someone steals your car, goes on a joyride through the city, and smashes it into someone else’s property, you won’t have to pay for the damages caused to that property. You will, however, likely need to file a claim with your insurance company to get your vehicle repaired.

Recommended Reading: What Is The Cheapest New Car

What If The Driver Is From Another State

In most cases, if the driver has permission, insurance will cover a driver from any state, but that is not always the case. It depends on policy terms and auto coverage. If the insured has MedPay or PIP coverage, and is driving a commercial or company vehicle, then that coverage will be primary. MedPay follows the driver, as does PIP.

Can My Son Drive My Car If He Is Not Insured

Most insurers cover someone else driving the policyholder’s car with their permission once in a while. But, if you’re going to start driving one of your parent’s cars regularly, you’ll need to be added or named on their auto insurance. You can’t legally drive your parents’ car without any insurance at all, either.

You May Like: How Do Car Auctions Work

When Is Someone Not Covered By My Car Insurance

Most states will allow you to exclude specific named drivers from your policy. This could be someone in your family whose driving record isnt great or has a few accidents to their name. By excluding them, you protect your own insurance premium from going up.

But what happens if they ignore this exclusion and use your car? And, worse still, what if they damage it? Your states laws could come into play at this point. But, as a general rule, your insurance provider wont pay out if the excluded driver uses the car without your permission and causes damage.

What Do I Need To Do To Get Doc On My Policy

To get DOC insurance on your policy and be able to drive someone elses car, you need to meet some requirements typically set out by insurance providers, including:

- You need to be 25 or over when the policy starts

- Your car insurance policy needs to be a fully comprehensive one

- The other car must have insurance already

- Your car must be in a driveable state

- Your occupation cannot be in the motor trade, where you often drive other cars)

It also needs to be stated on your certificate of motor insurance that you have the DOC extension.

Read Also: How To Get Mice Out Of Car Vents

Final Thoughts On Your Car Insurance And Other Drivers

Trying to understand which auto insurance coverages follow the driver and which ones follow the vehicle can be tricky. If you have questions about other drivers and your car insurance policy, call Plymouth Rock Assurance to get definitive answers to your questions. Plymouth Rock has been providing New Jersey drivers with car insurance advice and protection for decades.

Call , get your free quote online, or find an agent to learn about buying a home and auto insurance in NJ.