Paying Interest On A Car Loan/auto Loan

A car loan/auto loan typically has an interest rate between 4-5%. Since cars are so expensive and used as collateral for auto loans, lenders can usually charge interest rates on the lower side. However, since the vehicle is used as collateral for a car loan, the lender has the right to repossess your vehicle should you default.

Use An Auto Loan Calculator

You can take this a step further using an auto loan calculator. These calculators allow you to find the monthly payment with different interest rates and loan terms. The Bankrate auto loan calculator will also provide a full amortization schedule so you can see the amount of interest youre paying each month and the total interest paid over the life of the loan.

Simple Interest Auto Loan Benefits

Simple interest auto loans come with a few key advantages that make them a popular option:

- More affordable payments: Since the amount of interest you pay each month is only based on the principal balance, youll get lower monthly payments than you would with a compound or precomputed interest loan.

- Sizable cost savings: If you decide to pay the loan off early, you could save a bundle in interest. For example, if you take out a five-year, $25,000 auto loan with a 5 percent interest rate, the monthly payment will be $471.78. Plus, youll pay $3,306.87 in interest over the loan term. But if you pay an extra $100 each month, youll pay the loan off in 49 months and save $651.04 in interest.

Don’t Miss: Where Can I Shampoo My Car

How Simple Interest Is Calculated

With the simple interest formula, interest is computed daily based on the principal balance, but it doesn’t compound. Interest building up daily sounds intimidating, but this can work to the advantage of car buyers. As a buyer pays down their car loan, the amount of interest paid decreases while the amount of principal paid increases all while the monthly payment stays the same.

Here is how simple interest is calculated using this example auto loan:

- Car Loan Amount: $18,000

- Loan Term: 60 months

- Interest Rate: 6.00%

- Monthly Payment: $347.99

Take 0.06 and multiply by the loan balance of $18,000 to get $1,080. Divide that by 365 to get the daily interest charge of $2.96. Multiply $2.96 by the number of days in that particular month to get the month’s interest charges of $91.76. During the first month of this example loan, $91.76 of the buyer’s $347.99 monthly payment would go toward interest, while the remaining $256.23 goes to the balance.

The next month, the loan balance would be $17,743.77, and the same calculations repeat. Multiply 0.06 by $17,743.77 to get $1,064.62. Divide that by 365 to get a daily interest rate of $2.91, and multiply by the number of days in that month to get $87.50, that month’s interest charges. For this second month, $87.50 of the $347.99 monthly payment goes to interest, and the remaining $260.49 is knocked off the balance.

This pattern of and increasing principal payments continues every month.

Paying Interest On Credit Cards

The average interest rate on credit cards is approximately 14-24%. Unlike payday loans online same day, personal loans, and traditional installment loans, credit cards only charge interest on the funds used. That means if you have a credit limit of $1,000 but only spend $100 within a given billing cycle, you will only be charged interest on the $100 spent, not the entire $1,000 limit.

Read Also: What Is The Best Car Insurance

How To Save On A Simple Interest Auto Loan

Use these strategies to save money on a simple interest auto loan:

- Pay more than the minimum: Paying extra each month or even doubling up on the payments can help you reduce the principal balance faster and pay off the loan early. But before using this strategy, confirm that the lender doesnt assess prepayment penalties.

- Make timely payments: If you fall behind on loan payments, you could be charged late fees and accrue additional interest on your simple interest auto loan.

- Sign up for autopay: Doing so prevents you from having to worry about missed payments, unnecessary fees or adverse credit reporting, which could be costly over time.

Whats The Average Interest Rate On A Car Loan

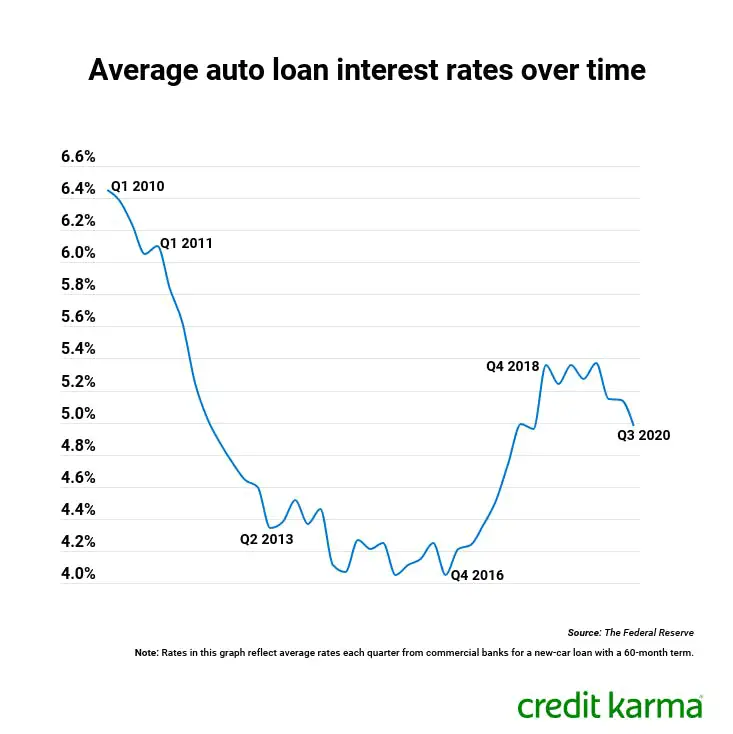

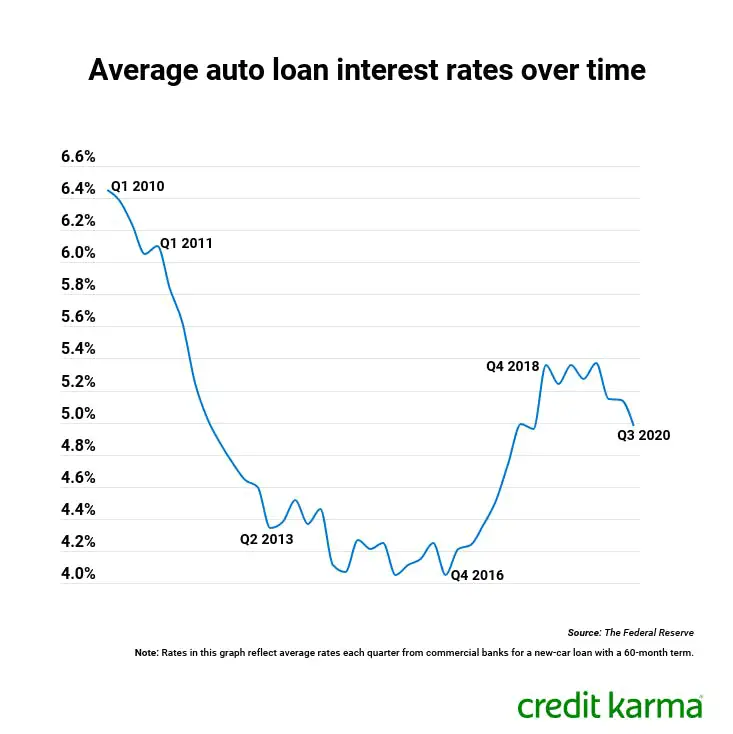

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

Also Check: How To Trade In A Car With Negative Equity

Financing With A Credit Card

Many people consider financing their car with a credit card. This means that you get a credit card with a big credit limit and pay for your car with your card. As we explain below, this is not a good idea and definitely not a wise financial decision. You should rather consider your other loan options before opting to use your credit card to finance your car.

How To Minimize Interest Charges On Your Car Loan

If you want to save money on interest charges on your car loan, there are a couple of things you can do before obtaining a new car loan so you get a better interest rate. But there are also several things you can do to reduce the total interest you pay on an existing car loan.

Paying Early

If you have a simple interest rate on your car loan, you could save a significant amount of money in interest charges by paying off your loan early. When you have simple interest and amortization, making unscheduled payments and regularly paying more than the minimum payment will allow you to significantly reduce the amount of interest you pay.

Excellent Credit

If you are planning to apply for a car loan soon, you can improve your chances of getting a reasonable interest rate by boosting your credit score ahead of time. Doing a few simple things to increase your credit scores before applying for your loan can ensure you get the best car loan available with lower interest rates.

Short Loan Terms

You might be hesitant to choose shorter loan terms because of the higher monthly payment. But choosing shorter terms, you could access lower interest rates on your auto loan. In addition to being offered lower interest rates, you will end up paying less interest because youll have fewer monthly payments.

Refinancing

References:

Also Check: How To Reset Car Bluetooth

How Do You Calculate Amortization On A Car

Car Loan Amortization Formula

Do car loans use amortization?

Auto loans are amortized. As in a mortgage, the interest owed is front-loaded in the early payments.

How long can you amortize a car loan?

More than half of all new car loans are currently financed for 84 months seven years or longer. Industry standard used to be to amortize car loans over 60 months five years but as low interest rates settled in, payment periods began to stretch longer and longer to make monthly payments as low as possible.

How A Lower Monthly Payment Can Cost You More

One of the most important things to understand about how auto loans work is the relationship between the loan term and the interest you pay. A longer loan term can dramatically lower your monthly payment, but it also means you pay more in interest.

Consider a $25,000 car loan at a 3.00% APR and a 48-month term. Over 4 years of payments, youll pay $1,561 in total interest on the loan. If you extend that same loan to a 60-month term , youll lower your monthly payment by $104but youll increase the total interest you’ll pay from $1,561 to $1,953.

Read Also: How Can I Sell My Car

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Should I Finance A Car For 72 Months

Is a 72-month car loan worth it? Because of the high interest rates and risk of going upside down, most experts agree that a 72-month loan isnt an ideal choice. Experts recommend that borrowers take out a shorter loan. And for an optimal interest rate, a loan term fewer than 60 months is a better way to go.

Read Also: What Happens If My Car Gets Repossessed

Get A Better Interest Rate By Refinancing Your Car Loan

If your interest rate isnt quite working for you, consider vehicle refinancing. You can find the best deals in minutes by using Auto Approves innovative auto loan matching tool. Simply request a free, no-obligation online quote on their website.

Auto Approve will match you with banks and credit unions that can offer you the most competitive rates, starting at just 2.25 percent. Best of all, theres no credit check to get started, and it only takes a few minutes of your time.

Do Car Dealers Like It When You Pay Cash

If you tell them youre paying cash, they will automatically calculate a lower profit and thus will be less likely to negotiate a lower price for you. If they think youre going to be financing, they figure theyll make a few hundred dollars in extra profit and therefore be more flexible with the price of the car.

Also Check: Are Car Batteries Covered Under Warranty

An Example Highlighting The Impact Of Interest Rate

Your interest rate will also have a dramatic impact on what you end up paying. Adjust the above figures slightly to a 5-year loan with 6% interest.

When you change the interest rate, watch what your numbers do. With a 6% interest, you will see the following changes.

- Original Car Price: $45,031

- Down Payment of 10%: $4,503

- Amount Financed After Payment: $40,528

After making a down payment, the balance is financed. The monthly payment ends up being $783.52, with a total paid of $47,011.19, which includes $6,483.19. With the down payment included, there is a total of $51,514.19 paid.

How It Differs From A Precomputed Interest Auto Loan

If you take out a precomputed interest auto loan, the lender calculates the interest youll pay over the loan term. Its added to the principal loan amount and divided evenly to generate the monthly payment figure.

So, repaying the loan before the term ends wont save you money since interest is already factored into the amount you owe when you take out the loan.

Recommended Reading: How To Stop Rodents From Chewing Car Wires

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 366,817 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Taking Advantage Of The Simple Interest Structure

The simple interest loan formula presents savvy borrowers with the opportunity to save money in the long run because there are no early payment penalties. Consumers can work toward paying down their balance early to save on interest in the long run.

Here are three strategies borrowers can use to accomplish this:

- Round Up Payments Instead of paying $347.99 a month in the example above, the buyer could pay more every month. If they were to round up their car payment to, say, $375 every month, the borrower could pay their loan off faster and save in interest.

- Pay More When Possible Extra payments don’t have to follow a strict schedule. Buyers can pay extra when they have money to spare to reduce the balance, and less interest will accrue from then on.

- Payment Splitting This method involves making payments in two installments each month half earlier, and the other half around the due date. This reduces the daily interest charges that accumulate between the two payments. Done every month, the money saved can add up to make a worthwhile difference.

Read Also: Can You Get Wifi In Your Car

How Amortization Works On A Car Loan

Most auto loans are fully-amortizing, which means that the monthly payments are calculated so that if you make every payment according to the original loan schedule, the loan both principal and interest will be completely paid off by the end of the loan term.

At the beginning of the loan, a larger percentage of each of your monthly car payments will go toward interest. Your principal balance wont decrease much until youve had the loan for some time. Over time, as you pay down the principal and less interest accrues as a result, a more significant portion of the monthly payment will go toward the principal balance.

Since the value of a car depreciates as it ages, you could find yourself with negative equity in your car loan also known as being upside-down if you decide to get rid of the vehicle near the beginning of the loan term. This means you owe more than the car is worth, and it can be challenging to sell it or trade it in without having to pay out of pocket. Negative equity is more likely to be a problem if you didnt put any money down when you purchased the car, or if you chose a longer loan duration.

What Is An Auto Loan

Auto loans are one of the most common ways of purchasing a vehicle for middle-class Americans. The average person does not have enough money to buy their car outright, so they get an auto loan. Car loans are loans with monthly installments used for the express purpose of buying a car.

The loan terms are set so that the loan balance plus interest is repaid within a specific period of time, typically between one and five years. Like mortgages, auto loans are a type of secured loan in which the equity of the car you buy is used as collateral. This means that if you repeatedly dont make your monthly payments and default on the loan, your car could be repossessed by the lender.

Read Also: How Much Does It Cost To Repair Ac In Car

Computing Your Total Interest Using An Online Calculator

How Much Interest Is Paid On A Loan

Today, it is normal for banks to charge you a TIN of between 5% and 10%, although the best personal loans on the market will apply, at most, a TIN of 6.25%.

How is interest paid on a loan?

In the settlement of a loan, the installment is the amount to be paid at the agreed frequency. Depending on what we have agreed, it can be monthly, quarterly, semi-annually, etc. What we pay will depend on the amount of the loan, the interest rate and the term that we have agreed.

How are loans paid off?

Debtor interest = debit numbers * . Exceeded interest = exceeded numbers * .Example of settlement of a credit account :

How do interest on loans work?

When an amount is required from a bank, something more than what was delivered must be returned, that extra that must be paid is an interest rate. In the event that a person decides to invest their money in a bank fund, or that is added to the final cost of a person or entity that resolves to obtain a loan or credit.

You May Like: How Often To Change Battery In Car