Car Insurance Rates Methodology

Age16-year-old driverModelIncidentsGender

Average Cost Of Auto Insurance For Drivers With A Dui

Insurers generally charge drivers with a DUI history higher rates due to the increased risk of accidents associated with such behavior.

Drivers with a DUI history pay 88% more on average for car insurance compared to drivers with a clean record. That’s $1,723 more per year for car insurance.

In our analysis, North Carolina saw the largest relative increase in insurance rates, with premiums going up by almost 300% for a driver with a DUI on his record. Conversely, Nebraska penalized drivers the least after a DUI. Its rates increased by only 45% for our sample driver.

Drivers with a history of driving under the influence or while intoxicated should consider getting free car insurance quotes from multiple carriers. Your record may be assessed differently across insurers, so getting several rates can help you find savings.

| State |

|---|

Rates are an annual average for our sample driver with a full-coverage policy.

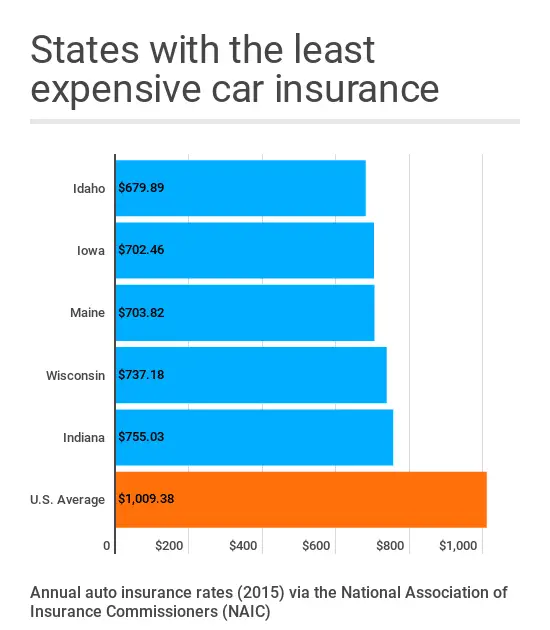

How To Buy Car Insurance

The national average for car insurance with liability, collision and comprehensive insurance is $1,190, according to the most recent data from the National Association of Insurance Commissioners. But you shouldnt focus strictly on cost when youre looking for a car insurance policy.

Thats because auto insurance companies all calculate their rates differently, resulting in a wide range of pricessometimes by thousands of dollars a year. Its smart to compare car insurance quotes from multiple companies. You can get free quotes online or by calling an independent agent in your area.

Make sure you ask about car insurance discounts. Insurance companies offer many types of discounts to attract customerseverything from good driver discounts, car safety discounts, multi-policy discounts, and even discounts for paying in full or going paperless.

Finally, consider a companys customer service. The best car insurance companies pair competitive prices with good customer service. If you get into a car accident, you want to be sure your insurance company will make the insurance claim process go as smoothly as possible.

Read Also: Which Car Has The Best Gas Mileage

Use Of Occupation Maybe

While using credit or education level in auto insurance pricing was contentious, the use of occupation wasnt as controversial: 44% didnt believe a drivers occupation should affect rates, but 36% thought it was OK.

Like other pricing factors that arent about actual driving, some insurers give discounts for certain occupations. For example, lawyers, doctors and educators may be able to score lower rates.

Average Car Insurance Rates After A Dui

Getting caught drinking and driving will mean significantly higher prices for car insurance. On average, auto insurance rates go up about 93% for a driver with a recent DUI, NerdWallets analysis found.

For a 35-year-old driver, average car insurance rates after a DUI are:

-

$3,139 per year for full coverage.

-

$1,134 per year for minimum coverage.

You May Like: How To Unlock A Car Door With A Screwdriver

How To Get Cheap Car Insurance

But you can still find cheap car insurance by shopping around for rates every year and every time something major happens in your life, including marriage, a new job, moving or buying a new car. Additionally, if youve had a recent at-fault accident, DUI or other traffic violation, be sure to shop in the month after the third and fifth anniversaries of the incident.

If youre ready to shop, you can check out the cheapest companies in your own state for several driver profiles.

Car insurance costs $136 per month on average, according to NerdWallets rates analysis. However, your rate will vary depending on factors such as where you live, the vehicle you drive and your driving history. Compare car insurance rates to find the cheapest car insurance for you.

On average, full coverage insurance costs about $136 a month compared to $47 a month for minimum coverage. However, unlike minimum coverage, full coverage insurance pays out if your car is stolen or you need repairs after an accident. Minimum insurance covers damages to another person or vehicle only in an at-fault accident. It does not cover your own repairs or injuries.

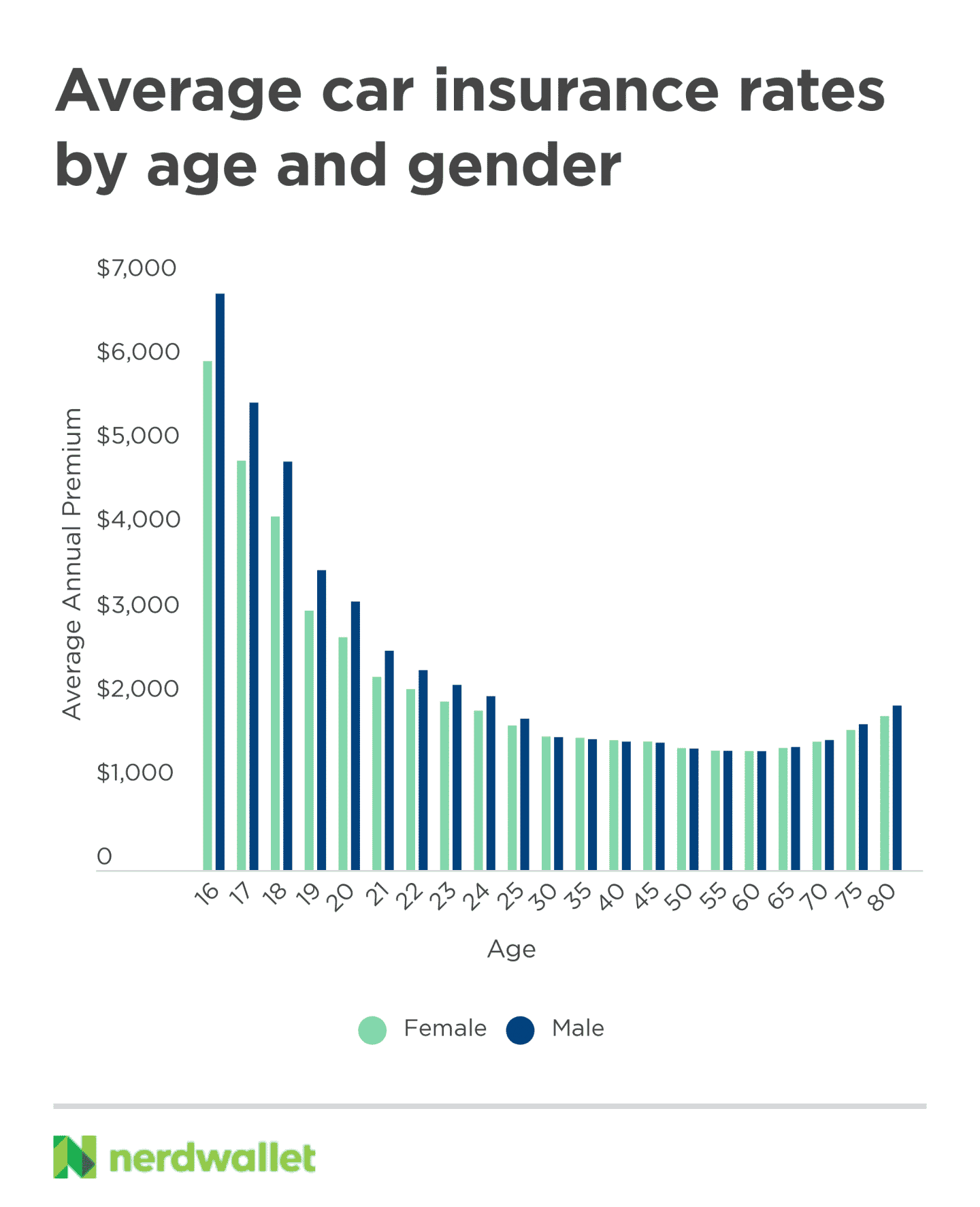

Its hard to say exactly who pays the most for car insurance since there are so many factors that affect your auto insurance rates. In general, teen drivers, drivers with a recent DUI and drivers with poor credit pay some of the highest car insurance rates on average.

The Most Expensive States For Insurance

On average, auto insurance is most expensive in Florida, where rates are 76% more expensive than for most drivers nationwide. We found that the cost of car insurance in Florida is $105 more expensive per month, or $1,262 per year, compared to the national average.

Besides Florida, Louisiana, Michigan, New Jersey, and New York are the states with the most expensive average car insurance rates. The combined average cost of auto insurance in these states is 53% more expensive than the national average.

What if car insurance costs are too high in your state?

You can still get affordable coverage in states where average insurance costs are high. You can keep costs low by avoiding accidents and tickets, taking advantage of discounts, and by comparing quotes when its time to renew your policy and switching companies if you find a better deal.

Also Check: How To Put Ac Refrigerant In Car

Buying Car Insurance For A Used Car

Buying auto insurance for a used car is a little different. Because a used vehicle has already depreciated, you probably wont need gap insurance. And since you could select minimum coverage with less risk, the average cost of auto insurance policies for used vehicles will likely be lower than when you buy a new car.

The documents youll need to purchase an car insurance policy for a used car are different then when you buy a new car from a dealership. If you bought your car from a used car lot or from a private seller, youll need:

- Proof of registration

- Proof of insurance

Car insurance rates for an older car are usually lower, but keep in mind youll likely have higher repair and maintenance costs that might offset those savings. Ask the dealership if they offer any warranties on used vehicles.

If you purchase a used car, you need to get your policy the day before you pick it up, so that its active when you register the vehicle.

What Exactly Is Automobile Insurance

Car insurance is a kind of insurance policy that covers you and anyone else listed on the policy. You can purchase insurance for your automobile and any person else who drives it along with your consent. The price of automobile insurance is depending on numerous elements, which includes age, driving history, place, and kind of vehicle. To find out the very best program for the requirements, youll be able to examine quotes and compare policies. Right here are some of essentially the most important aspects to consider before buying vehicle insurance.

How much does the policy expense? Your cars age, driving history, as well as the deductible you select will all influence the value you pay for insurance. Drivers using a clean driving record tend to spend less than these with multiple accidents. Also, should you drive a whole lot or live in an location that has greater threat of accidents, you will spend more than someone who drives less. So, preserve that in mind when choosing a policy.

Recommended Reading: How To Wrap A Car

The Cost To Repair Or Replace A Damaged Vehicle

The potential cost of repairing or replacing your car helps determine how much you’ll pay for auto insurance, says the III.

For example, if you’re buying an expensive sports car, the cost to repair that vehicle after an accident is likely more than repairing a standard four-door sedan. That’s why the type of car you buy is a major factor when determining your car insurance premium.

What Vehicle Insurance Will Be The Least Expensive

Finding the very best vehicle insurance rate for you personally isnt always simple. Youll need to know what kind of coverage youll need and how much you can afford. Some drivers can locate cheaper prices if they live in an urban region and stay away from driving on highways. An additional approach to get the lowest rate would be to park your vehicle inside a garage. Distinct states have various minimum coverage requirements, and drivers will pay more in other states if they pick greater coverage limits. The lowest rate will probably be for the state minimum coverage, or no coverage.

Irrespective of the type of coverage you want, you need to shop about every year to find the cheapest rate. State law determines the minimum quantity of coverage you have to carry, but you should contemplate your personal requirements when determining the very best price. If you are living along with your parents, it might be more affordable to stay on their policy till youve a more steady driving history. As well as comparing quotes, you ought to also check out car insurance discounts and raise your credit score.

Don’t Miss: How Wide Is The Average Car

Get The Right Amount Of New Car Insurance

Its a good idea to know how much car insurance you need before you go to the dealership. For example, you should know how much liability car insurance is sufficient to cover your net worth, such as your home and savings account. An insurance agent can help you decide on coverage limits and optional coverage types.

How Are The Road Infrastructure And Bridges In New Orleans

Obviously, the driving behavior of others on the road can influence how safe it is to drive in a city. But another major factor concerns the state of the road infrastructure and bridges. And in New Orleans, the infrastructure and bridges are something of a mixed bag.

On the one hand, the city is very committed to making the roads safer. In 2020, the city began a $200 million project to fix potholes, improve the drainage system, and even provide better equipment to the citys police and fire departments. And this is part of a previously approved $500 million plan to improve infrastructure, including crumbling roads.

However, that investment is so high, particularly because New Orleans has long needed better infrastructure.

Also Check: How To Pay Off Your Car Faster

How Much Does Car Insurance Cost For Drivers With Good Credit

The average car insurance cost is 20% less for drivers with an excellent credit history compared to drivers with average credit.

Drivers with good credit are considered lower risk by insurance companies and, as a result, can receive substantial savings on their auto insurance costs.

State Farm offered the best overall rate and largest discount for drivers with very good credit. Famers had the highest rates, while Farm Bureau had the smallest percentage discount for those with very good credit.

| Company |

|---|

Rates are an annual average for our sample driver with a full-coverage policy.

Having poor credit causes your rates to increase by an average of 59%, as compared to having average credit. Nationwide had the smallest increase in rates , while Farm Bureau had the lowest rates for those with poor credit.

How Long Do I Have To Add A New Car To My Insurance Policy

When buying a new car, your insurance carrier will provide a grace period between seven to 30 days to update your policy with your new ride. For example, Progressive allows 30 days, which means if you have a claim within that period, your new car is still covered in the same way your previous vehicle was.

With Progressive, you have a 30-day grace period to add your new car.

You May Like: How Do I Find Out If My Car Was Towed

Why Some Cars Cost More To Insure Than Others

The top three things that impact the cost of a car’s insurance are:

- Price: The more expensive the sticker price, the more that car is going to cost you to insure. Lenders require comprehensive and collision coverage to protect their interests. Your carrier is on the hook to pay your luxury automobile’s market value if it’s stolen or damaged beyond repair.

- Parts and Repairs: Some car manufacturers use high-tech parts made from carbon fiber or other specialized materials. These parts are expensive to repair, driving up the overall cost of damage claims. According to Auto Insurance Nerds, electric cars are often more expensive to insure because they are much more costly to repair.

- Safety: Today’s vehicles roll off the lot equipped with innovative safety features. These developments equate to fewer injuries, and fewer injuries mean less money paid out for medical bills.

New Car Insurance: How To Insure A New Car

When you buy a new car, there are many factors to considerlike add-ons and upgradesbut nothing is more important than learning how to insure a new car. The new car insurance grace period or temporary coverage differs per carrier, but it ranges between 0 to 30 days. If you must make a claim within this period, your carrier can cover your new ride with your previous plan. However, its best to get your new ride insured as soon as possible.

Buying a new set of wheels involves a lot of choices that come at you suddenly. Do you want leather seats, front- or four-wheel drive, or an add-on package that includes the latest technology? In all of the excitement of your new purchase, you may forget to think of one very important thing your auto insurance. However, if you drive off the dealership lot without proof of insurance, the clock is ticking. If you forget, then you can end up driving while uninsured.

Read Also: Is Subaru An American Car

Optional Car Insurance Coverage Types

Liability insurance, uninsured motorist coverage, medical payments, and collision and comprehensive insurance are a good foundation for a car insurance policy. But you might need a few additional coverage types to fill in some gaps. Here are some to consider.

- Gap insurance. If your car is totaled due to a problem covered by your policy, such as a car accident or fire, gap insurance covers the difference between the actual cash value of your car and how much you owe on the loan or leases. For example, if you have $15,000 outstanding on your loan but your cars value was $13,000, this coverage pays the $2,000 gap.

- Rental reimbursement insurance. If your car is being repaired due to a problem covered by your policy, this coverage pays for a rental car or substitute transportation, such as train and bus fare, during repairs.

- Roadside assistance insurance. If your car breaks down or you run into another problem , this pays for service like a tow truck, jump-start, fuel delivery or a locksmith.

Car Insurance You May Be Required To Buy

In nearly every state, a motorist must buy liability insurance for a new car. The only exception is New Hampshire, where you aren’t required to buy car insurancebut you must prove you have adequate assets to pay damages, medical bills and more if you cause an accident.

Liability insurance pays the cost of property damage and injuries to other people in an accident in which you’re at fault.

Additional car insurance coverage you might need to buy includes:

- Comprehensive and collision coverage: If your car is leased or covered by a loan, you’ll likely be required to purchase comprehensive and collision coverage. Comprehensive coverage pays for non-crash claims involving your vehicle. This can include theft, as well as damage due to weather, fire and fallen objects. Collision coverage pays for damage done to your vehicle in a crash.

- Uninsured and underinsured motorist coverage: Some states require drivers to carry uninsured motorist coverage, or both uninsured and underinsured motorist coverage. If you get into an accident with somebody who lacks car insurance or doesn’t have enough car insurance, uninsured and underinsured motorist insurance will help pay for damage to your vehicle.

- Personal injury protection coverage: Some states require motorists to carry personal injury protection coverage. This covers medical bills, funeral expenses and lost income stemming from injuries suffered by your and your passengers, no matter who’s at fault.

Recommended Reading: How Old For Rear Facing Car Seat

Why Is Auto Insurance For New Drivers So Expensive

A lack of experience behind the wheel is the main reason why auto insurance is so expensive for new drivers.

Insurance companies charge higher rates to drivers they consider more likely to be involved in a car accident. Since inexperienced drivers are generally considered more likely to be involved in an accident than those with a record of avoiding tickets and accidents, new drivers are charged higher rates.

In addition to qualifying for low base rates on car insurance, safe drivers often qualify for additional discounts.

For example, Allstate offers a claims-free discount to new and existing customers with no recent claims. Travelers offers a tenure discount to new customers who switch over after four years with their prior company.

These are just a couple of examples of how a new driver who establishes a good driving record may become eligible for lower rates in the future.

What Types Of Car Insurance Are Required

Here are types of car insurance that are generally required by states.

Liability insurance: Required in most states.Car liability insurance pays for injuries and property damage you cause to others. A good rule of thumb is to buy enough liability insurance to cover what can be taken from you in a lawsuit.

Uninsured motorist coverage :Mandatory in some states and optional in others.Uninsured motorist insurance pays for you and your passengers medical bills and other expenses if someone crashes into you and they dont have any liability insurance. A related coverage, underinsured motorist coverage, helps with you and your passengers medical bills when a driver with insufficient coverage causes an accident resulting in injuries.

Collision and comprehensive insurance:Required if you have a car loan or lease. These are two separate coverage types often sold together. Collision and comprehensive insurance pay for your vehicle repair bills due to problems such as car accidents, car theft, fires, floods, severe weather, falling objects, vandalism and collisions with animals.

Personal injury protection:Required in some states. Some states use a no-fault car insurance system. In these states youll make smaller injury claims on your own auto insurance no matter who was to blame. These claims fall under personal injury protection, which is required in no-fault states and available in some others.

Also Check: When Can You Refinance A Car Loan