Car Insurance Discounts For Any Age

Regardless of your age, you can trim costs by qualifying for car insurance discounts that match your driver profile.

A “safe” or “good” driver discount nets the highest savings on average, based on a 2021 CarInsurance.com discount savings analysis. Typically, these are limited to drivers over age 21. You usually must have a clean driving record, so no moving violations, and no accidents for the past three to five years to earn a safe driver discount.

Being accident-free, which means youve had no accidents during the past three to five years, nets a car insurance discount of 26% on average.

Auto home bundle discounts earned a 14% savings, on average, according to the analysis.

For younger drivers, student-away discounts save 18%, on average, though it can be much higher, up to 23%. A good-student discount saves drivers 16%, but can also be much higher.

Senior drivers can also cut their costs. Drivers over age 55 and over who complete a senior driving training course can save an average of 5%, but it can range up to 12%.

How Much Is Car Insurance For An 18

Car insurance for an 18-year-old will average at $2,172 annually for a standard liability policy with limits of 50/100/50. That stands for bodily injury of $50,000 per person and $100,000 per accident plus property damage of $50,000. A state minimum policy is cheaper at $1,910 but not recommended as novice drivers are more likely to crash and thus carry higher limits. A full-coverage policy comes in at $5,399 pricey but worth it if you need collision and comprehensive on your vehicle.

Auto Insurance Expenditures By State

The tables below show estimated average expenditures for private passenger automobile insurance by state from 2014 to 2018 and provide approximate measures of the relative cost of automobile insurance to consumers in each state. To calculate average expenditures, the National Association of Insurance Commissioners assumes that all insured vehicles carry liability coverage but not necessarily collision or comprehensive coverage. The average expenditure measures what consumers actually spend for insurance.

Expenditures are affected by the coverages purchased as well as other factors. The NAIC does not account for policyholder classifications, vehicle characteristics or the amount of deductibles selected by the policyholder, differences in state auto and tort laws, rate filing laws, traffic conditions and other demographic variables, all of which can significantly affect the cost of coverage. The NAIC notes that three variablesurban population, miles driven per number of highway miles, and disposable income per capitaare correlated with the state auto insurance premiums. It also notes that high-premium states tend to also be highly urban, with higher wage and price levels, and greater traffic density. Many other factors can also affect auto insurance prices.

Recommended Reading: How Much Horsepower Does My Car Have

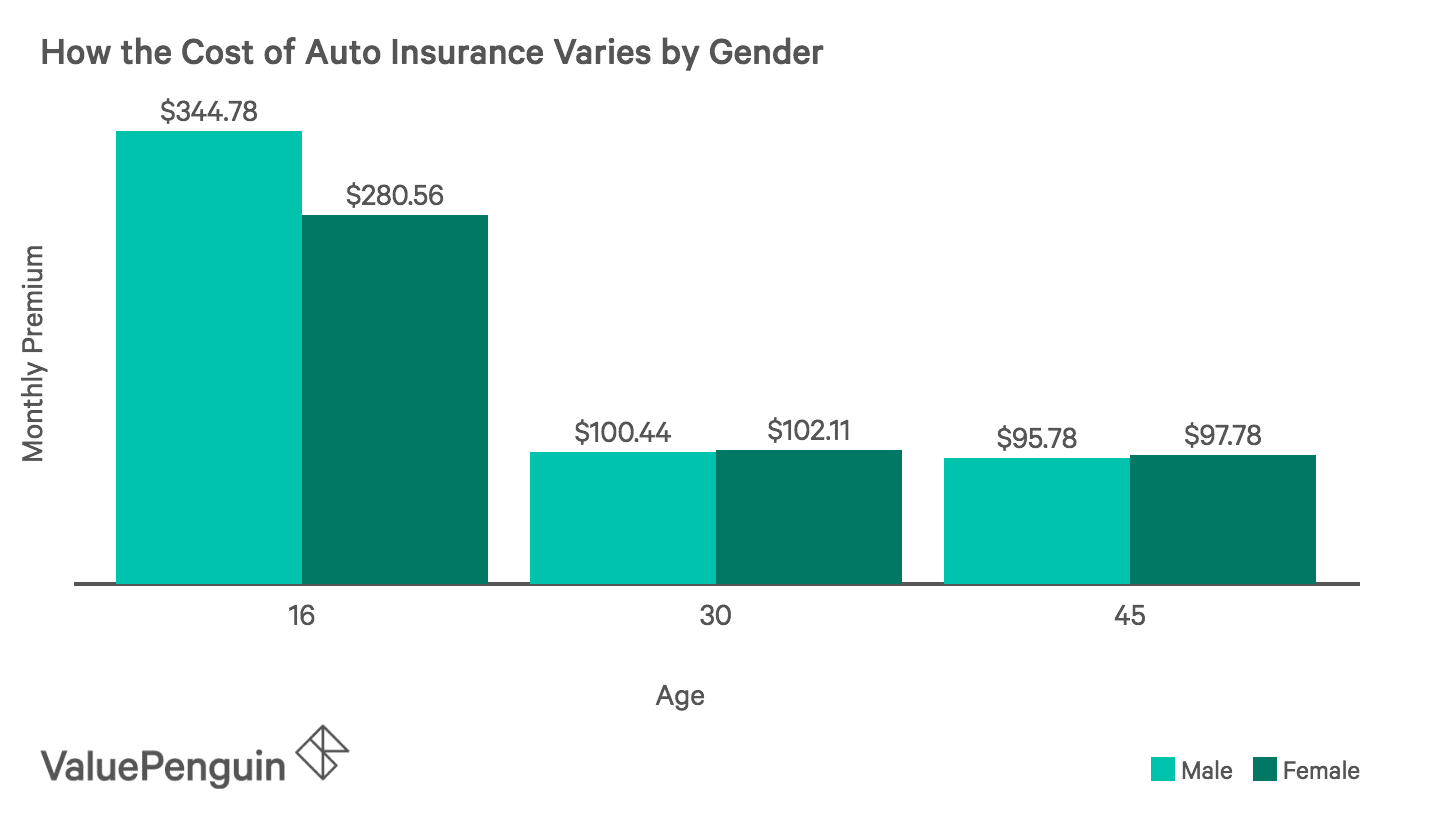

Average Cost Of Car Insurance By Gender

We know what youre thinking – you cant discriminate based on sex anymore! Yet despite the EU directive which prohibits insurers from assessing a drivers risk based on their gender, male drivers are still paying more on average than female drivers. According to Confused.com, male drivers are edging closer to the £900 mark and are paying £878 on average for their car insurance – £114 more than female motorists who are paying £764 on average.

How To Find The Best Car Insurance Rates

Buying car insurance doesnt have to mean breaking the bank there are ways to save. Discounts are one of the best ways to lower your premium. Most major car insurance carriers offer discounts. Here are some of the most common insurance discounts in the U.S.:

- Claims-free: Drivers who have no auto claims on their record for the past several years typically qualify for savings.

- Bundling insurance policies: You can often reduce your auto insurance premium when you bundle your car insurance policywith a home insurance policy, earning discounts on both policies.

- Good student discounts:Many auto insurers offer discounts for young drivers who earn good grades in school.Paying in full: If you can afford to pay your car insurance premium in full, versus monthly or quarterly, you may reduce your premium.

- Telematics: Most car insurance companies offer telematics programswhere you can allow them to track your driving habits with an app or device for savings.

Because every auto insurer offers a different suite of discounts, speaking with your insurance agent or company representative may be the best way to learn about savings opportunities.

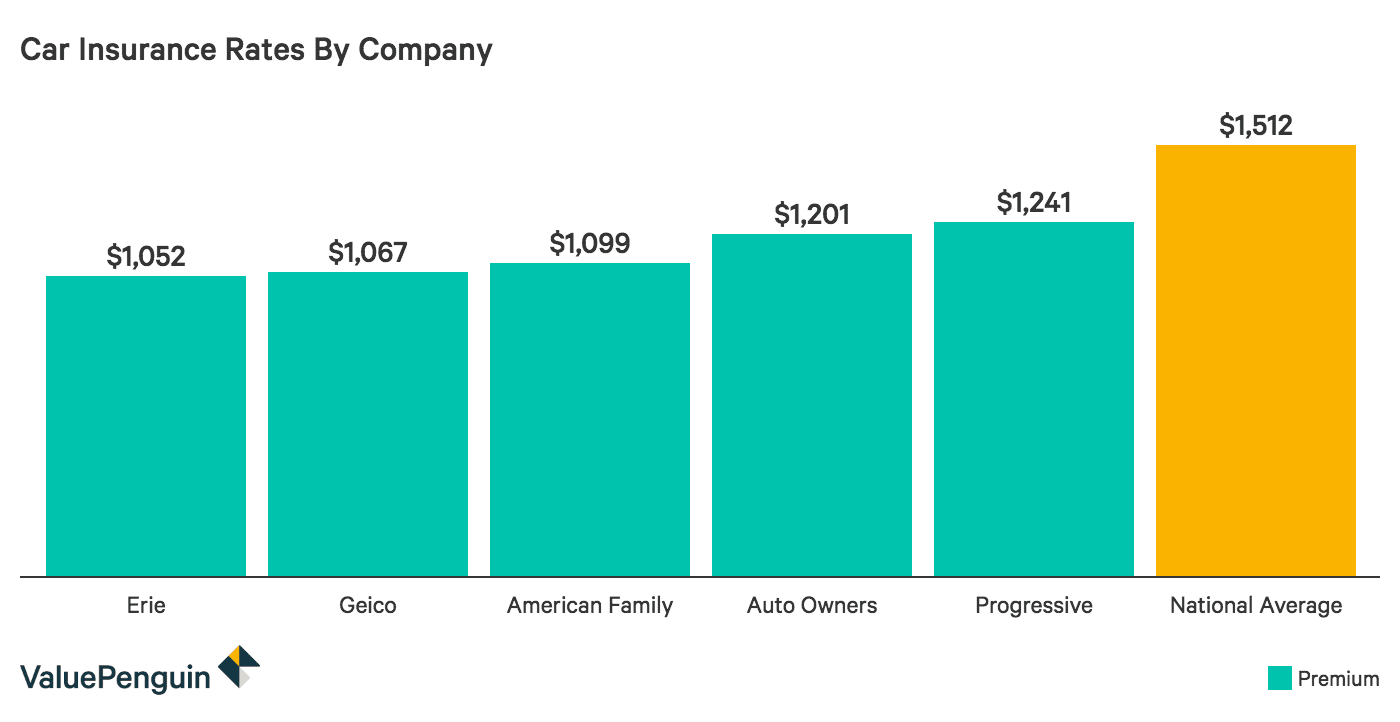

Additionally, getting quotes from several car insurance companies can help you compare rates. Each company sets its own rates, so the same coverage can cost vastly different amounts with different providers. Comparing quotes might help you find the lowest price for the coverage you need.

Also Check: Pool Noodle Hail Cover

What Kind Of Car Insurance Coverage Do You Need

No matter what kind of vehicle you are insuring you can choose various levels of coverage, depending on how much protection you want for your car insurance:

- Collision and Upset coverage protects you from costs to repair damage to your vehicle caused by impact with another vehicle or an object such as a guardrail.

- Coverage against perils other than collision or upset, previously called Comprehensive, protects you from costs to repair damage to your vehicle from unexpected situations such as fire, theft, vandalism or natural disasters.

- All Perils protection combines both of the above coverages.

- Specific Perils coverage protects your vehicle only against specific dangers, such as theft or attempted theft, some natural disasters, riots or civil disturbances.

Meglio Pagare L’assicurazione Auto Per Intero O Mensilmente

In genere, pagherai meno per la tua polizza se puoi pagare per intero. Ma se pagare una grossa somma forfettaria in anticipo ti mettesse in una situazione finanziaria ristretta, ad esempio, ti lasciasse incapace di pagare la franchigia dell’assicurazione auto, rendendo pagamenti mensili dell’assicurazione auto è probabilmente un’opzione migliore per te.

Recommended Reading: Cars Salesman Commission

Find Out How Your Rates Stack Up Against Other Age Groups And Locations

In this article, well explore how average car insurance rates by age and state can fluctuate. Well also take a look at which best car insurance companies give the best discounts on car insurance by age and compare them side-by-side.

Whenever you shop for car insurance, we recommend getting quotes from multiple providers so you can compare coverage and rates. Many factors affect your premium, so whats best for your neighbor might not be best for you.

Use our tool below or call our team at to start comparing personalized car insurance quotes:

Average Car Insurance Costs With Tickets Or Accidents

Your accident and ticket history is another factor insurance companies consider when setting rates and determining if they can insure you.

- A driver with a clean record pays an average of $1,424 per year for car insurance.

- The same driver with a ticket on their record pays an average of $1,836 per year.

- If that driver were at-fault for an accident, he pays an average of $2,237 per year.

There are things that can combat increases or lower the costs to your car insurance after an accident. In some states, attending traffic school can get violation points taken off your record. That, in turn, can impact your premiums. And, depending on the insurer, you may get a break if its your first violation. Its worth discussing your options with your insurance agent.

Car Insurance Premiums With Tickets and Accidents

Scroll for more

- $2,237

Also Check: Can You Buff Out A Scratch On A Car

Does Car Insurance Decrease Every Year

A car insurance does not decrease every year ideally. Car insurance rates are determined by many factors. These factors include:

#1. If youve gotten a ticket

#2. caused an accident or

#3. If youve been convicted of a DUI or other major violation.

Youll probably see your premium increase at your renewal. Even if nothing changes on your policy, your premium probably wont stay exactly the same. Insurance companies file new rates with the departments of insurance in each state they operate in each year, so your premium may increase or decrease to reflect these new rates at each renewal.

How To Get Affordable Car Insurance

Here are some tips to help you get affordable car insurance:

- Shop around. Get comparable quotes from at least three different insurance providers before every renewal period and go with the best value. Weve included the top cheapest car insurance companies below to give you a head start.

- Dont drop your coverage. Even if you go a period without a car, consider a non-owners policy to avoid gaps in coverage. Insurers frown upon coverage gaps and it could affect your future rates.

- Increase your deductible. Selecting a higher deductible can result in a lower premium. However, this is only a good option if you can afford to pay the deductible if needed.

- Look for discounts. Most insurance companies offer a variety of discounts for which you may qualify.

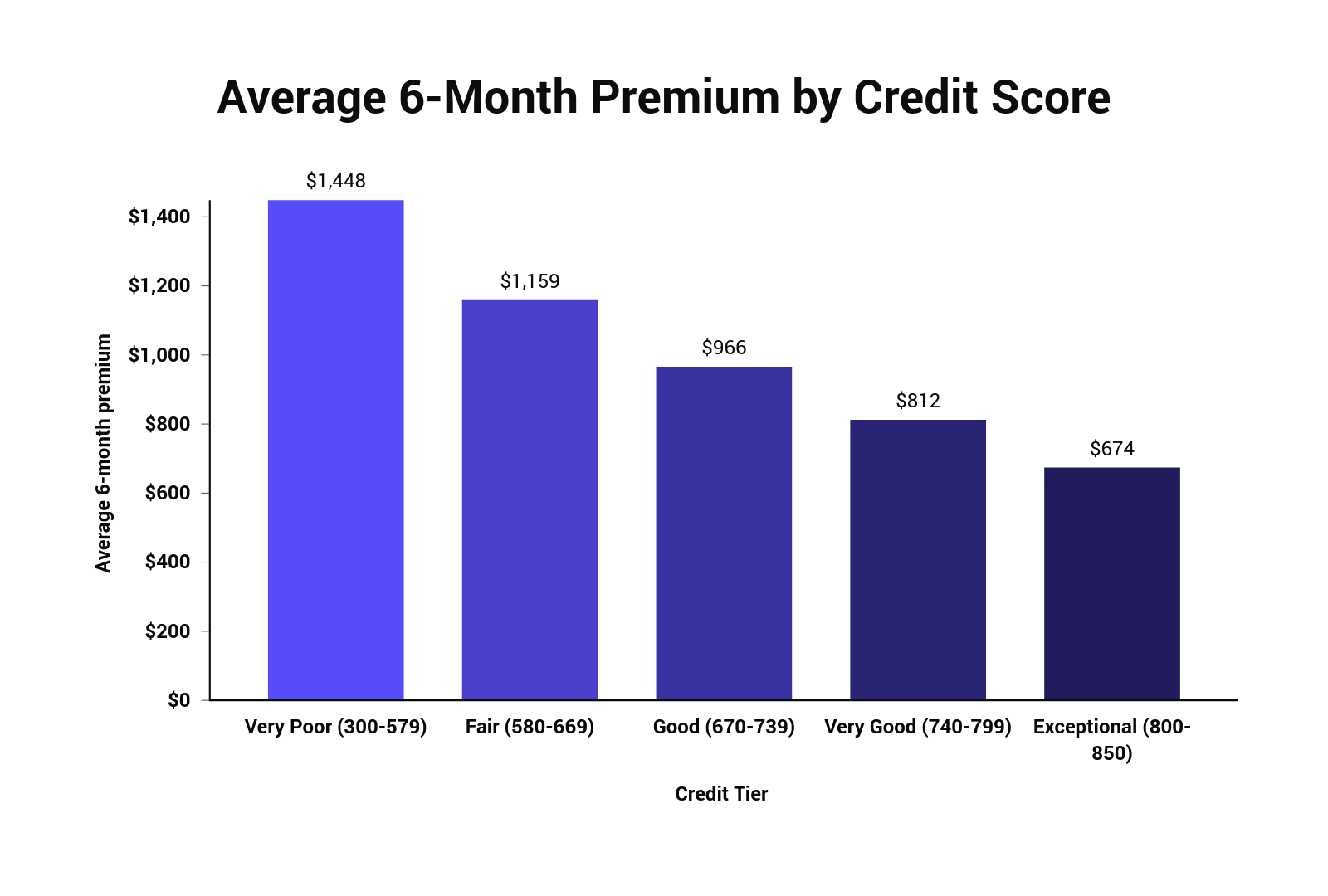

- Have a credit score of 650 or higher. In most states , auto insurers can use your credit score in pricing your policy. Drivers with lousy credit pay 71% more, on average than those with good credit, Insure.com found in a rate analysis.

Read Also: Adding Bluetooth To Factory Car Stereo

Why Are Insurance Rates So Low In Nova Scotia

Auto insurance rates in Nova Scotia are among the lowest in the country, largely due to government reforms introduced in 2003. These auto insurance reforms have helped reduce rates by 27% across the province. The average policy in 2003 was $1,069, compared to an average of $891 in 2019. The reforms gave drivers a wider range of auto insurance choices and now there are more than 60 private insurance companies they can choose from.

Whats Going On With Auto Insurance Rates In Ontario

For at least two years before the COVID-19 pandemic, Ontario auto insurance rates were trending upwards. FSRA approved overall auto insurance rate increases each quarter.

| Timeframe | |

|---|---|

| 1.56% | 21 |

Then 2020 happened, and everyone knows the year was unlike any other. COVID-19 changed everything, including the auto insurance industry. Insurance rebates, premium reductions, and other forms of relief became the norm.

| Timeframe | |

|---|---|

| Q4 2020 | -0.17% |

According to FSRA, since March 17, 2020, FSRA approved 83 rate applications, and 81 of those applications were for an average premium change of 0% or less. Almost all approvals were related to COVID-19 and what fewer drivers on the road entailed.

From an auto insurance standpoint, the outlook appears to be much the same for drivers in 2021. FSRA says it will continue to ensure that auto insurance rates reflect Ontarians changing driving habits, and they expect auto insurers to provide customers with more rebates and rate reductions in 2021.

Recommended Reading: How To Read Club Car Serial Number

Ready To Find The Best Insurance Rates

While insurance rates are higher in some provinces, you don’t have to accept high prices. In Ontario and Alberta, drivers can shop online at Rates.ca to find the cheapest car insurance.

With RATESDOTCA drivers save an average of $427 by comparing auto insurance rates from over 30 of Canada’s leading insurance providers.

Liability Car Insurance Costs By Coverage Level

| Liability coverage limits |

|

NOT Covered |

NOT Covered |

Most other companies that offer rideshare insurance cover Period 1 only. State Farm is one of the few that enables you to increase your coverage for all three ridesharing periods. Their policy also allows you to bypass the insurance company hired by your rideshare company if you have a claim. There have been many complaints about the customer claims service from these insurers.

Allstate’s Period 2 and 3 coverage doesn’t increase your coverage types or limits, but it does help with the high deductibles in your Uber or Lyft coverage. Uber’s insurance comes with a $1,000 deductible. Lyft’s is even higher$2,500. If you get into an accident during periods 2 or 3, Allstate pays you the difference between these deductibles and those on your personal auto policy. So, if your personal deductible is $500, Allstate will give you $500 if you drive for Uber or $2,000 if you drive for Lyft to help pay your bills.

You must have your personal auto and rideshare insurance with the same insurer. Rideshare is add-on coverage, not a stand-alone policy. If you like your current auto insurance company and their rideshare insurance seems reasonable and gives you a comfortable level of coverage, buy from them. If you’re not satisfied with what you’re offered, consider switching companies. Comparison shop for the best overall dealpersonal and ridesharingthat you can get.

|

Senior Driver |

$507 |

|

$4,801 |

Also Check: How To Protect Car From Hail

Take Advantage Of Multi

If you obtain a quote from an auto insurance company to insure a single vehicle, you might end up with a higher quote per vehicle than if you inquired about insuring several drivers or vehicles with that company. Insurance companies will offer what amounts to a bulk rate because they want your business. Under some circumstances they are willing to give you a deal if it means youll bring in more of it.

Ask your insurance agent to see if you qualify. Generally speaking, multiple drivers must live at the same residence and be related by blood or by marriage. Two unrelated people may also be able to obtain a discount however, they usually must jointly own the vehicle.

If one of your drivers is a teen, you can expect to pay more to insure them. However, if your childs grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a good student discount on the coverage, which generally lasts until your child turns 25. These discounts can range from as little as 1% to as much as 39%, so be sure to show proof to your insurance agent that your teen is a good student.

Incidentally, some companies may also provide an auto insurance discount if you maintain other policies with the firm, such as homeowners insurance. Allstate, for example, offers a 10% car insurance discount and a 25% homeowners insurance discount when you bundle them together, so check to see if such discounts are available and applicable.

Will Commercial Auto Insurance Cover A Vehicle Used For Personal Business

Most insurers will allow an owner or employee to use an insured vehicle for personal use if the coverage is requested and proper disclosure is made on the application. The cost for providing coverage for regular personal use is typically an additional $50 per year. In almost every case, the insurance carrier will require every person with access to a business vehicle to be listed as a driver on the policy.

You May Like: How To Charge Vehicle Ac

Average Car Insurance Premiums By Age

The number of years you’ve been driving will affect the price you’ll pay for coverage. While an 18-year-old’s insurance averages $2,667.89 per year, the average 30-year-old’s price drops to $1,883.93.

Car insurance costs tend to fall with age. But, that makes insuring a teen driver incredibly expensive. But, it’s also important to remember that it will vary from person to person, regardless of your age based on other factors like your driving history.

Here’s the breakdown of the average car insurance cost across age groups, according to data from Savvy.

| Age |

| $1,064.50 |

The Shared/residual Market And Nonstandard Markets

All states and the District of Columbia use special systems to guarantee that auto insurance is available to those who cannot obtain it in the private market. These systems are commonly known as assigned risk plans. Assigned risk and other plans are known in the insurance industry as the shared, or residual, market. In assigned risk plans, high-risk policyholders are proportionally assigned to insurance companies doing business in the state. In the voluntary, or regular, market, auto insurers are free to select policyholders.

Motorists can also obtain auto insurance from the nonstandard portion of the private market. The nonstandard market is a niche market for drivers who have a worse than average driving record or drive specialized vehicles such as high-powered sports cars or custom-built cars. It is made up of both small specialty companies, whose only business is the nonstandard market, and well-known auto insurance companies with nonstandard divisions. AM Best estimates that the nonstandard auto market generated $16.9 billion in direct premiums in 2019. The market consists of about 130 mostly small- to medium-sized insurers whose nonstandard auto premiums account for more than 50 percent of their total net premiums written.

You May Like: How To Keep Squirrels Out Of Car Engine

What Optional Coverages Are Available

Depending on the insurer, there are many optional coverages available, which can be added to the policy by endorsement. These endorsements allow the business to tailor their policy according to their industry and individual needs.

- Hired and Non-owned Liability: Provides liability coverage on vehicles rented by the business or when an employee is using their personal vehicle for business-related activities.

- Hired Auto Physical Damage: This endorsement allows the business to provide physical damage on vehicles rented for business use and is subject to the deductible selected.

How Much Should I Be Paying For Car Insurance

How much you should pay for car insurance varies widely based on a variety of factors. Geography is typically the most important factor for safe drivers with decent credit, so it helps to understand your state’s averages.

How much you should pay for car insurance varies widely based on a variety of factors. Geography is typically the most important factor for safe drivers with decent credit, so it helps to understand your state’s averages. The national average for car insurance premiums is about $1621 per year, and there are states with averages far away from that figure in both directions. Learn more about how much I should be paying for car insurance.

Read Also: Auto Title Transfer Az