Is Repairing A Totaled Car Worth The Effort

Only you can decide whether repairing your totaled car is worthwhile. However, you should consider the expenses of repairing a car, and whether or not it is safe to drive the car.

Insight:

The best thing is to be well informed, says Ward. Talk to your mechanic. Do your research. Make sure you know what you are getting yourself into.

What Happens Next If You Total A Financed Car

Assuming youre covered, your insurer will send a payment to your lender for the actual cash value of the car, minus any deductible. Make sure you give your lenders contact information and the account number to your agent or insurance company. If your car is totaled and you still owe on it but the accident was not your fault, contact the at-fault drivers insurance company with your lender information.

To maintain your good credit, you should to continue to make your loan or lease payments until the insurance company issues payment to your lender. If you dont have insurance or dont have enough coverage, youre on the hook for the balance left on your vehicle even though the car is no longer drivable.

Should You Buy Back Your Totaled Car

If youve been in an accident and you want to buy back your totaled car from your insurance company, there are a few things you need to know.

If youve been in a car accident and totaled your car, youre not alone. In 2018 alone, there were 5 million car crashes that resulted in property damage. Furthermore, private passenger auto insurance companies had more than $162 million in incurred losses in the U.S. in 2019.

Heres a breakdown by state:

Incurred Losses By State, Private Passenger Auto Insurance, 2019| State | |

|---|---|

| United States | $162,379,305 |

- Note: Losses occurring within a fixed period whether or not adjusted or paid during the same period, on a direct basis before reinsurance.

- NAIC data, sourced from S& P Global Market Intelligence, Insurance Information Institute.

If your cars been totaled in a crash but you dont want to go through the hassle of buying a new car, you could buy your totaled car back from your insurer. Keep reading if youre curious about buying your totaled car back from your insurance company.

You May Like: How To Find My Old Car Without The Vin

How Much Is It To Buy Back A Totaled Car From An Insurance Company

I was involved in an accident recently and the damage to my car didnât seem too severe but the insurance company told me it is totaled. The car has some sentimental value, so I was wondering how much would it would be to buy it back from them.

fair market price for the vehicle in its current conditionlet your car insurance company know immediatelyrequire a salvage titlefree

How Do I Keep My Totaled Car

You see, your insurance company doesnt just take your car for fun. They salvage your car to recoup some of their prices. That means that youll need to get in touch with the insurance company and find out how much theyre willing to part with the totaled vehicle. That amount will then be deducted from whatever payment youd receive for the car being totaled.

But you really need to carefully consider whether or not this is a good idea. Your cars value will be drastically reduced, and not just because its been damaged. Typically, the title will have been changed to a salvage title or another title type which will permanently lower the value of your vehicle, even after its repaired.

If you are truly determined, however, all you have to do is contact your insurance company and find out what theyll accept for a buyback. Its difficult to know how much this will be, due to varying vehicle values, but if you get some estimates for salvaging your vehicle, theyll probably be in the right ballpark.

You May Like: How To Calculate Car Interest

The Process Of Buying Back The Rv

As you go through the process you will see that underneath all the insurance jargon and confusing terms for parts and services you may have never heard of, you will see that its not as confusing or scary as you think.

The main things to understand about the value of your buyback will be in the details of the repair itself and the value of your RV. Understanding safety regulations is also a big piece of the totaling process.

Even if the RV could be resurrected and be driven again, the question is, Can it be driven safely?

If they decide that there are too many safety concerns because the damage was too great to make proper repairs, then the vehicle will need to be totaled.

Make sure you know everything about your RV when you take it in to be appraised. Every feature adds up to a different dollar amount for the final tally. Here are some important things to know about your RV for insurance purposes.

- Model, year, and trim

- Any additional features or aftermarket parts you had installed, and their value

- Current mileage

Once the insurer appraises the damage and value of the RV, they will have a garage give an estimate on the repair costs. After the final numbers are presented for the repairs and the value, the insurer will be able to make an educated decision on if it can be fixed safely or if it needs to be totaled.

If it needs to be totaled, they will alert you and explain your options. If a buyback is on the table, they will calculate the salvage value of the RV.

Obtain A Written Settlement Offer From The Auto Insurance Company

Once the adjuster contacts you with an offer, ask them to email it to you with the valuation report or CCC report . Many insurance companies rely on this report to provide a market evaluation showing the car’s value and ultimately use it to determine the settlement amount. Confirm that all of your vehicle’s features are considered on this report and that the report correctly lists the mileage. Upon receiving the written offer, ask the adjuster to show three additional items:

A. Sales tax they are responsible to payout the state sales tax B.Payoff lien amount the amount to be paid directly to the auto financing company for any outstanding vehicle loans C. Net settlement amountthe amount that you will receive from the company.

Read Also: How To Keep Car Windows From Fogging Up

When Buying Back A Totaled Car Makes Sense And When It Doesnt

May 6, 2022

An act of nature or a collision can result in damage so extensive that the vehicle is deemed a total loss or totaled by the insurance company. When this happens, the insurance company will offer the car owner fair market value less a deductible. Then they will typically take possession of the vehicle and auction it.

Can the owner ever keep their totaled vehicle? In some instances, the insurance company offers the owner the option of buying back a totaled car. However, keeping a total car only makes sense in some circumstances. Heres what car owners need to know about buying back their car after it has been declared a total loss.

What Is The Value Of Your Written Off Vehicle

Its important not to accept the first figure your insurer offers you when they write off your vehicle as a total loss.

Do your research and get a quote using our salvage calculator before negotiating. Insurers may quote a figure that is lower than what they can actually achieve, whereas our calculator will compare the best offers available to you. Your vehicles value as a total loss will depend on its category.

The Association of British Insurers produced a salvage code to make it easier to understand the condition of a vehicle. Since 1st October 2017, the following categories have been used:

You May Like: Why Does My Car Squeak

What Happens When Your Car Is Totaled And You Are Not At

In situations where an accident results in a total loss at the fault of another driver, the at-fault driver’s insurance will usually pay you the value of your totaled vehicle.

But what happens when your car is totaled and there isnt another driver at all? If your car is damaged beyond repair as a result of a falling object, like a tree dropping on it during a storm for example and you have comprehensive coverage insurance your insurer will likely pay you the cash value of your vehicle, minus the amount of your deductible.

Now, if youre thinking, What happens if my car is totaled and the fault is split between both drivers? In cases like this, its best to check in with your claims representative to learn about how coverage and payouts will be managed. Exactly how much each insurance group pays for a totaled car when both drivers contributed to the accident depends on the amount of fault assigned to each driver, among other factors such as specific regulations in your state.

See What You Can Save On Car Insurance

Enter your information to see how much you can save on auto insurance.

- If the damage is severe and the vehicle can’t be safely repaired, it’s considered totaled.

- If it will cost more to repair your vehicle than it’s worth, they will total it.

- State regulations may dictate the amount of damage your vehicle can have before it’s totaled.

Being involved in an accident is stressful enough. Arm yourself with information so you can be well-prepared for dealing with your insurance provider when and if your car is totaled.

Read Also: What To Ask When Buying A Used Car

What Is The Actual Cash Value Of A Car

RELATED: What Happens if a Dealership Totals Your Car?

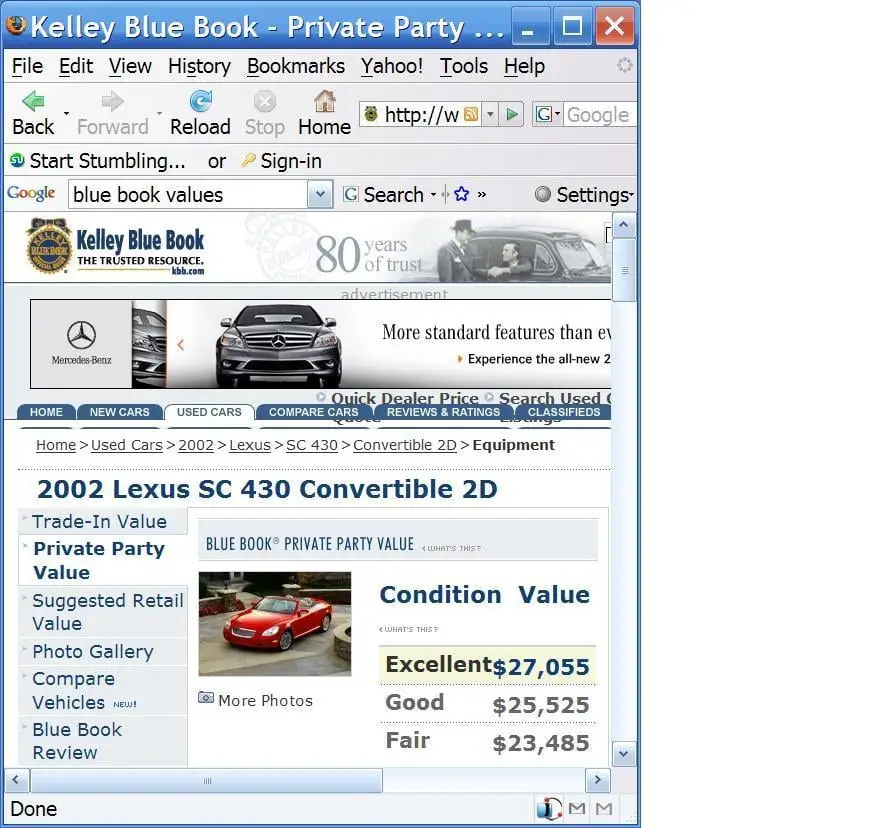

According to Kelley Blue Book, your cars actual cash value is how much it was worth just before the loss. That value doesnt mean that youll get what you paid for the vehicle, though, as the cars depreciation is also factored in.

That all being said, the amount that your insurance company pays you out depends on the state that you live in. In Arizona, for example, the state threshold to total out a car is 70% of its ACV. That means if you have a car that has an ACV of $10,000, then the insurance company will deem it a total loss if the damage is $7,000 or more. In that case, if you wanted to buy the car back, then its up to you as to whether or not you think its worth it.

Types Of Insurance Coverage That Protect A Vehicle

Comprehensive auto insurance covers a vehicles damage if the vehicle was damaged by acts of weather, vandalism, an animal in the road, etc. If the driver was at fault in an accident, collision coverage will kick in to handle the repairs.

Full coverage is typically inclusive of liability, comprehensive and collision insurance. Liability insurance will settle and pay for damage to another drivers injuries and vehicle damage sustained in a crash caused by the policyholder.

Comprehensive and collision insurance could be involved when a car is damaged. As in all accidents, a police report will be filed, the car owner will contact their insurance company and discuss the nature of the accident. Fault will be determined . Then an insurance estimator will examine the damage to the vehicle and determine the amount that needs to be paid for repairs.

In some situations, the damage is so extensive that the price to repair the car costs more than the value of the vehicle. When this happens, the insurance company will deem the car a total loss.

Every state has its own formula for how a totaled vehicle is determined. The owner of the car receives the actual cash value for their vehicle minus the deductible and the insurance company takes possession of the vehicle.

In some cases, the insurance company will offer to let a car owner buy back their vehicle. What do car owners need to know about buying back a totaled vehicle? Is it worth it?

Recommended Reading: How Old For Car Seat

If The Airbags Deployed Is The Car Considered A Total Loss

Not necessarily. Deployed airbags are not an immediate qualifier for a total loss. If, however, the cost of replacing the airbags is more than the value of your car, your vehicle will likely be a total loss.

Many wonder if airbags deploy, is a car totaled even if the damage is minor? A lot more goes into equating a total loss than just airbag deployment. As youll find, the answer to that all depends on the value of the car weighed against other costs, like the estimate of how much the car may go for at a salvage auction plus the complete cost of repairs, including towing, parts, labor and other auto-body expenses, like window replacement, paint and primer too.

If you have questions about airbag replacement after an accident, our friendly insurance agents are willing and able to help!

What Are The Steps To Buying Back A Totaled Car

Don’t Miss: How To Lower Car Payment

How Long Do Accidents Stay On Insurance Record

The answer to the question how long does an accident stay on your record? is three to five years. That said, drivers should do everything within their power to avoid traffic tickets and additional accidents for six years. If a policyholder is involved in another incident within that time frame, their insurance rates are likely to skyrocket.

Is My Car Totaled Calculator

How do you know if the offer for your total loss car is even close to acceptable? It would be great to have a salvage car value calculator you can use to figure out how much your car is worth now, compared to its value before your accident.

Unfortunately, thats not a calculation insurance companies are willing to provide. But if youre asking yourself, How much is my totaled car worth, there is a rough calculation you can make on your own:

- Find the Kelley Blue Book Value for your car in fair condition.

- Work out 20 to 40 percent of the fair condition value, depending on how bad your total loss cars condition is. Its probably closer to the 20 percent mark.

Keep in mind, every car depreciates. To you, that means that the value of your car, whether it has been totaled or not, is losing value every day you drive it.

You May Like: How Long Do Car Batteries Usually Last

How Can I Buy Back My Totaled Car

The specific process to buy back a totaled car is largely up to your insurance provider. However, there are a few things that will be consistent in every situation.

First, youll need to settle on your cars value as if you were taking a payout instead of keeping it. It will do you well to research values so you can ensure youre getting a fair shake from your appraiser.

Remember the salvage value mentioned previously? Now is when you need to determine what that value would be for the insurer. Your totaled cars salvage value will be deducted from the payout youd receive.

How Does Gap Insurance Work After A Car Is Totaled

Keep in mind, there is such a thing as still owing money to your lender after you receive payment from the insurance company. Why? Because the insurer is only obligated to pay you for the fair market value of your car, and sometimes when youre financing a car, youll owe more money on it than its actually worth. This is called being upside-down, and its why you should have auto lease or loan gap coverage.

Gap coverage is an additional auto coverage you can add to your auto policy so, in the event youre upside-down when your car is totaled, itll help pay for the gap between what your car is worth and what you still owe to your lender, subject to any applicable coverage limits. At American Family Insurance, the maximum payout for gap coverage is equal to 25 percent of your vehicles actual cash value. So, if your cars ACV is $4,000, youll have an extra $1,000 in gap coverage with this added protection in place.

Another important detail about this coverage is that the loan must be a vehicle loan and be taken out only to purchase the vehicle. So, if you used a home equity loan to purchase a vehicle, this coverage would not be available. Additionally, it doesnt pay for items such as extended warranties, credit life insurance, loan rollover balances or late payment penalties and fees.

You May Like: How To Avoid Paying Sales Tax On A Used Car

Uninsured Motorist Property Damage And Underinsured Motorist Property Damage :

UMPD/UIMPD applies when a driver with no insurance or not enough coverage is at-fault in an accident that totaled your vehicle. UMPD/UIMPD may be beneficial if you dont have collision coverage and can cover your vehicle up to a specified dollar amount on your policy, instead of the vehicles value. The availability of UMPD/UIMPD varies by state and a deductible may apply.

Please note that in certain situations, UMPD/UIMPD may not offer enough coverage to pay the value of your vehicle. For example, if the UMPD limit on your policy is $25,000 and your car is valued at $35,000, youll be $10,000 short. To avoid this situation, its a good idea to carry collision coverage if your vehicles value exceeds the limit of your UMPD/UIMPD coverage.