How Much Car For A Monthly Payment

When youre buying a car, the dealer will often try to get you to fixate on how much you can afford in monthly payments. Hell then structure the deal to give you the most car for the lowest monthly payment. Sounds great, right? It isnt. Sure, the longer the loan, the less youll pay each month. But youll actually end up paying more for the car in the long run, because youll be paying more in interest payments. This table calculates how much you will have to pay each month for a vehicle, assuming an annual interest rate of 3.5 percent. Buyers paying off their vehicle in four years pay 6.8 percent of payments in interest. Those taking five years have 8.4 percent of their payments going to interest. And those taking six years have a whopping 10 percent of payments going to interest.

Auto Loan Amount

How Much Does An Exhaust System Cost

If you want to know how much does an exhaust system cost, first think about how much power you expect to gain from adding a new exhaust system to your vehicle. A performance exhaust system can improve the efficiency of your car and increase the overall horsepower up to 5 percent. The price of an exhaust system depends on the desired result, the make and model of your car. You can expect to spend the average cost of an exhaust system between $300 and $1500.

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

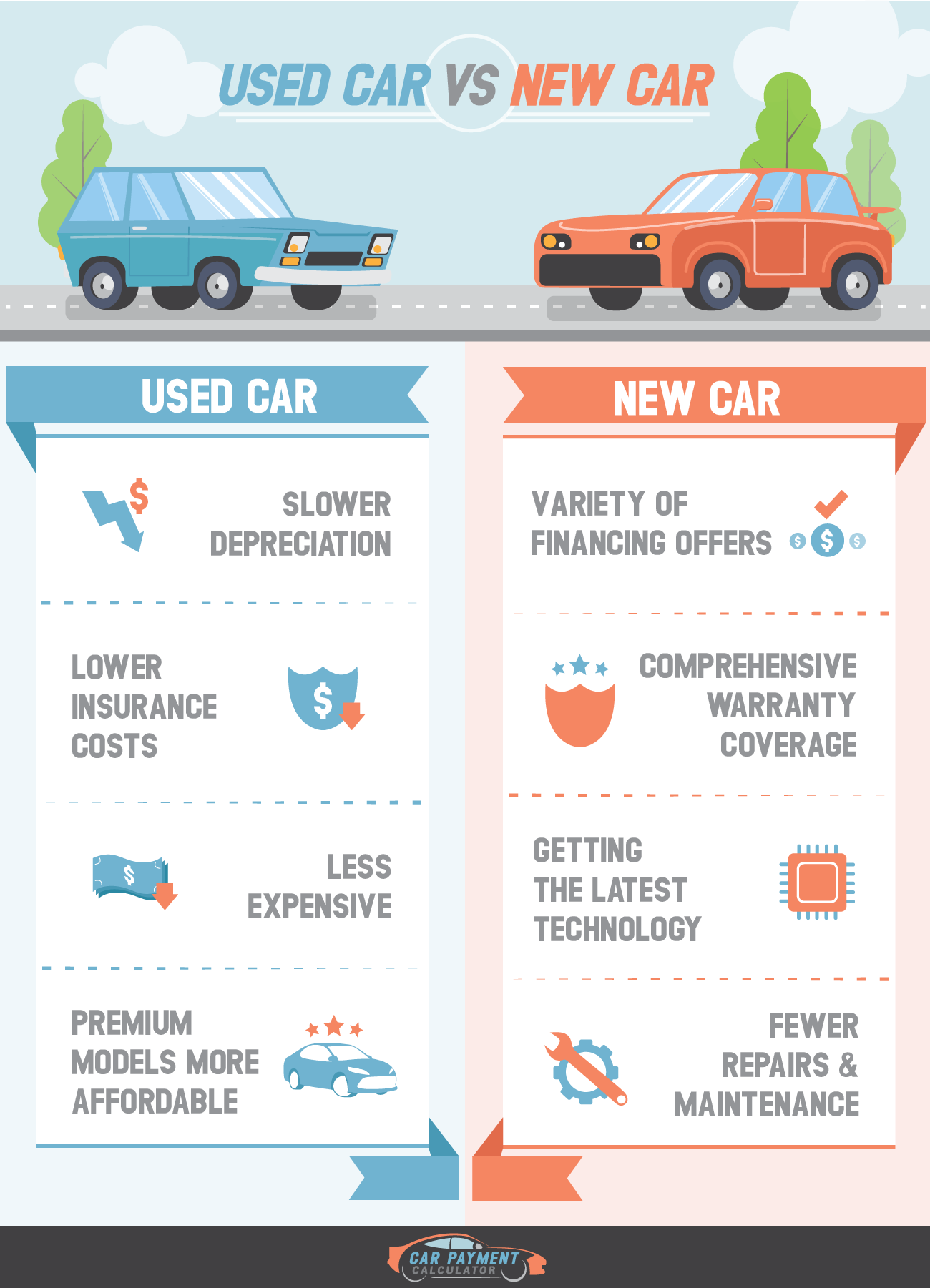

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

Don’t Miss: How Do I Get My Car Title In Florida

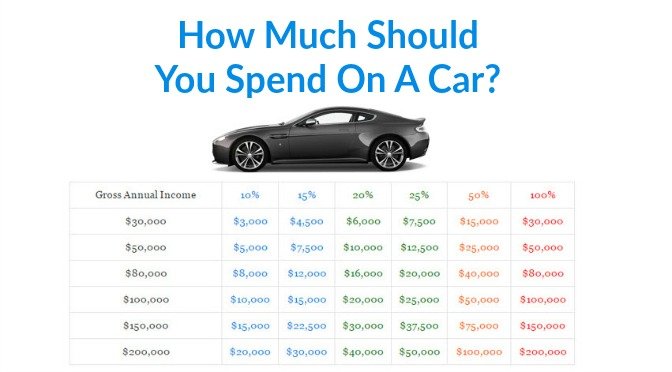

How Much Should I Spend On A Car Based On Salary

January 30, 2019 Budgeting Advice

Buying a car gives you a lot of freedom. You no longer have to live life by the bus schedule and you can stop bugging friends and family for rides all over town. You can hit the road whenever you like, and listen to whatever music you want on the way there. Unfortunately, that freedom comes at a cost.

Cars are getting more expensive

The average cost of both new and used vehicles are on the rise. According to data from Kelley Blue Book and Edmunds, the average cost of a new car in 2018 was $37,577 and the average used car cost $20,084 the highest price since 2005.

With cars getting more expensive and Canadian budgets getting tighter, its important to be realistic about what you can afford to spend on a new vehicle. But, how much should you spend on a new car?

Everyones budget is different

Even if you and your neighbour make the same amount of money, your lifestyles, vehicle priorities and debt situations are probably quite different. Budgets dont have a one-size-fits-all solution, but there are some expert-recommended spending ratios that can make it easier to figure out how much car you can afford without going into the red.

Here are 4 salary equations to consider:

Debt-to-income ratio

Figuring out your debt-to-income ratio is a good way to see how much debt youre already carrying and how much new debt you can responsibly take on and, by extension, how much you can afford to spend on a new car.

10% of your salary

20% of your salary

You Need A Car Thats Comfortable Functional And Brand New

Youre in the market for a new car thats comfortable, built to a high standard and affordable. You dont want something thats already been used instead, you want your car to be completely new.

If this sounds like you, its best to spend about 20 to 25 per cent of your total annual income on a new car. Using the average UK salary of £26,000 per year, this gives you about £6,500 to spend on a new car.

Around this budget, youll be able to afford some small city cars such as the Suzuki Alto or the Kia Picanto, both of which are available for under £8,000. If your budget extends slightly beyond this limit, the Citroen C1 is available from £8,245.

If you need a larger or more powerful car, its worth looking at the used market. A wide range of cars are available for 20-30% off their new price after just one or two years of light use, making them great low-cost comfortable choices.

Don’t Miss: What To Use Instead Of Car Wash Soap

Understand How Much You Can Afford

The first thing you should do is calculate how much you can afford to spend on a used car.

A lot of people skip this step and head straight to the car lot to check out the inventory.

Unfortunately, this can create a situation where you find the perfect car and make an impulse purchase despite the vehicle being out of your price range.

As I previously mentioned, our recommendation is that you spend no more than 20% of your annual take-home pay on a used car.

The easiest way to calculate this number is to multiply your monthly net income by 12 to get your annual take-home pay. Then, multiply that number by 0.2 to get your max budget for a used car.

From there, all you have to do is save up and pay cash!

How To Save On Your Average Car Payment In Canada

You can take the following steps to lower your average car payment in Canada:

You May Like: How Much Does A Car Salesman Make Per Car

How Much Should I Pay

The exact amount that you should spend on a car might change depending on who you ask. Some experts recommend that car-buyers follow the 36% rule associated with the debt-to-income ratio . Your DTI represents the percentage of your monthly gross income thats used to pay off debts. According to the 36% rule, it isnt wise to spend more than 36% of your income on loan payments, including car payments.

Another rule of thumb says that drivers should spend no more than 15% of their monthly take-home pay on car expenses. So under that guideline, if your net pay is $3,500 a month, its best to avoid spending more than $525 on car costs.

That 15% cap, however, only applies to consumers who arent paying off any loans besides a mortgage. Since most Americans have some other form of debt whether its credit card debt or student loans that they need to pay off that rule isnt so useful. As a result, other financial advisors suggest that car buyers refrain from purchasing vehicles that cost more than half of their annual salaries. That means that if youre making $50,000 a year, it isnt a good idea to buy a car that costs more than $25,000.

Additional Expenses To Think About

Youll need to consider the following expenses in addition to your average car payment in Canada when budgeting for a car:

| Expense | Average cost |

|---|---|

| Gas | You can expect to pay between $100 and $160 per month on gas depending on a number of factors, including your fuel economy and how far you drive. |

| Insurance | Youll likely pay between $100 and $200 per month on car insurance depending on what type of car you have and how much insurance you need. |

| Emergency repairs | You can pay several hundreds up to several thousands of dollars for emergency repairs to your vehicle depending on the damage. |

| Routine maintenance | You may pay anywhere from $200 to $1,000 per year on routine maintenance. This can include oil changes, tire rotations, filter replacements and other repairs that keep your vehicle running smoothly. |

| Registration. | Registration and licensing fees can cost anywhere from $50 to $250 per year, depending on where you live. |

You May Like: Suspend Car Insurance Geico

How Much Should I Spend To Buy A New Car Or A Second

Every financial advisor faces this million-dollar question:How much should I spend to buy a new car or a second-hand car.

The old school of thought still prevails, people buy high end car to show off their stature and to prove the social status in the community.This thought process has been influenced by their immediate friends and relatives who own high end cars that grants a sense of achievement.In hindsight they are over bored by upgrading to premium cars, maintaining the car and went behind the large price tag. At times they do agree that they made the worse financial decision.

As a financial advisor we come across such cases multiple times.Fortunately,there is a basic rule one can follow to buy a car i.e.,20/4/10.20 stands for the down payment.One should be ready with 20% of down payment of the on-road price of the car.4 stands for loan tenure,it should not be beyond 4years.Nowadays banks offer loan for 7years to reduce the monthly EMI and to optimize the eligibility to give the car loan.0 stands for all your expenses related to that car like EMI,Insurance,maintenance,fuel charges etc.Let us break this down to get a better clarity.If the on-road price of the car is 20lakhs then one should be ready with 4lakhs as down payment so that the loan is not a burden on you.

Views are personal: The author is Vishal Goenka,is Mumbai based Mutual Fund Distributor

Mutual Fund investments are subject to market risks,read all scheme related documents carefully

How Much Of Your Salary Should You Spend On A New Car

Your choice of car can have a huge effect on both your personal freedom and your finances. Since your car is likely the second most expensive thing youll buy, after your home, its important to budget carefully to make sure it stays affordable.

There are several rules of thumb for working out how much to spend on a new car, many of which are extremely helpful. In this guide, well explain how much you can afford to spend on a new car, compared to the amount you earn every year.

Whether youre shopping for a car youre passionate about or just need a simple and effective car to get to and from work every day, read on to work out how much your next new car should cost.

Read Also: Car Freshie Shapes

What Are The State Ev Credits And Incentives

Many states and even local governments looking to speed up EV adoption rates offer their own incentives. California is a leader in incentivizing EV purchases with a direct consumer rebate up to $4,500, for example, through the Clean Vehicle Rebate Project. There is currently a waitlist for applications, however. Colorado, Washington and New England states also offer some generous state incentives that you can combine with the federal EV tax credit. Even your local utility company may subsidize an EV purchase.

How To Find The Right Car With My Budget

In other words, what are the cheapest car that I can afford?

Really, there are plenty of options to have a nice financed car with a small budget. If you cant afford a jaguar because your monthly budget is £150, we will find cars that could be a good deal for you:

- For example, the iconic fiat 500 is a car that you can afford with £150 budget per month.

- Citroen C1 is another car that can be considered with £150 per month.

- Toyota Aygo is also reachable with £150 per month.

Recommended Reading: How Much Does A Car Salesman Make Per Car

The Downpayment On Your Car Should Be At Least 20% Of The Purchase Price

If you put any less down, you could be paying more than what the car is worth by the end of the year, it is also known as negative equity. According to Edmunds, a car depreciates in value by 9% as soon as you drive it off the lot. By the end of the year, that same car has lost about 19% of its value.

Think about it, if you buy a $20,000 car with 0% down by the end of the first year your car is worth $16,200 through depreciation. However, assuming 4% annual percentage rate interest on a 5-year loan youre paying about $370 per month your remaining amount owing is roughly $15,560, but this amount does not include applicable taxes, fees, and finance charges of the loan itself.

However, If you put 20% down, your car payments are $295 per month and your remaining amount owing is $12,460 . Still. you owe less, youre paying less per month, and youre nearly halfway to paying off the car completely.

A lower monthly payment makes affording gas, maintenance, and auto insurance a little easier on the pocketbook.

How Much Should I Spend On A Car

Leather interior. Rearview cameras. Automatic emergency braking. While you may dream of a shiny new car with all of these features and more, you may need to prepare for sticker shock.

The average new car costs more than $40,000, and used cars average above $21,000. Of course, you can buy a brand new car for as little as $16,000, and decent used cars can be picked up for a few thousand. What this means is that you have to think about your needs, budget, and other financial priorities. Then decide how much you can spend and wish to spend to meet your transportation needs. Whether its a used or new vehicle, well try to make the decision easier for you.

Recommended Reading: How To Get Internet In A Car

Other Things To Consider

There are more costs to owning a car than just the payment and insurance. You should also budget for how much you’ll need to spend on gas and maintenance — although a new car should be covered under warranty for most of a new-car loan period.

Also consider the length of your car loan. While longer loans will, in general, give you a lower monthly payment, you’ll be paying more overall in interest charges. In addition, longer loans increase the amount of time you’re “underwater” on the new car. That’s the situation, known more formally as negative equity, when you owe more on your loan than the car is worth if it was sold. And that can make it more difficult to sell or trade-in the car.

Finally, don’t forget that these guidelines can and should vary depending on your situation. If you don’t drive very much, or spend a lot of your income on housing costs, you may prefer to spend less per month on your new car. If you’re a car enthusiast, or need a very specific vehicle for your job or commute, you might want to stretch your budget a little higher. Overall for most people, spending 10% to 15% of your monthly take-home pay on a new car loan is a good guideline.

How Much Should You Spend On A Car Payment

Read Also: How Much Commission Does A New Car Salesman Make

What Is The Cost To Upgrade Car Audio

A car audio system upgrade is a great way to make your vehicle more efficient. There are many costs associated with upgrading your cars audio system, whether you want to replace specific components or completely overhaul the entire system.

It can be expensive to upgrade your cars audio system, but it can also be very affordable. It all depends on what your budget is, and what you want out of your cars audio system.

An entire cars audio system can be upgraded.

- Upgraded speakers

- An amplifier with more power

- A modern head unit

- Good quality wiring.

It should also include the cost of hiring a qualified technician to set up the system.

All of these factors are considered, and an upgrade to a cars audio system at the lower end of the price range will run you $695. This includes a standard technician to install it.

A high-spec system that is installed by a skilled technician will cost between $1730 and $1900.

There is no limit on how much you can spend on car audio systems. However, a moderately expensive system with top-of-the-line installation is within this range.

This budget will provide enough sound quality for most audio enthusiasts. However, if you want to get a better audio experience, then increase the budget.

It is important to consider your budget when building your cars audio system.

If you dont know how to install the system, you should always consider hiring a technician. Take your time researching and finding out the best solution for you and the car.