Why Buy Car Insurance Online

- Easily get the lowest car insurance premium quotes from the best car insurance providers in India.

- No need for you to search for car insurance near me, car insurance agent near me or a car insurance company near me, like ever!

- You can do this from the comfort of your home, office and mobile

- With help of Coverfox, buying the best car insurance policy is a completely online, paperless, simple, easy & secure process.

- No more waiting for the policy document! Once you buy your favourite car plan from Coverfox, the policy is delivered instantly straight to your inbox.

- From comprehensive to third party, own damage to pay as you drive, cashless car insurance to car insurance for commercial vehicles, you can get all of these plans along with car insurance offers on Coverfox at the click of a button.

To help you with the same, we have created a step-by-step guide on buying the right insurance plan for your precious car.

Check Out These Common Types Of Car Insurance Coverage:

- Liability coverage: This common type of car insurance coverage is mandatory in most states, except Virginia and New Hampshire. You must have at least the minimum liability coverage. If you drive without it, penalties will follow.

- Collision coverage: This is optional coverage, but your lender or leaseholder might require it from you. Its main role is to cover the damage dealt by you to other vehicles or objects.

- Personal Injury Protection coverage: Check your states insurance requirements for personal injury coverage because several states, including Florida and New York, require drivers to carry minimum coverage due to no fault laws. This insurance covers your medical bills and those of any passengers in your car regardless of fault. It also pays for lost wages.

- Uninsured and underinsured motorist coverage: As the name implies, this insurance covers your loss if you get hit by a driver who has little or no insurance coverage. By adding this coverage to your policy, you get medical or car repair compensation in the event of an accident.

- Comprehensive coverage: Typically, this is optional coverage but if you are buying your car with a loan or lease, your lender may require it. Comprehensive coverage helps you to cover damages from fire, vandalism, theft, and more.

Searching Online Is Just One Option

While there is a seemingly endless number of companies issuing auto insurance policies these days, there are really just two ways to buy car insurance: You can purchase a policy in-person through an agent — a licensed individual who sells policies on behalf of one or more insurance companies — or you can buy directly from an insurer via Web site or telephone.

Buying car insurance online still accounts for a relatively small portion of total auto insurance sales, but it’s increasing in popularity. According to a 2011 survey by the Internet marketing research company ComScore, just 20 percent of new auto insurance policies were purchased online, compared to 43 percent purchased from an agent. However, the number of online purchases represents an increase of 5 percent from just two years earlier, while the number of agent purchases represents a 6 percent decline. Additionally, a 2011 survey by J.D. Power and Associates showed that 54 percent of new auto insurance owners applied for a rate quote online, the first time this has happened for a majority of respondents .

There are six types of coverage that can appear on a typical auto insurance policy: bodily injury liability, property damage liability, collision, medical payments/personal injury protection, comprehensive and uninsured/underinsured motorist coverage. Check with your state’s insurance department to find out which types of coverage drivers are legally required to carry and which types are optional.

Also Check: How To Get Dried Sap Off Your Car

How Can You Save With Your Car Insurance

What is the best way to save on your car insurance? Ask about discounts and you can inquire every time you speak with your insurance issuer.

What is the easiest way to get a discount on your car insurance? Well, if you own a home or more than one car, you can bundle them together with the same insurer. This is one of the biggest discounts you can find. But check your eligibility for others, too, including if you served in the United States military.

Get Discounts For Installing Anti

Individuals have the potential to lower their annual premiums if they install anti-theft devices. GEICO, for example, offers a potential savings of 25% if you have an anti-theft system in your car.

Your insurance company should be able to tell you specifically which devices, when installed, can lower premiums. Car alarms and LoJacks are two types of devices you might want to inquire about.

If your primary motivation for installing an anti-theft device is to lower your insurance premium, consider whether the cost of adding the device will result in a significant enough savings to be worth the trouble and expense.

Don’t Miss: How To Change The Interior Color Of A Car

Is Tyre Covered Under Car Insurance

Tyre is not usually covered in a standard package policy. However, there is Tyre Protect addon offered by most insurers where you can cover the Tyre by paying a little extra premium.

Tyre is not usually covered in a standard package policy. However, there is Tyre Protect addon offered by most insurers where you can cover the Tyre by paying a little extra premium.

Cancel Your Old Policy

If youâve been shopping for car insurance to replace a current policy, wait until after your new coverage is in placebefore you cancel your old policy. You want to make sure you donât leave any gaps in your coverage.

To do this, set the cancellation date of your old policy and the effective date of your new policy on the same day. Insurance policies begin and end at 12:01 AM on a given date, so you donât have to worry about having a full day of overlapping insurance.

Also Check: How To Get Sap Off Car

List Yourself As An Excluded Driver On The Policy

This is a legal statement that, as an unlicensed driver, you are not going to drive the car. Note that if you do drive illegally and get into an accident, the insurance company will not cover any claims. If you get or regain your license while the car is insured, you must notify your insurance company and provide your new license number before you are legally insured on the policy.

What You Need To Prepare

To purchase car insurance, and to get an accurate quote on coverage and premium, youll need to provide specific information, and sometimes documentation.

Expect to provide the following:

- Your full name

- the mileage , and

- the vehicle identification number

The vehicle identification number, or VIN, is usually displayed on the dashboard of the car, or on the inside of the driver side door.

However, you should usually be able to obtain the VIN number from either the person or the dealership youre buying the vehicle from.

Don’t Miss: How To Remove Scuff Marks From Car Door Panels

How To Compare Quotes On Price Comparison Sites

Price comparison sites are a good place to start as they allow you to get multiple quotes quickly.

Once you’re on the insurer’s website, check the policy details again, just in case the comparison site had described details incorrectly.

The main price comparison sites for insurance are Compare the Market, Confused.com, Go Compare, MoneySuperMarket and Uswitch.

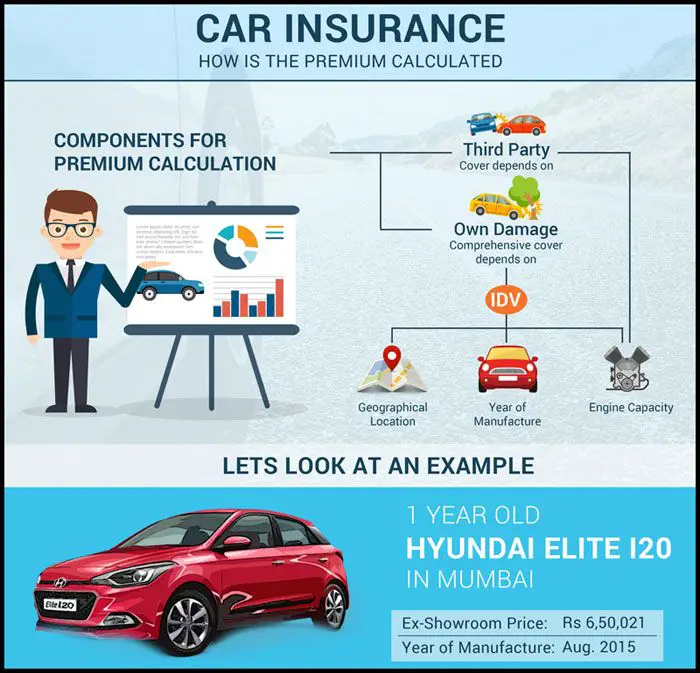

How To Calculate Car Insurance Policy Premium

You can calculate the car insurance premium for your car with the help of an online car insurance premium calculator. We have created a free tool that will automatically calculate the premium for your car. This is how it works:

- The calculator generates premium quotes based on the inputs you have input.

- It will give you a detailed view of the different car insurance quotes from various insurers

- You can compare, buy and renew policies with this calculator

- For third party liability, you need to enter the details of the engine capacity of your car.

- For comprehensive cover, you need to enter the details of your cars make, model variant, ROT location, and age.

You May Like: How Much Does A Car Salesman Make Per Car

At What Age Does Car Insurance Become Cheaper

Theres a myth that car insurance premiums become cheaper after you turn 25, but theres no evidence to back this up. And no insurer that we know of offers an over-25 policy.

Cheap car insurance for new drivers can be hard to find, but we have good news. According to LowestRates.ca data, car insurance premiums gradually decline every year after age 18, with the biggest drop in price occurring on average between the ages of 20 to 21. Your rates will continue to fall if you maintain a clean driving record and make zero claims.

Shop For Car Insurance Before Going To Car Dealers

Many people wonder, do you buy a car first or the insurance? The best thing to do is shop for car insurance ahead of going to a car dealership or before buying a new car or purchasing a used car.

If you want to shop for insurance before owning a car, ask the dealership or car owner for the vehicle identification number, or the VIN of the vehicle you have in mind, so you can obtain more accurate quotes for insurance.

If youre financing the vehicle, car dealers will ask for proof of insurance before you get the keys to your new car.

Can you get car insurance from your car dealer? Of course. But its not recommended in most cases. Many dealers work with specific companies and their interests may not align with yours.

Read Also: How To Register A Car In Ny

How To Find The Right Coverage At The Right Price

Here’s a quick rundown of the 10 steps, followed by a more detailed guide.

1. Determine your state’s minimum insurance requirements. 2. Consider your own financial situation in relation to the required insurance and consider whether you need to increase your limits to protect your assets. 3. Review the status of your driving record do you have any outstanding tickets or points on your driver’s license? 4. Check your current coverage to find out how much you are paying. 5. Get competing quotes from insurance websites and individual companies of interest to you. 6. Make follow-up phone calls to insurance companies to get additional information about coverage. 7. Inquire about discounts. 8. Evaluate the reliability of the insurance companies you’re considering by visiting your state’s insurance department website, reviewing consumer surveys and talking to family and friends. 9. Review the policy before finalizing it. 10. Remember to cancel your old policy.

You can do a lot of your insurance research online, using insurance quote sites and specific company Web sites to build a list of comparative quotes.

Check Insured Declared Value

The IDV or Insured Declared Value of the car is its current market value. When calculating your car insurance, the IDV is important as it is the amount your car is insured for. In case of total loss – complete damage or theft of the car – the policyholder receives the Insured Declared Value when the claim is settled. Always select the IDV carefully as a lower IDV means insufficient compensation in the event of total loss, even though it means lower policy premiums. On the other hand, a higher IDV could mean paying more expensive premiums.

You May Like: Can You Add Bluetooth To An Older Car

What Is Third Party Insurance

Third party insurance covers you for damage to other peoples property. It doesnt cover damage to your own car.

When deciding whether third party insurance is worth buying, consider whether you can afford the average cost of $3,000 for vehicle repairs1. This could be significantly higher if you happen to damage an expensive sports car.

Its a good idea to take out third party insurance as a minimum to prevent finding yourself personally liable for large costs.

What Is Cashless Car Insurance

Cashless car insurance is a benefit offered the car insurer where you dont have to pay anything to get your car repaired if the repairs are done in the insurance companys authorised garages.At Digit, we have 5800+ garages across the country and we also offer a Pick-up, Repair and Drop service with a 6 months repair warranty.

Cashless car insurance is a benefit offered the car insurer where you dont have to pay anything to get your car repaired if the repairs are done in the insurance companys authorised garages.

At Digit, we have 5800+ garages across the country and we also offer a Pick-up, Repair and Drop service with a 6 months repair warranty.

Recommended Reading: Can I Turn In My Car Lease Early

Choose Your Car Insurance Coverage

Car insurance includes several different types of coverage, some of which are optional and some of which you can adjust based on your needs. You also need to make a decision on the deductible amount that works best with your budget.

Here are the steps to help you choose how much insurance you should buy.

Check Out Our Tips On How To Get Great Car Insurance

If you are confused about how to buy car insurance, you’re in the right spot. In this article, we’ll help you understand the basics of car insurance, how much coverage you need, and how to start a policy. Finally, we’ll show you a few tips and tricks for how to get the cheapest car insurance rates.

To make the decision process even easier, weve already taken a look at the industry’s leaders and narrowed down the top companies in our best car insurance providers review, considering factors such as cost of coverage, customer satisfaction, and the ease of the claims process.

Also Check: How Much Is Car Registration In Texas

When Does The Policy Start

Usually, insurance policies purchased online or over the phone begin immediately. However, you can choose to pre-purchase your insurance policy and have it start on any day you like.

Most insurance providers offer a few payment options to give you flexibility and help make your insurance more affordable. Options vary but often include:

A cheaper rate if the annual amount is immediately paid in full A slightly higher rate to allow you to pay month to month

You usually have the option to start the policy immediately, regardless of which payment option you choose.

What If My Car Insurance Policy Gets Expired

Every car insurance comes with a validity period, post which you need to renew it to continue to enjoy its benefits. However, even if you miss to get your car insurance plan renewed by the expiry date, you can still get it renewed till the next 90 days from the date of expiry. After the expiry of this 90-day period, car insurance cannot be renewed. In such a case, you need to purchase a new car insurance policy.

Read Also: How Much Does A Car Salesman Make Per Car

What Type/level Of License Is Required To Buy A New Car

Although it may not be necessary to have a valid drivers licence to purchase, insure or register a car, you will need one in order to legally drive your new vehicle off the lot. In Canada, many provinces have different stages of graduated licencing so be sure to check the department of transportation to ensure you have a valid licence before you drive away.

Determine Your Coverage Needs

When comparing quotes from multiple insurers, make sure youre getting the same amount of coverage from each company. Not sure how much you need? Each state has its own minimum car insurance requirements, but you may want broader coverage for your vehicle.

The table below includes some of the most common types of coverage:

|

Coverage type |

|

|---|---|

|

Medical expenses, as well as lost wages, child care, funeral costs and other losses due to an accident, regardless of fault |

Still not sure how much coverage to select? See the next section for info on finding an agent to talk you through your options.

» MORE:How much car insurance do you really need?

Don’t Miss: How To Buff A Car Scratch

Compare Quotes From Reputable Car Insurance Providers

Whether you’re buying auto insurance for the first time or looking to switch from your current car insurance company, it’s a good idea to get quotes from multiple insurance providers. This can help you compare coverage and rates. It’s important to remember that since auto insurance quotes are based on your individual circumstances, whats best for your neighbor might not be best for you.

According to our cost estimates, the average 35-year-old pays between $990 and $2,700 and above per year for car insurance depending on the company. That’s a wide range, which is why it’s so important to compare rates.

If you are not sure where to start, consider getting quotes from some of the best car insurance providers.

| Best Car Insurance of 2021 | Superlatives |

|---|

How Do I Get Car Insurance

Youll need to call your insurance company with all the details of your new car like the make, model and VIN. 2 Youll also need to have your lease or financing details, plus your banking information on hand. Whether you purchase your insurance online or over the phone, you will be talked through all the necessary questions and can arrange for your coverage to start in time to pick up your car. Once you set up insurance for your vehicle, you can then register it . In fact, your vehicle must be registered for your insurance to be valid.

Before you leave the dealership, you will have to show them confirmation of coverage. This confirms the vehicle is insured for physical damage coverage, which is generally a requirement when financing or leasing.

If youve never bought insurance before heres an introduction on how to get car insurance. Already have your car insurance with us? You can now add your new vehicle to your existing policy by logging into MyInsurance – its quick, easy, secure and available 24/7. If you prefer to speak to someone over the phone, here is some information about how to contact us.

Don’t Miss: How To Program Honda Key To Start Car