How Credit Scores Affect Apr

Annual percentage rate is the cost you pay each year for financing – it includes finance charges, fees, and other charges. Because financial institutions use credit scores to make sure youre able to repay a debt, creditors usually check your credit before quoting you an APR. The better the credit score, the more favorable APR you may receive.

FICO SCOREHow Do I Calculate A Monthly Car Payment

Using the car payment calculator, fill in information like car price, interest rate and loan terms. The calculator also provides a place to add the sales tax rate for your local area. To get closer to seeing the actual payment, be sure to insert your down payment information plus your cars trade-in value, including any amount you owe. Thats how you calculate monthly car payments. Need help determining the trade-in value of your vehicle? Easy! Use our car valuation tool to get an estimate.

Can You Negotiate The Apr For A Car Loan

This will depend on who the lender is and how creditworthy you are. Car dealers that originate auto loans may have more leeway to work with the interest rate in order to get the deal done. Moreover, lenders are not usually required to offer you their best interest rate available, so negotiating could save you hundreds or thousands of dollars over the life of the loan.

Also Check: Can You Have 2 Car Insurance Policies

Hit Calculate To See What Your Monthly Car Payment Would Be

Youll see three results:

What your monthly car payment would be:

Dont forgetthis is what youd pay every single month for the entire loan term. And with the average new car payment at $576 for almost 70 months, that’s thats a really long time to pay on a car before you own it.2 Whew!

What youd actually pay for the car:

Remember what we said about interest rates? This number represents the all-in price of the car because of them.

How much interest youd pay during the term:

This shows you how much of your all-in price isnt even going to the car. Its money youre paying the lender just for the privilege of borrowing their money.

If you want to play around with your results, just use the sliders to change the numbers. Adjust the slider on the car price to see how your monthly payment raises or lowers. Or you can adjust the slider on the results to see how the car price changes.

Buying New Versus Used Vehicles

Buying new has its advantages, such as the fact that it has never been previously owned. It has that new car smell and everything about it is brand new. The engine is clean and the interior has no stains, burns or defects. However, the individual who purchases new pays a much higher price than if they had purchased the same make and model used.

Though purchasing a used car means that there may be imperfections left behind from the previous owner, the cost of ownership is typically lower. The advantages of purchasing used include:

There are several advantages for purchasing used instead of new. However, purchasing used does have a few disadvantages, too. For example, the vehicle typically will no longer be under any type of warranty & third party warranty services can be quite expensive. It may also have significant wear and tear on the engine and other vital drive train parts, especially if it has been used as a fleet vehicle or owned by an individual who traveled a great deal, such as a sales professional. When purchasing used, if you want to avoid expensive repair fees it is typically best to purchase something that is only two or three years old with low mileage. On average, cars clock about 12,000 miles per year. If a three year old vehicle which has over 100,000 miles on the engine is probably not a good bet.

How to Make Sure to Buy a Quality Used Car

How to Prevent Buying a Lemon

Don’t Miss: How To Register A Car In California

Why An Auto Loan Calculator Is Important

Our calculator shows you the payment youd get based on a cars price. Its important to figure out what a price in the tens of thousands of dollars would actually translate as your monthly payment. You should use an auto loan calculator when you first car shop online so youll know your price limit. You should also use one at the dealership to make sure that the dealer isnt trying to inflate your monthly payment and slip in add-ons.

Before you go to the dealer, get prequalified for an auto loan so you know what car loan APR you deserve and the dealer cant pad the rate and take the difference as profit. Potential lenders include your local credit union, bank or online lender. You could fill out an online form at LendingTree and get up to five offers at once from auto lenders.

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Recommended Reading: How To Wax A Car With A Buffer

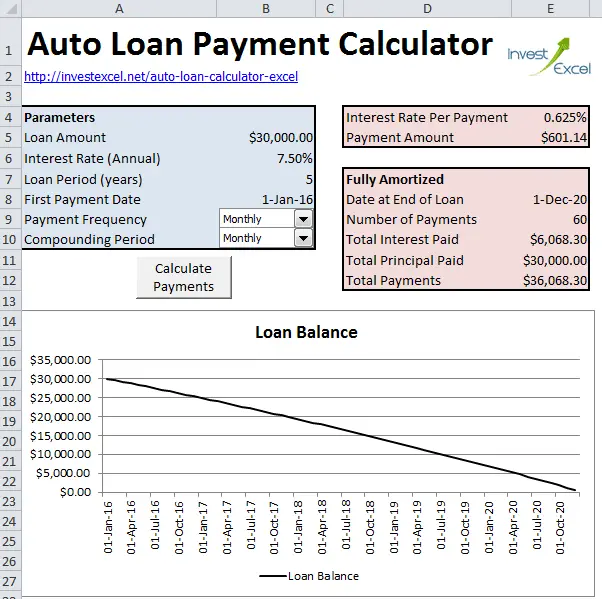

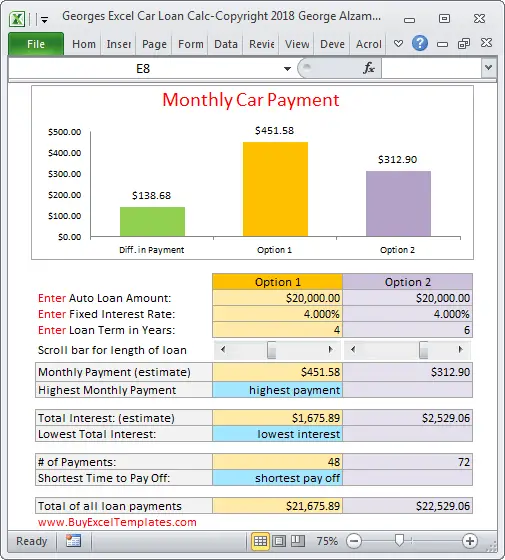

Using Microsoft Excel To Calculate Auto Loan Payments

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Recommended Reading: What To Use To Clean Leather Car Seats

How Does Your Credit Score Impact Your Monthly Payment

In general, lenders view credit scores as a way of gauging the risk that their loan will be repaid. Lenders tend to charge lower interest rates to customers with good credit scores since they have greater confidence that the loan will be repaid in full. Since interest rates are directly correlated with monthly payment amounts, having a good credit score will usually result in being able to secure a lower interest rate and lower monthly payment.

Is It Smart To Do A 72 Month Car Loan

Is a 72-month car loan worth it? Because of the high interest rates and risk of going upside down, most experts agree that a 72-month loan isnt an ideal choice. Experts recommend that borrowers take out a shorter loan. And for an optimal interest rate, a loan term fewer than 60 months is a better way to go.

You May Like: How Does Car Loan Interest Work

How Does A Trade In Potentially Impact Your Monthly Payment

A trade-in will usually help decrease your monthly payment but not always! If the trade has positive equity , it can be put toward the purchase of a new vehicle and reduce the amount that needs to be borrowed, which in turn reduces the monthly payment. If the trade has negative equity , the negative equity in the trade will need to be paid-off by the dealer. Frequently, that negative equity is rolled, or added, to the new loan, increasing the amount that needs to be borrowed and increasing the new monthly payment.

What Loan Term Length Should I Choose

Avoid stretching out your loan term to keep your auto loan payment as low as possible. Youll not only pay more in interest you may also end up having negative equity, meaning you owe more on the car than its worth, for an extended period of time. Choose the shortest loan term you can manage while balancing other expenses like housing, savings and repaying other debts.

Don’t Miss: Is Car Rental 8 Legit

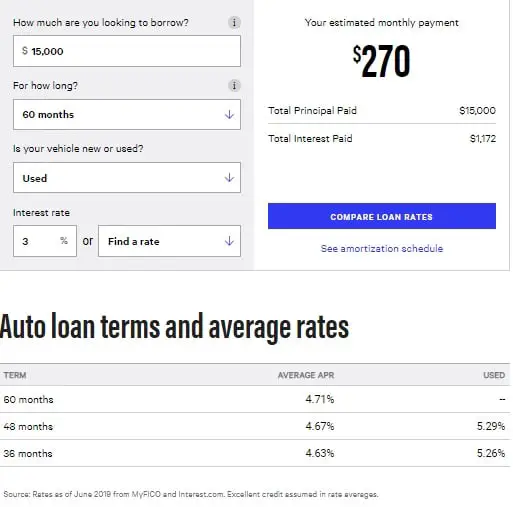

How To Use Credit Karmas Auto Loan Calculator

A car could be one of the biggest purchases youll ever make. Thats why its important to understand how various factors can affect how much you pay to finance a car.

Whether youre just starting to shop for a car or are ready to finance a particular make and model, getting a sense of your monthly loan payment can help with your decision.

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. Itll also help you figure out how much youll pay in interest and provide an amortization schedule .

Keep in mind that this calculator provides an estimate only, based on the information you provide. It doesnt consider other factors like sales tax and car title and vehicle registration fees that could add to your loan amount and increase your monthly payment.

Here are some details on the information you might need to estimate your monthly loan payment.

Calculating Auto Loan Payments

Recommended Reading: What Do You Need To Renew Car Registration

Do Dealerships Like Big Down Payments

Its actually a split, but in most cases, dealers will gladly take your money. Without getting into the jargon behind it, the time value of money states that money in hand now is worth more than in the future due to inflation. Therefore, a big down payment will usually cause a salesmans eyes to light up.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Recommended Reading: How To Siphon Gas From A Car

How Do I Calculate A Car Loan Payment

Banks and other lenders calculate car loan payments using complex formulas. For example, a bank determines the interest rate you qualify for based on your credit score, debt-to-income ratio, and other factors. Suppose you pre-qualify for a car loan and know the interest rate and the sales tax rate in your area. In that case, its easy to calculate and estimate your vehicle loan payment using our car calculator tool.

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Recommended Reading: What Does Insurance Cover If Your Car Is Stolen

How Can I Calculate My Car Payment

Our loan calculator shows how much a loan will cost you each month and how much interest you will pay overall. It can be helpful to use the calculator to try out different scenarios to find a loan that fits your monthly budgetand the amount of total interest you’re willing to pay.

The best way to get a lower auto loan interest rate is to improve your credit score. If you have a low credit score, consider holding off on a car purchase until you can improve your score.

To calculate your monthly car loan payment by hand, divide the total loan and interest amount by the loan term . For example, the total interest on a $30,000, 60-month loan at 4% would be $3,150. So, your monthly payment would be $552.50 .

If you took a three-month payment freeze on a loan due to a COVID-19-related financial hardship, your subsequent repayments could be slightly higher to compensate.

The longer you take to repay a loan, the more interest you’ll pay overalland you’ll likely have a higher interest rate, as well. Make a down payment, if possible, and aim for the shortest loan term possible with a monthly payment you can still afford. And keep in mind that a car comes with expenses beyond the loan payment. Be sure you’ll have money left over to pay for car insurance, gas, parking, maintenance, and the like.

How Much Car Can I Afford

Research shows that the average monthly car payment for both used and new cars continues to rise each yearand the average monthly payment for a used car recently hit more than $400 a month for the first time ever.6

Maybe even more disturbing is that the amount of money Americans owe on their cars has increased by 95% since 2010, and 7 million borrowers are more than three months behind on their car payments!7,8

What does all of this actually mean? Americans are pushing the boundaries on their budgets, and in some cases, theyre pushing them past the limit.

But we dont want that for you! So, when youre deciding how much car you can afford, heres our rule of thumb . If you cant pay for the car with cash on the spot, then you cant afford it. Bottom line.

See, most people decide how much car they can afford based on how big of a monthly payment they think they can take on. But heres our challenge. Instead of asking How much monthly payment can I afford? ask How much car can I afford to pay in cash right now?

That brings us to another question: How in the heck do you pay cash for a car?

Were glad you asked.

Don’t Miss: How To Get Cosigner Off Car Title