Make Sure To Document

This demands meticulous documentation regarding miles driven for business as opposed to other intentions. In addition, records of destinations and business transacted could be requested by the IRS before such allowances are made. Full exemption of interest from taxable income is possible if the car was purchased in the name of, and for the exclusive use of, the business itself.

Dont Miss: Mlo Endorsement

Another Way To Claim Tax Benefits On Your Car

Besides the tax benefits you get on your annual income for paying the interest on your car loan, you can also claim tax benefits upon showing your car as a depreciating asset. A depreciating asset is a commodity whose price is seeing a gradual reduction as time passes. If you show your car as a depreciating asset, you can claim tax benefits on it by showing the depreciation as an expense. The depreciation expense can be exempted from tax even if you have purchased the car without a loan.

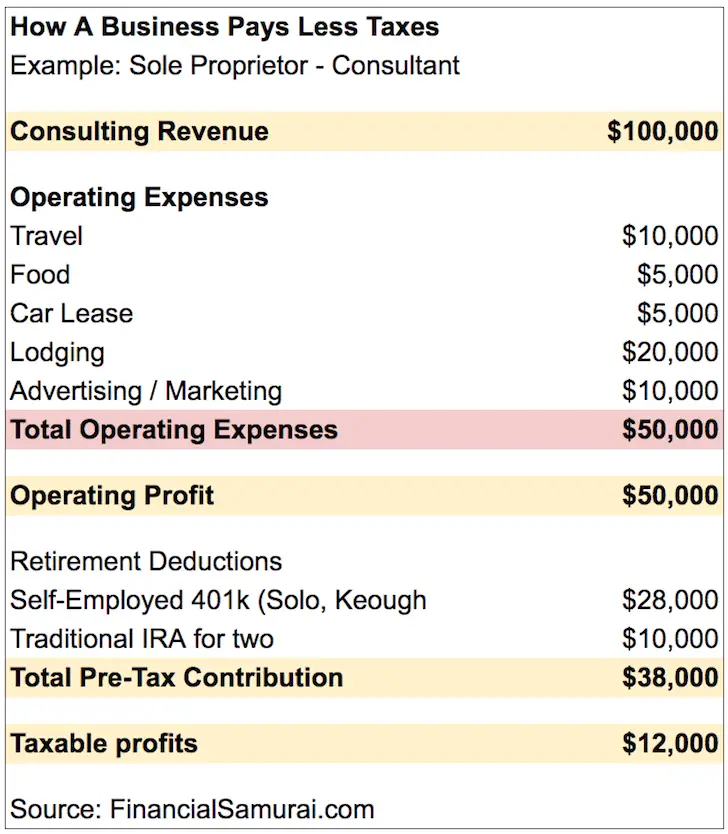

According to the rule, salaried professionals cannot get tax benefits on car loans. Only business owners and self-employed individuals can get those benefits and exemptions. Cars for personal use are luxury products, whereas the cars used for businesses and commercial purposes can be considered a business expenditure.

Are Car Finance Payments Tax

As a car dealership, we get these questions a lot:

- Are car finance payments tax-deductible?

- Can you write off interest on a car loan?

- Is auto loan interest tax-deductible?

- How do I know what car loan expenses to deduct from my taxes?

The answers to these questions vary depending on your vehicle usage.

Understanding what expenses are tax-deductible is critical in maximising savings on your taxes. Read on to learn more the answer to Is car loan interest tax-deductible? and other related questions about auto tax deductions.

Also Check: How To Register A Car In Ny

Selecting A Lender For Car Loan

So, tax benefit on a Car Loan is only available to self-employed professionals or business owners when the loan is taken for a vehicle that will be used for commercial purposes. But even if you are a salaried employee, there are still other Car Loan benefits that you can avail based on the lender you select.

For instance, banks now offer a pre-approved Car Loan to selected customers. Loans of up to 100% of the on-road price of the car, part-prepayment and full-prepayment facility, and zero processing fee are some of the other top benefits.

Apply for a Car Loan, and you are sure to experience several benefits, irrespective of whether you want to purchase a car for commercial or personal use.

Vehicle Loan Tax Exemption

As mentioned above, borrowers applying for home loans or education loans are eligible to claim tax benefits. This is because the interest paid on only certain loans can be claimed as an expense under the Income Tax Act.

For instance, in the case of a home loan, any borrower can claim tax deductions on the interest paid as well as principal repayment.

However, when it comes to a car loan, the interest paid on loan is not considered an expense in some cases. One can only treat it as an expense and avail tax deductions when they purchase the car for business purposes. Hence, not everybody can claim a car loan tax exemption.

Also Check: Who Buys Used Car Batteries

Topic No 505 Interest Expense

Interest is an amount you pay for the use of borrowed money. Some interest can be claimed as a deduction or as a credit. To deduct interest you paid on a debt, review each interest expense to determine how it qualifies and where to take the deduction. For more information, see Publication 535, Business Expenses and Publication 550, Investment Interest and Expenses.

When you prepay interest, you must allocate the interest over the tax years to which the interest applies. You may deduct in each year only the interest that applies to that year. However, an exception applies to points paid on a principal residence, see Topic No. 504.

Types of interest deductible as itemized deductions on Schedule A include:

- Investment interest and

- Qualified mortgage interest including points see below.

Types of interest deductible elsewhere on the return include:

- Interest incurred to produce rents or royalties . See Publication 527, Residential Rental Property and Publication 535

Types of interest not deductible include personal interest, such as:

- Interest paid on a loan to purchase a car for personal use.

- Points , service charges, credit investigation fees, and interest relating to tax-exempt income, such as interest to purchase or carry tax-exempt securities.

How To Claim Tax Benefits On A Car Loan

If youre a salaried individual looking for tax savings on your new car loan, you cannot enjoy any tax benefits on a car loan for salaried employees. However, as a business owner, you can enjoy tax savings when filing your income tax return

To get a tax rebate on car loan, you have to list the car loan interest paid as a business expense. For this, you can request your lender to issue an interest certificate indicating the amount paid as interest on the car loan to enjoy tax savings.

Don’t Miss: How To Change Car Tire

Tax Exemption On Home Loans:

Home loans are one of the most hefty loan liabilities that customers in India avail. Not only is the amount and tenure on these loans massive but also the loan installment that customers are required to pay are large sums of money. Contrarily, the tax benefits that customers get to reap on home loans are great.

Some of the most important aspects of tax benefits on home loans in India are listed below:

Dont Miss: Usaa Loan Approval

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Read Also: How Do Car Brakes Work

Deducting A Company Car Loan As A Business Expense

This is the one exception to deducting car payments–if a car is used one hundred percent of the time for business.

Keep in mind, this policy regarding car tax deduction is more in the line of a company car, not the use of personal vehicles for business purposes.

If you purchase a car strictly for only business use, you can deduct the cost entire cost of business-owned vehicles and their operation. Be warned, the IRS is often suspicious of folks who claim they purchased and used a car for “only business”. Chances are slim that a self-employed business owner would use a vehicle 100 percent for business use so trying to deduct the entire cost of your company car looks fishy.

We always recommend you work with a certified public accountant if you have any questions in regards to writing off your vehicle for business use.

You Use A Vehicle Partially For Business Use And Partially For Private Use

If you finance a car that you use partially for business purposes and otherwise for personal use, you can claim part of the vehicles expenses on your taxes. However, youll need to correctly identify the percentage of the total vehicle use that is business use.

The best way to keep track of the cars business usage is to keep a logbook or diary of your activity with the vehicle. For example, you can track your mileage at the beginning of the workday and at the end of the workday to determine the number of miles you traveled for business use.

Note: According to the Australian government, traveling back and forth from your place of business is considered private use. The only exception to this policy is if you work from home and travel to other locations for business purposes.

You May Like: When Can A Child Stop Using A Car Seat

Debt Expenses That Can Be Deducted

Though personal loans are not tax deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year.

However, certain criteria must be met to qualify for the above deductions. Mortgage interest, for example, is only deductible if the loan was taken out to fund the purchase of a primary residence. You may be able to claim a tax creditwhich directly reduces the amount of tax you owe rather than your taxable incomefor mortgage interest if you were issued a mortgage credit certificate through a government program for low-income housing.

You shouldn’t need a tax break to afford a personal loan. If you’re interested in taking out a personal loan but aren’t certain what amount you’ll be able to repay, you ought to consider using a personal loan calculator to determine what you can afford each month.

How To Claim Car Loan Tax Benefit

Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes. For claiming the benefit, at the time of filing tax returns include the loan interest paid in a year in the business expenses column.

You can get in touch with your loan provider to get an interest certificate, so that you can know the exact interest you have paid in the year.

Also Check: How To Get Dog Hair Out Of Your Car

When Car Loan Interest Is Deductible

1. You can write off a part of your car loan interest if you bought a car for personal use but ALSO use it for business purposes. For example, lets imagine that you are a business owner, freelancer, gig worker, or self-employed contractor. Even if you bought the car for personal use, you will be using it for certain car-related business expenses . These expenses can be written off from the car loan interest that you pay every month.

However, you can only claim tax deductions for business purposes and not when you used the car for personal reasons. For example, if 70% of your car use was for business and 30% for personal affairs, then you can only deduct 70% of the car loan interest from your tax returns.

2. You can write off up to 100% of your car loan interestif you bought a car solely for business purposes.

Ready To Take The Next Step

If you’re looking for your next car â whether for personal use or business â and you don’t have the best credit score, CarsDirect wants to help. Over the last 20 years, we’ve cultivated a network of special finance dealerships that work with subprime lenders that have experience assisting people with poor credit.

You can find out more information about all your vehicle and auto finance-related questions on our site, and, when you’re ready, you can even get our help connecting to a dealer near you. To be matched with a dealership, simply fill out our fast, free, and no-obligation car loan request form to get started!

Read Also: How To Add Bluetooth To Car Factory Stereo

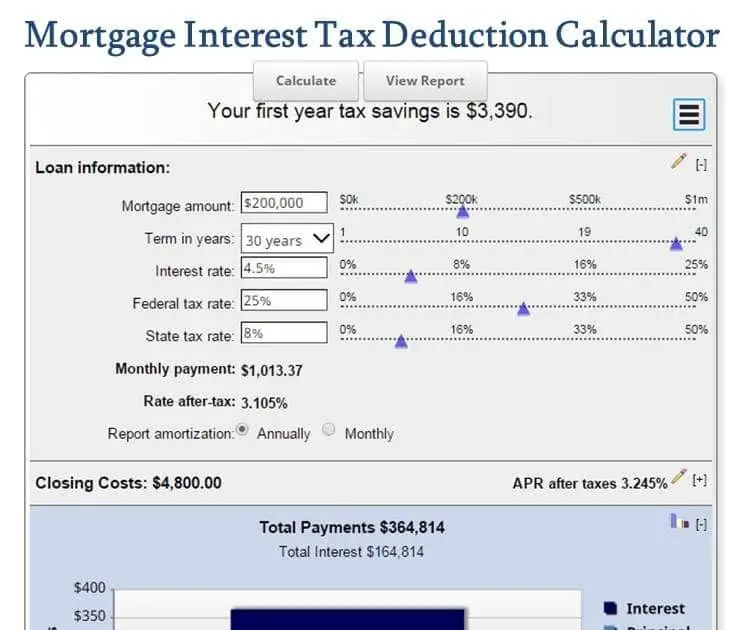

Why You Would Want To Use A Mortgage For Income Tax Deduction

During tax season, itâs always smart to claim as much as possible when filing taxes. Doing so will lower the amount of tax youâre required to pay the government, meaning youâll either lower the amount of taxes youâll have to pay or youâll increase the amount of tax return youâll be given by the government.

However, itâs important to know if your mortgage is tax-deductible before claiming it at tax time. Below are a few scenarios where your mortgage interest might be tax-deductible.

Commercial Car Loan Is Tax

When you take out car finance to purchase a vehicle for use in your business, the interest you pay on the loan is a business expense.

This means that you can claim a tax deduction based on the proportion that business use makes up the total use of the vehicle.

This calculation is easy if the vehicle is only used for business. It’s much more common for a car to be used partly for personal use, and if this is the case, there are two methods you can use to determine the proportion of business use.

Recommended Reading: How To Part Out A Car

Is Car Loan Interest Tax Deductible If I Use A Car For Business And Personal Reasons

The answer to âis auto loan interest tax deductible?â gets more complicated if the car is used for both personal and business reasons.

Example: Ralph uses his car 50 percent for his business and 50 percent for personal trips. He uses the standard mileage rate to deduct his car expenses. Ralph pays $3,000 a year in interest on his car loan. He may deduct 50% of this amount, or $1,500, as a business operating expense in addition to his business mileage deduction.

So, even if you use the standard mileage rate, make sure to keep track throughout the year of how much you pay for parking and tolls, and deduct it along with the business percentage of your car loan interest, and property tax you paid when you bought your car. These vehicle deductions can add up.

Writing Off Car Loan Interest With The Standard Mileage Method

If you choose to take the standard mileage deduction, you can’t take any vehicle expenses as a separate write-off.

Instead, all of these write-offs are included in a standard mileage rate set by the IRS. You’ll get to write off that amount for every business mile you drive.

To use this method, you’ll need to keep good records for your business mileage using a mileage log. Pro tip: Commuting miles don’t count. For more information, check out our post on business vs. commuting miles!

Keep in mind that, with this method, there are some costs that aren’t included in the standard mileage rate: parking fees, tolls, DMV fees, and even car washes. That means you’ll still have to do some expense tracking, using Keeper or a manual expense-organizing system.

Here’s an example of how the standard mileage rate method works. Pretend I’m a self-employed personal shopper who has to visit clients for styling appointments.

For all these client visits, I racked up 5,000 miles in a year. To calculate my write-off, I take 5,000 and multiply it by the IRS standard mileage rate of $0.56. That yields a tax deduction of $2,800.

Who should use the standard mileage method?

In general, the standard mileage rate is the best method for writing off car expenses if you do a whole lot of driving for work. If you’re a more typical freelancer â and especially if you work out of a home office â taking actual expenses is likely to save you more on your tax bill.

Don’t Miss: How To Report Suspicious Car In Neighborhood

Review Of Car Loan Is Tax Deductible 2022

Review Of Car Loan Is Tax Deductible 2022. You can claim tax benefits only on interest. Now, the one thing to keep in mind is that the amount you can deduct is based on how much the vehicle is used for business versus personal purposes.

Before borrowing against the home, you should. This will therefore reduce your tax bill. The costs you can deduct with the actual expenses method include gas, repairs, insurance, oil changes.

Source: windes.com

If you use a van regularly for your private use, you can claim assessable van benefit which is currently £3,350. Some of the expenses you may get a tax rebate for include operational expenses like fuel and oil, repairs and servicing, lease payments, insurance premiums, registration, and depreciation.

Source: graceful-page.flywheelsites.com

In order to make the interest on your auto loan tax deductible, it needs to qualify as a legitimate expense that can be itemized and written off when you file your taxes. If your van has zero emissions, you would once have been able to claim a van benefit exemption.

Source: classiccarwalls.blogspot.com

Again, youll want to consult a tax professional to make sure youre maximizing your deductions. The amount owed in car sales tax will be clear on the purchase order thatll state your tt& l fees.

Source: www.taxuni.com

This would also apply to the purchase of a vehicle or motor home. Through deduction claims, expenses, log books and all other claims to get more of your tax back each year.

Source:

What If My Car Is For Personal Use As Well

estimate how often youâre using the car for personal and business uses

- 50% of your carâs use is for business and 50% is personal

- You paid $25,000 for the car and you have a 10 percent interest rate, which gives you $2,500 in loan interest

- If youâre claiming 50 percent business use for taxes, your deduction would be $1,250âthat is, 50% of the loan interest amount

MORE:

Don’t Miss: How To Apply Car Wax

Tax Deduction For Interest Paid On Car Loan

The Interest paid on some types of Loans is allowed to be claimed as an Expense under the Income Tax Act. However, all types of interests are not allowed to be claimed as an expense.

The most common reasons for which people take loans are when they intent to buy a home or a car. It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases.

However, the interest paid on car loan is not allowed as an expense in all cases. It is only allowed to be treated as an expense where the Car is being used for Business purposes.

If a Salaried person takes a Car Loan, then he cannot claim the Interest on Car Loan as an expense. Therefore, there would no treatment of the interest paid on Car Loan by the Salaried Employee.