Does My Business Need A Vehicle

Need is not the same as wantwhile your business might be able to afford a lovely vehicle for you to drive around in, if;its;determined to be;not required for you to perform your activities it could attract Fringe Benefits Tax;, but more on that later;

;Occupations such as tradesman require work vehicles;like a Hilux or other dual cab ute;to get from one job to the next, but also to carry their tools and equipment to their customers, so a;type of utility;vehicle is essential;as oppose to them trying to claim a;ferarri;would be;used for the same purpose.;There are also;several;industries that provide;delivery;and would require a van;or;if they;are more of a mobile service;and would;need;a vehicle to move from one appointment to the next.;Consider a;40-hour;work week;, how many hours would you spend on the road? Do you have a;principle;place of business and just head out for the ad-hoc meeting? Or are you required to visit your clients on a regular basis?;;

;If you have a business,;whether that be as a sole trader or company, youd need to determine whether purchasing a vehicle would be a worthy investment. After all,;its;not just the cost of the vehicle, but also;the following which you will need to consider when;determing;the;impace;on the bottom line:;;

Should I;just;buy the car in my name?;

This depends on what percentage your car mileage will be used for business vs personal. If the car is exclusively for business use, then by all means purchase it in the businesses name.;;

Factor #: Your Companys Financial Status

My experience is that many of the considerations a small business owner would need to address are not that dissimilar to those of an individual, says Levin, an expert with 25-plus years of experience in the fields of financial services and debt relief. One is your companys current financial status or, put simply, whether or not you can afford it.

For instance, if your business is in the red and youre having a hard time keeping your doors open, buying or leasing a vehicle through your business probably isnt the best idea. Not only could a purchase of this type keep your liabilities above your assets, but it could also erode your relationship with your staff. This is especially true if theyre struggling to do their jobs because of being forced to use second-rate equipment or if they havent received a raise in years, yet they see that youre driving around in a brand new company-owned car.

Determining your companys financial status involves thinking about a variety of things, says Levin. Some of these include:

- How long youve been in business

- How profitable your business is

- What your cash flow is

Dont forget to include insurance costs in your business future financial projection, as this reoccurring expense can really add up over time. This also means realizing what type of insurance you will need, and that depends on how you intend to use your vehicle says Intuit QuickBooks.

Deduct The Price Of Your Car On Your Taxes

You can buy a new car and claim it as a business asset as long as you register it under your business. This means youll get a nice deduction around tax time. However, its crucial that you track the usage as they will require you to report the frequency of use and the mileage that you put on your car.

With taxes, it comes down to the percentage of use. For example, if you use the car 80% of the time for business and 20% for personal errands, you can only claim 80% of the purchase price of your vehicle on your taxes. Its a lot of paperwork, so you will need to be prepared if you want to register your car under your business.

Read Also: Can You Add Bluetooth To An Older Car

Vehicles That Can Be Driven On Public Roads

Some vehicles can be operated on public roads but are exempt from the requirement to hold valid registration. Examples include:

- heavy industrial equipment such as a tractor, backhoe, grader or street sweeper

- trailers with permanently attached equipment such as air compressors, welders, tar buckets, concrete mixers, converter dollies, crushing equipment and jeeps and boosters when they dont carry a load

- farming equipment used for agricultural uses or livestock

- mobile homes

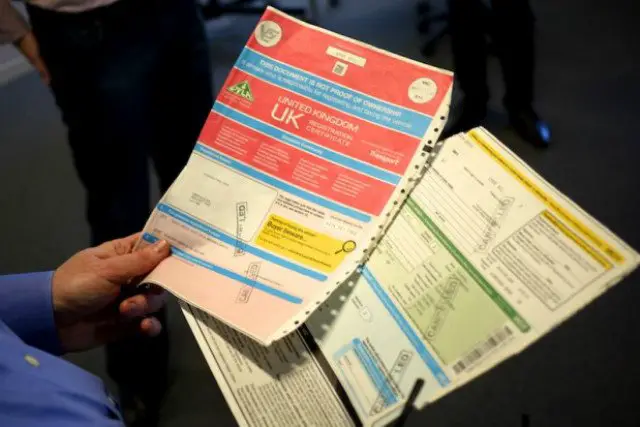

Register And Title A Passenger Or Commercial Car Truck Motorcycle Or Suv

You or your business must register and title any vehicle you own or lease. Registrations do not need to be in the owner’s name, or for only one person. When you purchase a new vehicle through an auto dealership, the auto dealer can register and title the vehicle, and issue plates .

See more information about

Don’t Miss: How To Get Sap Off Car

Transferring Vehicle Title To Your Llc

If you intend to transfer title of a vehicle you already own to your new LLC, these are the steps you need to follow.

Research How Youll Use The Vehicle

Not every business owner needs to lease through their business. Following the IRS guidelines for claiming vehicle expenses, certain sole proprietors and partnerships could just as easily lease a car through a personal account and either write off qualified business costs or take a standard mileage deduction.

Don’t Miss: Where Can I Junk My Car

Can I Register A Vehicle Even If My Name Is Not On The Title

Can I register a vehicle even if my name is not on the title?

Yes, HOWEVER, you will need required documents in order to register the vehicle if your name is not on the title.

1. Have the purchaser sign the back of the title where it says Buyer Signature/Purchaser Signature. Print off a TR-212a and have the purchaser sign at the bottom of the form where it says Owner’s Signature. Bring in the title documents, proof of insurance, signature form , and payment, and we will register the vehicle without the owner in the office.

2. Have the purchaser sign a Power of Attorney that allows you to bring in their paperwork and sign their name for them. The Power of Attorney is a one time use, original document that cannot be copied or used for anything other than registering a vehicle for someone else.

Related Tags;

Factor #: What Type Of Vehicle You Want

When deciding whether you should use a vehicle as a business expense, you must also consider the vehicle you want. Specifically, Levin says you should think about the type of vehicle you intend to purchase, such as whether its high-end, middle of the road, or some kind of specialty vehicle. Each one comes with a different price tag and can meet different needs.

For example, if you plan to utilize your vehicle for personal use too, then you want one big enough to hold your entire family. And if you live in an area that is subject to a lot of snow, then a four-wheel-drive or all-wheel-drive vehicle may make the most sense so youre able to better navigate what is often treacherous winter roads. A long commute makes a vehicle that is either long-range electric or good on gas a must.

Another vehicle consideration is the estimated resale or residual value of vehicle, says Levin. Considering this type of information up front, before you make the purchase, can potentially save you a lot of regret. It can also help you make the best decision possible when it comes to which vehicle youll eventually purchase in your business name.

Just remember that, ideally, you want to select the one that will work best with what you intend to use it for and the number of miles you expect to drive daily, yet will also provide the best resale value down the road, when youre ready to sell it or trade it in.

Don’t Miss: How Much Does A Car Salesman Make Per Car

Cons Of A Company Car

As with buying a car for personal use, the up-front cost of buying a vehicle is no joke. If your business is struggling with cash flow or still young, that cost can be greater, either in the form of higher interest rates or greater impact on the company.

Paying for repairs and general upkeep of the vehicle, while tax deductible, can have an immediate impact on your business. While you will see the benefit of such expenses, it may take some time, and drive you to other means to cover the additional expenses.

The liability on a company car goes up as more and more employees use it, meaning the insurance expenses for your business could go way up. Your personal insurance may not be impacted in case of an accident, but the legal stress for the company is enough to make it a tremendous headache nonetheless.

So, if youre considering purchasing a company car, be sure to give it significant though and run the numbers on your business. Some areas of your business may need your attention before such a purchase is possible or wise. Best case scenario, a company car can provide great incentive for your employees and improve efficiency within your organization.

From The Editors Desk

What Were Reading

Leading With Gratitude, by Adrian Gostick and Chester EltonResearch shows that grateful bosses have happier more productive workiers and they fare better themselves. Heres how to do gratitude right

Working From Home: Making the New Normal Work For You, by Karen MangiaLook good on Zoom; When to accept meetings; How to pass on new workloads, and other helpful tips.

Blue Collar Cash: Love Your Work, Secure Your Future, by Ken RuskGuidance to those who want to skip the student loans and 4 years and pursue blue-collar careers that lead to success, from someone who did it.

Making Conversation, by Fred DustWhen work meetings become joyless time suckers, heres advice for conversations designed to move things forward with clarity and context.

You May Like: How To Protect Car From Hail

Can I Sell My Vehicle To My Llc

Many people who have their own limited liability company desire to transfer their property to the company and put the property under the LLCs legal name. Selling your car to your own LLC is legal under current law and its something you can do whenever you want. You have to consider, though, that there are some procedures and legal specification details you must follow in order to successfully sell your car to your LLC.

How To Register A Vehicle In A Company Name In Florida

To register a vehicle in a company name in Florida, you must pay the required fee that covers your tag, taxes, registration certificate and validation decal. You have 10 days after the purchasing the vehicle or becoming a resident of the state to register it, according to Florida State law. Proof of insurance, along with the original title of the vehicle, is required for registration. Additionally, you must pay the tax, title and tag fee when registering a company vehicle.

Step 1

Obtain a copy of the bill of sale for the vehicle. Also, have the original title for the vehicle available. The state of Florida requests a bill of sale to list the buyer’s and seller’s names, date of purchase, price of the vehicle and the vehicle’s description. Have the seller list the company name as the buyer on the bill of sale.

Step 2

Get the insurance required by Florida state law on the vehicle. The minim amount of insurance you must carry on your vehicle in Florida is $50,000 for liability of property damage and personal injury protection for $125,000 with $250,000 per occurance according to the Florida Department of Safety and Highway Vehicles website. However, company vehicles are generally covered under a commercial policy and have higher liability limits, such as $500,000.

Step 3

Step 4

References

Also Check: How To Remove Hail Dents From Car Hood

Saving Money Without Changing Your Lifestyle

The problem with vehicles is fairly simple. They depreciate, they rack up expenses, and every few days it seems like you are back at the pump to fill them up. If you are an average consumer, this adds up quickly. However, as long as you are a small business owner, you have a card up your sleeve that you can play. By making your vehicle a part of the business, you can improve your financial statements, and write off many of the expenses related to the vehicle.

Suggested: What You Need to Know Before Purchasing a Vehicle for Business

While operating a car is still going to be expensive, you can deduct the overall expenses related to the business activities in which the car was used. And what makes this even better, is that you have a few options for doing so, depending on what you think is the more important method for your specific type of operation. You can either keep track of all of the business activities for which your car was used, or you can deduct a flat rate per business mile driven. To simply keep a log of all of your trips might only take you a few seconds before you get out of the car each day . Those few seconds of logging can literally add up to hundreds or even thousands of dollars in savings just on taxes.

Vehicles That Cant Be Driven On Public Roads

Miniature vehicles that are less than standard size cant be issued a vehicle registration certificate and cannot be driven on public roads. These vehicles may be used on privately owned land only.

Examples include:

- 3 or 4 wheeled miniature all-terrain vehicles

- segways

This also includes a vehicle bought for parts.

Read Also: How To Stop Car Windows From Fogging Up In Winter

Vehicle Examination And Licence Renewal

All motor vehicles shall pass the vehicle examination prior to registration. Only type approved new private cars and motorcycles are exempted from mechanical examination prior to first registration. However, when private cars reach the age of six, they are required to undergo annual vehicle examinations at the Designated Car Testing Centres prior to re-licensing.

Other types of vehicles such as goods vehicles and special purpose vehicles, van-type light good vehicles, public buses and private buses, they are subject to annual mechanical examination after registration. Owners of these types of vehicles can make an appointment online for vehicle examination at the government vehicle examination centres.

You can submit your application for renewal of vehicle licence by post, through Internet or coming to the licensing office in person or by agent within 4 months before the expiry of your vehicle licence. The vehicle licence fee varies depending on the type of vehicle and its cylinder capacity. Late renewal is subject to an additional charge which is 0.33% of the licence fee for each day overdue.

Company Car Or Personal Car: Which Is Better For Business Use

As a small business owner, youre always looking for ways to maximize profits and make your company run as efficiently as possible. Using a vehicle for your business represents one financial aspect of running your company that deserves a closer look. The Canada Revenue Agency allows you to write off the use of a vehicle for your business. On top of deciding how you want to claim your tax deduction, you need to decide whether or not you should use personal vehicles as part of your business or purchase a company car thats only for business purposes.

In both cases, the answer comes down to which option offers more advantages from a tax standpoint. Once you know the applicable rules, you can do the math and make an educated decision.

Recommended Reading: How Much Does A Car Salesman Make On Commission

Should I Register My Car Under My Business

by Compendent;·; 3 min read ;·;May 1, 2021

If you use your vehicle primarily for business purposes, you may be wondering whether you should register as part of your business or keep it registered as a personal car. There are some advantages to this regarding car insurance and taxes; however, this decision isnt right for everyone.

Also, its a great idea that you talk to a lawyer before making any moves, such as registering your vehicle under your business name. But otherwise, this article will provide you with the knowledge you need to make an informed decision that fits your circumstances the best.