What Can I Expect From A Rental Car Insurance Plan

Purchasing a rental car insurance plan is quite straightforward. You can generate a quote online in minutes by submitting your basic contact information as well as your location and dates of travel.

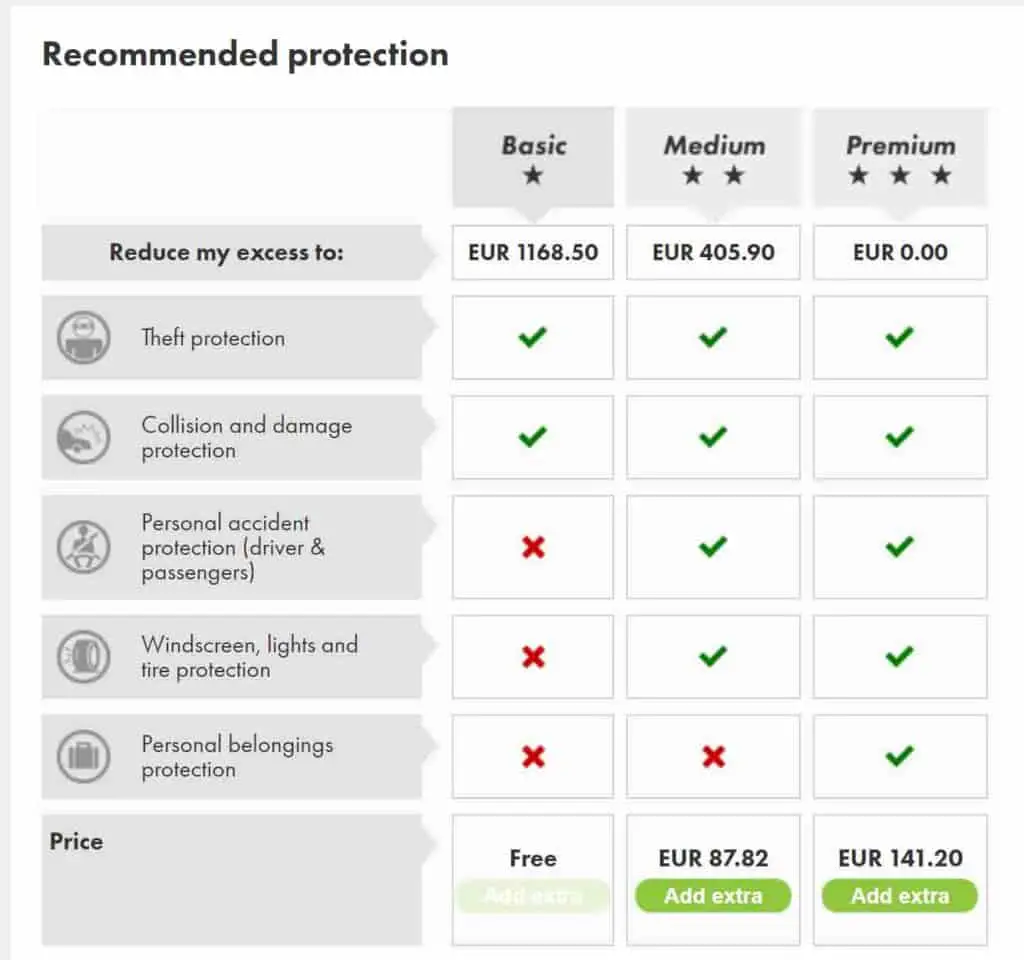

Here’s an example from InsureMyRentalCar.com:

From there, you’ll typically see a few price points that show a breakdown of different coverage included in the quote, and then you’ll need to fill out the online form for your address and other personal information, a short four- or five-step process.

Will My Credit Card Cover Me

There are tons of credit cards on the market that offer benefits which may include some level of protection for a rental car. Because each card offers different coverages, it’s important to first review your cardholder agreement or reach out to your credit card company to ensure you have enough coverage.

Keep in mind that with most credit card companies, there are certain conditions that must be met for coverage to be active. For example, in order for coverage to apply, some credit card companies may require you to charge the cost of the rental vehicle to your credit card. And, with your credit card’s coverage, although most vehicles are covered, there are some exceptions. Make sure you check your credit card policy for further details or reach out to your credit card company for further information.

Read The Car Rental Agreement

Unfortunately, you probably won’t be able to do this until you get to the rental counter, where you may start feeling pressure to hurry up from all those people in line behind you. But hang tough despite any glares and huffing, and read the fine print of your rental agreement.

Find the sections that disclose your responsibility under state law if there’s an accident, and details about the rental agency’s waiver. If state law limits your liability exposure and your auto policy and credit card are sufficient for what you are liable for, you might safely pass on the LDW, which is actually, strictly speaking, a waiver of your liability rather than true auto insurance.

For example, one Hertz agreement we saw from a California rental limited the renter’s liability to the fair-market value of the vehicle, plus charges for towing and storage, and impound and administrative fees. For loss or damage to the car from vandalism unrelated to theft, the liability limit was $500, and renters were not on the hook for loss or damage relating to theft unless it resulted from their failure to exercise ordinary care.

You should take the waiver if you’re renting overseas or in Mexico , because your personal auto insurance is usually valid only in the U.S. and its territories, and in Canada.

Now go have fun on your vacation with true, and more affordable, peace-of-mind about car accidents!

Jeff Blyskal

Read Also: Does Car Color Affect Insurance

Coverage May Not Always Be Financially Smart

However, it has to be said that electing coverage is not always a good idea. At least, on some level. Rental car insurance is often tiered. For the sake of the example, lets say theres full or basic coverage. Full coverage is as armored up as one can get. Should an accident happen, theres almost no way the insurance company wont cover whatever damage was done.

Basic, or as its often called, liability coverage, is a little more limiting, as the name implies. Generally speaking, that will only cover the most minimal of fender benders. There are also some instances in which electing coverage may not be worth it. Only in for a night? You probably wont be driving enough to need that insurance. Or, perhaps your credit card covers it anyway. No need to buy coverage twice.

Does My Car Insurance Cover A Rental Car That I Rent While On Vacation

Most car insurance policies provide coverage for a temporary substitute vehicle. This would include your vacation rental. However, this doesnt necessarily mean you have complete coverage. Be sure to watch for these gaps.

- Youll be renting the vehicle for a longer period of time than your insurance covers.

- Your personal insurance doesnt include comprehensive or collision coverage.

- The rental is more valuable than your personal vehicle.

- Your deductible still applies

Also Check: How Much Do You Pay For Car Insurance

Do I Need Insurance For My Rental Car Here’s The Surprising Answer

On a recent visit to Anchorage, Alaska, a stray pebble struck Brian Novak’s rental vehicle. It left a deep crack on his windshield. Unfortunately, he had declined the car rental insurance, which meant he was responsible for a $400 repair bill.

His story repeats itself thousands of times every day and is about to become even more common. At the car rental counter, when asked if they want insurance for their rental car, many travelers say “no.” That’s usually because the optional collision damage waiver can double the cost of the vehicle. So they have to make a bet that they’ll drive safely and return the car in working order.

Sometimes they don’t.

Car rental insurance can be confusing. There are so many options. Here’s how to sort through … everything.

Getty

Car rental insurance can be confusing

“Many people find rental car insurance confusing,” says Ernesto Suarez, CEO of InsureMyRentalCar.com. “They end up spending a fortune at car rental desks or find themselves with a huge deductible bill at the end of their trip after a small chip to their windscreen.”

“It took a few months,” he says, “but my credit card covered all costs.”

Others aren’t as fortunate. Almost every day, consumers who had no insurance or whose cards didn’t cover the damage contact my consumer advocacy organization. They’re on the hook for hundreds or thousands of dollars in damage. In rare cases, they may have to replace the entire vehicle, which can lead to financial ruin.

GettyGetty

Renting A Vehicle With A Car

Want to use a car-sharing service such as Turo? Before completing your reservation you will have to choose the coverage that suits you or decline it. The options vary depending on the country where you rent the vehicle. Make sure you understand the scope of the coverage before making your choice.

If you have Endorsement Q.E.F. 27, your personal auto insurance may be sufficient. The coverage offered through your credit card may only be valid for bookings made through traditional rental agencies. Check with your credit card company for details.

Read Also: How Much To Install Speakers In Car

Can You Rent A Car Without Owning Car Insurance

Yes. Most states require car rental companies to carry minimum coverage on the cars they own. So, even if you dont purchase coverage, you can legally drive a rental car. However, its strongly advised to have some insurance coverage because youll be responsible for paying for any damages that occur without it.

Do You Need To Buy Rental

This article was published more than 7 years ago. Some information may no longer be current.

Chris Rank/Bloomberg

It’s been a long flight and the kids are cranky as you exit the airport toward the car rental office. You can’t wait to get a car to get to that beach-side villa, the one you found a great deal on over the Internet. The car rental itself was dirt cheap, too, especially since you glossed over the added insurance on the website.

However, as you’re signing for the car, the clerk behind the counter asks: “Would you like the added insurance? Otherwise, you’ll be liable for the car.” You freeze, your tired mind wondering what that even means. “I’m insured on this,” you think. But are you? Do you get the added liability coverage or stick with your own insurance? There isn’t one simple answer.

“When you get to that desk, that’s the last place you want to make that decision,” says Steve Kee of the Insurance Bureau of Canada. Kee says that getting as much information about your own insurance before you go to the rental office is key to both protecting yourself and saving money, because the onus lies with the renter to ensure coverage for any claims. Whatever coverage you have is not necessarily the same as that of someone else.

Stephen Menon advocates getting the facts before renting, but his focus is on credit cards. He’s the associate vice-president for consumer card products at Toronto-Dominion Bank.

Like us on

for our weekly newsletter.

Special to The Globe and Mail

You May Like: How To Get Ants Out Of Your Car

Does Purchasing Rental Car Insurance Coverage Cover Other Additional Drivers

Not necessarily. If youre depending on your personal insurance policy, talk to your insurance provider to be sure your coverage will extend to a secondary driver youve given permission to drive the car. If you purchase rental insurance from a car rental company, you may be required to pay an additional driver fee.

Do You Need A Collision Damage Waiver

Its wise to purchase this type of rental car insurance. While your regular car insurance policy may include collision coverage for rental cars, it most likely includes a deductible and may not pay for all the rental car company’s charges, such as loss of use .ii Your credit card may include free collision damage coverage, but credit card rental car insurance is typically secondary coverage, meaning any claims will go first to your auto insurance company.

The most affordable way to ensure adequate protection in case of collision or theft is with third-party rental car insurance. The Rental Car Damage Protector from Allianz Global Assistance provides affordable collision loss/damage insurance coverage up to $75,000.

Unlike the waivers rental car agencies sell, the Rental Car Damage Protector is actual insurance that can protect your rental car almost anywhere in the world.

Don’t Miss: Where Can I Get My Car Registration Sticker

Is Rental Car Coverage Primary Or Secondary

Primary coverage is better, but few cards offer it. After an accident, primary coverage pays first, allowing you to bypass your personal auto insurance. That means you can avoid paying a deductible and potentially seeing your premiums rise. The secondary coverage that most credit cards offer typically means your auto insurer pays the claim but the card will reimburse your deductible and potentially other costs not covered by your personal policy.

Rental Car Liability Insurance

Liability insurance covers damage to other vehicles, property and people as a result of accidents you cause when driving your rental car. Note that this does not cover you, your passengers or the rental vehicle itself.

The state minimum levels of liability insurance are included as part of the basic rental fee in almost every state. In these cases, any additional insurance you purchase will at most give you higher coverage limits. There are some exceptions, most notably in California, where rental companies are not required by law to include liability insurance.

- Average cost: $1016 per day

- Comparable to: Bodily injury liability and property damage liability insurance

Also Check: Do Convertible Car Seats Have Bases

Do You Need To Buy Rental Car Insurance

Whenever you pop into a car rental agency to rent a vehicle, the customer service representative always asks whether you wish to purchase rental car insurance. If you didnt think it through beforehand, it could be a head-scratcher. Do you opt in and purchase the rental agencys insurance policy on top of the cost of the vehicle? Or do you decline it and save a few bucks?

Rental companies typically offer four types of auto insurance for their fleet:

- Collision damage waiver This protects you from paying for any damage to the rental car, or if it is stolen.

- Supplemental liability insurance This protects you and any other authorized driver against third-party injury, death, and property damage claims.

- Personal collision insurance This covers you and your passengers for any medical expenses resulting from a collision.

- Personal effects coverage This pays for losses, theft, or damage to any personal items you have inside the rental car.

Do you need to shell out the extra cash for any of these protections? Is it in your best interest to opt in for all four coverage types?

The answer lies in whether you have rental car coverage elsewhere already. Many and auto insurance policies provide coverage for when you rent a car. But you need to be sure. If youre not sure, call your credit card issuer and insurance broker or agent to find out ahead of time. You dont want to get into a collision, have no insurance, and be on the hook for thousands of dollars.

What Liability Auto Insurance Doesnt Cover

Liability auto insurance wont pay for your own medical bills or repairs to your car its only designed to pay others for the damage you cause behind the wheel.

To cover your own bills, youll need to rely on other types of insurance, such as health insurance for your medical expenses and collision insurance for repairs to your vehicle. If you want more protection, consider buying full coverage car insurance. Full coverage isn’t a specific type of policy, but refers to a combination of coverage types including liability insurance and comprehensive and collision coverage.

Read Also: When Does Leasing A Car Make Sense

Why You Might Not Have To Buy Extra Rental Car Insurance:

- In most cases, your personal auto insurance will cover you as if you were driving your own car.

- Major credit cards generally include some level of collision insurance when you reserve and pay for the entire rental with that card.

- If you are traveling for business, you are likely covered by a company insurance policy. Check with your employer to be sure you know what coverage they provide.

Renting A Car On Vacation What Insurance Do You Need

Usually states require basic liability coverage on rentals, but the requirements vary. Be sure to check the limits and terms of this coverage before purchasing.

As one typical line in a credit cards fine print puts it, You must decline the optional collision/damage waiver offered by the rental

Excerpt Links

You May Like: What Is The Cost Of Car Shield

Do You Need Personal Accident Insurance

Probably not. According to Consumer Affairs, the benefits provided by personal accident insurance may already be included in your health, life or car insurance policies or they may be included in the coverage the car rental company provides. If youre traveling overseas, where U.S. health insurance may not be accepted, then you should carry travel insurance with emergency medical benefits and emergency transportation benefits. These benefits are broader than personal accident insurance, because they can cover your medical expenses in an emergency overseas, whether or not it was caused by a car accident.

Insurance From A Car Rental Agency

Insurance from car rental agencies is often costly. You should decline it if you are sufficiently covered by your auto insurance or credit card. But if you dont have a choice, its often cheaper to choose a prepaid plan that you buy before your leave.

Depending on your other insurance, you may only need civil liability coverage or damage insurance for the rental. If thats the case, remove the coverage you dont need to make sure you dont pay twice. In Europe, for example, both insurances are usually included in the base price of car rentals.

Read Also: What Car Payment Can I Afford Calculator

Does My Credit Card Cover Me

Many credit cards offer some coverage for rental cars . Be sure to check the fine print the card may only offer collision coverage, which covers property damage but not costs associated with injuries.

In many cases, the credit card company may offer additional rental car insurance for a fee. The rates may be reasonable, but be sure that you do not pay extra for coverage that you already have from another source.

If your health insurance, for example, covers any injuries that you sustain in an auto accident, you would not need to purchase personal accident insurance for your rental from your credit card company. You may, however, need to purchase supplemental liability insurance to cover damages to another driver if you cause the accident .

Before you rent a car, call your credit card company to find out exactly what is covered.

Be sure to call each time you are about to rent a car to make sure that your coverage has not changed, since credit card auto insurance policies tend to change frequently. Also, verify that the coverage limit is high enough to adequately protect you.

Make sure you fully understand your coverage, so that you are not coerced into buying insurance you dont need at the rental car office.

A Warning About Car Sharing Services

Car sharing services like Zipcar might be different. For example, Zipcar provides new members with liability coverage. However, it only covers only up to the minimum financial responsibility limits required in the state and jurisdiction in which the accident occurs. Plus, you must be a member in good standing who complies with the membership contract to get coverage.

These limits can be very small and might not cover the total cost of an accident. To make things worse, your personal car insurance probably doesnt consider Zipcar a rental car and likely wont extend coverage. Zipcar members are also responsible for a fee of up to the first $1,000 of damage to the Zipcar vehicle per incident. You can purchase an optional damage waiver to reduce or eliminate this fee.

See How Much You Could Save on Auto InsuranceGet a Free Quote

Also Check: Does Credit Score Affect Car Insurance

Rental Car Insurance: To Buy Or Not To Buy

The bottom line when it comes to rental car insurance is to make sure you dont pay for something you dont need. But its also not worth taking unnecessary risks to save a buck.

If you rent cars often, you might want to update your personal policy to get more coverage while you rent. And even if you dont rent often, its still good to review your personal policy when you travelor at least once a year.

As long as you have a solid auto insurance policy, next time youre at the rental agency counter you can simply smile and say, No thank you.

If you need to update your auto insurance policy, or want to make sure you have enough coverage, we recommend working with an independent insurance agent whos part of our Endorsed Local Providers program. Theyre RamseyTrusted and will listen to your specific situation to get you coverage that suits your needs and your budget.

Connect with an ELP near you and start saving today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.