What Happens If I Buy A New Car Is It Covered

If you get a new car, your current insurance will automatically cover it for about 20 days. The type of coverage depends on whether the car is an additional or replacement car.

- An additional car gets the same coverage as the car with the most coverage on your policy.

- A replacement car gets the same coverage as the car it replaces on your policy.

Tell your company about a new car as soon as you can to avoid a lapse in coverage.

What Does Full Coverage Include

Generally, full coverage usually offers the most protection for you and your vehicle. Although it depends largely on the insurance company, full coverage typically covers the driver, their passengers, their vehicle and damage or injuries they cause others in an accident.

Some of the elements typically covered by a full coverage car insurance policy include:

- Windshield Cover

What Does Full Coverage Car Insurance Consist Of

Everyone needs car insurance to ensure that they are protected when out on the road. However, there are a number of different types of car insurance policies. One popular type of car insurance is referred to as âfull coverageâ which typically includes liability, comprehensive and collision coverage.

Letâs take a closer look at the different types of car insurance coverages out there and the advantages that come with choosing full coverage for a vehicle.

Read Also: How To Make Money With My Car

Full Vs Liability Coverage

Full and liability coverage is something that every driver has to consider.

Liability coverage alone has a lot of holes in terms of the damage that can leave a driver without compensation.

However, full coverage isnt right for everyone. There are some circumstances in which only liability coverage is appropriate.

Liability coverage is an option, but there are significant exclusions, and you dont want to learn the hard way that your insurance doesnt cover what happens to your vehicle.

What Is A Limit

The coverage limit is the maximum dollar amount that a car insurance company will pay for a covered claim. Once the limit is reached, the insured is responsible for paying for the rest.

It is important to remember that full coverage is not a type of policy, but a combination of insurance coverages. The three main types of coverage are liability, comprehensive, and collision, but there are others you can buy to help protect your finances if you are responsible for an accident.

Don’t Miss: Where Can I Find My Car Title

When Should You Drop Full Coverage On A Car

Full coverage offers lenders and vehicle owners broad spectrum car protection. But as a car ages, its going to depreciate at a rate of about 10 percent annually. And if your car isnt worth much, you may not need full coverage anymore because the limits that pay for expensive repairs to your car wont be reachable. Given the vehicles limited resale value, it may not make sense to carry a policy like this.

If that leaves you pondering questions like, If my car is paid off what kind of insurance do I need? dont worry, its a common concern. Its a good idea to consider the value of your car and match it with coverage that protects it best. If you paid for a new car in cash, and own it outright, full coverage still makes good sense because youve got a lot to protect if something should happen.

Do I Need Full Coverage Car Insurance

It depends. You may want to consider full coverage if:

- You’re financing a car. Lenders typically require full coverage in addition to other coverages required by the state.

- You want financial protection. Without full coverage, you may be required to pay out-of-pocket to replace your vehicle after a total loss or theft.

- You want peace of mind. Having full coverage protects you against a wide range of scenarios that could put you at financial risk.

If you don’t have a loan or other financial commitments on your vehicle, most states only require Liability coverage.

Recommended Reading: Does Insurance Follow The Car Or The Driver

Types Of Auto Coverages

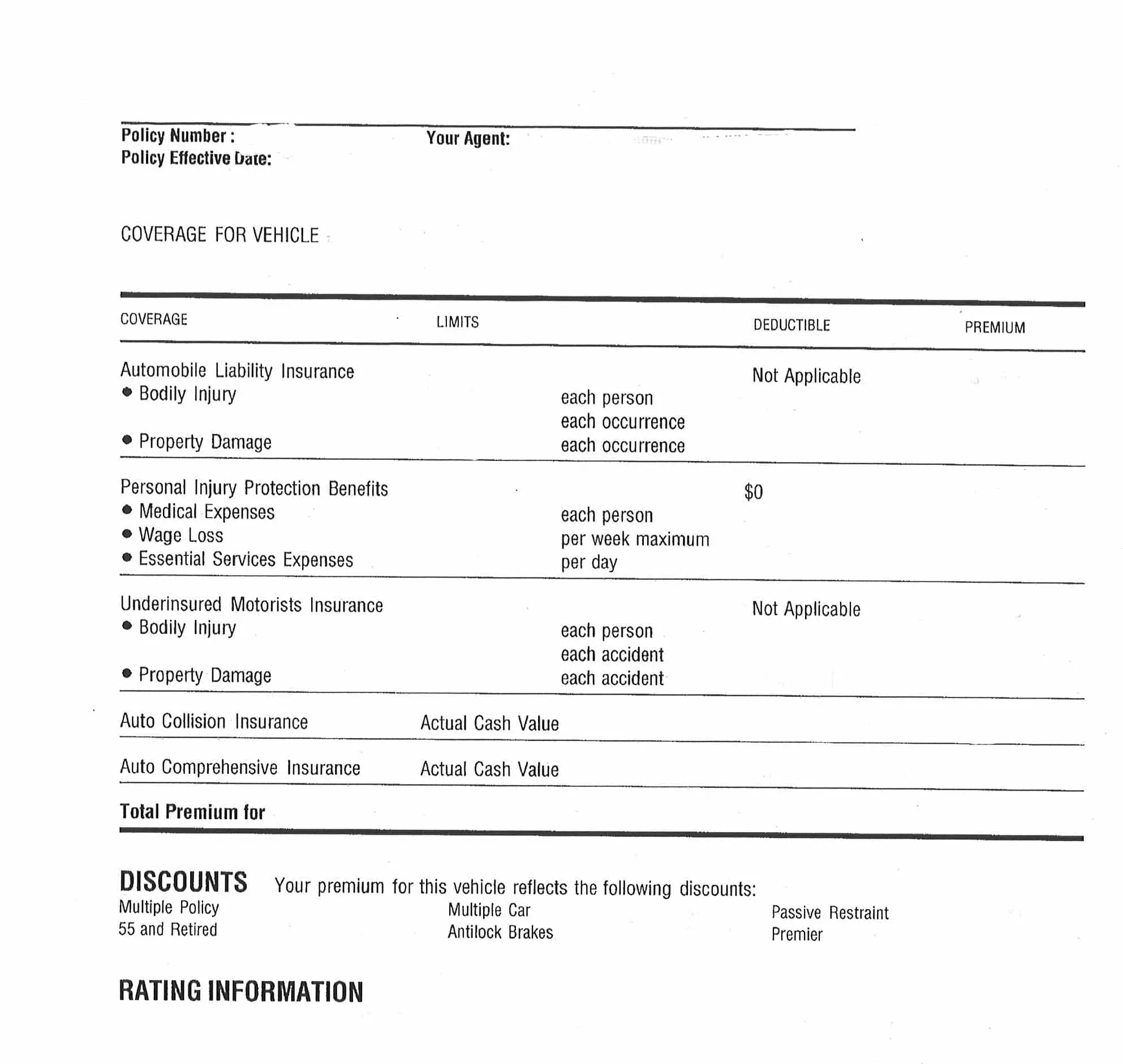

There are eight basic auto insurance coverages. You can choose whether to buy the others.

Think about buying more liability coverage. The minimum liability limits might be too low if you cause a multi-vehicle accident or the other drivers car is totaled. If you dont have enough liability coverage to pay for the damages and injuries you cause, you might have to pay the rest out of your own pocket. The other driver could sue you.

What Is Collision Coverage And What Does It Cover

Collision coverage typically covers damage to the insured driverâs car in an at-fault accident with another vehicle. Usually, it also covers damage in a collision with an object, like a guardrail, pole or tree. In some states, like Massachusetts, collision insurance may even apply regardless of fault and may apply in hit and run situations.

You May Like: Where Do I Register My Car

What If The Other Drivers Limits Arent High Enough To Pay My Bills

If the other drivers policy limits arent high enough to pay for all your car repairs, file a claim with your insurance company. Your collision or uninsured/underinsured motorist coverage should pay the difference. If you file a claim with your insurance company, youll have to pay a deductible.

If the other drivers limits arent enough to cover all your medical bills, file a claim with your auto insurance company or your health insurance company. Your auto insurance company will use either your PIP coverage, medical payments coverage, or your uninsured/underinsured motorist coverage to pay the difference. You might have to pay a deductible.

Whats The Difference Between Full Coverage And Liability Car Insurance

Full coverage car insurance includes liability insurance, as well as comprehensive and collision coverage.

Liability insurance covers the cost of the other partys injuries and/or car repairs from an accident where youre at fault. It also pays for your legal defense if youre sued over the car accident.

Comprehensive and collision insurance pays for your cars damage if its in an accident or in a non-crash-related incident . Comprehensive coverage also pays out if your car is stolen.

If you cause an accident, liability-only car insurance wont pay for any damage to your vehicle or injuries to you or your passengers.

Also Check: Why Cant I Turn My Key In My Car

Average Full Coverage Car Insurance Cost In Ontario

Because of the variables that combine to determine insurance prices in Ontario, a truly average rate across the province has little meaning. A driver in Brampton or Vaughan, for instance, may see an insurance rate of $2,000 for full coverage. In Kingston, however, a driver with the same coverage, driving record, vehicle, and personal status may pay less than $1,000.

Collision, comprehensive, and all perils coverage come with deductibles. This is the amount a driver pays before the insurance company contributes after an incident. The policyholder sets the amount of deductible for their policy. An owner opting for a high deductible pays a lower premium than the driver who chooses a low amount. Some insurers sell a policy add-on that removes deductibles entirely. Some drivers may consider this essential in a policy with full coverage for their situation.

How Can I Customize My Car Insurance Policy To Best Meet My Needs

Even though you must have the state required coverage, you can still customize your policy. You may decide to carry higher limits than the state minimums for extra protection.

You can also select your deductible amounts on certain coverages. Or, you can add coverages to help with roadside assistance, rental, or even mechanical breakdown. You may also want to consider an umbrella insurance policy.

You May Like: How To Remove A Car Radio

Cost Of Full Coverage Insurance

How much can you expect to pay for full coverage car insurance? Well, it depends on where you live, the type of vehicle you drive, and your driving, credit, and insurance history. You can check out our handy chart to compare car insurance costs by state. But generally speaking, the National Association of Insurance Commissioners reports that the national average combined premium was $1,204 in 2019. While this figure can serve as a good starting point, inflation and other factors are affecting comprehensive and collision rates and you could pay hundreds more or less depending on where you reside and what your driving and insurance records look like.

Explained: What Does Full Coverage Car Insurance Consist Of Is It Worth It

Before making an informed decision about buying car insurance, you first need to know the answer to the following question: What does full coverage car insurance consist of? The answer is fairly simple: the term full coverage typically refers to a car insurance policy that includes not only liability insurance , but also comprehensive insurance and collision insurance. Lets briefly examine what all of this means.

Read Also: How Does Car Interest Work

Tips For Saving Money On Full Coverage

Wondering how you can save on full coverage and make your auto insurance policy feel more affordable? Try some of these tips:

- Maintain a good driving record

- Try to consolidate or bundle separate policies

- Drive a less expensive vehicle

- Shop around for a better rate

- Search for car insurance discounts

- Find a flexible payment option that works for you

- Avoid lapses in coverage

Common Full Coverage Questions

What is full coverage car insurance?

What does full coverage car insurance cover?

How much does full coverage car insurance cost?

Please Note:

MAPFRE Insurance® is a brand and service mark of MAPFRE U.S.A. Corp. and its affiliates, including American Commerce Insurance Company , Citation Insurance Company, The Commerce Insurance Company, Commerce West Insurance Company , MAPFRE Insurance Company , and MAPFRE Insurance Company of Florida.

Articles

You May Like: How Often Should I Change The Oil In My Car

First Part Of Full Coverage: Liability Insurance

Liability insurance covers damages you are at fault for and cause to another driver or their car. It is the only part of car insurance that you are required by law to carry. Within liability, the two main types of insurance are bodily injury and property damage liability insurance. Bodily injury deals with injuries you cause to the drivers themselves, while property damage is any damage you cause to another vehicle, or structure. Neither coverage is meant to protect you or your car they are exclusively for other drivers to file a claim against your insurer.

For example, if you got injured in an accident, and required surgery, you would have to file through the other driver’s BI insurance to pay for the surgery rather than your own BI coverage.

Having these two coverages is the most basic type of car insurance you can carry. Each state institutes a state minimum, which is written in a three number format like 25/50/25. The first two numbers refer to your BI coverage, where the first is the limit of insurance you have for one person in an accident, while the second is the limit for the entire accident. The third number is the limit for your property damage liability coverage.

What Is Medical Payments Coverage And What Does Medpay Cover

MedPay is a type of medical payment insurance sometimes included in a full coverage policy that generally helps cover medical expenses associated with a car accident, regardless of fault. It typically covers expenses not only for the policyholder, but also for any family members covered by the policy. Passengers traveling in the insured vehicle when the incident occurs are also usually covered by MedPay. In some cases, it may even be possible to extend a medical coverage policy to cover injuries incurred as a pedestrian or bicyclist.

Personal Injury Protection, or PIP, is similar to MedPay in that it can help cover medical expenses. Typically, PIP can cover lost wages and replacement services as well. In some states, PIP or no-fault coverage is required coverage.

Recommended Reading: How To Build Your Own Car

What Is Full Coverage

So what does full coverage car insurance cover? In most cases, it includes liability, comprehensive, and collision coverage. Collision and comprehensive will protect you and your vehicle if you get into an accident. If you’re found at fault for an accident. liability will pay for damages you might cause to others.

Nationwide says it is important to realize that full coverage helps provide the best possible protection, but you still have to pay your deductible if you cause an accident. Most states have minimum requirements for liability coverage, but you can usually choose the amount of collision and comprehensive coverage. You can also determine the amount of deductible that you feel comfortable paying.

What Is Comprehensive Coverage And What Does It Cover

Generally speaking, comprehensive coverage insures a car against extreme weather like hail, wind, fire or flood damage. It usually covers damage incurred from falling objects, like branches or trees, and collision with an animal. Typically, comprehensive coverage also helps cover losses from vandalism or theft.

Also Check: Where Can I Weigh My Car

How Much Is Full Coverage Insurance On A New Car

There is no difference in the cost of full coverage car insurance between a new and a used car. That is to say, the answer to the question How much is full coverage on a used car? is the same: it depends.

The average cost of full coverage car insurance in 2022 is $1,682, according to Insurance.com data. That will vary based on a wide variety of factors. The value of the car is more important than whether its new or used.

What Does My Policy Cover

Coverages vary by policy and depend on the types of coverages you choose. This table shows some of the things most policies do and dont cover. Read your policy or talk to your agent to be sure of your exact coverages.

What policies cover| Most policies cover: | Most policies dont cover: |

|---|---|

| Damage to your car because of fire, hail, theft, flood, flying gravel, or hitting an animal | Accidents that happen while youre driving for a ride-hailing service or delivering food or other items for a fee |

| Accidents that happen while you or someone covered by your policy is driving a rental car | Accidents that happen while youre driving a car that doesnt belong to you but you could use regularly, like a company-owned car |

| Accidents that happen while youre driving in other states and Canada | Equipment not permanently installed in your car |

| Your attorneys fees if youre sued because of an accident | Accidents that happen while youre driving in Mexico, driving for business, or racing |

| Car repair, lost wages, and medical and funeral bills to the other driver and passengers if you cause an accident | Damages that you caused intentionally |

Recommended Reading: When Do You Turn The Car Seat Around

Definition & Examples Of Full Coverage Car Insurance

Full coverage auto insurance is a commonly used term among auto insurance buyers. It usually refers to a combination of liability, collision, comprehensive insurance, and any other coverage that a vehicle owner may want. The combination of policies and coverage that your insurance carrier offers will vary by state, and it’s up to you to determine what level of coverage you need.

“Full coverage auto insurance” is a term that refers to multiple insurance coverages on a vehicle. It is often a package that includes liability, collision, and comprehensive insurance. It can also have other options that you may want or need. Insurance policies and coverage will vary by state, and it’s up to you to decide what you need after meeting your state’s minimums.

Full coverage is the level you think you can take on any financial burden for damage to your car or others. Learn more about your options so you can decide what you need in order to be fully covered.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right

At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance affects their finances, we have licensed insurance professionals on staff who have spent a combined 47 years in the auto, home and life insurance industries. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation of how we make money.Our content is backed byCoverage.com, LLC, a licensed entity . For more information, please see ourInsurance Disclosure

You May Like: How Much Do Car Dealership Owners Make