What You Need To Know About Liability Car Insurance

Home MediaCompare car insurance quotes

Liability car insurance cover the cost of damages after an accident you cause. In most states, drivers must have liability insurance policies to legally drive on public roads.

This article will explain everything you need to know about liability car insurance what it does and doesnt cover, how much it typically costs, and recommendations for liability insurance providers.

We at the Home Media reviews team have researched and ranked the best car insurance companies on the market. Below, youll find two of our recommended providers for liability auto insurance or any other kind of coverage.

Does Liability Insurance Cover Car Theft

You might be wondering if liability insurance covers car theft. Unfortunately, it does not. It also doesnt provide cover for:

- Any damages to your vehicle as a result of a break-in, such as broken windows or a damaged ignition system.

- Any items that were stolen from inside your vehicle during a break-in.

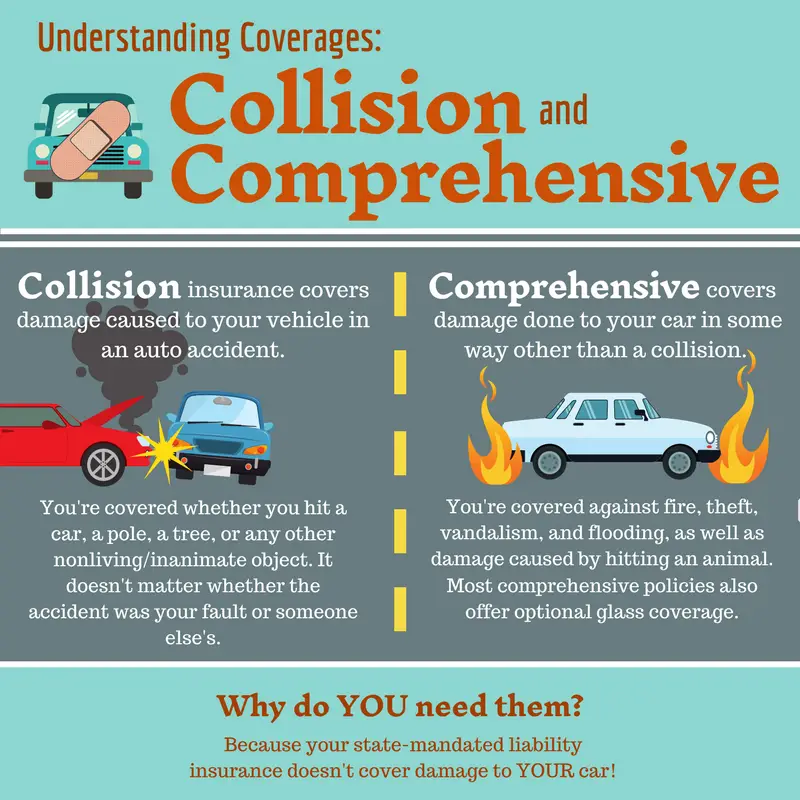

If youd like to insure your vehicle against car theft, you need to take out comprehensive coverage over and above your liability insurance. When your vehicle is stolen, your comprehensive insurance will pay out the actual cash value of your vehicle.

Apart from vehicle theft, comprehensive insurance provides protection against any damage your vehicle may incur due to a non-collision event. Such events may include vandalism, natural disasters, accidents in which animals are involved, or glass and windshield damage.

In general, the limit on comprehensive coverage is the actual cash value of your vehicle. The only amount youll need to pay when claiming from comprehensive insurance is the deductible.

What Is The Difference Between First

As per property and casualty industry definitions, a first-party refers to the owner of a particular property. A third party refers to an outsider, it could be a pedestrian, another road user, or even your neighbor. When your car insurance protects you against damage to your car for replacing or repairing it then it is called first-party insurance. However, if you were to cause a collision by your fault and cause injury or damage to others then it could be claimed under third-party insurance.

You May Like: Fastest Cars In Forza Horizon 3

Example Of How Liability Insurance Works

Here’s an example of what might happen if your car insurance policy has liability limits of 25/50/20 and you cause a major accident on the highway, injuring two people:

- Person 1 has $65,000 in medical bills and their car is totaled, costing $20,000 in property damage.

- Person 2’s medical costs total $20,000, and their car has $5,000 in damage.

- You would be responsible for $40,000 of Person 1’s medical bills but none of Person 2’s medical bills .

- You would be responsible for none of Person 1’s property damage, but you would have to pay Person 2’s $5,000 in property damage .

To learn more, check out WalletHub’s guide to liability car insurance.

Third-party liability insurance is insurance that pays when the policyholder injures another person or causes damage to another person’s property. In car insurance, third-party liability insurance is required in almost every state, and it only applies when the policyholder causes an accident. Third-party liability insurance does not pay for the policyholder’s own injuries or property damage.

What Are The Types Of Auto Liability Insurance

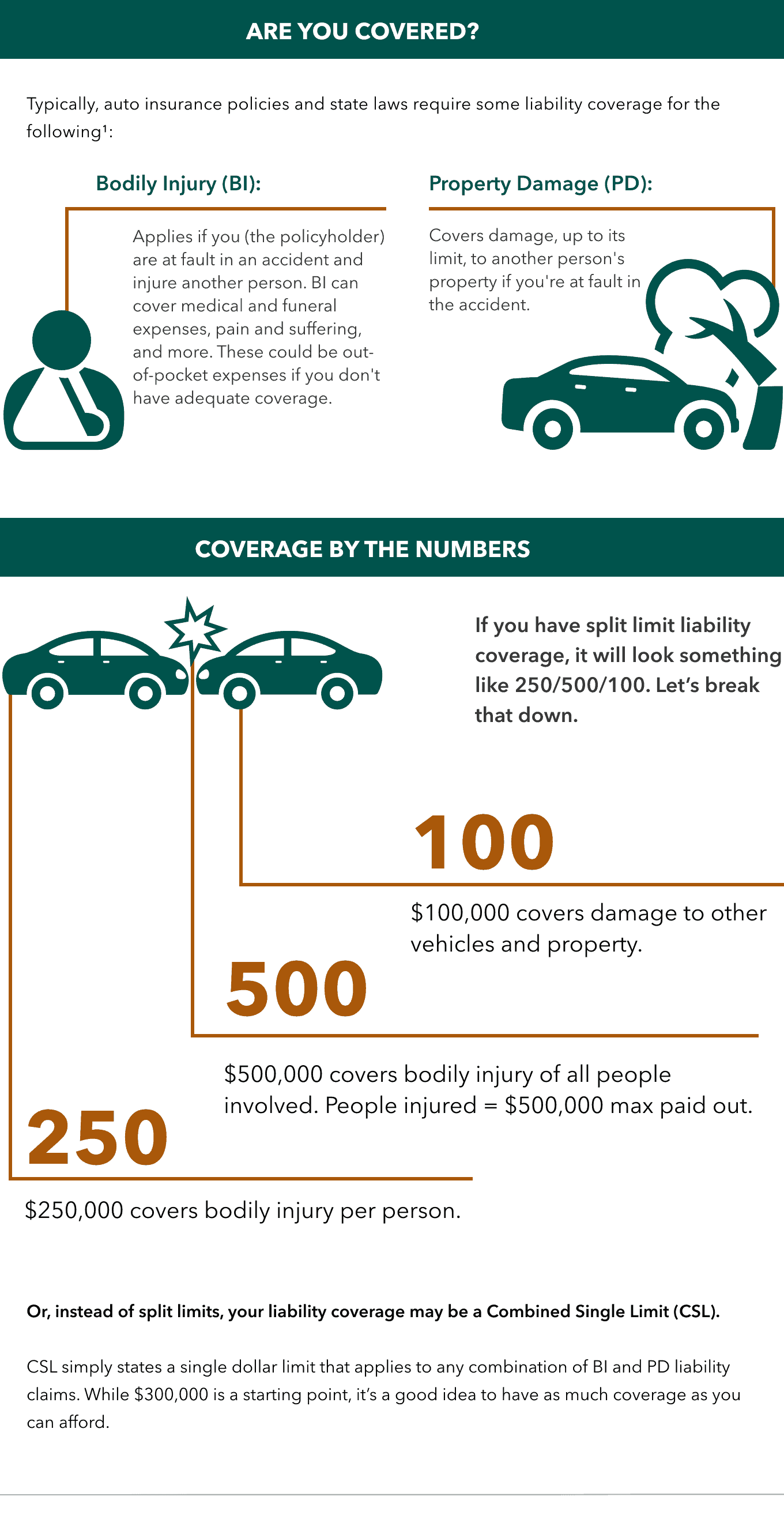

Auto liability insurance can be split into two types bodily injury liability coverage and property damage. Most states require drivers to have both. But what are the differences between the two?

Bodily injury liability coverage: This type of liability coverage pays out if you hurt other people in an at-fault car accident. Bodily injury liability coverage covers medical bills, recovery treatments, and even lost wages if the injured party cant work while undergoing medical treatment. Some insurance companies even cover funeral costs after a fatal accident.

Property damage liability cover: Having property damage liability coverage helps you cover the cost of damages to property resulting from an at-fault accident. Depending on your insurance carrier, your property damage liability coverage can help you cover the cost of repairing the other partys damaged car. As well as other property that may have been damaged in the accident.

Each state has a minimum liability limit that all drivers must meet. So dont hesitate to get in touch with your DMV or a local agent before buying liability car insurance coverage.

Also Check: How Much Does A Car Salesman Make On A Sale

What Are Personal Liabilities Examples

Personal liability claims can range from simple charges like medical bills caused by visitors to complex claims like lost earnings caused by an accident at your home. Damages that a lawsuit may seek to recover may result in legal expenses. A property damage or bodily injury as a result of your negligent actions.

What Is Liability Insurance Vs Full Coverage

Liability insurance will cover damage to other vehicles or injuries to other people when you’re driving. Full-coverage policies do include liability insurance but also additional protection to cover damage to your own vehicle.

In most states, you are required to have some level of car insurance, but these minimum coverage requirements are mostly limited to liability coverage. Full coverage a shorthand name for policies that include comprehensive and collision insurance is never required by state law, but your lender may require it if you lease or finance your car.

Read Also: How To Rewire Car Speakers

What Does Auto Liability Insurance Coverage Cover

Depending on which province you live and drive in, auto liability coverage could protect you from paying damages caused by an at-fault accident. Click on your province to see what types of damages are covered where you live.

Liability insurance could cover the costs of damages caused by an accident you are found to be responsible for in Alberta. These types of damages are categorized as:

Property damage: In the event of an at-fault accident, liability insurance could help cover the cost of the damages caused to another persons personal property from the accident. Personal property can include both their home and their car.

Bodily injury: Should someone be injured in an at-fault accident, liability insurance could help cover medical expenses and loss of wages caused by the incident.

Liability insurance covers the costs of damages caused by an accident you are found to be responsible for. These types of damages are categorized as:

Property damage: In the event of an at-fault accident, liability insurance could help cover the cost of the damages caused to another persons personal property from the accident. Personal property can include both their home and their car.

Bodily injury: Should someone be injured in an at-fault accident, liability insurance could help cover medical expenses and loss of wages caused by the incident.

How Much Does Liability Insurance Cost

According to the most recent insurance cost report issued by the National Association of Insurance Commissioners , the average annual liability car insurance premium in the U.S. in 2019 was $650.35. This number can vary widely by state. For example, in North Dakota, the average liability premium was $312.30. In Florida, the average was $997.20.

The cost of car insurance isnt the same for every driver, even within the same state. Details such as your vehicle, age, marital status and driving record will impact your rates. Other factors that affect car insurance premiums include your credit score , coverage limits and chosen deductible.

Recommended Reading: Detective Columbo Car

What Liability Insurance Doesnt Cover

If you only have the most basic form of liability insurance, your own vehicle wont be insured in the event that you are found to be at fault in an automobile accident. This is why other forms of insurance are so important. An insurance broker can explain coverages such as third party liability, accident benefit coverage, uninsured automobile coverage and direct compensation-property damage coverage. Depending on what province you live in, these types of coverages may be mandatory.

What Does Liability Insurance Cover

There are two types of coverage under the liability section of your car insurance policy bodily injury and property damage.

Bodily injury covers expenses associated with injuring someone else in an at-fault accident. Your policy may respond by covering the costs of their medical expenses and loss of wages as a result.

Property damage helps pay for damage you cause to someone elses personal property during an accident. This can include anything from their car to their house.

Don’t Miss: How Much Commission Does A Used Car Salesman Make

When Should I Increase My Third

Basic plans provide you with a minimal amount of coverage. How you use your vehicle can impact the potential risk and damages. It’s recommended you increase your limit if :

- You carpool and frequently drive with others in the vehicle.

- You drive your vehicle for work.

- You drive in the United States frequently.

- You drive in a high traffic area.

What Is Comprehensive Insurance

Some people consider car insurance only as financial help in an accident, but there are many other incidents that could cost money that you would want more coverage for. Comprehensive insurance repairs your car when it is damaged by theft, vandalism, fire, weather or accidents with animals such as deer.

For example, should your window be broken so a thief can steal your laptop, your insurance provider would cover the replacement of the window.

Also Check: Why Is California Registration So Expensive

What If I Owe More On My Car Than What Its Value Is

Its possible to get into an accident that totals a car youre still making payments for but not get enough from your insurance provider to settle your debt. In fact, it happens all the time from both accidents and theft. People often have to make payments on a car that was stolen from them.

This is because your provider is paying you for the actual cash value. Also known as ACV, its the current value of your car minus whatever deductible you have.

To safeguard yourself against this, consider purchasing either gap insurance or new car replacement coverage.

- Gap insurance pays off the gap between your ACV and the amount you still have left on your loan or lease.

- New car replacement can be used if youre the first owner of a car or if your car is less than one to two years old. It guarantees that you will be paid more than the ACV of your totaled car and be given enough to replace it with a car of the same value.

These additional coverages can give you extra peace of mind.

Consider Your Net Worth

How much liability insurance you need can also depend on your net worth. If you have a lot of assets such as a house, car or sizable bank account and not much debt, you may want to purchase more liability insurance to cover your net worth and prevent assets from being taken in a judgment. You may even want to consider an umbrella insurance policy to provide extra liability coverage.

Read Also: Car Care One Gas Locations

Understanding State Minimum Liability Car Insurance

Each state has its own minimum required liability insurance, and while the most affordable liability auto insurance in the state minimum, its worth your while to consider a higher amount.

Remember, if the injuries and resulting medical bills are greater than the amount for which you are insured, the balance may be your personal responsibility.

Many state minimums are $25,000 for property damage, but with the average cost of a vehicle sitting around $38,000, that $25,000 dollar figure is already $13,000 too low if you total anothers vehicle. And medical bills can easily exceed the $50,000 to $60,000 required as a minimum in personal injury coverage as well.

You will see liability limits often expressed as 50/100 or 100/300, which would be $100,000 per incident and a maximum combined limit of $300,000 per incident in the later example.

What Liability Car Insurance Doesnt Cover

Liability car insurance doesnt cover damages to you or your vehicle after an accident. If you want your insurer to cover these damages, youll need collision and medical coverage. The exception is no-fault states, in which your liability policy will cover personal injury expenses.

Liability coverage wont pay for property damages and medical bills for the other driver if youre not at fault.

You May Like: Remove Scuff Marks From Car Interior

Do You Need Liability Insurance Or Full Coverage

You should always get full coverage insurance if you can afford it. No matter how good of a driver you might be, your vehicle is likely going to get damaged in some way or another. Having full coverage insurance will provide a wide financial safety net that will alleviate some of the burden that comes with handling car issues.

When deciding whether or not to purchase liability-only insurance, you need to consider your states laws, the value of your car, and your financial situation. A general rule of thumb is that you can consider dropping full coverage insurance if the cost is more than 10% of your cars value. However, you should not drop collision and comprehensive coverage if you cannot afford to pay out of pocket to repair or replace your car when its unexpectedly damaged.

How To Find The Best Liability Auto Insurance Provider

All auto insurance companies offer auto liability insurance coverage but not all companies will provide coverage for drivers who have poor driving records or a conviction for a DWI or DUI. You may even be denied if you have a bad credit rating.

But you can usually overcome these issues with some smart shopping. Start here, with us. Weve curated a list of the top liability car insurance providers in the industry and well match you with the best carrier for your needs and your budget.

Questions?

Don’t Miss: What Oil Do I Need For My Car

What Is Liability Car Insurance And What Does It Cover

Liability insurance covers the driver of another vehicle if you are in an accident that is your fault. It doesn’t cover you, your injuries or your car. Still, it can help protect you from being personally sued if you have purchased enough liability insurance to cover the other party’s losses.

Liability insurance is required in every state except New Hampshire. If you are hit by someone else, and it’s their fault, their liability insurance will cover damage to your car and your medical bills. There are two types of liability insurance:

What Is Liability Car Insurance

Liability insurance is a mandatory coverage that must be included on your car insurance policy in order to legally drive a vehicle in Canada. If youre at-fault in a car accident, your liability coverage helps cover the cost of legal expenses arising from damages caused to other drivers, pedestrians, or property, up to your policy limit.

Get Competitive insurance quotes in 5 minutes.

Also Check: How To Hook Up Car Amp In House

Can You Buy Higher Limits

One option is to buy higher limits on your liability insurance. This will increase what you pay for premiums. But youll have peace of mind knowing youre better protected.

Heres something else to consider about the nature of car accidents. No one plans for them. Thats why theyre called accidents.

After the investigation, you could be found at fault for the crash. The cause could be chalked up to simple carelessness. Or maybe it was purely accidental, such as hitting a patch of ice and sliding into someone elses car. Either way, when you are deemed the cause of any accident, you can be found responsible for other peoples medical costs along with damage to their car or other property.

What Is The Difference Between Third

Third-party insurance helps to claim for damages caused to others due to your at-fault accident. This includes bodily injuries, legal expenses, and property damage claims. Liability coverage is mandatory. However, comprehensive coverage is optional coverage. Comprehensive coverage protects your vehicle against damages not due to a collision. This includes theft, vandalism, fire, falling objects, natural disasters, riots, damage due to hitting an animal, etc. This coverage will protect the insured against any losses unrelated to the drivers actions unless excluded. But it may provide cover for sudden actions by others and environmental events that are beyond control. If you own your car outright then you may decide to not have it. However, if you purchased your car on financing then they may insist that you purchase comprehensive coverage. This is to safeguard their vested interests in your car that they have financed.

Don’t Miss: How To Connect A Car Amp In Your House

Understanding Car Liability Insurance

Liability car insurance helps cover the cost of damage resulting from a car accident. In many states, if a driver is found to be at fault in the accident, their insurance company will pay the property and medical expenses of other parties involved in the accident up to the limits set by the policy.

In states with no-fault auto insurance, however, drivers involved in an accident must first file a claim with their own insurance companies regardless of who was at fault. In those states, drivers are typically required to purchase personal injury protection coverage, which covers their accident-related medical expenses as well as those of their passengers.

Liability car insurance consists of two types of coverage:

What Car Liability Insurance Doesnt Cover

If you’re responsible for an accident, your liability coverage won’t pay to repair your vehicle, nor for injuries that you personally sustained. Youll need separate coverages for these exposures, including collision coverage, comprehensive coverage, and medical payments coverage.

Recommended Reading: How To Keep Car Door From Freezing Shut