What Happens When An Insurance Company Totals A Car

If youre in an accident and your insurance company determines your car is totaled, heres what happens next:

- Your claims adjuster will want to get your vehicle moved to a fee-free storage facility. They will probably ask you for any keys to the vehicle and will have you remove all personal items in it

- Once your vehicle is considered totaled, insurance will pay you a cash settlement, which is a check in the amount of the actual cash value on your vehicle, less any applicable deductibles

- If your vehicle is leased or has a loan on it, you will need to let your leasing group know that your insurance company will be contacting them

- If you still owe money to a lender on your vehicle, your claims adjuster will need to pay them. For example, suppose you owe $8,000 on your vehicle loan and your vehicle is worth $10,000. Your claims adjuster will issue $8,000 to your lender and the remaining $2,000 will be issued to you. If your vehicle is leased, the payment goes directly to the leasing company.

Of course, if you own your vehicle free and clear, youll get the full amount and can use it to purchase a replacement vehicle.

Talk To A Car Accident Lawyer

You might be able to handle your own insurance claim. But if you have questions about your rights and options, talk to a car accident lawyer. A lawyer can answer your questions, negotiate with insurers, and represent you in court if necessary. It’s worth the expense of hiring a lawyer when you don’t feel the insurer is offering a fair settlement for your totaled car.

Learn more about how an attorney can help with your car accident claim. You can also connect with a lawyer directly from this page for free.

Know Your Car’s Value

There are several guides to determine the current value of your car for insurance purposesfor example, Kelley Blue Book, and theNational Association of Automobile Dealers’ NADA Guides.

Note that most standard auto policies will not pay to repair a vehicle if it is “totaled”that is, if the repairs cost more than the cash value assigned to the car. It is up to your insurer to decide whether to pay for repairing your car or to declare it a total loss and pay you its book value.

However, you may be able to make a case that the pieces of the car were worth more than the book value and so increase your settlement. To do that, you’ll have to submit evidence such as mileage records, service history and affidavits from mechanics to show that your car was worth more than a typical car of its make and model.

Recommended Reading: How Much Is The Cheapest Car Insurance

S To Take When Your Car Is Totaled

If your car is totaled, there are a few steps to take to settle your claim and get back on the road.

I Use My Vehicle For My Primary Or Second Job Will My Claim Be Paid If I Am In An Accident

Personal cars used for business, like for delivering pizza and ride sharing arent covered under a personal auto policy. You should always tell your agent or insurance company about your plans to start driving for a ride share company as you will likely need excess coverage for when your vehicle is being used for business purposes.

Also Check: How To Remove Lien From Car Title

Replacing Your Totaled Car

When your insurance company deems your vehicle a total loss, you will likely have to find a replacement. Unfortunately, your insurance provider is not going to buy you a new vehicle. They only have to pay you the ACV of the one you lost. The good news is, according to Insurance.com, many states will make insurers pay the sales tax on your new vehicle. Of course, they don’t actually pay it on the new vehicle you buy, but rather include it in the settlement for the vehicle you lost.

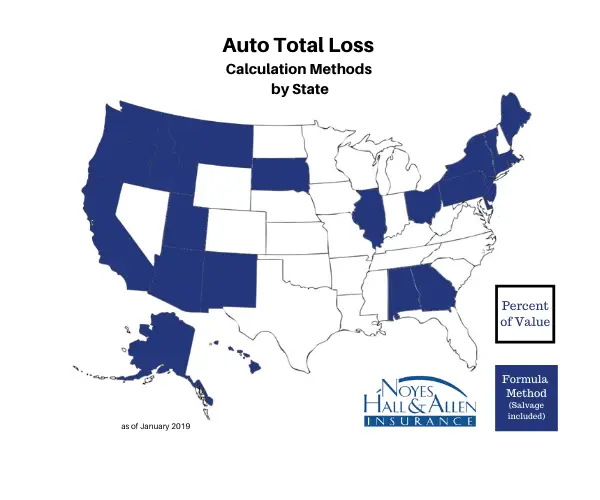

What is covered in regard to sales tax will vary by state, but Insurance.com shares a few examples:

This list demonstrates how varied the requirement for paying sales tax can be from state to state. If your car is totaled in an accident, you’ll want to look into the rules on this in your state to ensure you’re being reimbursed properly when you purchase a replacement vehicle.

How Do Insurance Companies Determine A Total Loss

To determine whether a car is a total loss, the insurance company must calculate the vehicles ACV immediately before the loss occurred and estimate the amount of damage. Most insurers work with a third-party vendor that aggregates vehicle data to determine the ACV. The insurance company will then send an adjuster to inspect the damage and estimate the repair costs.

If the damage exceeds the threshold set by the state or insurance company for totaling a car, the insurer will declare it a total loss. If this happens, the carrier will reimburse you for the ACV of the vehicle.

Even if you get into a car crash and your vehicle is not completely totaled, your insurance company may still pay for your repairs.

You May Like: How Often Should You Change Your Car Battery

Whats Your Cars Actual Cash Value

A cars actual cash value is how much it is worth when taking its depreciation into consideration. After youve been in an accident where your vehicle has been damaged, your insurance company will have a claims adjuster look it over to assess how much repairs will cost. There are a number of factors they will consider when deciding if its worth repairing. Insurance.com shares what some of these are:

- Any parts or upgrades that have been added

In addition, they will look at the selling price of similar cars in your area. If you feel that your insurance provider is undervaluing your vehicle, you can request to see the other cars they are comparing yours to. You can then try to find your own comparisons that you believe to be a closer match to what your vehicle is worth and present them to the insurance company. Its important to note, however, that an insurance company will never pay you more than your vehicles actual cash value .

Read Also: Where To Buy Boat Paint

Will My Car Be Written Off After An Accident

Cars get written off after being damaged, whether in an accident or due to other circumstances such as flood or fire. Different insurers use different rules to decide whether a damaged vehicle is a write off, but the decision will usually be based on the cost of the repairs and the value of the vehicle in question.

You May Like: How Do I Transfer A Car Title

What If Insurance Wants To Total My Car But I Want To Keep It

If you decide to accept the insurers decision to total your car but you still want to keep it, your insurer will pay you the cash value of the vehicle, minus any deductible that is due and the amount your car could have been sold for at a salvage yard. It then will be up to you to arrange to make repairs.

They will cut you a check, says Ward, and then youre on your own.

How Your Insurance Provider Determines Your Payment

Insurance companies use algorithms and adjusters to determine the value of your damaged vehicle. The adjuster will assess the damage done to your vehicle and its actual cash value. You can always use an independent appraiser should you decide that you are unhappy with what your insurance company determines.

Don’t Miss: How Often Should Car Oil Be Changed

My Car Is In The Shop Due To An Accident And I Need A Car To Get Around How Can I Get Rental Car Reimbursement From My Or The Other Partys Auto Coverage

If you are found not at fault for the accident, you can open a third party claim with the at fault partys policy under Part 4 . If you are at fault for the accident and you purchased optional coverage Part 10 available through your personal auto insurance carrier, you may open a claim with your own policy. Please refer to your auto policy selections page and policy language for the per day policy limit. The selected daily limit is the most your carrier will pay per day. Insurers are not required to provide a substitute transportation that is comparable to your auto.

Filing A Claim At Progressive

and a claims representative will walk you through the claim process. You can also file a claim by logging into your policy or using the Progressive app.

If youre not a Progressive customer, you can track an existing claim online.

Looking for more information about auto insurance? Our car insurance resource center has you covered.

Related articles

Don’t Miss: Rattling Sound In Car When Driving

Rental Reimbursement Auto Insurance

If your car is totaled by a problem covered by your policy, rental reimbursement insurance covers rental car bills or other forms of transportation, like subway and bus passes. This type of coverage can only be added to your policy if you carry collision and comprehensive insurance. It can be valuable coverage to have considering the total loss process usually takes longer than your typical fender bender car insurance claim.

Dont Miss: Where To Copy Car Key

What Is A Totaled Car

Insurance companies total a car when the cost to repair the damage exceeds the vehicles book value at the time of the crash. Its a function of basic math and the regulations in your particular state.

Also, insurers total a car that they consider would still be unsafe to drive even after making all the needed repairs. They may also declare it a total loss if it would be unsafe to drive, even if you fix it.

If the insurer totals your car, they will pay you the vehicles actual cash value . The actual cash value is how much the car was worth just before the loss. It includes a reduction in value for depreciation, so the ACV will be less than what you paid for the vehicle, even if its relatively new.

Recommended Reading: How To Get New Car Smell Back

Total Loss Vs Partial Loss

Part of being a responsible boat owner includes staying informed about the important aspects of your boat insurance coverage. Learning the definitions of and differences between total and partial loss, as well as agreed value and actual value policies is vital in selecting the best watercraft insurance coverage for you.

Total Loss

Total loss occurs when damage to a vessel or cargo is beyond repair or salvage. Total loss can be divided into two different categories: Actual and Constructive. Actual total loss occurs when your vessel or cargo is damaged beyond repair. Constructive total loss occurs when the vessel or cargo can be repaired, but costs for such a repair exceed the value of the vessel or cargo itself.

Partial Loss

A partial loss to your vessel occurs when damage occurs that can be repaired, such as a minor collision with another boat or dock, or running aground.

Common Types Of Insurance To Consider:

- Collision This covers damage to your car from a moving crash. That is, if you drive into another car, tree, fence, or other objects.

- Comprehensive This covers damage from non-crash events like a falling tree, hail, vandalism, and so forth.

- Uninsured motorist You and your vehicle are covered when a motorist without insurance is at fault in a crash.

- GAP From the moment you drive your car off a dealers lot, your car loses value. Over the initial couple of years, that loss is significant. If you secured a loan to pay for it, the chances are good that you owe more than the cars current book value. If thats the case when an insurance company declares your car a total loss, you will be stuck paying that difference. Gap insurance will step in and cover that difference in your coverage.

- New car replacement insurance If you buy a new car, you may be able to get coverage that will replace your car with a similar vehicle. Think of it as GAP insurance 2.0.

Related Totaled Car Articles:

Read Also: What To Do When Upside Down On Car Loan

Totaled Cars: What Happens When An Insurer Totals Your Car

Updated on Wednesday, March 24 2021 | 0 min. read| by Lee Prindle

Heres what it means when an insurance company declares your car a total loss, what you can do about it and more.

If an accident or incident damages your vehicle enough, your insurance provider may declare it a total loss.

As you might expect, there are some insurance implications to totaling a vehicle. There are other impacts to consider, too.

Keep reading to learn about what happens when an insurance company totals your car. In particular, you will find answers to these and other questions related to totaled cars:

Is Repairing A Totaled Car Worth The Effort

Only you can decide whether repairing your totaled car is worthwhile. However, you should consider the expenses of repairing a car, and whether or not it is safe to drive the car.

Insight:

The best thing is to be well informed, says Ward. Talk to your mechanic. Do your research. Make sure you know what you are getting yourself into.

Also Check: How Much Is Car Insurance Per Year

Total Warfare: What To Do When Your Auto Insurer Totals Your Car

Michelle, the former editorial director, insurance, at QuinStreet, is a writer, editor and expert on car insurance and personal finance. Prior to joining QuinStreet, she reported and edited articles on technology, lifestyle, education and government for magazines, websites and major newspapers, including the New York Daily News.Read full bio > >

Penny is an expert on insurance procedures, rates, policies and claims. She has extensive knowledge of all major insurance lines — auto, homeowners, life and health insurance. She has been answering consumers questions as an analyst for more than 15 years and has been featured in numerous major media outlets, including the Washington Post and Kiplingers.Read full bio > >

Why you can trust Insure.com

Quality Verified

Your car suffered major damage in an accident. Now what? Do you buy a new one? Do you have it repaired? In most cases, thats a decision that will be made by your car insurance company. If you disagree, you can try to work out a deal to pay for repairs. If you cant agree, you can fight your insurer but get yourself familiar with the claims process first.

More specifically, your insurer will weigh the cost of repairs plus reimbursement expenses for a rental car against the cars actual cash value.

A car generally is considered to be a total loss when the estimated cost of repair plus the salvage value equals or exceeds its actual cash value.

Key Takeaways

A Body Shop Is Repairing My Vehicle After An Insured Loss Does My Insurance Company Have To Pay For Original Equipment Manufacturer Parts

If the damage to your car affects how it can be driven safely, the insurance company will pay to repair it with an OEM part. For non-safety parts, unless your claim occurs during the first 20,000 miles on the auto’s odometer, the insurance company does not have to pay for OEM parts. For autos with more than 20,000 miles, state regulation allows for the replacement of damaged parts with used, reconditioned or after-market parts. You can insist on OEM parts, but you will have to pay the difference in cost.

You May Like: What Do You Need To Get Your Car Inspected

What Happens If Your Car Is Totaled Not Your Fault

What happens if your car is totaled? Generally, when a car is totaled, it means the cost of repairing it exceeds the market value of the car. In some states like Alabama, a car becomes a total loss if the repair cost is more than 75% of the value. For example, if a car is worth $10,000 and the repair cost is estimated at $8,000, it is considered a total loss.

The insurer can also determine when a car is totaled. In this case, the adjuster considers several factors, including vehicle mileage, condition, cash value, and more.

Unfortunately, without comprehensive or collision coverage, and your vehicle is totaled, you may have to spend money from your pocket to fund another vehicle. If you are leasing or financing your car, you may be mandated to have comprehensive or collision coverage. However, it is optional if you paid off your car.

When is a car Totaled?

A car becomes totaled when it has been in an auto accident and is not repairable or the repair cost exceeds the value.