How Much Is Classic Car Insurance: Classic Car Insurance Cost Per Month/year

Ever wondered how driving on one of those classic cars on the road felt like? Must feel wonderful. However, it also makes one wonder how much does classic car insurance cost. Collectible car insurance is 40-50% cheaper than standard auto insurance. Conventional vehicles are more expensive to insure because of how consumers use these vehicles on a regular basis, compared to classic cars that only have limited coverage due to how rare these cars are used.

State Farm: Best For Students

If you would like the option of online services or a local agent, we found State Farm auto insurance to be one of the best car insurance choices for in-person interactions with more than 18,000 local agents. In our State Farm insurance review, we found that the provider offers basic types of coverage, GAP insurance, and rideshare auto insurance coverage in most states.

In addition to its network of local insurance agents, State Farm has convenient online options, including the Pocket Agent smartphone app. Customers can use this app which has received positive reviews to pay insurance premiums, file claims, and request roadside assistance.

Like USAA and Geico, State Farm offers numerous discounts. Most notably, the Drive Safe and Save incentive program collects driving data through your smartphone app and reports back to State Farm about your driving habits. Drivers receive an automatic 5-percent discount on the average car insurance payment just for enrolling.

Average Car Insurance By Age

Age is an important factor considered by insurance companies when determining rates. Drivers tend to pay less for insurance as they get older. Drivers in the 18-25 age range pay higher average car insurance.

Young drivers pay more for insurance because they are more likely to get into an auto accident which results in more expensive rates.

Also Check: Recharging A Dead Car Battery

How Can You Find Your Best Rates

Comparing the prices offered by different companies is your best bet for finding cheap auto insurance rates. Fortunately, this is very easy to do these days.

You can find online quote systems that will tell you how much your coverage will cost from the comfort of your computer or even your smartphone.

Some of these systems are offered by individual insurers. Others can offer multiple quotes because they are independent and not owned by any particular company.

The independent sites are pretty useful because they can deliver a handful of comparison quotes from multiple companies.

Alternatively, you might call a local insurance agent. These trained professionals should be able to offer you free price quotes. They can also offer you advice about the type and amount of coverage you should purchase.

Does It Pay To Comparison Shop For Auto Insurance Rates

Some people never bother to shop around for auto insurance because they think that all companies are very similar.

The truth is that some companies do offer better prices for certain types of customers than others. This can be true if you have a clean driving history or have had a few accidents.

For example, did you even know that insurers can consider your credit report when they determine how risky you are to cover? Some of the top insurers in the country offer discounts for things like driving an eco-friendly car.

It might not seem like a credit report should have anything to do with driving, but insurers say that people with good credit tend to make fewer claims. They also contend that people who purchase green cars tend to have fewer accidents.

Enter your ZIP code into the free tool below to start comparing average monthly auto insurance costs in your area.

Don’t Miss: Can You Lease On Carvana

What Is The Average Car Insurance Cost By State

One of the most significant determinants of car insurance prices is your home state.

Michigan is the most expensive, with an average yearly premium of $3,466, while Maine is the cheapest at $1,062. The main culprits for high prices in any state are the presence of a no-fault insurance system, a high population density, and frequent car accidents. Additionally, a high theft rate or a significant potential for natural disasters increases comprehensive coverage.

Your zip code is another significant factor. Based on our experience, densely populated cities, with a high average income and frequent traffic jams tend to have the highest car insurance prices. For example, State Farm charges $261 monthly for a 40-year-old driver with a clean record in Los Angeles. The same driver pays only $186 for in San Diego.

How Much Is Car Insurance Get Average Car Insurance Costs

The average cost of car insurance is $1,758 annually or $146 per month for a full coverage policy.

For a driver with good credit and a clean record, the average cost of car insurance is $1,758 annually, or $146 per month, for a full coverage policy. Thats according to CarInsurance.coms rate analysis of coverage from up to six insurers for nearly every ZIP code in the nation. While what you pay will depend on your unique driver profile, its helpful to know the average cost of car insurance so youre aware of how much you can expect to pay. Here we provide an overview for various driver profiles and show how rates break down by coverage level, state and company.

Also Check: How To Get Internet In Your Car

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

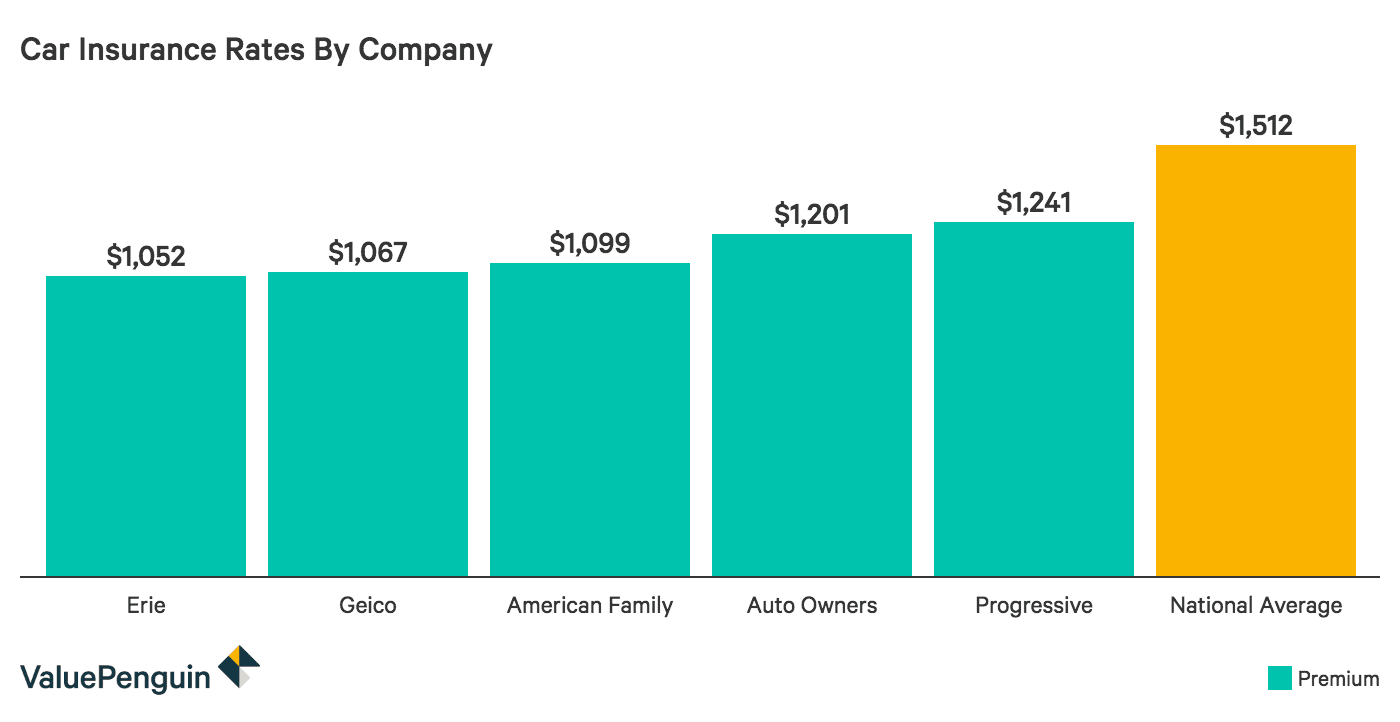

Average Car Insurance Costs By Company

Every car insurance company sets rates based on dozens of factors, including your driving history, location, vehicle and demographics. Theyre making an educated guess about how likely you are to file a claim in the future and setting your price accordingly.

Each insurer treats each factor differently. If you have poor credit, one insurer might charge you 10% more for the policy, while another would charge 40% more. A discount for being claim-free in recent years might earn you a 20% discount with one company and 5% at another.

All this results in very different rates from one person to the next. This is why the company that gives your friend super-low rates might not be the cheapest for you.

Here are annual rates for many of the nations largest insurers, for full and minimum coverage.

Recommended Reading: How Much Does A Car Salesman Make Per Car

Faq: Average Car Insurance Costs

How much are monthly auto insurance payments?

The price of monthly payments depends on if you have minimum coverage or full coverage car insurance, as well as other factors. The National Association of Insurance Commissioners estimates the average cost for full coverage is around $1056 per year and $644 per year for liability coverage. That comes to around $90 per month and $54 per month for the latter coverage level.

How much should I pay for car insurance?

Auto insurance premiums vary by coverage level, location, gender, and driving history. Coverage needs are different depending on the driver and vehicle, but usually paying under $100 per month is considered a good rate

How much is car insurance for a 24-year-old?

Our research found that the cost of car insurance for a 24-year-old driver ranged from approximately $1,300 to over $2,000. Young men typically pay more for an auto insurance policy, since they are statistically more likely to be file a claim.

Is car insurance expensive for young drivers?

Car insurance is usually more expensive for young drivers due to their lack of driving experience. Other factors like limited credit history or insuring risky vehicles like sports cars can also increase the premiums.

How Much A Dui Raises Average Car Insurance Costs

|

Type of policy |

|

|---|---|

|

$565 |

$1,152 |

Our analysis found an average increase of at least $500 a year for full coverage car insurance after a DUI in every state, and in California and Michigan, the average increase is more than $3,000 a year.

Shopping around for the cheapest car insurance after a DUI can lessen the blow. Among the largest companies in our analysis, average annual rates for full coverage car insurance after a DUI ranged from $809 at American National to $8,589 at Encompass, a difference of more than $7,780 a year between companies.

Switching to your states minimum required insurance coverage is another way to lower the cost. For minimum coverage, we found average annual rates ranging from $292 at American National to $4,248 at Auto Club Group, a AAA insurance carrier. However, if you have a loan on your car, or its leased, you may be required to keep collision and comprehensive coverage.

You May Like: How Much Does A Car Salesman Make Per Car

Average Car Insurance Costs In Washington

How much is insurance in the Evergreen State?

With a population of over 7.7 million, Washington is the 13th most populated state in the country and features over 167,112 miles of road. There are many factors that go into calculating the rate you pay for car insurance. Below is a breakdown of how much drivers in Washington pay for coverage based on different factors. To learn more about insurance requirements in Washington, check out Washington Car Insurance.

How To Get Affordable Car Insurance

Here are some tips to help you get affordable car insurance:

- Shop around. Get comparable quotes from at least three different insurance providers before every renewal period and go with the best value. Weve included the top cheapest car insurance companies below to give you a head start.

- Dont drop your coverage. Even if you go a period without a car, consider a non-owners policy to avoid gaps in coverage. Insurers frown upon coverage gaps and it could affect your future rates.

- Increase your deductible. Selecting a higher deductible can result in a lower premium. However, this is only a good option if you can afford to pay the deductible if needed.

- Look for discounts. Most insurance companies offer a variety of discounts for which you may qualify.

- Have a credit score of 650 or higher. In most states , auto insurers can use your credit score in pricing your policy. Drivers with lousy credit pay 71% more, on average than those with good credit, Insure.com found in a rate analysis.

You May Like: Diy Car Freshie

Which Company Offers The Best And Cheapest Car Insurance In California For Drivers After An Accident

CSAA is the best company in California for cheap car insurance with an accident on your record. It offered our sample driver an average monthly premium of $182 for a full-coverage policy. This is only $38 per month more than what CSAA charges customers with clean driving records.

Cheapest car insurance companies in California after an accident| Company | |

|---|---|

| $276 | $117 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

The AAA-affiliated Interinsurance Exchange of the Auto Club is another good option for California drivers with an accident on their records. It offers drivers with accidents an average monthly premium of $252 for full-coverage car insurance.

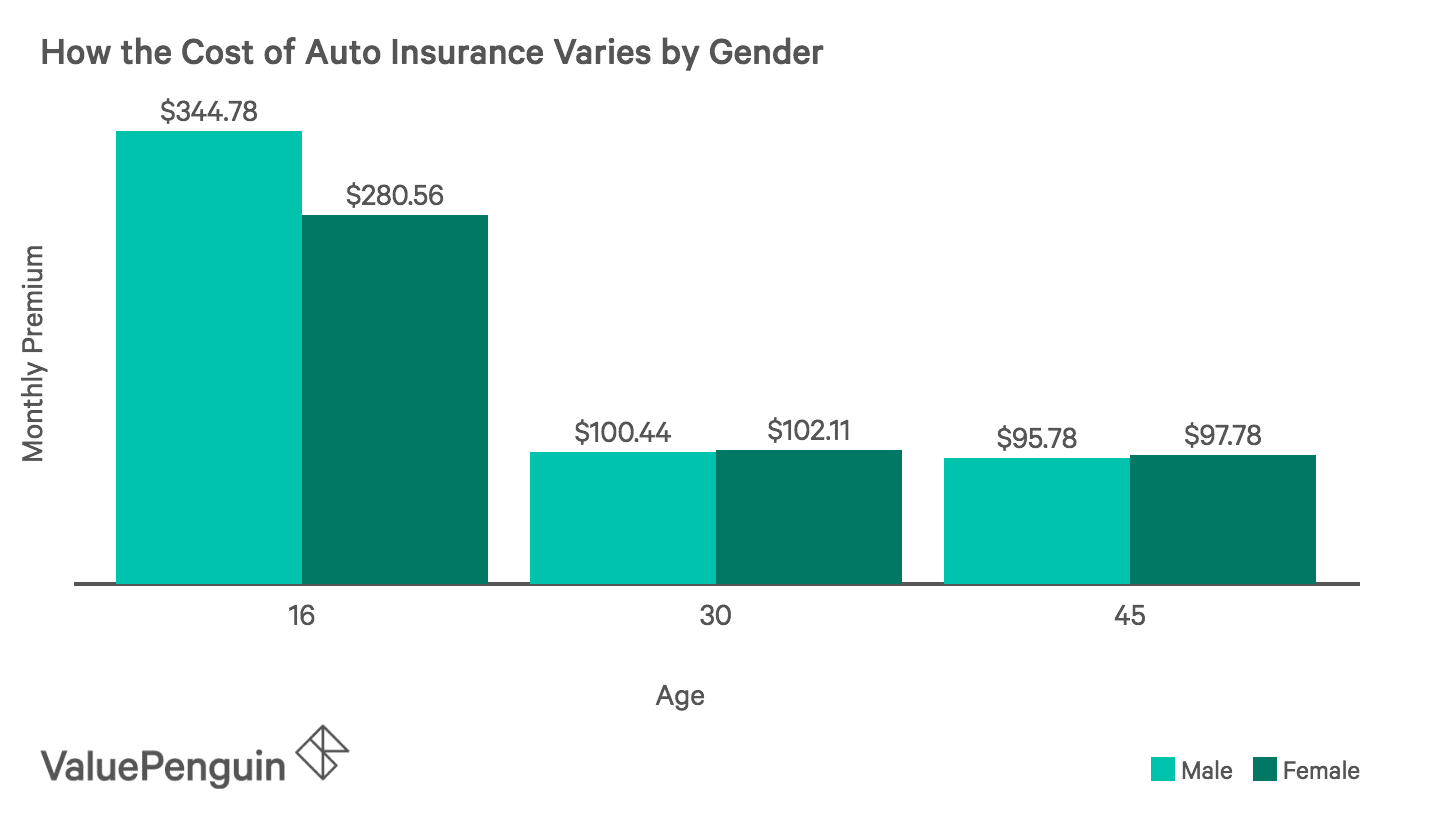

Average Car Insurance Rates By Age And Gender For The Early 20s

When you hit your 20s, your rates start to drop, but youll still pay more than most drivers until you reach age 26. Below youll find average car insurance cost by age for several common coverage sets for the time when your teen years are in the rear-view mirror but much cheaper rates are still a bit further down the road.

Also Check: What Do Car Detailers Do

Teen Drivers And Car Insurance

What is the average insurance premium increase when adding a female teen driver?Adding a female teen driver to your insurance policy as opposed to a male teen usually results in a lower premium increase. On average, girls raise your insurance premium by 129%.

The death rate for motor vehicle accidents for males is double that of females. This contributes to the lower premium increase for females.

What is the average insurance premium increase when adding a male teen driver?Teenage boys increase the average insurance bill by as much as 176%. This is just about 50% higher than the premium increases for a teenage girl.

Why is car insurance more expensive for teens?Young drivers don’t have much of a driving history. Companies charge more for teens to cover the risk of insuring an unestablished driver.

Data shows that teens are also more likely to engage in risky driving behavior such as speeding and driving under the influence.

How can you keep your insurance rates down with a teen driver?Luckily, there are ways to lower your insurance rates even with a teen driver:

- Encourage them to get good grades – a B average or higher can lower your premiums

- Provide a safe and “older” model car

- Increase your deductible

- Don’t list your teen driver as the “primary driver”

Free Auto Insurance Comparison

Secured with SHA-256 Encryption

|

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney. |

- Many factors affect the average car insurance cost per month.

- The state that you live in can significantly affect the cost of your monthly premium.

- Other factors, such as your cars safety rating, may affect the cost of your premium as well.

The average car insurance cost per month is $86 in the United States. However, the average monthly payment varies based on your driving history, crediting rating, provider, and other factors that affect auto insurance rates.

Most drivers want to manage essential recurring costs to save money. Registering and driving a vehicle requires the owner to present proof of financial responsibility.

Continue reading to learn more about the average monthly car insurance rates. If youre ready to shop around, enter your ZIP code in the free comparison tool above to find affordable average monthly auto insurance costs right now.

Your rates will vary greatly based on your unique history, as you can see.

You May Like: Getting Hail Dents Out Of Car

Average Auto Insurance Rates By Age And Gender

Whos likely to pay more for coverage? Lets look at rates by age, gender, and marital status.

Average Monthly Auto Insurance Rates Based on Age, Gender, and Marital Status

| Age, Gender, and Marital Status | Average Monthly Auto Insurance Rates |

|---|---|

Younger drivers have more expensive rates, while older drivers pay much less. Single drivers also pay more for auto insurance, while married drivers pay cheaper rates.

As a rule, young drivers will pay more for their auto insurance.

How To Save Money On Car Insurance

From the moment you start shopping around for auto insurance, there are a number of ways you can save. Even if you already have an existing car insurance policy, there are still some steps you can take to lower your premiums.

Bundle your home and auto insurance: Combining multiple policies with the same company can earn you serious savings

Take advantage of car insurance discounts: Check with an agent to make sure youâre getting every discount you can, including discounts for having certain safety features in your car, or for taking a defensive driving course

Change your coverage limits: Not every driver needs the highest level of every coverage. We recommend liability levels of $100,000 per person, $300,000 per accident in bodily injury liability and $100,000 per accident in property damage liability, typically written as 100/300/100 on your insurance policy

Raise your deductible amount: A higher comprehensive or collision deductible means lower premiums â just remember you may actually have to pay that amount when you file a claim

Shop around once a year: Even if youâre happy with your coverage, reshopping your car insurance annually with Policygenius can help you save big and make sure youâre not paying too much for coverage

You May Like: How Do I Get My Car Title In Florida

How Much Is Car Insurance For A 25

Hitting 25 years of age helps bring down the cost of auto insurance. The annual average nationwide for a 25-year-old is $737. That is for a standard liability policy that includes $50,000 for bodily injury per person, $100,000 max for all injuries and $50,000 of property damage . A bare-bones state minimum policy cost is a bit less at $657. You need a full-coverage policy for sure if your car is leased or financed has an average annual rate of $1,957.

Average Cost Of Car Insurance By Region

| Region | |

|---|---|

| Mid-Atlantic | $3,016 |

| Southeast | $2,745 |

| Southwest | $2,670 |

| Midwest | $2,511 |

| Northeast | $2,433 |

| Northwest | $2,136 |

| $136 |

The Mid-Atlantic has the most expensive car insurance rates, and it’s the only region with an average higher than $3,000. Auto insurance is much more affordable in the non-mainland states of Alaska and Hawaii.

Don’t Miss: Who Does Avis Own