How Can I Avoid Paying My Car Insurance Deductible

You can avoid paying your car insurance deductible for vehicle repairs if the mechanic agrees to waive it, which is possible but highly unlikely. In some cases, your insurer may also waive your comprehensive deductible for glass repair specifically. Otherwise, if you are filing a car insurance claim with a type of coverage that has a deductible, you have to pay it.read full answer

Types of Car Insurance That Dont Require a Deductible

Not every insurance claim requires you to pay a deductible. For example, many insurers waivecomprehensive deductibles for glass repair, and some states allow drivers to choose a separate $0 glass deductible.

In addition, if you are in an accident and another driver is at-fault, your costs will be covered by their liability insurance, which doesnt require you to pay anything out of pocket. If you choose to use your collision coverage or personal injury protection insurance to cover immediate costs, you will have to pay your deductible. However, your insurance company will eventually recoup your costs from the at-fault drivers insurer.

On the other hand, you may have to pay a deductible if you are hit by an uninsured motorist and have to use your uninsured motorist property damage insurance, though it usually depends on your state.

What To Do If You Cant Afford Your Car Insurance Deductible

When Do I Need To Pay A Deductible On My Car Insurance

Why does it seem that sometimes you have to pay your deductible on a car insurance claim, and sometimes you don’t? What is the rational to this seemingly inconsistent process?

At HPM Insurance we represent many insurance companies so can provide some insight into the general guidelines that most insurance companies follow regarding deductibles. So…

What Is The Average Deductible Cost

Because consumers choose varying types of car insurance coverage with different monetary limits, deductibles can vary significantly from one driver to the next. For most drivers, typical deductible amounts are $250, $500 and $1,000. According to MoneyGeek’s data, the average car insurance deductible amount is approximately $500.

Also Check: How Much To Repair Dent In Car

Other Situations With No Deductible

An auto insurance deductible won’t apply to you in the following scenarios:

Another person files a claim against your liability coverage

There is no car insurance deductible on a liability claim, meaning you pay nothing out-of-pocket for an accident in which your insurer pays for the damages and/or injuries you caused to another person, up to your policy’s limits.

You selected a disappearing deductible

Some insurers offer a “disappearing deductible” program that lowers your deductible a set amount for each violation- and claim-free policy period. After a certain number of policy periods, you can end up with a $0 deductible for comprehensive or collision claims. However, your deductible typically resets to its original amount after filing a claim.

You have free repairs on glass claims

In some states, your insurer may repair or replace your windshield without requiring a deductible, or they may give you the option of choosing a $0 deductible for glass claims. Other insurers, including Progressive, may waive your deductible if they can repair your windshield rather than replacing it.

Do I Pay My Deductible If Im Not At Fault

The short answer? Maybe. You can choose to wait until the at-fault drivers insurance company connects with you and pays for your damages, but that method is rarely swift. Your other option, if you want to get the process rolling so youre back on the road quicker, is to file a claim with your insurance company, pay your deductible and have them cover the remaining costs for damages.

But it doesnt seem fair to have to pay for an accident that wasnt your fault, right? Thats where deductible recovery and subrogation comes into play.

You May Like: How To Install Led Lights In Car

Key Things To Know About Car Insurance Deductibles

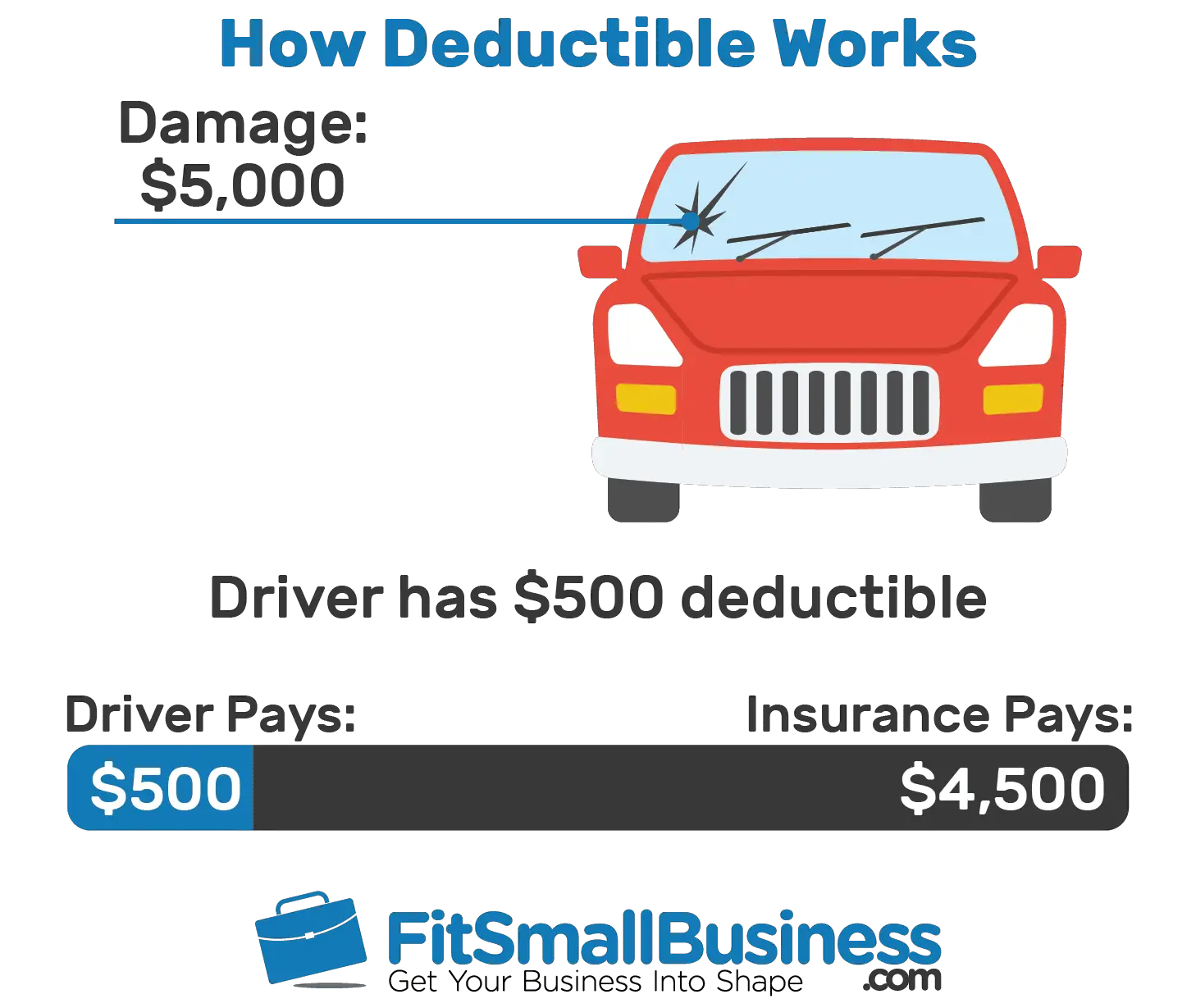

How Do Auto Insurance Deductibles Work

If youve got auto insurance or are shopping around for some you may have heard the term deductible. When you build a car insurance policy, youll have to decide how much of a deductible you want, most often either $500 or $1,000. So what exactly is a car insurance deductible? And how much should yours be? Well help you understand your deductible and whats best for your auto insurance to help protect what matters most.

You May Like: How To Wire Car Speakers

Do You Want To Pay Less For Car Insurance Or Repairs

A higher deductible will generally lower your insurance premium, but you will pay higher out-of-pocket costs if you file a claim for damage to your vehicle. Some claims may even be covered under your deductible and you might have to pay the entire amount out of pocket if you filed. For example, if you back into a tree and do $350 worth of damage to your vehicle and your collision deductible is $1,000, you will pay out of pocket for all the repairs.

If you opt for a lower deductible, your car insurance rate will likely be higher, but you would have lower out-of-pocket costs if you file a claim. If your deductible is $100 and you cause that $350 damage by backing into a tree, you would only have to pay your $100 deductible, while your insurance would pay the other $250. However, you could spend more on your premium by having a lower deductible and never end up filing a claim. This is the nature of having insurance coverage and an example of the risk both you and the insurer take on.

How Do You Pay Your Car Insurance Deductible

After an accident, you submit a claim to your insurance company for the cost of damages. Once your claim is approved, your insurance company issues a payout. Your insurer then subtracts your deductible amount from your claimâs payout amount.

Letâs say your claim is approved for $2,500 and your deductible is $500. Your insurer writes you a check for $2,000. Therefore, you donât have to worry about sending your insurer a check.

Just make sure that you can cover your deductible out-of-pocket. Some insurers may ask you to pay your deductible first.

You May Like: Does Walmart Do Car Alignments

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

|

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD& D insurance as well. She has worked for small health insuran… |

Written byRachael BrennanLicensed Agent for 15 Years |

|

Chris Harrigan has an economic degree from Limestone College and an MBA from Clemson University. He previously managed auto insurance claims for Enterprise Rent-A-Car. Currently, he is using his business and insurance expertise to provide insurance data analysis and visualizations to enhance the user experience. |

Former Auto Insurance Claims Manager |

What Is Deductible Recovery

With deductible recovery, American Family will work through a process called subrogation. Subrogation is the insurance worlds way of saying, were working on getting your deductible back because the accident wasnt your fault.

Basically, subrogation is when one insurer receives money from another insurer so that the not-at-fault driver gets their deductible back.

Heres how subrogation works in car insurance:

Your insurance company will pay for your damages, minus your deductible. Dont worry if the claim is settled and its determined you werent at fault for the accident, youll get your deductible back.

The involved insurance companies determine whos at fault. Sure, you know the answer to this, but its all part of the process. You might be asked for a statement about the accident, so having the police report, pictures and/or other important details will be helpful.

Your insurance company recovers your deductible. After determining the other driver was indeed at fault, your insurance company will work through the subrogation process to recover your deductible. You may need to submit proof that you paid your deductible, which could be a body shop invoice or credit card statement.

Also Check: What Is An Automatic Car

Work With An Experienced Car Accident Attorney To Help You Understand Your Insurance Policy

Car Accident Lawyer, Andrew Finkelstein

Insurance laws are not always straightforward, making it difficult to understand what you have to pay out-of-pocket for a car accident and what you may qualify to recover. Thankfully, when you work with an experienced car accident attorney who is familiar with these insurance claims, they can help you understand your eligibility for compensation and assist you as you fight for the money you deserve. They do this by:

- Looking into the details of your car accident and the injuries you sustained to figure out what financial recovery options you have.

- Going through your insurance policy and helping you understand how your coverage and deductibles work and how they can impact your recovery.

- Answering all the questions you have regarding the accident, the insurance process, and what you have to do next.

- Representing you in all case-related communications with the other side and the insurance company.

- Working with your insurance company to file a claim.

- Investigating the car crash and securing the evidence needed to prove what happened.

- Identifying all the liable parties and determining if you can claim additional compensation from them.

- Fighting for you in settlement negotiations and ensuring they go after the just amount you deserve.

- Working with your insurance company to get your deductible amount, if you had to pay it following the motor vehicle accident.

- Filing a lawsuit against the at-fault party to recover the maximum damages you need.

How To Avoid Paying A Car Insurance Deductible

The best way to avoid paying a car insurance deductible is to avoid accidents, theft, or damage. Practice defensive driving, follow the rules of the road, obey the speed limit, and avoid driving in bad weather. Keep vehicles garaged in a safe location, and consider installing anti-theft devices.

People can also choose a policy with no deductible, albeit at a higher cost. Or they can sign up for a vanishing or disappearing deductible with insurers who offer it. This will reduce the amount of the deductible by a set amount during each time period the driver is free of accidents. Many insurers do set a minimum deductible, but people can reduce their potential out-of-pocket costs substantially over time.

Recommended Reading: Does My Car Have Sirius Xm

If Another Driver Causes A Crash And Their Insurance Pays

In most states, a driver who is responsible for causing a crash is obligated to pay for all damages associated with the collision. For example, if Driver A is at fault for an accident that damaged Driver B’s car, Driver A’s insurance should fully pay for Driver B’s repairs. Driver B shouldn’t owe a deductible.

Sometimes, however, the driver who should cover the costs has no insurance or too little coverage. If that’s the case, another motorist may need to make a claim under their uninsured or underinsured motorist coverage. A deductible may apply in this situation.

How To Deal With Deductibles

Deductibles are simply an inevitable aspect of numerous kinds of insurance, but they shouldn’t stop you from getting the repairs you need after an accident. To get your repairs taken care of in a timely manner, it’s always best to make a claim against your own car insurance policy assuming you have the proper coverage, according to HPM Insurance. Keep in mind that this is the best course of action regardless of who’s at-fault for the accident.

When you’re involved in an accident that’s not your fault, you should still file the claim with your own insurance company. Your insurer is always going to want to pay the least amount of money possible, so if they discover you’re not at fault, they will pursue reimbursement from the other driver’s insurance company. This reimbursement is especially useful as the amount covers your deductible. Just remember that you’ll only have your deductible covered for you if your insurer is able to get coverage for the entire cost of the damages from the other insurer.

With these factors in mind, you can find a deductible for your policy that best fits your driving needs from a provider like Progressive. Don’t forget that the more time you spend on busy roads, the more likely you’ll have to pay a deductible eventually.

Information and research in this article verified by ASE-certified Master Technician Duane Sayaloune of YourMechanic.com. For any feedback or correction requests please contact us at [email protected].

Also Check: How Much To Charge Ac In Car

When You File A Comprehensive Claim

Comprehensive car insurance covers your vehicle if youre involved in an incident that does not include another driver. Examples of comprehensive claims you may make include theft, break-ins, fires or damage from falling trees. If you have coverage from a comprehensive insurance company and need to file a claim, you will pay your comprehensive coverage deductible.

Is Car Insurance Paid Monthly Or Annually

Car insurance can be paid a number of ways, but most companies provide a small discount for making fewer payments. Paying every three months will usually save you money over monthly payments, while paying one payment for a six- or 12-month policy will save you money over paying every three months.

There are usually three ways to make your car insurance payments:

-

Pay in full at the start of the policy: If you can afford to pay your car insurance premium in full, you can pay your bill with a single payment at the start of the policy. Drivers who pay their policy in full will make one payment per year for annual policies or two payments for six-month policies.

-

Pay quarterly : Quarterly car insurance payments mean youll make payments every three months. Drivers with annual policies who choose to pay quarterly will make four total payments, while drivers who have six-month policies will make two payments.

-

Pay monthly: Most car insurance companies let you pay for your policy monthly. Monthly payments allow drivers to make smaller payments, but it can cost more over the long run.

Don’t Miss: Can I Use Clorox Wipes In My Car

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right

At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance affects their finances, we have licensed insurance professionals on staff who have spent a combined 47 years in the auto, home and life insurance industries. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation of how we make money.Our content is backed byCoverage.com, LLC, a licensed entity . For more information, please see ourInsurance Disclosure

What Deductible Should I Choose For Car Insurance

Always pick a deductible amount that you would feel comfortable paying out-of-pocket. Outside of this, be sure to consider the value of your vehicle. A car that is only worth $1,000 probably isnât worth getting an $800 deductible for.

Deductibles usually range from anywhere from $200- $2,000. The most common deductible amount is $500. Keep the below ratio in mind when choosing your deductible amount:

- Lower deductible = Higher car insurance rate and lower out of pocket costs.

- Higher deductible = Lower car insurance rate and higher out of pocket costs.

You May Like: What To Do If You Hit A Parked Car

After An Accident Caused By Another Driver

Generally, the at-fault drivers car insurance company will process any claim you make for auto damage, if you contact them directly, they may accept liability and pay in full for your damages if their driver is considered fully at-fault. However, that company must first conduct their investigation into the claim. You may wait weeks or months to receive the money you need to repair your car.

In this case, you may file a claim against your policy and get your vehicle fixed faster. If you choose this option you will pay the deductible. Your insurance company will then participate in a process known as subrogation and negotiate with the other insurance company for reimbursement of the money they paid you. If the subrogation process is a success, you will receive a refund of all or part of your deductible depending on the circumstances of the accident.

We suggest that you always contact your insurance company if you are involved in an accident. They have experts hired to help manage the claim on your behalf.