Important Legal Disclosures & Information

Online Banking is free to customers with an eligible account however there may be a fee for certain optional services. We reserve the right to decline or revoke access to Online Banking or any of its services. All online banking services are subject to and conditional upon adherence to the terms and conditions of the PNC Online Banking Service Agreement.

PNC Alerts are free to customers. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply.

A supported mobile device is needed to use Mobile Banking. Standard message and data rates may apply.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries and regions. App Store is a registered mark of Apple Inc.

Google Play and Google Play logo are trademarks of Google LLC.

Visa is a registered trademark of Visa International Service Association and used under license.

Bank deposit products and services provided by PNC Bank, National Association. Member FDIC

Is 6 Years Too Long To Finance A Car

There’s really only one benefit of a long-term auto loan that spans six to seven years or even longer. The longer the car loan, the smaller the monthly payment. By taking out financing with an extended loan term, you can potentially buy a more expensive car and still stay within your monthly budget.

Can You Pay Off A 72

Consider refinancing your current car loan Refinancing with a new 72-month loan is a relatively long time that’s six years. Instead, look for a shorter term and a lower interest rate. If you do refinance for a long-term loan, consider paying extra toward the principal every month to pay off the loan early.

Read Also: What Is A 5 Door Car

Generally No But There Are A Few Roads To Consider

Ljubaphoto / Getty Images

In a crunch, you may look to your credit card to make your monthly car payment. Or, you may think of charging your car payment to earn some extra credit card rewards. There are a few options for paying your car note with your credit card, but the process isn’t as simple as regular everyday purchases. Before you try to make your car payment with your credit card, there are some caveats to consider.

Repossession And Avoiding Legal Trouble

Getting your car repossessed is stressful and embarrassing. If you know its about to happen and have chosen not to do a voluntary repossession, remove your personal belongings and after-market equipment such as subwoofers and lights before this happens.

The lender will sell your car at auction, and if the sale doesnt bring what you owe, youre on the hook for the difference.

You may be tempted to hide your car from your creditors to avoid this. Bad idea. Its illegal fraud, to be more precise and the harder you make the repo man work, the more he charges the bank, costs that will be passed on to you.

Recommended Reading: When Should You Refinance Your Car Loan

What Happens If I Double My Car Payment

If you pay double each month, you cut down on the interest twice as fast and start paying on the principal much sooner. … By paying more each month you will be spending more in the short term but saving more in the long term. Lowering the amount of principal to be paid back reduces the amount of interest you will pay.

Set Up Automatic Payments

You decide which savings or checking account you would like the money to come from each month. There is no charge for enrollment, and you can easily change or cancel the automatic payments online.

To set up automatic payments, sign on, select your auto loan from Account Summary, and then select Enroll in Autopay. You can also call us at 1-800-289-8004 or download the automatic loan payments authorization , complete the form, and return by mail or fax.

If you would like to change or cancel your automatic payments, please allow at least 3 business days before the automatic payment is scheduled to withdraw.

Don’t Miss: What Soap Can I Use To Wash My Car

Consolidate Your Monthly Statements

If you have two or more vehicle accounts, complimentary Combined Billing allows you to receive one consolidated monthly statement. Your consolidated statement will begin with your next billing cycle after your enrollment is complete.

How to enroll in Combined Billing:

Complete this enrollment form and mail it to the address or fax number listed, or obtain a form by calling

How To Make Your Car Payment

Jason Unrau

| Get a Quote |

Typically, you dont have the whole purchase price in cash when you purchase a vehicle. When that happens, you can set up a loan with a financial institution or lender to borrow the funds you need to pay for the vehicle. When you set up that loan, you need to make payments against the borrowed amount.

Car loan payments are usually arranged with the individual lender. There are certain criteria set up that you agree to including:

- A set term length for the loan

- Interest charges for the borrowed amount

- A payment schedule weekly, bi-weekly, semi-monthly, or monthly.

- A set payment amount including principal and interest

There are a few ways you can make your car payment to your lender. Not all lenders operate under the same guidelines, so confirm each method with your lender before signing your loan agreement.

Recommended Reading: What To Do If I Lost My Car Title

Ask Your Lender To Skip Or Defer A Car Payment

Some lenders offer borrowers deferred payments. This means that you may not be required to make the monthly payment. Instead, the amount due will be delayed until the end of your loan. This could result in lower monthly payments when youre having trouble paying when bills are due.

However, every lenders policy is different. Some policies may require that you still pay the monthly interest that is due. Also, each lender may have a different type of deferment policy and the number of times you can defer a payment may vary. So, you may not be able to defer payments very often. Its important to compare the policies of different lenders before landing on a loan provider.

How Do I Know Who My Auto Loan Lender Or Servicer Is

If you financed your auto loan directly with a bank, credit union, or other lender , that entity is your lender. If you got your financing through the dealer, or your lender transfers servicing rights to a third party, you can generally expect that you will receive a welcome letter from your lender or servicer giving you information about your loan.

The letter should include contact information and information about how and when you make payments. Make sure you keep and pay attention to your paperwork, as it can tell you:

- Who your lender or servicer is

- Where to send your payments

- What counts as an on time payment and whether there is a grace period

- The amount of any late fees

- Whether there is a penalty if you pay off the loan early

- Who to contact if you are having difficulty making payments

Read Also: Why We Took The Car

How Can I Avoid Paying Interest On My Car Loan

If you pay off the loan early, you’ll make fewer interest payments.

Using A Balance Transfer

With a high enough credit limit, transferring your auto loan to your credit card is an option. You’ll pay a balance transfer feeâeither a percentage of the transfer or a flat feeâbut if you can take advantage of a 0% promotional offer, you can avoid paying interest on the balance. Of course, that means you’ll have to pay off the balance by the time the promotional APR expires to take full advantage of the offer.

While transferring your balance to a credit card could save you money on long-term interest costs, it may not necessarily solve a cash crunch, particularly if you have to increase your payment to pay off the balance before the promotional period ends.

Don’t Miss: Can I Buy Bullet Proof Glass For My Car

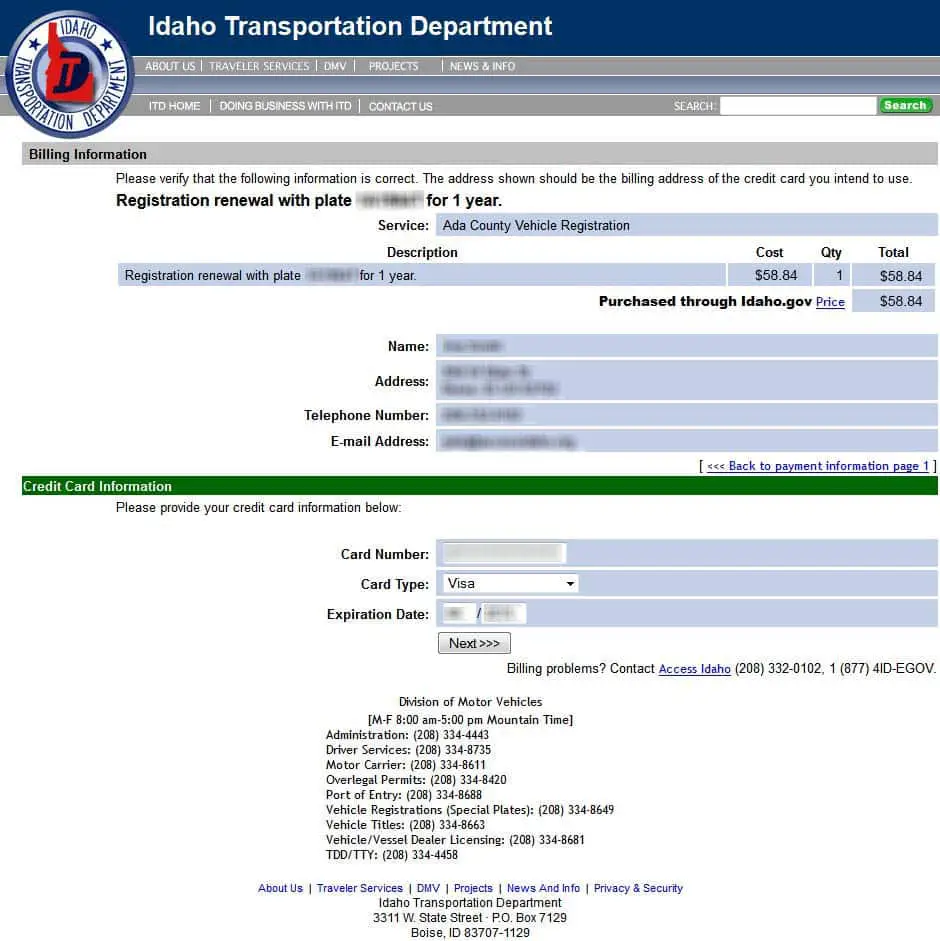

Use Your Mobile Phone To Make A Payment

You can use your mobile phone to make a payment from your bank on your car loan. Youll need to have a method of payment arranged with the lender in case you dont make your payment on time, much like a pre-authorized debit.

Step 1: Organize the payment. Make arrangements with your lender to pay your car payment yourself.

Youll need to provide a credit card or alternate form of payment in the event you dont make your car payment.

Sign your loan contract, agreeing to the terms of repayment.

Step 2: Make your car payment on or before your due date. Use your mobile phones bank app or a browser on your phone to complete a payment to your lender.

If you know you wont be able to make your payment on time, call your lender to make alternate arrangements.

If you miss a payment under this agreement, you may lose the option to pay your car payment yourself, and the pre-authorized debit agreement will take over.

Step 3: Make extra payments with your mobile phone. If you want to reduce your loan term or have extra income one month, you can pay an extra payment in the same fashion.

Frequently Asked Questions About Paying Off Your Car Loan Early

HOW Do i GET OUT OF A CAR LOAN?

There are several ways to get out of a car loan. You could pay it off, refinance it, sell the car to an individual or dealership or trade in the car for a less expensive vehicle.

WHAT HAPPENS WHEN YOU PAY OFF YOUR CAR?

When you pay off the car, the lender will send the title or a statement of lien release to you.

In states where the lender holds the title until the loan is paid off, they will send the title to you when you pay off the car, marked as free and clear of any liens. In states where an individual holds the title rather than the lender, the lender will send a document of lien release, stating the car no longer has a lien.

IS IT BETTER TO PAY PRINCIPAL OR INTEREST ON A CAR LOAN?

Its better to pay the principal. The principal is the set amount you borrowed to pay for the vehicle, but the interest fees can change based on how much principal you still owe each month. By reducing the principal early, you reduce how much you have to pay in interest.

Read Also: How Much Should I Spend On My First Car

How Does Leasing Differ From Buying

Your monthly payments with a lease are usually lower than when buying for the exact same car. Essentially you are paying for the cars depreciation during the period that you lease it plus some rent, tax, and fees. At the end of the lease, you have to return the car to the owner, unless your agreement gives you the option to buy the car.

Ask Your Lender About Financial Support Options

Obviously, you dont want to default on your payments. Do you know who else doesnt want you defaulting? Your lender.

As a result, lenders are typically willing provide some help if youre going through a financial downturn. That has been particularly true during the COVID pandemic. So, ask your lender about hardship programs, which include loan deferrals and late-fee waivers.

Deferrals are when the lender allows you to delay your next one or two payments before resuming the normal payment schedule. If you get a two-month deferral, your loan term will extend by two months. The interest will keep accruing while your payments are being deferred, so youll pay more before the loan ends. However, it shouldnt hurt your credit score.

A late-fee waiver is when the lender agrees not to collect a late fee when you make a payment within 30 days of its due date. Again, it shouldnt affect your credit score.

These arent long-term solutions, but if youve had a brief financial setback, they can help you through a tough time.

Read Also: Does Lightning Mcqueen Have Car Insurance Or Life Insurance

I Make My Auto Loan Payment Every Month Ahead Of My Due Date However I Dont Receive A Statement Reflecting This Why Am I Not Able To Receive A Statement

If the minimum payment due has already been made for the billing period, currently a statement is not generated. We do understand your concern and are looking into making a statement available regardless of whether a payment is due or not. We appreciate your patience as we continue improving the process.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How To Make A Remote Control Car

Paying With A Convenience Check Or Cash Advance

While you likely won’t be able to use your credit card to make a car payment as a regular transaction, you may be able to use a convenience check or cash advance to make the payment.

If you opt to use a convenience check, you can write it to yourself and deposit it into your bank account, then make your car payment as normal. Or you can make the check out to your lender and mail the payment.

To make your car payment with a cash advance, you’d need to perform a cash advance at an ATM. Then, you could deposit the cash into your bank account and make your payment normally. Or, you could purchase a money order and mail it to your lender.

Read your credit card’s terms for cash advances. Whether processed with a convenience check or via ATM, most incur a cash advance fee based on the amount of your advance. The transaction may also be charged a higher interest rate than other transactions. And you won’t get a grace period, so interest begins accruing immediately.

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Also Check: How To Install Aux Input In Car Stereo

How To Lower Payments When Purchasing The Car

If youre still in the market for a new car, the choices you make now can impact how affordable or expensive your car loan is for years to come.

Be sure to shop around and get quotes from several lenders. While your credit score and other personal financial details play a key factor in the interest rate and terms of the loan, some lenders will be able to offer better deals than others.

Keep in mind that you can often get an initial quote online without the lender doing a hard credit check that can impact your credit score. However, thats just an estimate of what you might qualify for based on those initial details.

You cant lock in an offer until you officially apply for a loan, which involves a hard credit check that has a temporary negative impact on your credit score. But if you apply with several lenders try to do so within a short period of time.

Modern FICO scoring models recognize that several mortgage or auto loan inquiries over a short period mean youre rate shopping, so it wont hurt your score as long as you keep it to a 45-day window. VantageScore and some older FICO models require you to rate shop within a two-week period.

Special Savings On Eco Vehicle Loans

Gas guzzling vehicles impact the planet and your pocket, which is why many drivers today are choosing electric or hybrid vehicles as their next ride. Save on more than just the price of gas with a Suncoast Eco Vehicle Loan. Rates start as low as 4.25% APR on all electric, hybrid, and plug-in hybrid vehicles.

You May Like: Can I Register My New Car Online