Top Car Insurance Comparison Sites For The Lowest Rates

Start here to get affordable auto insurance

Coverage and rates tailored to fit your needs

Lower rates

Compare multiple quotes and choose the most economical one

Reputable providers

We work in a network of trusted providers

One of Americas founding father Ben Franklin was noted for saying, Nothing is certain except death and taxes. But, thats only because he didnt live long enough to pay car insurance premiums. In modern times, its more accurate to claim that nothing is certain except death, taxes, and car insurance.

In most states, you are required to obtain auto insurance. Currently, only two states dont require car insurance: Virginia and New Hampshire. If you think the legal requirement to obtain car insurance results in a plethora of providers, youd be correct. Add to that the variances in state regulations, and you instantly see the need for reliable price quotes.;It is for this very reason that car insurance comparison sites have grown in popularity. However, this naturally inspires another question: What are the best car insurance comparison sites for 2021?

Who Offers The Cheapest And Best Car Insurance In Canada

A singular;auto company insurance that offers the cheapest auto insurance to all its customers doesn’t exist. Your auto insurance rate depends on your driving profile.

Price also depends on the insurance providers own risk tolerance. A company that has recently experienced record losses will often charge higher premiums to new customers.

Even if they seem interchangeable, insurance companies are not all alike. That’s why we stress the importance of comparing auto insurance quotes. Without the ability to compare, its impossible to know which insurance company can offer you the lowest premium. The variation in price is quite big. It’ll surprise you.

Signs Of A Bad Car Insurance Comparison Site

Some car insurance comparison sites that you should avoid are known for pushing people to offers from their advertising partners, providing misleading quotes, and offering little information about the insurance companies themselves. As a result, consumers could be missing out on better deals elsewhere, and they might purchase a policy from an insurer that offers lower rates at the expense of a good customer experience. ;;

It can be cheaper to buy car insurance online than through an agent, if you are willing to do the work of understanding and comparing policies. Using an agent can cost you 5% to 20% extra on a new policy in the first year and 2% to 15% every time you renew, according to numerous sources.

There are two kinds of car insurance agents: independent and captive. Independent agents work for themselves and sell car insurance from multiple companies. Their income comes from sales commissions. You will pay these either directly, as a service fee, or indirectly through higher premiums. According to the Independent Insurance Agents & Brokers of America, Inc., independent agents earn 8% to 15% of a new policy’s first year premium and 2% to 15% at renewal.

Captive agents work for a single company, offering only that insurer’s products. They earn a salary, usually plus commissions. Their initial commissions range from about 5% to 10% of the value of new auto policies that they sell, plus a small percentage at each renewal. This cost is included in your premiums.

Also Check: How To Know If Car Battery Needs To Be Replaced

Compare Cheap Car Insurance Quotes Today For Free

Go high on deductibles.if you’re willing to give a little with your deductible, you can wind up saving big on. Compare quotes from more than 100 trusted insurance car insurance comparison by driving history. Do you have more than 1 vehicle you want to protect? What is the car insurance rates comparison process?

Compare quotes and you could save up to £254*. Compare car insurance quotes and plans with flexible coverage of loss and damage due to accident, fire and theft. There’s a lot that goes into determining your auto insurance rates, and often, those factors vary from insurance carrier to insurance carrier. Insurance companies go to great lengths to verify the information you provide in the event of a claim.

Can I Lose My No

There isn’t an industry-wide rule regarding this. However, if you havent had an active car insurance policy for more than 2 years, you may struggle to get your new insurer to honour your previous no-claims history.

This depends on the insurer you end up going with though, so it is best to check with the provider if they are an exception to this general rule.

Read Also: How To Put Tint On Car Windows

Types Of Car Insurance Coverage

There are six standard types of auto insurance;coverage that are offered by most major insurance companies.;You’ll also want to decide what coverage level or limit to purchase of each type.

| Car Insurance Type | |

|---|---|

| Comprehensive coverage will pay to repair your car when it is damaged by vandalism or natural events like flooding. | |

| Medical payments | Medical payments ;reimburses you for medical costs associated with an accident for you and your passengers. |

| Personal injury protection | Personal injury protection ;pays for medical bills for you and your passengers after an accident, regardless of fault. Additionally, PIP can include death benefits and compensation for lost wages. |

| Uninsured motorist/underinsured motorist coverage | Under uninsured/underinsured motorist coverage , you are covered in the event that you are in an accident with an at-fault driver that does not have sufficient insurance. |

Car Insurance Quotes: Examples

Below are some auto insurance quotes examples of different driver types.;The table shows the average annual auto insurance quotes for drivers on different conditions, this gives a good idea of what your quotes should approximately be under these conditions, but of course there are many other factors that determine your rates.;

| Driver Status |

|---|

| $2904 |

Recommended Reading: How Much Does A Car Salesman Make Per Car

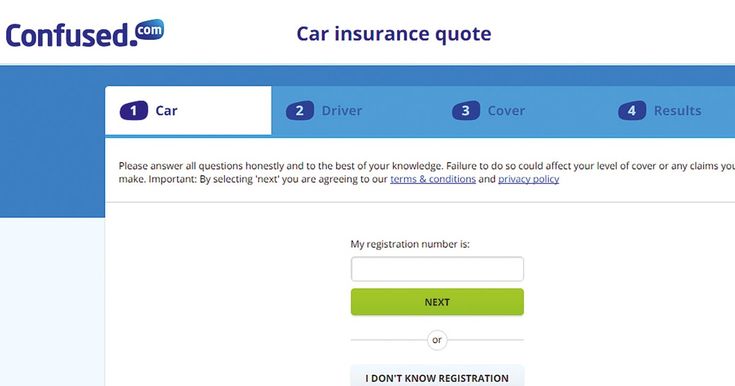

What Details Do I Need To Get A Quick Insurance Quote

To get a car insurance quote, youll need to tell us about:

- Your car either your registration number or the cars make, model and age. Youll definitely need the registration number to buy a policy.

- How you use your car for pleasure and commuting, or for business purposes too. Well also need to know how many miles a year you drive and where you keep your car at night.

- No claims discount how many years you have .

- Your driving history any accidents, insurance claims and driving convictions from the past five years. Be honest, or you could invalidate your car insurance policy.

- Additional drivers details of any additional drivers you want to add to the policy.

- Personal details you’ll also need to provide a few details about yourself unless youve compared with us before, then well do that for you. This will include your name, how old you are, where you live and the type of job you do.

- Your driving licence number if you can provide this, it might reduce your price with some insurance providers.

- Damage to another vehicle

- Property damage

- Car insurance could also cover you if your car is damaged by fire, attempted theft or if its stolen.

Not all car insurance policies offer the same cover, so always read the small print and make sure youre happy with any exclusions or limitations.

What Car Insurance Companies Offer Both Rental And Flood Insurance

There are plenty of companies to choose from when it comes to both rental car insurance and flood insurance. But what are the car insurance companies that combine rental and flood insurance?

According to the Insurance Information Institute in;a 2019 study, flooding rates have increased steadily over the past 10 years, and according to the New York Post, car rentals have more than doubled since 2019, making it more important now than ever to make sure youre covered in case of emergency.

It is important to remember there are plenty of options when it comes to these types of coverages, so even if your insurance company is one of the car insurance companies that dont offer car rental and flood insurance, there are plenty of others to choose from.

You May Like: What Does Srs Mean In A Car

How To Get An Ontario Driver’s Licence

In 1994, the Ontario government introduced its graduated licensing system requiring each driver to progress through a 3-step educational program to be a fully licensed driver. Successfully participating in the graduated licensing system allows you to legally operate a car or motorcycle.

Prior to this ’94, a driver only needed to pass a single written and road test in order to become fully licensed.

Once you begin the graduated licensing journey you have a 5-year window to earn your G licence. At a minimum it will take you at least 20 months to become fully licensed. Letâs take a quick look at this phased approach:

Whats Right For Your Neighbor May Not Be Right For You

While it may seem tedious to compare multiple car insurance quotes while;shopping for car insurance, the cost difference between companies can be hundreds of dollars. At the same time, you want to make sure you have the right amount of coverage to give you peace of mind.

Our review of the best car insurance companies should give you an idea of what makes for a good provider and a good policy. Below, well get into the best ways to shop for insurance and how you can get great deals.

When youre ready, use the tool above to start comparing multiple car insurance quotes in your area.

Don’t Miss: How Do I Get My Car Title In Florida

Direct Car Insurance Quotes Via Insurers: 37/5

When youre looking for free auto insurance quotes, one of the best ideas is to contact insurance providers directly. Although you could use one of the price comparison sites to look for cheap car insurance online, there are some disadvantages to doing so. Firstly, some insurers dont feature on such sites, and secondly, certain deals are only available if you go direct.

Of course, the biggest downside to contacting companies direct is that it takes a lot of time and effort on your part. The attraction of finding a great deal by going direct rather loses its appeal when you have to repeat all your details for the 15th time!

That said, you can be smart and short circuit the process. How so? By asking your friends, family and colleagues who they use for their auto insurance. Their advice will be based on real-life experience, and is guaranteed to be impartial. Armed with their recommendations, its much easier to draw up a more focused target list of companies to contact.

PROS– Often you can get the best deals by going direct- Youre not paying commission to a broker or online site- Greater choice and flexibility on policy options

CONS– Takes a lot of effort on your part to contact every single company

Weve used 1 to 5 scale ratings:;

- 5: Excellent

Check out our review of the;best and cheapest car insurance companies of 2021.

Compare Auto Insurance Rates And Quotes At A Glance

- Your state plays a big part in your rates. New York has the most expensive car insurance rates, at $2,759 per year. Wyoming has the cheapest rates, at $426 per year.

- The average car insurance rate nationwide is $87 a month for minimum coverage and $176 per month for full coverage.

- Rates vary quite a bit by company: State Farm has some of the cheapest quotes, at $64 per month, compared to Nationwide, at $107 per month, for example.

- Age is a significant factor. A 20-year-old driver pays nearly twice as much for car insurance compared to the average 30-year-old driver.

These differences in rates show why comparing quotes is so important. If you dont compare quotes, you might overpay for auto insurance coverage. Or you may end up with a cheap policy with insufficient coverage or subpar customer service.

Also Check: How To Remove Hard Water Stains From Car

What Information Do I Need To Get Auto Insurance Quotes

To make the process go as smoothly as possible, it helps to have the following information on hand:

;;Drivers license. If there are any other drivers in your household, youll need their drivers license information as well.

;;Vehicle identification number . You can typically find your VIN on the vehicles drivers side dashboard or printed on a sticker in the drivers side door or door jamb. If you havent purchased the vehicle yet but know what youre going to buy, ask the seller for the VIN. If you havent picked out your car yet, you can usually get a quote with a vehicle make and model.

;;Mileage. If you own the car, have the odometer reading handy.

;;How much coverage you want. Youll want to know what coverage types you want to buy and how much coverage you need. If youre not sure, its a good idea to speak with an insurance agent who can help answer your questions.

The auto insurance company will gather additional information about you, such as your driving history, past auto insurance claims and your credit.

Why Compare Car Insurance With Compare The Market

50% of consumers could save up to £267**

5 minutes to get a quote^^^^

29.25% of consumers could save up to 46% on their premium

**Based on Online independent research by Consumer Intelligence during May 2021. 50% of customers could achieve this saving on their car insurance through Compare the Market. ^^^^On average it can take less than 5 minutes;to complete a;car quote through Compare the Market based on data in November 2020.29.25% of new car insurance customers achieved this average saving through Compare the Market, according to independent research carried out by Consumer Intelligence during May 2021.

Also Check: Hyundai Equus Bass 770

Full Coverage Car Insurance Quotes By Age And Gender

Another main factor in determining your auto insurance quotes is your age and your gender. Unexperienced drivers are considered are a very high risk by insurance companies and they quote such young new drivers accordingly. Females usually pay less for car insurance than males on average since males are considered a higher risk due to over confidence that leads to accidents in many cases. Below is average full coverage car insurance quotes per year by age and gender. Of course, the rates may vary by many other factors, including your state, vehicle type and more.

| Age |

|---|

| $1468 |

Factors That Impact Your Car Insurance Rates

You might think that car insurance quotes for the same driver or car would be similar across all providers. However, every auto insurance company has its own costs to cover, based on data from their existing customers and claims.

An insurance rate calculation has many subtle complexities, and multiple factors contribute to your final rate. Based on the information you provide in your driving profile, a car insurance company will categorize your risk potential and calculate a personalized rate.

Unfortunately, some factors are out of your control, but there are still a few for which you are 100% in the driverâs seat. Therefore, being in the know could save you money on your auto insurance policy. Here are seven factors that auto insurance companies will consider before offering you a personal car insurance quote.

You May Like: How To Add Refrigerant To Car

Compare Multiple Car Insurance Quotes

Shopping around is the best tip for reducing auto insurance rates. There is a huge number of insurance providers, most specializing in different areas or customer bases. You need to look to find the perfect option for your needs and demographic.

Remember: Dont simply pick the cheapest option. You want to be sure your insurance agency has quality claims servicing and strong customer support. Getting into an accident is a stressful event. You dont want to make it worse by dealing with a long claims process.

Can Price Comparison Sites Save You Money On Car Insurance

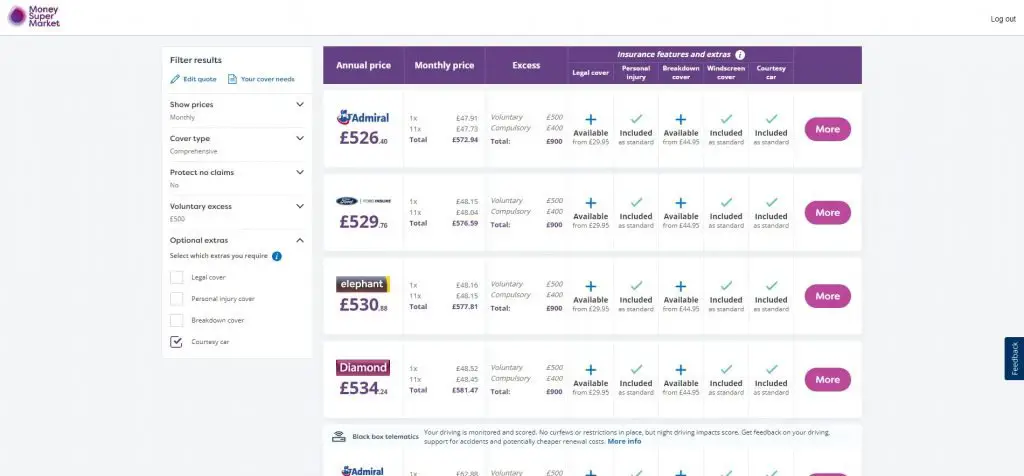

Simply put, yes. Price comparison sites have a huge number of insurers on their databases, so theyre able to find you great deals with minimal effort from you. Its always worth using one for quotes when your insurance renewal date comes up because auto-renewing is the most expensive option of all. For instance, you could Super Save up to £253* on your car insurance with MoneySuperMarket¹.

*51% of consumers could save up to £253.08 on their annual car insurance premiums. Consumer Intelligence, July 2021.

Comparison sites give service providers a lot of custom, so they can sometimes wangle deals you wouldnt get by going direct. They often provide their own incentives as well. The following freebies are accurate as of September 2021:

Recommended Reading: Florida Dmv Duplicate Title

Recommended Reading: Turning In A Lease Early

How Auto Insurance Comparison Websites Help Drivers

You’ve come to the right place. Car insurance protects you against financial loss for damages resulting from car accidents, theft, weather events and other unforeseen costs according to your policy type. Comparing auto insurance rates online is one of the fastest ways to get low premiums without sacrificing coverage. The rate you pay depends on your personal situation, and our tools can help you get and compare auto insurance quotes.

Getting the right car insurance coverage can be as frustrating as it is confusing. With your quotes in hand, you’ll have all the information you need to complete your car insurance comparison and choose the best policy. The average car insurance rate nationwide is $87 a month for minimum coverage and $176 per month for full coverage. An auto insurance quotes comparison is the best way to find cheap rates for great coverage.

Is Young Driver Insurance Right For You

While many young driver policies feature black boxes, its important to understand whether a black box is something you would like in your car. Many drivers claim that the constant tracking, curfews and mileage limits make it difficult to gain rewards and some drivers dont like having their every move traced.

You can weigh up the pros and cons of black box insurance by reading our guide to the best black box insurance. If youre not sure if telematics is for you, read our guide to the best UK car insurance companies to get a deal thats right for you.

You May Like: Disconnecting Car Battery When On Vacation