Is There A Gender Gap In Car Insurance Rates

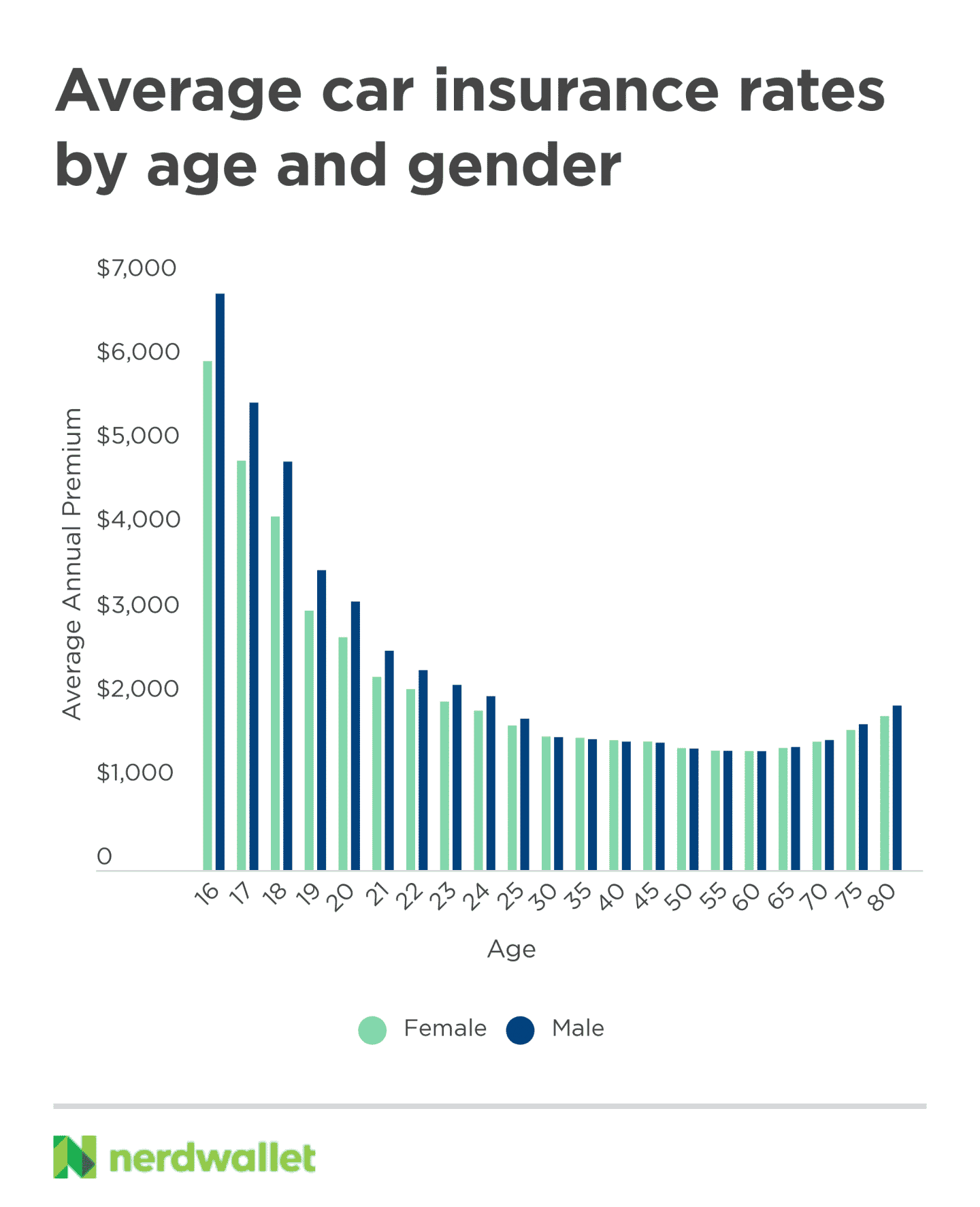

Our analysis shows that female drivers tend to pay less than male drivers.

As drivers age and get more driving experience, the gender gap in rates narrows to a negligible amount. In some age groups, women pay slightly more than men, but around age 35 average rates are the same.

As drivers get older, female drivers start paying less again.

One of the reasons men tend to pay more than women for car insurance is because men are riskier to insure. Men typically drive more miles than women and are more likely to practice risky driving behaviors like speeding, driving while under the influence of alcohol, and not wearing safety belts, according to the Insurance Institute for Highway Safety .

In nearly every year from 1975 to 2019, men died in car crashes twice as much as females, according to an IIHS analysis of the U.S. Department of Transportations Fatality Analysis Reporting System. In 2019, 71% of all motor vehicle crash deaths were males.

Seven states prohibit the use of gender as a pricing factor in auto insurance:

Car Insurance Rates For Women

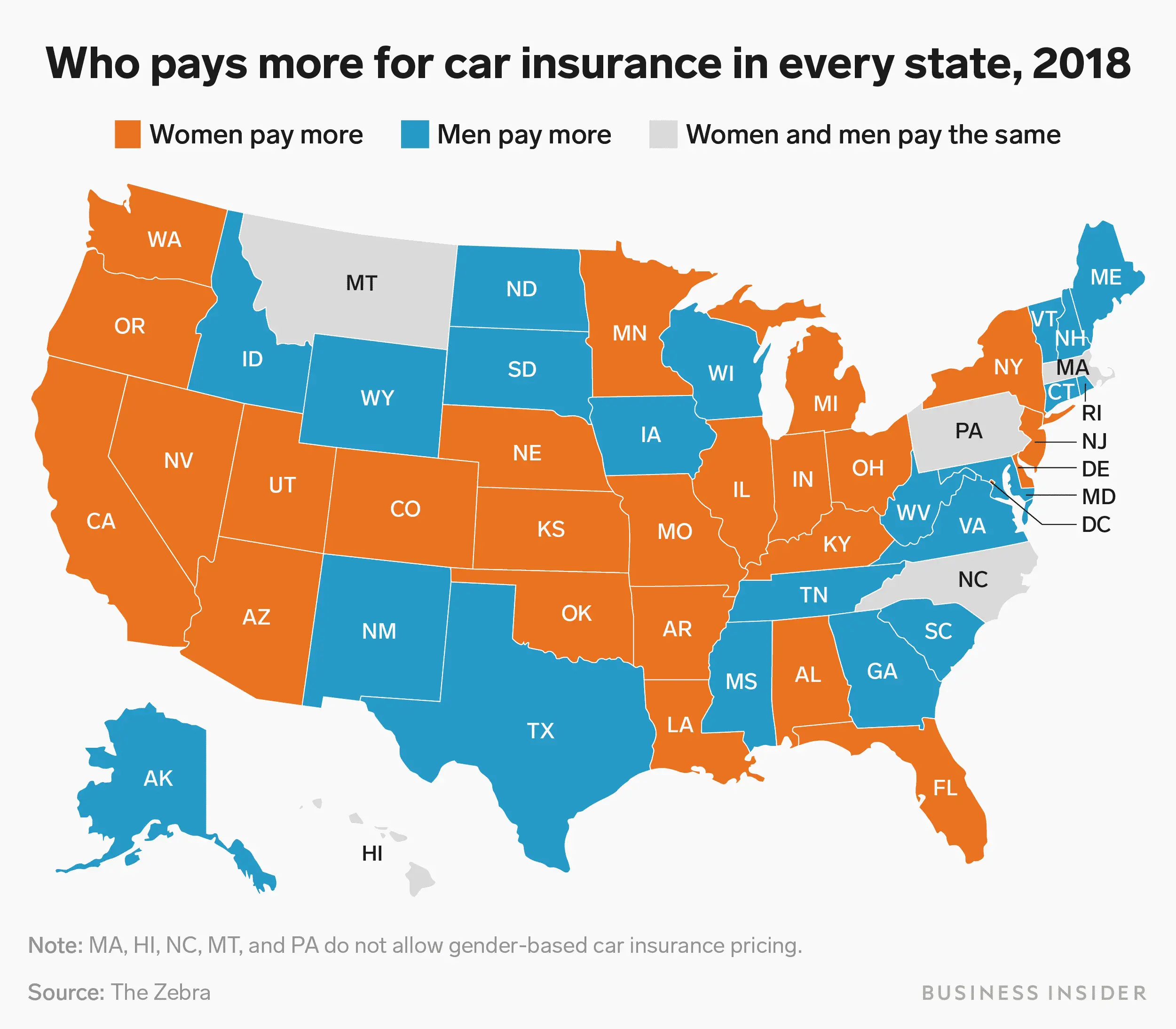

Two recent studies have confirmed that middle-aged women paying more for car insurance is common throughout the country. In 2017, the Consumer Federation of America found that in 58% of the instances in which companies used gender to adjust car insurance rates, 40- and 60-year-old women faced higher premiums and were penalized more often. They gathered over 100 quotes from some of the biggest auto insurance carriers in the nation.

More recently, in 2021, Yahoo! Finance reported that women pay slightly more for car insurance on average than men overall, but they pay noticeably more in 21 states and Washington, D.C.

To be sure youre getting the most affordable rate you can, its crucial to compare quotes from different providers when shopping for car insurance. Its the best and only way to see how different companies can offer the coverage you need at a price that works for you.

At Clovered, we live to make this easy. Our goal is to simplify the insurance process and get you covered sufficiently with our online quote tool.

Rethink your auto insurance premium with a free quote from the nation’s top companies.

Compare Auto Insurance Quotes

If your record is clean of insurance claims, car accidents, and traffic infractions for the past three to five years, we recommend comparing auto insurance quotes between providers. One auto insurance provider could charge 20% higher premiums for the same coverage than another. Shopping around between multiple providers may make you wonder why you didnt decide to change your insurer earlier.

Recommended Reading: Where To Find Title Number For Car

Why Do Insurers Use Gender When Devising Auto Insurance Rates

Insurance is based on risk. Men drive more than women. Theyre more likely to get in accidents, get tickets, and get arrested for DUI. Men are also more likely to drive a car thats more costly to insure.

Car insurance companies use many factors when creating rates:

- Type of vehicle

Insurers dont weigh them all the same. Underwriting departments vary on how much importance they put on each.

Why Men Are Considered More Risky To Insure Than Women

According to research from the AAA Foundation for Traffic Safety, which examines the behaviours of American drivers, men are more likely to engage in aggressive driving behaviours, such as speeding through a red light.

In addition, men happen to get into more collisions overall than women. Data from Statistics Canada shows that of the 1,851 deaths reported in 2018, 1,313 involved male drivers accounting for 29 per cent of overall deaths that year compared to 538 involving female drivers.

Read Also: How To Build A Mousetrap Car

Which Group Pays More For Car Insurance Married Or Single

It depends on a number of factors, including the age, driving record, and location of the individual. However, generally speaking, married individuals tend to pay more for car insurance than single individuals.

This is because married individuals are more likely to have more accidents and receive more tickets than single individuals.

What Women Pay More Than Men For Auto Insurance Yup

Its a widespread belief that men pay more for automobile insurance than women. But thats only true for young adults.

Several studies in 2018 and 2017 revealed that women over 25, particularly those between 40 and 60, often pay more than men not less for auto insurance, all other rating criteria being equal. Now, California has become the latest in a handful of states that have outlawed setting rates for automobile insurance based on gender.

As one of his last acts before leaving office at the end of 2018, former California Insurance Commissioner Dave Jones issued regulations prohibiting the use of gender in individual automobile insurance ratings in California, effective Jan. 1.

California is the first state in decades to take the step, joining states including Massachusetts, Michigan, Montana, North Carolina and Pennsylvania, most of which passed their laws in the 1970s and 1980s in the wake of the womens rights movement.

In an interview, Jones said its fair for insurance companies to set premiums based on a drivers accident history, number of speeding tickets and other factors that are under the drivers control. But using gender is unfair because a person has no control over that, he said.

Short on Reasons

Why? The insurance industry wont give many reasons.

Several insurance companies contacted by Stateline, including Geico, Farmers and Progressive, refused to comment for this story or to explain what factors they consider in setting rates, including gender.

Don’t Miss: How To Lease A Car With Bad Credit

What States Do Not Allow Insurers To Set Rates Based On Gender

According to the Consumer Federation of America , almost all states use gender to calculate premiums, with the exception of:

In recent years, state legislators such as former California Insurance Commissioner Dave Jones have advocated for and passed laws banning gender-based pricing, citing it as a factor outside of a drivers control.

Who Pays More For Car Insurance: Men Or Women

A popular assumption is that the average car insurance rates by age and gender would lean more favorably to women. After all, men are statistically much more likely to get into accidents than women, are more prone to drive without seatbelts, and have historically received more speeding tickets than women across all age groups. Naturally, we would expect men to pay substantially more for auto insurance.

| Female | |

|---|---|

| $2,133 | $795 |

Surprisingly, the data does not support this assumption. Take a look at the chart above. Although men pay more for auto insurance when it comes to full coverage, they dont pay more for all aspects of auto insurance .

$11 less

When you examine minimum liability, men actually pay

For 12 months of full coverage, insurance for females is $7 less than insurance for males . When you examine minimum liability however, you can see that men actually pay an average of $11 less .

| Full coverage | |

|---|---|

| 0.51% | -2.09% |

However, keep in mind that this data doesnt take into account ranges of age, location, or the amount of miles traveled per day. Its an average, and therefore doesnt necessarily represent what any one person might pay .

If these additional factors were included, the data could likely paint a different picture. The key takeaway is that gender alone does not significantly contribute to the cost difference in insurance.

Recommended Reading: How To Get Cigarette Smoke Smell Out Of Car

How Can I Reduce My Car Insurance Premiums

Regardless of your gender, there are several things you can to do keep your car insurance premiums affordable. Here are some easy things you can do to find affordable car insurance premiums.

There are so many factors that affect the overall cost of your car insurance policy, including your gender and other demographic information. Knowing how insurance premiums are calculated can help you be a smarter shopper and choose the right car insurance for your needs. Although gender does have some effect on your premiums, the overall price is a combined representation of the financial risk you present to your insurance company.

Help protect yourself on the roadwith Insurance Panda

Finding Affordable Car Insurance As A Woman

Rates vary based on where you live, if you pay your bills on time, and a number of other things. Here’s what you can do to find cheap car insurance for women.

Compare quotes

The most important thing you can do to find cheap and affordable car insurance for women is to research around. Nobody will get the best deal from the same company. It’s a good idea to get auto insurance quotes from both big and small companies.

Know that gender isn’t a big deal

Finding the cheapest insurance company overall can lower your rates by a lot more than finding one with lower rates for women. In most states, things like your driving record and can also have a bigger effect on your car insurance rates than your gender.

Ask about discounts

Most insurance companies offer discounts that could help you save money. If you use the discounts, you are eligible for, your premium could go down. There are different discounts for each company and state, but some of the most common ones are getting your home and auto insurance from the same company, taking part in a telematics program, and paying for your insurance in full.

Changing your coverage

Safe driving habits

If you drive safely, your car insurance costs will probably go down by a lot. Your insurance rates can go up a lot because of accidents, tickets, and DUI convictions. By keeping your driving record clean, you can avoid having to pay these extra fees.

Don’t Miss: How To Find My Car If It Got Towed

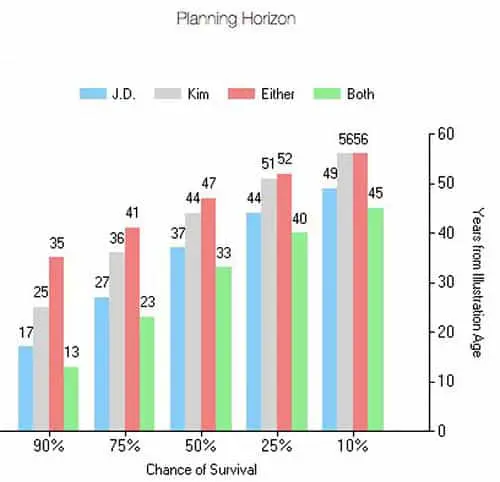

Why Is Male Life Insurance Higher Than Females

Male life insurance rates are typically higher than female life insurance rates because males are more likely to die prematurely than females. In the United States, men have a life expectancy of around 78 years, while women have a life expectancy of around 85 years.

Additionally, men are more likely to die in accidents or from diseases such as cancer. Therefore, male life insurance rates are typically higher than female life insurance rates because the risk of death for men is greater than the risk of death for women.

How Does Your Occupation Affect The Cost Of Car Insurance

There are a few factors that affect the cost of car insurance. One of the most important factors is the level of risk associated with your occupation.

Certain jobs are more likely to result in accidents, and as a result, they will typically cost more to insure. Other factors that can affect the cost of car insurance include the age of your vehicle and your driving record.

Read Also: How To Sign A Car Title Over To New Owner

Individual States And Auto Insurance Rates

Per Insure, there are some states that do not consider gender when determining rates:

This is great news for these young male drivers who would otherwise typically expect a large insurance premium bill every six months. Unfortunately, women in Nevada pay almost 6 percent more for auto insurance than the state’s male drivers.

All drivers in Michigan can expect to pay more than in other states, according to Car and Driver, even before considering the age and gender of a policyholder.

Why Does My Gender Matter To Car Insurers

By Rachel

Are you wondering why you have to circle “female” or âmaleâ when filling out an insurance application or applying for quotes? Most drivers are surprised to learn that their gender has an impact on their rates, and the initial reaction is to think that this gender profiling is sexist. After all, the women vs men as drivers debate is a touchy subject.

If you are ready to learn why insurers care about whether you are male or female, read on to find out if gender profiling in car insurance rates is based on fact or fiction. We will also show you what drivers can do to save on car insurance, regardless of gender.

Don’t Miss: Who Is The Cheapest Car Insurance Company

Average Car Insurance Rates By Age And State

Delaney Simchuk, Car Insurance WriterFeb 11, 2022

Average car insurance rates by age group range from $716 per year for 45-year-old drivers to $3,343 per year for drivers who are 16 years old. Car insurance rates are highest for teens and seniors, on average, because they are considered high-risk due to an increased likelihood of accidents and expensive claims.

How Both Genders Can Save Money On Car Insurance Rates

Regardless of gender or age, there are a number of ways to potentially reduce your car insurance rates.

For example, consider the type of car you drive as it has some influence on how much you pay for insurance. Economy vehicles are often less costly to insure than sportier or luxury vehicles. Age of your vehicle can also have an impact as older cars may be cheaper to insure as they cost less to replace.

Its also always in your best interest to shop around. Each provider will consider the same factors when giving you a quote but do not necessarily weigh the importance of those factors equally. For example, your credit score may play an important role for one company, but may be less important to another. For this reason, quotes will vary by provider, and comparison shopping can help you determine which is most affordable for your coverage needs.

Discounts have an immediate impact on lowering your premium. Many insurance companies offer numerous ways to receive discounts on your premium. For example, there are safe driver discounts, multiple vehicle discounts, as well as bundling discounts .

Recommended Reading: When Do You Change Car Seats

Call And Ask For Discounts

Call your insurance provider every six months to see what new discounts you may qualify for. Whether a male driver or female driver, changes to your policy may be in order as your life circumstances change. For example, switching to an older make and model vehicle could slash 20% off your monthly premiums, thanks to the lower cost of replacement parts.

Do not forget to enroll in policy-related discounts. Paying your policy in full up front or signing up for autopay, paperless billing, and bundling multiple policies could further reduce your monthly premiums.

How Men Can Lower Their Car Insurance Premiums

While it might seem unfair that ones sex can help determine insurance premiums, the statistics paint a clearer picture of why insurance companies charge men more for car insurance.

That said, if youre a male driver, its still within your power to lower your premiums. Drive safely, obey traffic rules, dont miss a payment, and dont make any false claims about your driving history. And most importantly, dont take the first rate youre offered. Shop around and compare the car insurance market. You might be surprised to find you can save thousands on your premiums just by putting in that bit of extra time upfront.

LowestRates.ca is a free and independent rate comparison website that allows Canadians to compare rates from 75+ providers for various financial products, such as mortgages, credit cards, and home and auto insurance.

Recommended Reading: How Much It Cost To Charge Electric Car

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Speeding ticket: Earning a speeding ticket conviction may be one of the most common driving infractions and, on average, it increases full coverage premiums by 21%.

- At-fault accident: An at-fault accident on your record could raise your monthly full coverage car insurance payment from $148 to $210, and increase your annual premium by 42%.

- DUI conviction: Being convicted of a DUI could raise your monthly full coverage premium to nearly $300, and stay on your driving record for 10 years or more.

Which Gender Pays More For Car Insurance

Find Cheap Auto Insurance Quotes in Your Area

In most states, car insurance companies are allowed to consider your gender when setting car insurance rates. Over the course of their lifetimes, women tend to pay slightly less but only by a small amount. Younger men and women will see the biggest gender gap, while adult drivers can typically expect a price difference between men and women of less than 1%.

Some insurers might recommend that transgender or nonbinary drivers list themselves by the sex designation on their birth certificate, although some insurers in some states provide the option for you to list yourself as something different than male or female.

Also Check: When Does Car Insurance Go Down After Accident

Does Gender Affect Health Insurance

Gender affects health insurance in two ways. First, insurers may charge different rates to men and women for the same coverage.

Second, insurers may give different levels of coverage to men and women, based on their gender.

For example, women may be charged more for the same coverage than men. This is because insurers may believe that women will use more healthcare services than men, and so the costs of the coverage should reflect this.

Similarly, women may receive less comprehensive coverage than men. This is because insurers may believe that women are less likely to need the same level of coverage as men, and so they may not require the same level of coverage.