Other Possibilities To Remove Cosigner From Car Title

If the car title has both names, he can remove his name from the title. He needs to have a certified copy of his death certificate and a bill of sale for his share.

He must apply for a new title in his name alone in the state where the car locates, and then he can re-register the vehicle in his name only in his home state. If you dont want your name on the title anymore, youll need the same documents as above, and you can leave the other persons name on it.

Refinance The Car In Your Name

If you can refinance the vehicle in your name, that can also be how to get a cosigner off a car loan. Just bear in mind that youâll probably need to have a spotless payment record and a good credit score for the lender to be on board with a refinance. You might be able to get a new loan from your current lender or possibly transfer the loan to another lender.

How To Remove A Cosigner From An Auto Loan

- Sell the Car & Pay Off the Loan: At its most simple, through the act of selling your vehicle you can use the proceeds to pay off the rest of the loan, if the car title is in your name. This will free you and the cosigner from any obligation.

- Refinance the Loan: The most common reason a cosigner might be removed is because of a legal separation, in which the borrowers ex-spouse remains on the loan after a divorce or other process. This process however does not release either party from the contract. If the payments are not met, whether the borrower or cosigner are aware of it, this will negatively affect both their credit scores. If you refinance your loan in your name, you can redefine your loan such that the cosigner is no longer responsible.

- Cosigner Release: Some car loans have a cosigner release option, in which the loan policy automatically removes the cosigners financial responsibility after a requisite number of timely and full payments have been made. Be sure to contact the lender and go over your loan closely to learn more about your options if this is the case.

Also Check: How To Remove Hail Dents From Car

Removing Your Name From A Joint Auto Loan

Taking your name off a car loan. Common reasons someone may want their name off a joint car loan include divorce, separation, or the other borrower not holding up on their end of the deal.

Each of these situations could be hurting both of your . If theres bad blood between you and the co-borrower, and someone stops paying because of it, your credit scores could really suffer unless the situation is resolved. In joint auto loans, both parties’ credit scores are affected by the loan, both positively and negatively depending on how the loan is treated.

If you need to get out of a joint car loan, you typically have two options: refinance your auto loan or sell the vehicle.

How Can I Get Rid Of A Cosigner From A Car

The DMV will not allow you to remove a cosigner from your title unless you can prove that the cosigner cannot be financially responsible for their portion of the car. If the cosigner is dead, you will require supplying a licensed replication of the death certificate and evidence of right. You cannot remove the cosigner until you show the DMV that he is deceased.

If the cosigner has filed for bankruptcy, you will need to provide a letter from the bankruptcy court vouching that he cannot be financially responsible for the car.

If the cosigner has declared the car stolen and you have a police report, you can remove the cosigner. In this case, the cosigner will no longer be responsible for the vehicle. If they damage the car, they will be liable for the damages.

Read Also: How To Replace Car Stereo

How Can I Get A Cosigner Taken Off A Car Loan

When I was a college student with almost no income or credit history, I bought a car and asked my dad to be my cosigner. Now that Iâve been out of school for a bit, I have a good-paying job and a great credit score and want to remove my dad from the loan. How can I get my dad taken off the loan as a cosigner?

- Look over the loan contract to see if there is a cosigner release procedure.

- If your contract doesnât outline how to remove a cosigner, and ask if itâs an option.

- If your contract doesnât allow you to remove a cosigner, refinance the loan and submit your new application without a cosigner.

- Pay off the loan if possible so both of you are free of the financial liability.

remove the cosignerOnly refinance the vehicle if youâre receiving a more favorable interest rate

My Vehicle Was In An Accident And I Received An Insurance Check For The Repairs How Do I Cash The Insurance Check When It Is Payable To Both Wells Fargo Auto And Me

If the check amount is $2,500 or less, you can take the check to a Wells Fargo branch and ask an employee to endorse it on behalf of Wells Fargo Auto. Find a Wells Fargo banking location near you. If you are unable to visit a branch, please call us at 1-800-825-8506, Option 4.

If the check amount is more than $2,500, please call us at 1-800-825-8506, Option 4, for instructions on how to endorse the check and for next steps. Were available to assist you Monday Friday, from 7 am to 7 pm Central Time.

Read Also: How Old For Car Seat

Why Does The Amount Of Interest I Pay Change Each Month

The amount of interest paid each month changes because the daily interest amount decreases as the principal balance decreases.

At the beginning of the loan, the principal balance is higher, and as a result, the daily interest amount is higher. As you start paying down your principal balance, the amount of interest you pay each month decreases.

Additionally, interest accrues daily, and the number of days between payments makes a difference. More days between payments results in more days of interest charges, and fewer days between payments results in fewer days of interest charges.

How Do I File A Claim Or Use My Aftermarket Product

Contact the coverage provider for information on how to file a claim or how to use the product their contact information is listed on the aftermarket product contract. Your coverage provider will let you know if they will reimburse you for expenses or if they will pay the expenses at the time a covered service is performed. They will also explain other conditions, such as requiring that the maintenance be performed at the dealership where you purchased the vehicle.

Don’t Miss: What Do You Need To Sell A Car

What Exactly Is A Cosigner

A cosigner, very simply, is a person who takes financial responsibility for a car loan, mortgage, or line of credit. They guarantee that the loan will be paid back, by them, in the event that the primary borrower stops making on-time payments for any reason.

For example, the borrower may have lost their job or is otherwise under financial strain. It could also be because the car owner is irresponsible or, worst case scenario, has died. Obviously, in the case of death, the borrower is not at fault for failing to pay, but the cosigner is still responsible for making the monthly payments.

Its important to note that the cosigner has no legal claim to the car the borrower alone holds the cars title. A further snag could be if the deceased left the car to someone else in their will. Even though the vehicle has a new owner, the cosigner is still responsible for the loan payment.

How To Get Someones Name Off A Joint Car Loan

A joint auto loan is when a primary borrower shares a car loan with either a cosigner or a co-borrower. You may have needed a cosigner or co-borrower to get approved, but things change, and you may no longer need or want their name on the loan. If you want to remove someones name from a joint auto loan, you need to refinance the loan on your own.

Read Also: How Old For Rear Facing Car Seat

What Is A Cosigner

A cosigner is the guarantor of a loan. If the primary borrower canât make payments for some reason, the cosigner will be on the hook for those missed payments. People usually need a cosigner because their credit score is too low to secure enough financing for a large purchase. For younger buyers who may have no credit score at all, a cosigner is often their only option.

Adding the cosigners additional income and/or higher credit score increases the lenders confidence a loan will be repaid. Cosigners are often family members. Parents often cosign their childâs first car purchase or apartment lease.

Whats The Role Of A Cosigner

It can be challenging to remove a cosigner from a loan. To gain a better understanding of why, lets look at why a cosigner is used at all. Essentially, a cosigner is needed when the borrowers own credit and/or income isnt enough to qualify for the loan by himself or herself. The cosigner, presumably, has stronger credit and income, and is required by the lender or creditor to help guarantee that the loan will be repaid.

Loans involving a cosigner include a cosigners notice. The notice asks that the cosigner guarantee the debt. This means that if the original borrower fails to make payments on the debt, then the cosigner becomes responsible for the balance. The cosigner then is obligated to make payments until the debt is paid when the borrower cant.

Co-signing a loan is risky for the cosigner, because it can affect the cosigners credit if the borrower doesnt satisfy the debt and the cosigner has to take over. The debt can ultimately affect the cosigners credit scores and access to revolving credit, such as credit cards.

Before co-signing a loan, a cosigner should be sure that he/she is able to comfortably take on the monthly payments if it comes to that. The cosigner should also make sure he/she doesnt need to get a loan of his/her own over the course of the cosigned loans terms. Cosigning on the borrowers debt will affect the cosigners overall credit utilization and ability to secure other credit opportunities in the meantime.

Featured Topics

Don’t Miss: How To Remove Adhesive From Car

Ways To Remove Yourself As A Co

Here are a few of the ways you can go about removing yourself as a cosigner.

1. Refinancing

If you want to remove yourself as a cosigner, you can ask the borrower to refinance their loan in their name only. You can refinance between each term throughout the duration of your loan. When they refinance, they can change the terms of the loan agreement including removing the cosigners and possibly even reducing their interest rate.

Refinancing can be a great option because it can not only remove your name as a cosigner, it can lead to lower payments and a reduced rate. This can be applied to most types of loans and is the most favourable option, especially for loans with large balances.

2. Improve Borrowers Credit Rating

If you want to remove yourself as a cosigner before the loan has been fully paid off, you can try asking the lender to remove you as the cosigner. Some lenders may be willing to do so if the primary borrower can show that they can handle the loan on their own.

The primary borrower can help strengthen their credit and finances with the following:

- Check Credit Report For Errors The borrower should pull their credit report and check if there are any errors on their credit report that may be affecting their credit scores.

- Pay Off Other Debts If the borrower has fewer debts, the lender may be more willing to remove you as cosigner as more of the borrowers income can be used towards the loan.

3. Pay Off The Loan Faster

4. Sell The Financed Asset

What Happens If I Make A Payment That Does Not Clear

If a payment is returned unpaid, we may attempt to present the payment to your financial institution one more time. Your financial institution may charge a fee each time the payment is returned. If the payment doesn’t clear, youll need to resubmit the payment once you have sufficient funds in your bank account.

Recommended Reading: How To Wash Car In Winter

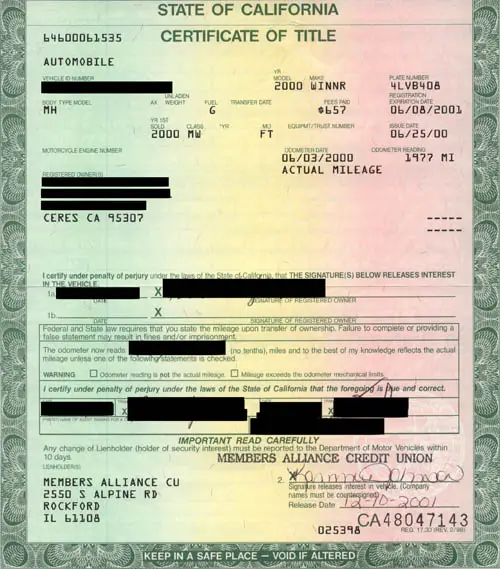

Put The Title In Your Name

When you remove the cosigner using any of the options mentioned above, you also remove their name from the car title.

You may be able to complete the cosigner removal without completing the loan payment. You will sign the title over to yourself. If the car title uses and , the cosigner must also sign because they are also a registered owner of the vehicle. However, if the title uses or, any one of you borrower or cosigner, can sign the title.

To register the car ownership in your name, you will need proof of the loan payment, title application form, and valid photo ID. You can down the application form from your states DMVs website.

If the car has a lien on it, you also need the release of lien or any other notification from the lienholder or lender . If you refinanced the car, youd also require a new loan agreement.

Go to your DMV and submit the documents. You will pay a processing fee mentioned on your DMVs website, typically $20-$30.

Refinance The Outstanding Balance

You can release a cosigner from your original auto loan and potentially obtain better terms and rates than your initial loan by refinancing. Refinancing simply involves taking out a new loan and using those funds to pay off your auto loans. The new loan will be in the name of the primary borrower, and the cosigner for the previous loan will be released.

Read Also: How Much Does It Cost To Paint A Car

How To Remove Your Name From A Car Title With An Additional Person

To clear your character from the title, you will require seeing the car finance. If funded, the lender will require removing the vehicles lien. But if the lender wont release the lien, you will need to go through the court system to remove the lien.

When you add a persons name to the title as an additional security holder, the lender will require them to have a lien. If the lender does not release the lien, the only way to remove the name from the title is by going through the court system and having the lien removed.

Breakups And Car Loans: How To Remove Your Ex From A Cosigned Loan

Refinancing is one of three options to remove a cosigner from a car loan.

Cars are meant to be the ultimate symbols of freedom cruising down an empty highway, with the top down, and wind in your hair as you make your way on to your next adventure. But too often, it turns into just the opposite: a trap.

There are a lot of reasons why people go in together on a car loan. Maybe theyre married and its supposed to be joint property anyways. Sometimes, a parent or a friend cosigns a loan for someone else who isnt able to get a car loan on their own.

Either way, even though you might start these relationships and loans with the best of motives, sometimes those intentions head south. And when they do, you might be wondering how you can get out of that cosigned or co-borrowed auto loan.

There are ways to do it, but first, itll depend on your circumstances more than anything else.

2022 Auto Refinance Rates

Recommended Reading: How To Find My Car

Option #: Pay Off The Loan

Easier said than done, right? The average used car loan was $20,554 in 2019, according to a recent Experian study. If you had enough extra cash lying around to pay off the loan, chances are you would have already done it by now.

There is one way to raise enough money to pay off the loan, though: by selling the car. This might be tough if youre attached to the car, but consider the consequences if things go bad. If the other person decides to skip town and stop paying, then you could be on the hook for the payments.

Again, if you have a co-borrower, youll need to get their permission before you sell the car because legally, its their car too.

Getting Your Name Off A Cosigned Loan

When you cosign any form of loan or line of credit, you become liable for the amount of money borrowed. This may impact your ability to borrow money for yourself because a lender will include the amount of the loan you cosigned on as part of your debt load when calculating your debt-to-income ratio.

Plus, the payment history on the cosigned loan or line of credit is reported on both the borrower’s and the cosigner’s . If you’ve agreed to cosign a loan for a friend or relative, but no longer want the responsibility of shared credit, how do you get your name off the loan? Fortunately, there are four key ways.

Read Also: Where Can I Weigh My Car