What Should I Consider When Looking At A Lease

The most important factor is the mileage limit. This puts a limit on how much you are allowed to drive. Most leases offer a mileage limit of 15,000 miles or less per year. You can get a higher mileage limit, but this will increase your monthly payments as the car will be depreciating more during that period. If you accidentally drive over your mileage limit, you will have to pay an additional charge when you return the car.

You also need to consider the terms of the lease. Most leases require you to be responsible for wear and tear and damages to the car, as well as any missing equipment. Youll have to service the car according to the manufacturers recommendations and youll have to take out insurance which is up to the required standard.

If you might move during the period you lease the car or you plan on taking a holiday, make sure you are allowed to take the car outside the state you are in. Most leases dont allow the vehicle to move beyond state borders.

Get Out Of Debt Sooner

The final benefit is youre able to get out of debt sooner than you would with a longer loan term. Youll be free to drive your vehicle for longer without having to worry about making monthly payments on it.

A common issue with purchasing a new vehicle is that many car owners feel the need to get a new one after several years. If you buy a new car every six years and opt for six-year loans, youll constantly be making payments. With a shorter term, youll have time to breathe in between purchases.

Understanding How Car Payments Work

If you are considering buying a car it is important to understand how car loans work.

Lower monthly payments usually sound like a good idea. Sure, you have more cash flow available, but paying less per month it is not always financially beneficial. It is important to understand what determines your monthly payment and what it means for your finances.

Recommended Reading: Can I Pay Car Insurance With Credit Card

Switch To Biweekly Payments

Biweekly payments simply make more sense for the average worker, who gets paid biweekly. You can schedule your payments to coincide with your paychecks.

Specifically, split your monthly payment in half and set up automatic payments every two weeks. It may seem like youd just be paying the same amount each year. But you really make 26 half-month payments each year, or 13 months worth of payments each year rather than 12.

You get to pay off your car loan early without even noticing the impact on your monthly budget.

You could also pay more than a half-month payment every two weeks to pay off your loan even faster.

How Much Are Monthly Car Payments

Average monthly car payments are based on more than just the cost of the vehicle. Your expected monthly cost is based on how much you are borrowing to finance that vehicle in order to pay off the loans principal, along with your interest rate and loan term.

| Average |

|---|

Source: Experian State of Automotive Finance Market second quarter 2022

Recommended Reading: How Much Is A Rental Car

Strategies For Avoiding The Typical Car Loan Length

If you don’t want to pay off your car over the course of a typical car loan length, there are strategies you can use to avoid this. These strategies can help you pay off your vehicle at a pace that is most suitable for your financial situation:

- Use low APR loans and make a large down payment.

- Make a large down payment.

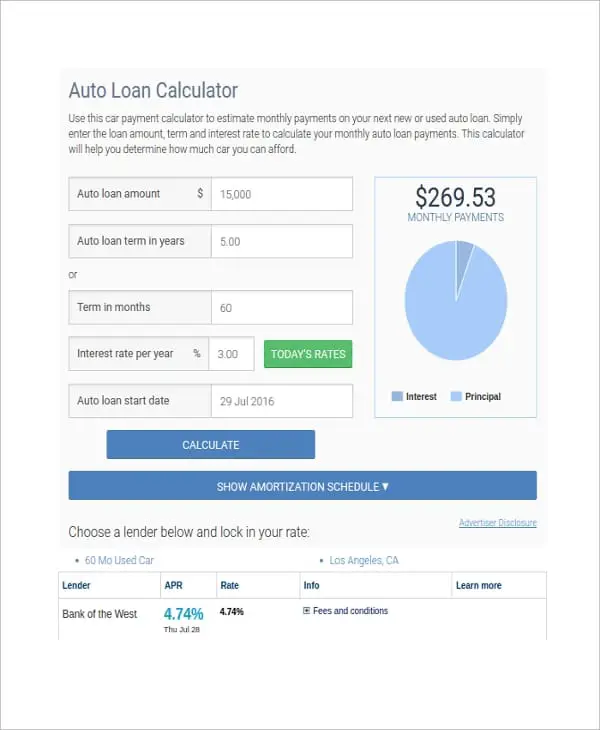

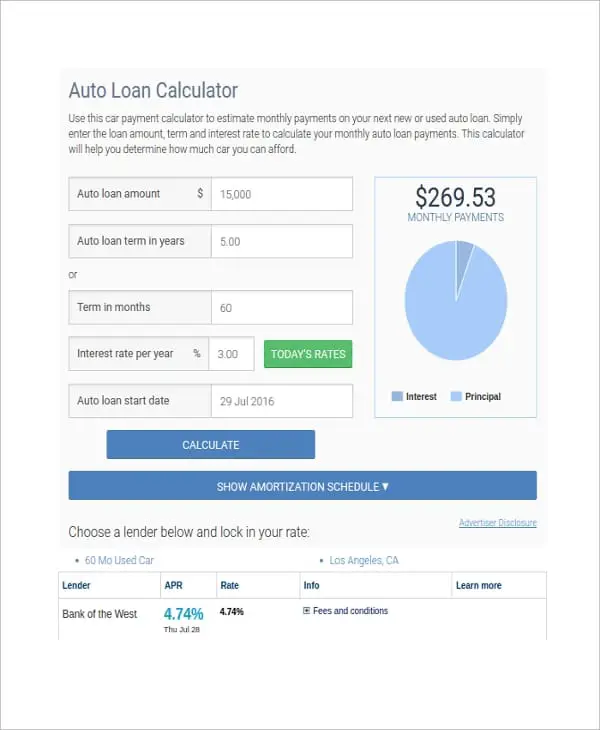

- Try an online auto loan calculator.

- Boost your credit score.

- Lease instead of buy.

Nerdwallet explains that a low can help you increase cash flow for investing purposes. Only take out a loan if you can get a low APR.

In order to prepare yourself for depreciation, you can make a significant down payment. The larger a down payment, the smaller your monthly payments, which can help you avoid negative equity.

To be sure your numbers are right, use an online auto loan calculator. Several websites offer comprehensive and easy-to-use calculators that can help you determine your monthly payments based on:

- The cost of the vehicle

- Your down payment

To improve your loan terms, you should boost your credit score. Lenders are more likely to offer lower interest rates to borrowers with trustworthy credit scores. You can do this by opening credit accounts and making consistent, on-time payments to them.

Youll Likely Have Repair Costs While Paying Down The Loan

If your loan term is longer than 60 months, you could be making car payments long after your warranty has expired. Many new cars come with basic warranties that last three or four years and powertrain warranties that span five or six years. A cars repair costs tend to increase with age, and if your warranty expires before the loan is paid off, you may face repair bills while still making monthly car payments.

A handful of automakers do offer slightly longer warranties. Kia, Mitsubishi, Hyundai and Genesis offer 10-year/100,000-mile powertrain coverage.

Recommended Reading: How To Get Rid Of Roaches In Car

You Will Be Lured Into An Eternal Debt Trap

Unfortunately, most people will actually not be making their regular car payment on that same car in year 7.

Around year 5 or 6, theyll get bored with their current ride and trade it in for a new vehicle. Since theyll still be owing on their car loan, theyll roll the remaining balance, called negative equity, into a new car loan, effectively never getting out of debt.

Some who trade-in for a new vehicle before year 4 or 5 might actually never get out from underwater of their car loan. They NEVER stop owing more than their car is worth!

You can avoid all the above headache by simply committing to pay off a 7 year car loan way ahead of schedule.

The Real Cost Of A Car Payment

Remember that $30,000 car you bought ? Well, after the five-year term you agreed to, youll end up actually paying $33,223 total. Thats over $3,223 more than the original price! You dont have to be Mark Cuban to know thats not a good deal.

The real kicker? Cars go down in value. Yeah, the dealer wont tell you that your awesome new car will lose 60% of its value within the first five years!3 So by the time the new car smell wears off, youve paid $33,223 for a car thats worth maybe $12,000.

Plus, if your car loses value faster than you make your payments, youll end up with an upside-down car loan on your handsand boy, is that a mess to deal with!

Even though the total auto loan debt is at $1.44 trillion and auto loan interest rates continue to grow, people are still financing cars.4 Why? Because weve been conditioned to think taking on debt to get the coolest ride is normal. But normal is broke. The good news? There is a better way to get a car.

Don’t Miss: How To Put Music On Usb Drive For Car

For A Long Time Three

In the fourth quarter of 2021, the average loan term for new-car loans was nearly 70 months, according to the Q4 2021 Experian State of the Automotive Finance Market report.

There are a couple of possible benefits to getting longer-term loans, depending on your financial situation. But there are also notable risks to longer-term loans that may make a five-year car loan, or other options, a better choice.

You’ll End Up Paying More Than The Car Is Worth

When you take out a long-term auto loan, you’ll end up paying more money for the vehicle than it’s worth. This is what’s known as being “underwater” or “upside down” on the loan.

New cars depreciate very quickly and lose a lot of their value within the first couple of years. Many experts say a car loses 10% of its value the moment you drive it off the lot. Different cars depreciate at different rates, so yours could lose its value even faster.

Consider some of the costs of owning a car, too. If you unexpectedly get into an accident or if your car is stolen, you may owe more money on the car than it’s worth. Or, if you decide you want to sell the car, this will lower the resale value.

If you do decide to take out a 72-month loan, it’s a good idea to purchase gap insurance. This insurance will cover the difference between what the car is worth and what you still owe on it.

Don’t Miss: How Do I Know What Rims Fit My Car

How Can I Buy A Car Without A Car Payment

Unlike popular belief, it is possible to buy a reliable used car with cash and not have a monthly payment strapping you down.

The first step is to buy a car you can afford with the cash you have in the banklets say its $4,000. Next, take what you wouldve spent on a car paymentaround $500and put it in your savings account each month for a year.

And as one of our fave money experts, Rachel Cruze, points out, there are a ton of great cars out there for under $10,000, like these:

- 2010 Subaru Outback

- 2010 Honda Accord

- 2011 Toyota Camry

But heres the best partyou dont have to stop with an $8,000 or $10,000 used car. Take that same principle we just taught you, and do it again. Then, in another year, youd have $6,000 more dollars to put toward another upgraded car!

Now, you have a paid-for car you loveand you still did it quicker than the average five-to-six-year loan term. Take that, car payment!

The truth is, this concept goes beyond freeing up your monthly budget. It frees up your lifeand helps you have more money to put toward important things that matter to you, like saving more money or investing for retirement.

Remember, youre the superhero herenot the car payment. Get that cape ready, Superman. You can do this!

Do Car Payments Build Credit

An auto loan is a type of installment loan, like most student loans, mortgage loans, and personal loans. As long as you make at least the minimum payment by the due date every month, the account should help your credit score over time.

You shouldnât buy a car or get a car loan just to build credit.

Auto loans can be expensive. The interest payments add up. Longer-term loans typically come with higher interest rates and higher total interest charges.

If you find yourself in a position asking, âis it a good idea to refinance a car?â or âdoes refinancing a car hurt your credit?â, there are several considerations such as an extended loan term and how this will affect your interest rate and credit score.

Donât be lured by a lower monthly payment over a longer loan term since you will typically be paying more in interest. If you can afford a higher monthly payment on a shorter-term loan with a lower interest rate, you will probably pay less for the car overall.

Paying off your car loan early by making extra payments or making larger payments every month can further help your credit score while saving you money on interest.

Also Check: How Many Amps Should A Car Battery Have

How Do You Get A Car Without A Car Payment

So, now that you see what an unbelievably bad investment car payments actually are, let us introduce you to a better option: buying a car with cash.

Sounds radical, doesnt it? You might think it cant be donethat this kind of thing is only possible for people like Richie Rich. But you dont have to be a millionaire to pay cash for a car. Here are some ways to have a car without having a car payment.

Heres How Long A Car Should Be Financed New Or Used

Steer clear of financial potholes when you buy a car.

That might be easier said than done if you already have your eye on a shiny new vehicle. But you could pay a price if you dont know how long a car should be financed.

The average price of a new vehicle has climbed to around $48,000, a stretch for many shoppers, while SUVs and trucks which are attracting much of the current buyer interest generally cost even more. Used vehicles, too, have climbed to an average price of around $28,000.

Shoppers are borrowing an average of more than $39,000 for a new vehicle and about $27,000 for a preowned vehicle, based on data from Experian, Edmunds, LendingTree and other sources.

But if you need to finance a vehicle for six or seven years or more, theres a good chance it may be beyond your budget, based on research by the Consumer Financial Protection Bureau , even though vehicles generally are lasting longer than ever before.

Whats more, the average length of a finance contract has reached 70 months for a new car and 67 months for a used car, according to a report by LendingTree. That means a lot of buyers may be in the same boat, borrowing more money than they can afford.

Read Also: How To Buy A Car From A Dealership

Average Term Lengths By Credit Score Range

| New vehicle loans |

|---|

| N/A |

But auto loans are stretching even longer topping six years for nonprime borrowers. Middle-tier credit borrowers take out the longest car loans, an average loan of 74.7 months. Top credit score borrowers have the lowest average loan terms at 64.1 months.

The average new car lease term is 35.9 months, or about three years.

Save What You Wouldve Spent On Your Car Payment

Speaking of saving, if you take that $554 car payment you wouldve had and put it into your savings every month, after 10 months, youll have saved $5,540! Add that to the $1,5002,000 you can get for your old beater car, and you have well over $6,000 to buy a new-to-you car with cash. Thats a major car upgrade in just 10 monthswithout owing the bank a dime in interest!

If you keep consistently putting the same amount of money away, 10 months later you would have another $5,540 to put toward a car. You could probably sell your current $6,000 vehicle for about the same price you paid for it 10 months ago. Now you have more than $11,000 to pay for a new-to-you carjust 20 months after this whole process started. You: 1. Car Debt: 0.

Recommended Reading: How Much Does It Cost To Get Car Windows Tinted

How Do I Change My Payment Due Date

Before you apply for a due date change, you’ll need to meet the following criteria:

- You’ve made the first payment on your auto loan.

- Your requested payment due date should not be more than 15 days from your existing payment due date. For example, if your existing due date is the 5th of the month, you can change it to the 20th of the month, or any day in between.

- This is your first payment due date change.

- Your account is current or no more than 10 days past due.

- Your loan has a fixed interest rate.

If you change your due date, your loan maturity date will be adjusted. Your monthly payment amount will remain the same.

To request a due date change:

Online

Sign on, select your auto loan from Account Summary, and then select Change payment due date. Review the criteria and continue, if you are eligible. Select your desired new payment date and submit.

To Lease Or Not To Lease

If you find car affordability might be a stretch, leasing is an option. Your down payment and monthly payment will be less a huge advantage but remember that leasing has strict mileage limits, and youll be turning the car back in after a set number of months. And starting the process again.

Compare leasing vs. buying a 2023 Kia Soul, for example.

Kia advertises a Soul LX with payments of $229 a month for 36 months, with $2,870 due at signing. While the monthly payment sounds terrific, youre limited to driving 10,000 miles a year before excess mileage rates of 20 cents per mile kick in. This could appeal to those who work from home, but anyone with a commute to work will gobble up the mileage allotment quickly making this lease not such a good deal.

Don’t Miss: How To Check If Car Battery Is Under Warranty

Any Credit Score Drop Is Likely To Be Minimal

Having said all of that, the credit score drop that results from paying off a car loan is likely to be quite small. Ill share my recent personal example. I monitor my own credit closely, and recently finished paying a 36-month car lease. As soon as the account was updated to paid loan on my credit, my FICO® Score dropped by 4-6 points, depending on which of the three credit bureaus I checked.

To be clear, every situation is different. The impact of paying off a car loan is likely to be small, but its important to emphasize that the effect on your credit score could be significantly different from mine. For example, if you have just one or two other items on your , or if your credit file is relatively young overall, most reports indicate that paid-off loans can cause a bit more of a dip in your credit score. On the other hand, if you have many other accounts in good standing, the effect of a paid-off car loan can be extremely minimal, if anything at all. Or, if you have a long-established credit history and most of your other active accounts are even older than your car loan, paying your loan off could potentially improve your length-related scoring factors and could result in a small increase.

Read Also: How To Make Multi Color-car Freshies