Not All Car Types Are Covered

If you stick to the standard categories of car rentals, such as compact, intermediate and full-size, your credit cards car rental policy should apply. However, most policies exclude specialty-class vehicles, including large passenger vans, pickup trucks, antique vehicles and motorcycles.

In addition, many policies exclude leases and micro-leases, and most exclude rentals through person-to-person car-sharing companies such as Turo.

Related: Are Turo car rentals covered by credit card insurance?

Scenario : Standard Chartered Prudential Platinum/ Visa Signature Card

The little-known Standard Chartered Prudential Platinum/Visa Signature Cards explicitly state that rewards points are awarded on insurance premiums.

Its not clear whether theyre referring to all kinds of insurance premiums, or just Prudential specifically. For what its worth, the T& Cs of the card dont list insurance as a blanket exclusion, so Im hopeful it applies to all underwriters.

In any case, you can definitely earn points on Prudential premiums, at a rate of anywhere between 0.29-0.6 mpd .

| Card |

| 0.6 mpd |

Can I Pay For My Car Insurance With A Credit Card

In most cases, insurance companies allow you to pay your auto insurance premiums with your credit card.

Choosing to pay with a credit card has many benefits, including raising your credit score and earning rewards points .

However, if mishandled, you may find yourself in debt.

Some insurance companies charge an extra fee if you’re paying for your premiums with your credit card, so contact your insurance provider to see if a fee applies.

Allstate offers the Easy Pay Plan setup that saves you up to 5% on certain policies. Contact Allstate for a quote, today!

Read Also: What Soap To Use To Clean Car

How Does Coverage Vary For International Rentals

Rentals in some countries may be excluded. For example, standard Visa and Mastercard coverage excludes rentals in Israel, Jamaica and Ireland. American Express wont cover in Italy, Australia and New Zealand. Aside from excluded countries, the good news is that if your personal auto policy doesnt cover you outside the United States, your secondary credit card coverage could become primary coverage automatically.

» MORE:

What Happens If I Miss My Credit Card Payment

If you miss your credit card payment, then thats a problem between you and your credit card company like your bank.

As long as the insurer can continue charging your credit card, and as long as payments continue to go through, your car insurance will remain active.

If your credit card is maxed out, or if your insurer is unable to charge your credit card, then your insurer could cancel your policy. Most insurers have a grace period of 7 to 14 days for a missed payment or delayed payment. If you still havent paid for car insurance after that grace period, then the insurer could cancel your policy, leaving you uninsured.

Pay your credit card bills on time to avoid any issues with car insurance credit card payments.

Also Check: How To Fix Scratches On Black Car

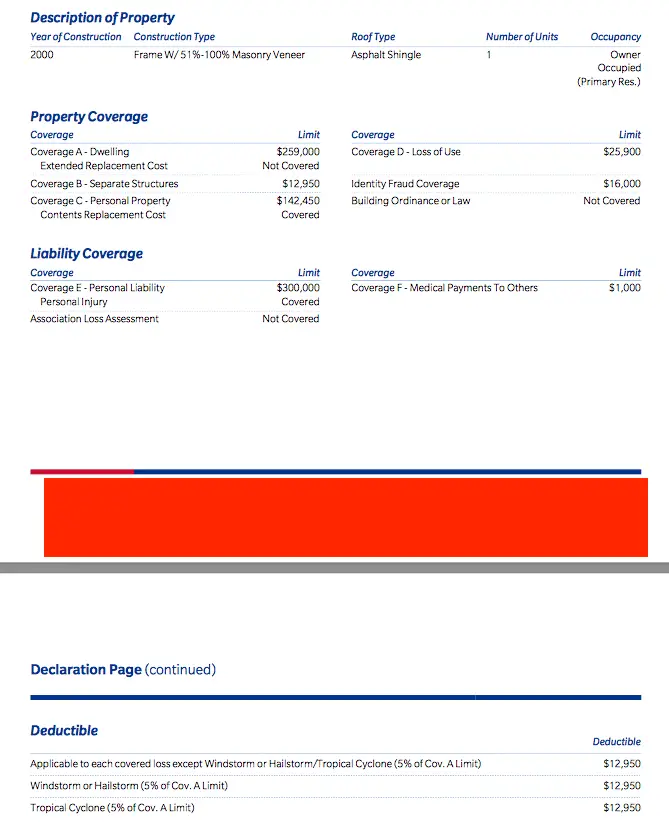

What About Liability Coverage

Liability coverage isn’t included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car . If you’re involved in an accident resulting in injury to another person, you probably won’t be covered.

Full liability protection comes with the rental company’s insurance. You typically have to add it on at the counter and/or at the time of reserving the car, unless you have extended rental car coverage through your personal auto insurance policy. Liability protection is likely more expensive for rental cars than for your own car it runs about $8 to $25 per day. Some countries may actually require that you opt into liability coverage when renting a car.

Are Progressive’s Online Rates The Same As Rates From An Agent

No. Buying directly by quoting online or calling instead of going through an agent could result in different prices for Progressive policies because these areas of our business make independent decisions about the expenses they incur and the prices of their products. When buying through an agent or broker, your rate includes the commission paid to the agent or broker for selling the policy. When you buy directly from Progressive, the rate reflects the cost of building, staffing, and maintaining the sales centers and marketing costs of that aspect of our business.

No matter how you purchase your Progressive car insurance policy, you’ll always receive the benefits and services we offer to all of our customers, including unparalleled 24/7 customer service, claims support, and online service.

Read Also: How To Salvage A Car

Primary Vs Secondary Coverage

Most credit cards offer secondary coverage, which means the coverage kicks in after your personal car insurance policy. In the case of an accident, theft or damage, you’d first need to file a claim with your own car insurance company before submitting a claim through your credit card’s insurance provider. If you don’t have a personal auto insurance policy , secondary coverage may still kick in just check your policy to make sure you’re covered.

Primary coverage, on the other hand, is just like the name suggests. With credit cards that offer primary insurance coverage, you can submit an accident claim right away by calling the number on the back of your card, without first submitting to a personal policy.

Is Credit Card Car Rental Insurance Enough

Wondering if your credit card car rental insurance is enough to cover you in a worst-case scenario?

That depends on what kind of coverage and how much you already have on your other policies.

Keep in mind that auto insurance covers car rental in most cases. But it’s always important to review all of your insurance coverage, read the details of the policy offered by your credit card and also review options for insurance you can buy from the rental car agency.

In general, credit card rental car insurance may be enough if you:

You should also consider your policy limits, deductibles and how much you want to avoid filing a claim on your personal insurance.

Also Check: How Much Is Car Shield Insurance

Paying Car Insurance With A Credit Card

Making payments for car insurance wonât affect your credit score. But if you pay with a credit card, things like your cardâs balance or late payments could be reported to the credit bureaus.

And most major insurers do accept credit cards as a form of payment. Just remember that using your credit card responsibly is what ultimately has a positive impact on your score.

Things To Ask Your Car Insurer

Before you commit to paying your car insurance with a credit card, check to see whether your insurer charges a processing or convenience fee.

You may also want to explore your options for how often payments can be made. Many insurers let you make payments monthly, biannually or annually. If you pay your car insurance annually, you might be able to avoid processing fees. While if you pay monthly, those fees can add up.

Things To Remember If Paying With a Credit Card

When it comes to how car insurance payments can affect your credit score, be mindful of your . Thatâs simply a measurement of how much of your available credit is currently in use.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio under 30%. So if paying your car insurance with a credit card puts the total amount of credit youâre using over the 30% mark, you may want to consider another payment method.

Best Credit Cards For Excellent Credit

1. Best Credit Cards for Excellent Credit for 2022 Creditcards.com Applicants with excellent credit are eligible for top credit card offers from issuers like Capital One, Chase, and American Express. credit Best cards for excellent credit Best for Travel: American Express® Gold Card Best for Cash Back:

Read Also: When Will The Car Shortage End

Things To Consider Before Using Your Credit Card To Pay For Auto Insurance

- Save money and earn points by using your credit card to pay off your insurance premiums. This option is incredibly beneficial, provided you handle your payments wisely.

- If you’ve got a track record of unpaid debt, it’s better for you to continue paying for your premiums with your debit card. You don’t want your credit card interest to increase or your credit score lowered.

- Not all insurance companies allow you to pay with your credit card, but the majority do. Speak to your provider to know more about this payment option.

Can You Pay Car Insurance With A Credit Card

With those types of perks, you may want to consider making car insurance payments with a credit card. While you can pay your car insurance premium with a credit card, it could cost you more in fees or damage your credit if you cant pay off your credit card bill by the due date each month.

Well walk you through the advantages and disadvantages of paying for your car insurance with a credit card, which insurers accept credit cards, and how to set up your payments.

Read Also: When Will My Car Insurance Go Down

Can I Pay My Car Insurance Premium With A Credit Card

Buy Car Insurance in 30 Seconds !

Save up to 50%

T& C Apply

- 20+ insurers to select from

- Easy Monthly Installments

To begin with, you can always pay your car insurance premium through credit cards as there are numerous advantages of using a credit card for car insurance premium payments. Additionally, you can choose to convert your purchase into easy monthly payments to avoid any financial burden.

Compare Best Credit Cards For Insurance Premiums By Dollar Value

Based on an average monthly spend of S$2,000, we analysed the best credit cards on the market to estimate returned value-to-consumer after 2 years, accounting for rebates and netting out annual fees. As a note, dollar value is heavily dependent on spending habits intangible benefits are valuable but difficult to quantify.

Read Also: What To Do When Someone Hits Your Car

Scenario : Via The Grabpay Mastercard

The GrabPay Mastercard can be a roundabout way of earning rewards on insurance premiums- provided you have a card that still earns rewards for GrabPay top-ups.

| Cards for GrabPay Top-Ups |

| *Based on general spending cards with earn rates of 1.2 to 1.6 mpd |

Whether its worth it to buy miles all boils down to how much you value a mile. The gold standard is of course to earn miles for free, but if banks keep cracking down, this may be the only option left.

What Are The Disadvantages Of Paying For Car Insurance By Credit Card

If you easily lose track of your spending, paying your insurance premium by credit card might lead to disadvantages like using your credit card to buy more than you can afford. When using your credit card, remember that you’ll need to make your full credit card payments on time or risk being hit with interest charges. Many credit cards allow you to set up auto pay so you don’t miss a credit card payment.

Pro tip:

If you use auto pay for your credit card bill, make sure you have enough funds in your connected bank account when your credit card payment is scheduled to be withdrawn. Otherwise, you could overdraw your bank account.

You May Like: Where To Charge Electric Car

Benefits Of Paying For Insurance With Your Credit Card

There are many benefits to using your credit card to pay your insurance premiums, including:

- Pay less on your premiums by getting your annual auto insurance rate paid in full. This option is cheaper, and you won’t have to worry about making monthly payments.

- Some credit cards offer rewards on every purchase, including paying for your auto insurance premium.

- Build your credit score if you continue to make your monthly payments on time.

Car Insurance Tax Deductibility Tips

- If a car is used exclusively for business, the entire amount of its actual cost can be deducted.

- If a car is driven for both business and personal reasons, the total cost can be prorated. For example, if the car is used for business half of the time, half of its actual cost can be deducted.

- If a taxpayer is deducting based on mileage, they should keep careful track of their work-related miles and can deduct only that amount.

Regardless of which type of deduction you choose, its important to keep careful records of business vehicle use. In addition, its usually best to calculate your deduction using both the actual value and mileage methods, so you can choose the method that gives you the highest tax savings. If youre still unsure whether you can deduct your car insurance, visit the IRS website or talk to a tax expert.

Read Also: How To Qualify For A Car Loan

Which Credit Cards Offer Primary Rental Car Insurance

Some credit cards offer primary rental car coverage, which does not require you to submit a claim to your other insurance before coverage can kick in. Many Chase credit cards offer this benefit. Examples of cards that offer primary rental car insurance include: Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, Chase Ink Business Preferred® Credit Card and the United Explorer Card.

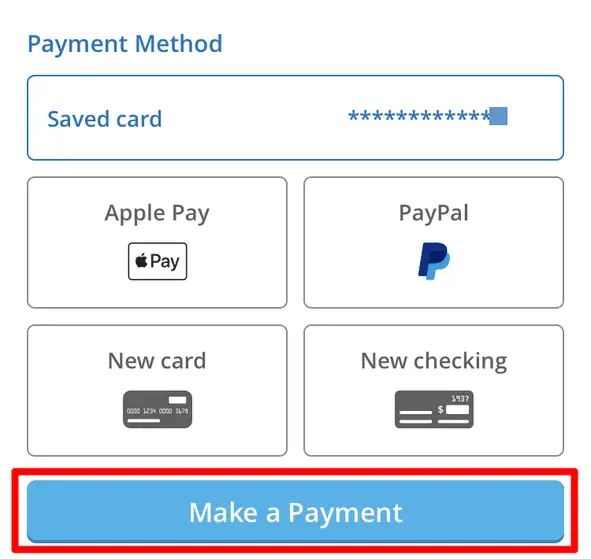

How Do You Pay For Car Insurance With A Credit Card

Most car insurance companies make it easy to pay with a credit card, and they offer a variety of ways to do so. As with most bills, you can pay online, over the phone, through the company mobile app or even instantly when you request a free quote online. If you’re able to pay your car insurance bill in one payment as opposed to monthly, you’ll likely receive a discount on your insurance premium. You’ll probably have a choice of the following payment options when you pay your car insurance with a credit card.

-

Online payments: You can use the car insurance company website to make a secure payment online. You can choose to pay your premium in installments or in full.

-

Paying over the phone: You can call your insurance company and provide your credit card number to the billing representative over the phone.-

-

Mobile app payments: Most car insurance companies offer a mobile app. You can download the app and set up your car insurance payments via the mobile app.

-

Pay-in-full discount: If you pay your bill in full, most insurers will offer a paid-in-full discount. Even if you cant afford the whole bill up-front, using your credit card can provide more time to pay off the bill, as long as you have a low interest rate.

-

Automatic monthly payments: Automatic monthly payments allow you to set it and forget it, so you never miss a payment. You can usually set up automatic payments online, over the phone, or using your car insurance companys mobile app.

Recommended Reading: How To Remove Light Scratches From Car Paint

Disadvantages Of Paying Car Insurance With A Credit Card

If youre trying to stop living paycheck to paycheck or struggling with paying your bills on time, you may want to avoid using your credit card to pay your car insurance. Other drawbacks include:

-

Extra fees: Some insurers may charge convenience or processing fees for credit card payments. These fees could be enough to negate any discounts youd get from paying your insurance with a credit card.

-

Interest rates: If you dont pay off your credit card bill every month, you could be charged interest on the balance. Although some credit card companies offer 0% interest for a limited period, most cards have interest rates between 15% and 26%.

-

Higher credit card balance: Some financial experts suggest keeping your credit utilization under 30% of your limit to avoid increasing your credit card debt. Anything over 30% could also hurt your chances of getting a mortgage, buying a car, or even renting an apartment.

-

Negative impact on credit score: Using more than 30% of your total credit limit could impact your credit score. Your credit score could also drop if you miss making payments on your credit card.

Can You Pay For Car Insurance With A Credit Card

Love the convenience of paying your bills with a credit card? Or, maybe youve hit a bump in the road and need to use your credit card to catch up on some bills. It doesnt matter why you want, or need, to pay your car insurance with a credit card, weve got some good news with American Family Insurance you can!

There are several ways to pay your car insurance with your credit card. Lets take a closer look so you can choose the option that works best for you.

Recommended Reading: How Much Does It Cost To Get A Car Painted