$100000 Isnt Always $100000 Due To Cost Of Living Differences Across The United States

Only 1 in 4 U.S. households make six figures or more. Business Insider has argued that $287,000 is the new $100,000.

How far will your salary stretch across the U.S.?

If youre thinking of moving or relocating around the country, we recommend you use the free CNN Money Cost of Living Calculator to find out.

Lets take CNNs calculator for a test drive. In this hypothetical scenario, our home-based city is Austin, Texas. Based on the Cost of Living in Austin, CNN Moneys calculator estimates the comparable gross salary you will need to make to maintain your lifestyle in other cities across the country.

As you can see, the higher the cost of living the higher your salary requirements.

To maintain the same $55,000 lifestyle in Austin, Texas in a city like New York or San Francisco means you need a salary increase to reach a $100,000+ income level.

You should also observe that the cost of living can vary widely within the same state. This is why you can maintain the same lifestyle on $5,000 less if you relocate to a lower cost of living city within the same state, like San Antonio in this instance. Try the calculator for free here.

If you want an even more detailed breakdown, we recommend Bankrates Cost of Living Calculator. Bankrate tells you everything you need to know about cost of living changes, right down to whether your monthly budget can still afford cheese on your cheeseburgers .

How Much Should I Spend On A Car If I Make $300000

It doesn’t matter so long as the car costs 10% of your annual gross income or less. If you make the median per capita income of ~$42,000 a year, limit your vehicle purchase price to $4,200. If your family earns the median household income of $68,000 a year, then limit your car purchase price to $6,800.

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Don’t Miss: How To Refinance A Car Loan With Bad Credit

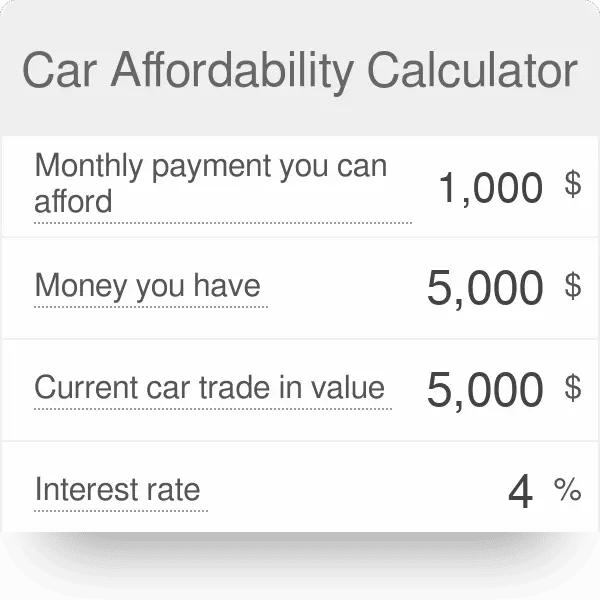

Use A Car Payment Calculator

Once you have an idea of how your monthly income and expenses look, you can gain more insight by experimenting with a loan calculator, like the one below.

Enter the price range you plan to shop in along with the interest rate you hope to qualify for. From there, you can see what type of monthly payment you might end up with.

Warning: Your car loan term is longer than years to retirement or invalid data was entered. Retirement charts are hidden.

How To Save Money On A Car

Assuming you’re buying out of necessity rather than a luxury, use the following tips to save money:

- Do your research. Know the average price for the car you intend to buy. Use Edmunds or Kelley Blue Book for these figures.

Look for any dealer incentives when buying a new car. Also, know the supply and demand of the vehicle.

Are they in demand and hard to find? Or do dealers have plenty sitting on their lot? These points will give you room for negotiation.

Email dealers and private sellers to ask for a quote on a specific car. Then compare those quotes to determine which provides the best deal.

You may find better deals. This gives you more room for negotiation with the seller too, as it now becomes a cash deal for them.

Chances are that the seller won’t let the deal die they will eventually meet your expectations. If they don’t, there are other cars out there for you.

You May Like: How To Remove Smoke Smell From Car

How To Determine How Much Car You Can Afford

A vehicle is often one of the most expensive purchases people make, so it is critical that you crunch the numbers to determine whether you can truly afford the car youre considering. And remember, the true cost of a vehicle goes well beyond the sticker price or monthly loan payments. Ongoing costs like fuel, maintenance and car insurance can vary significantly based on the type of car you purchase and should also be factored into your budget.

How Much Car Can I Get For $500 A Month

Also Check: How Many Cylinders Is My Car

The Best Cars For Around 500 Per Month

These are some of the cars you can afford if you earning over £50,000 a year:

BMW X3

The BMW X3 series is a car that you can navigate around suburbia or drive for a long time on the M1. Offering a smooth and comfortable ride on bumpy roads, it also remains calm at faster speeds. It comes fitted with deep windows allowing you an all around view and front and back parking sensors as well as a rear view camera that allows you to park comfortably and safely. The BMW X3 is a top competitor of the classic Land Rover Discovery and its easy to see why.

Land Rover Discovery

Everyone has heard of a Land Rover Discovery. Its the most well-known 4×4 as it can drive on almost any surfaces. With the ability to carry up to seven people, its the perfect choice for a family. Since entering the SUV scene in 1989 it has dominated the market with heritage and class. The Land Rover Discovery is perfect for those who wish to travel to their destination in leisure. With all models being fitted with front and rear parking sensors and a reversing camera as standard, you can park this slightly larger car with ease. If you wanted something that shouts luxury and style then the Land Rover Discovery is a perfect choice.

Ford Mustang

Identify A Target Price

When you’ve figured out your down payment amount and what you can borrow, add those numbers together to get your target price. Don’t forget to include taxes and fees in your total, which vary by state. If you want to get a rough estimate of the additional cost, you can add 10% of the advertised sticker price or sales price of the vehicle you want to buy.

Don’t Miss: Where Can I Refinance My Car

How Do Lenders Determine My Borrowing Power

Borrowing power is the amount of money that you can borrow at a specific point in time, based on your financial position. Lenders may use the criteria below to determine the final amount youre able to borrow:

- Your credit score. This is usually the most critical component that influences how much you may be able to borrow. Lenders use your credit score, and credit history, to predict the potential risk of a borrower.

- Annual income. Lenders consider your income when determining your ability to repay a loan. If a lender doesnt feel that your income will allow you to repay a larger loan properly, it may only approve you for a smaller amount.

- Multiple incomes. The more income you have, the more borrowing power you have.Living expenses. Lenders want to be sure that your new car payment will fit into your budget along with housing costs, utility bills, credit card bills, student loans and other monthly bills.

- Your savings. How much you have in your savings account could be used as a buffer in the event youre unable to repay a car loan with your normal income. If you have more cash savings, a lender may approve you for a larger amount.

- People who are financially dependent on you. Having dependents can add to your monthly expenses, which can impact your borrowing power.

Debt-to-income ratio and borrowing power

Heres Why Your Budget Is Lower Than You Were Hoping

If your reaction to the Car Affordability Calculator was:

Bruh thats it? Thats all I can spend on a car?

Well, you wouldnt be the first to feel that way.

I alsofelt that way back at my first job. Everyone I worked with was driving shiny new Mercedes-Benz and BMWs to work, while my budget calculations said I could only afford a used Mazda, at best.

I was making the same money as them, sowhat gives? Why cant I afford a new Hemi-powered Charger or Lexus crossover like seemingly everyone else on the road?

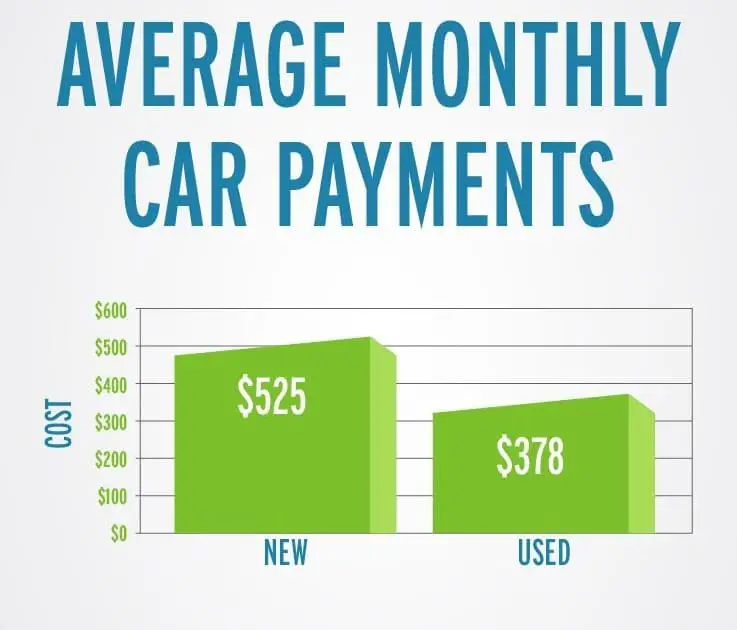

The reality is that most Americans are driving cars that they cant really afford. For the first quarter of 2022, Edmunds reported that the average new car loan term was a horrifying 70 months, with the average monthly payment reaching $648 for new cars.

This tells us that rather than considering a more affordable car, Americans are pushing out their car loan terms even farther, staying in debt longer, and simply paying way, way too much overall.

Remember, youre sticking to the 35% rule for several reasons:

Recommended Reading: How Often Should You Change Car Tires

Leave Plenty Of Wiggle Room In Your Monthly Budget

If you worked out a monthly budget using the guidelines above, you probably know about how much you can afford to pay for a car each month. Still, dont forget to leave plenty of wiggle room in your budget.

Life happens and surprise expenses pop up. Roofs and cars need repairs. You might have unexpected medical bills or lose your job. The more extra cash you have in your budget, the better off youll be.

Leasing Vs Buying A Car

In your search for a vehicle, you might wonder whether it’s better to enter into a financing or leasing agreement. An auto lease allows you to rent a new vehicle from a dealership for an agreed-on period.

You must have a good credit score to qualify, and car dealerships often have other requirements for lessees. The monthly payment on a lease is typically much lower than what you’d pay each month if you financed the same car.

However, at the end of the lease term, you don’t own the car. Instead, you can either enter into a new lease agreement for a different vehicle or purchase the car you were leasing for a fixed price.

Not all lease agreements allow buyouts, so if you’re interested in this option, it’s important to make sure it’s available. If you don’t purchase the vehicle, you might be subject to additional fees related to excess mileage and its condition.

Also Check: How To Check Used Car

S To Determine How Much Car You Can Afford

Calculating how much car you can afford may help you save time and money in the long run. Several factors affect your auto loan rate, including:

- Your loan amount

Heres a breakdown of how much you can expect to pay in fees or taxes:

- Sales tax: Up to 11% and varies by state

- Registration fees: Typically range from $50 to $300, although some states, like Georgia, charge as much as $2,465 on average

- Documentation fees: Generally between $100 and $500, depending on your state

Making a down payment or trading your old car in can help you borrow less money when purchasing a vehicle.

How Much Should Your Car Cost Compared To Your Salary

Recommended Reading: How Much To Rent A Car

What Priced Car Can I Afford

A budget between 10% and 50% of your annual income is what you could reasonably expect to spend on a car. When youre cruising ad pages for that new ride, keep a budget in mind that fits you and your lifestyle. This is the most important bit of information to have with you while you shop for a new car.

How Can You Calculate How Much Car You Can Afford

To calculate how much car you can afford, you should follow two financial rules that financial experts recommend:

To figure out your take-home pay, take a look at your paycheck. You can either use your annual take-home pay or your monthly take-home pay to figure out what your budget might be. If you use your annual take-home pay, be sure to divide it into twelve months to find out what you bring home monthly. Once you have your monthly income figured out, multiply that number by .01 or 10% to figure out what your monthly budget might be for a car loan payment. Multiply your take-home income by 20% or 0.2 to figure out what your total monthly budget might be for all your car-related expenses. When youre figuring out your budget be sure to take into account any outstanding regular debts you might have. Debts might include things like credit cards, student loans, mortgage payments, business loans or any other finance charges you might have to cover on a monthly basis. Be sure to put your car payment estimate in the context of your life and other costs to ensure you find the right balance. There are a few pieces of information that you will need to collect before you start shopping, however. They include:

Read Also: How To Refinance My Car Loan

Example: Using The 20/4/10 Rule To Calculate How Much Car You Can Afford

Molly earns $80,000 per year, before taxes and is interested in buying a car. Her monthly salary before tax is $6,667. Molly plans to use the 20/4/10 rule to buy a car that fits her budget and still allows her to comfortably afford her other monthly expenses.

According to the 20/4/10 rule, she calculates that 10% of her $6,667 monthly salary is $667 per month. She then estimates how much shell have to spend per month on car insurance, gas and maintenance like this:

| Car expenses | |

|---|---|

| Total cost of car-related expenses: | $425 |

If Molly can only spend $667 per month on all car expenses, and has to spend $425 of that on car insurance, gas and maintenance, then the maximum amount she can afford to spend on car loan payments is $242 per month .

Molly starts looking around for cars, and finds a 2017 Toyota Camry at a used car dealership for $13,000. Using the 20/4/10 rule, shell have to put a 20% down payment on the car $2,600 in this case which she can pay out of her savings.

She then compares auto financing offers for the remaining $10,400 cost of the car . Because of her excellent credit score, shes offered a 4-year loan term at a 4% interest rate. Her monthly car loan payments would then end up being $234.82.

That means Molly will be spending a total of $234.82 + $425 = $659.82 per month on all of her car-related expenses, which is within her budgeted amount of $667.

Why Is My Amount So Low

Cars may be necessary transportation, but their quick depreciation means spending more than you have to on a car is a fast way to make your hard-earned money disappear unnecessarily.

A bank or car dealer will likely approve you for much more than your result on our calculator. But what the dealer says you can afford and what you can actually afford are very different. Remember, if you stop paying your car loan, the bank repossesses the car. Either way, they win.

The result of our car affordability calculator shows you a sensible amount to spend on a car. And yes, it might be far lower than you might think. But remember that the more money you spend on a car, the less money you have available for everything else housing, food, travel, entertainment, paying off debt, and saving.

Your car is one of your largest monthly expenses the lower you can keep that expense, the faster youll be able to build wealth in other areas.

Finally, before you get to buy a car you have to make up your mind on how much you have and many cars you can afford. The above steps will help you determine.

If youve found any of the information in this article handy, please subscribe with your email below, to receive regular updates like this one, and also share with your friends through the various platforms seen above.

CSN Team.

Don’t Miss: How Long Does It Take To Paint A Car