What Other Factors Affect Your Insurance Rates

Even if insurers use a credit-based insurance score to calculate rates, they take other factors into consideration. Some of these include the following:

- Your driving history

- Personal information such as age, marital status, and gender

- Type of coverage you want

Your driving history plays a key role in costs, especially if you have violations or accidents on your record. Although having a single speeding ticket might not cause your rates to jump, a DUI is more serious.

They might also factor in potential discounts, such as a pay-per-mile policy or usage-based policy. Companies such as Root Insurance offer an app or installed device that tracks your driving behavior to determine your eligibility and costs.

Having A Low Credit Score Can Also Raise Your Premium

Insurance companies work out the price you pay based on how risky they think you are.

There are all sorts of things they take into account when setting your price – even your job title and postcode. A bad credit score doesn’t help, because it makes it look like you’re not very good at handling debt.

Some data also shows that people with bad credit scores are also more likely to make a claim, and that can add a hefty chunk to the price of your car insurance.

These extras are on top of the interest you’ll be paying on a monthly repayment plan, which, sadly, can also be more for those with a history of credit trouble.

Will A Poor Credit Rating Affect My Car Insurance

When it comes to calculating your premium, insurers will consider a number of factors, for instance, your age, address and the type of car you have. So, while a poor credit score can affect what you pay for car insurance, its not the only consideration.

Its worth knowing that some research suggests drivers with a low credit rating are more likely to make a claim. This data can mean your insurer charges you slightly more compared to someone with a good or excellent credit history.

If you decide to pay for your policy in one lump sum, the price youre quoted is the price youll pay . If you ask to pay in instalments, you can expect to be charged interest, which means youll pay more overall over the course of the year.

Don’t Miss: How To Activate Onstar Without Being In The Car

How Do Auto Insurance Scores Affect Your Rates

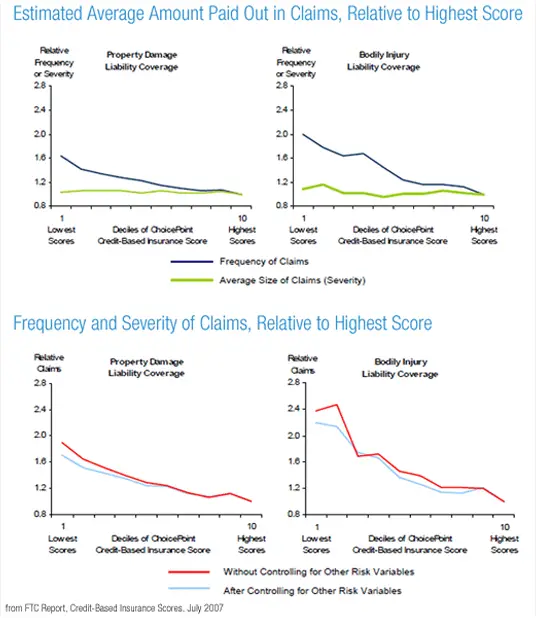

An auto insurance score measures the likelihood of you filing a claim. As with many types of insurance, how likely you are to file a claim impacts the rate you payand when it comes to auto insurance, studies have shown that drivers with less-than-great credit are more likely to file claims.

Drivers who are likely to file claims cost auto insurance companies more money, so if you have a low auto insurance score, youre likely to be offered less attractive rates.

Many Auto Insurance Companies Use Your Auto Insurance Score To Determine Your Rate And Factors That Affect Your Credit Score Also Play A Large Part In Determining Your Auto Insurance Score

Most people are familiar with the concept of credit scores, but fewer may be aware that their credit score can impact how much they pay every month for car insurance. In fact, many auto insurance companies use something called an auto insurance score to determine your rate, and factors that affect your credit score also play a large part in determining your auto insurance score.

If you find yourself being offered bad rates from insurance companies due to poor credit, improving your credit score will go a long way toward getting you better auto insurance rates.

You May Like: What Does Oem Mean For Car Parts

How Does Credit History Affect Auto Insurance Scores

While a credit-based insurance score is different from a credit score, they use a lot of the same data and your credit score impacts your insurance score.

Your credit score helps creditors determine the likelihood that youll be late on a payment or default on a loan. Insurers use insurance scores to calculate how likely youll file a claim.

Auto insurance companies say your . Studies have shown that theres a correlation between credit history and insurance claims. People with lower credit scores tend to have more accidents and file more claims than people with higher scores.

An insurance company often pulls your credit history when determining a premium. A credit-based insurance score considers many of the same factors that your credit score ranks, so your credit score impacts your insurance score.

In fact, according to a rate analysis done by CarInsurance.com:

- On average, drivers with poor credit pay 71% more for a full coverage policy than drivers with good credit.

- Drivers with fair credit pay a rate that is 18% higher, on average, than those with good credit.

However, your credit isnt the only factor that insurers consider when gauging auto insurance rates. So, dont panic if you have poor credit.

Keep Hard Credit Inquiries To A Minimum

Credit inquiries come in two forms: hard checks and soft checks. Whenever you apply for a line of credit, the company considering you as a customer will pull your credit report, which constitutes a hard inquiry and does affect your score. When insurance companies review your credit in the quoting process, that is considered a soft inquiry and shouldnt have an impact on your actual credit tier. Too many hard inquiries can have a negative impact on your score. If you are trying to build your credit, you may want to consider waiting to apply for a loan or line of credit.

Don’t Miss: How To Get A Free Car

Is There A Difference Between A Credit Score And An Insurance Score

Yes. Insurance companies dont use your credit score but they do calculate an insurance score.

Your credit score is about your creditworthiness and how likely you are to miss payments. A credit-based insurance score uses your credit history but focuses on predicting the likelihood of you making a claim in the near future.

Insurance companies and the data analytics companies they buy information from, such as LexisNexis, dont disclose details of how they calculate insurance scoresits proprietary information. However, according to the Insurance Information Institute, factors the score might include are:

- Length of credit history

Which Car Insurance Companies Dont Check Credit Reports

Unless a car insurance company specifically states that it doesnt consider credit when determining pricing, its best to assume they all do if your state allows your credit history as a rating factor.

There are currently four statesCalifornia, Hawaii, Massachusetts and Michiganthat dont allow credit scores to help determine auto insurance rates. So, if you live in one of these states, all car insurance companies should skip reviewing credit history when calculating rates.

Some other states limit what insurance companies can do with credit scores.

For example, Maryland prohibits auto insurance companies from using credit history to determine if theyll insure you, cancel your policy, renew your policy or increase your premium once a policy is in effect. However, laws allow a credit review when you first apply for a policy, and they determine what youll pay at the policys inception.

Many state laws require auto insurance providers to disclose that your credit report may be reviewed and notify you if it results in an adverse action, such as higher rates.

Also Check: What Is The Safest Car

Do Car Insurance Quotes Affect Credit Scores

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to lenders. You can get as many inquiries as you want without negative consequences to your credit score. This is because the insurance company is not looking at your actual score it is just using your credit report information.

Can You Check Your Auto Insurance Score

Auto insurance scores arent accessible for free in the way credit reports and scores are, and theyre not as easy to get ahold of. LexisNexis and TransUnion allow you to purchase your auto insurance score report, but you have to call or email themthere isnt a one-click solution like there is with a standard credit report. FICO makes checking your auto insurance score a little easier with its myFICO service, but it costs $19.95 a month.

Fortunately, it isnt nearly as important to check your auto insurance score as it is to check your standard credit report and score.

First, auto insurance scores dont matter unless youre planning on enrolling in a new auto insurance policy or switching to a new insurance company. If you dont own a car and arent in the market for one, theres no reason to be concerned about your auto insurance score.

Secondly, even if youre in the market for auto insurance, you dont necessarily need to check your score directly. The factors that determine your auto insurance score overlap significantly with credit score factors, so you can assume that if your credit score is healthy, your auto insurance score will be toounless you have a bad driving history with multiple accidents and youve filed a lot of insurance claims.

Read Also: How Much Is My Classic Car Worth

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

In What States Do Insurers Use Credit Information

In all but three states, insurance companies use a credit-based insurance score to calculate your premiums. So unless you live in California, Massachusetts or Hawaii, your credit score will be factored in.

Insurance companies dont use a traditional FICO score, however. Instead, they have their own system called credit-based insurance scores.

Don’t Miss: How To Install 12v Power Outlet In Car

Compare Car Insurance And Save Up To $500 A Year

If you haven’t compared car insurance recently, you’re probably paying too much for your policy. Getting quotes from multiple insurers used to be time-consuming, but today’s technology makes it easy.

Using a free site like Pretected is easy and could help you save up to $500 a year on car insurance. In mintues, their “smart matching” system will provide tailor-made quotes from insurers that can meet all of your coverage needs – and your budget.

Stay protected on the road and find more affordable car insurance in minutes with Pretected.

How Much Will My Car Insurance Cost Based On My Credit Rating

The national average cost of car insurance is $565 per year for minimum coverage and $1,674 per year for full coverage. However, depending on your credit score and other rating factors, your premium could be much higher or lower.

The average cost of auto insurance also varies based on your gender, although some states do not allow gender to be used as a rating factor. Males often pay more than female drivers, since men are more likely to get into accidents than women. The table below shows the average full coverage premiums for men and women with various credit tiers.

| Poor credit | |

|---|---|

| $1,701 | $1,479 |

Your credit score is not the only factor that impacts your car insurance rate. Where you live can also be a significant factor.

You May Like: How To Touch Up Car Paint Chips

Why Does A Poor Credit Score Affect Car Insurance

If youve ever taken out a loan or credit, youll have a credit score which allows lenders to see whether or not youve repaid your debts on time. But while its well-publicised that a poor score can affect your chances of getting a mobile phone deal or mortgage, in some cases, it can also impact your car insurance.

What Is An Extraordinary Life Circumstance

At Nationwide we value our customers. We have an extraordinary life circumstance process that applies in all states. If your credit information has been directly influenced by one of the following events, you may qualify for reconsideration of your premium.

- Any catastrophic event declared by the federal or a state government1

- Total or other loss that makes your home uninhabitable1

- Divorce or dissolution of marriage

- Death of a spouse, child or parent

- Serious illness or injury, either to you or to an immediate family member

- Temporary loss of employment for three months or more, if such loss is due to involuntary unemployment

- Military deployment overseas

You May Like: How To Replace Car Stereo

What Is An Insurance Credit Score

This is a term from the US, where most insurers check a credit-based insurance score not a traditional credit score when someone applies for cover, and they use it to set premiums. Drivers with poor credit may pay as much as 42% more for car insurance than drivers with stronger credit. So far, we havent encountered this in the UK.

Does Your Credit Score Affect Your Car Insurance Rate

Youâve probably been told about the importance of your credit score, or FICO Score already.

When it comes to buying a car and renting or buying a place, your credit score will be one of the determining factors of whether or not you are able to. Your credit score acts as an indicator of how likely you are to pay your bills on time.

Renting and buying a car on a payment plan are prime examples of where a good credit score or FICO score will come in handy. But it also doesnât have to be with just large purchases. Your credit score will also tie into other payments like a mortgage for a home or a lease on a car. Of course, another regular payment that nearly everyone in the United States makes is car insurance.

And would you know it, credit score directly plays into and affects your auto insurance coverage annual premiums. But how do car insurance companies look at and perceive your credit score?

This post serves as your tell-all guide to the relationship between credit score and your auto insurance rates.

Recommended Reading: Where To Get Car Keys Made

How Does Credit Score Affect Your Car Insurance Premiums

If you’ve ever applied for a credit card, gotten a mortgage for your home, or leased a vehicle, you might know that credit scores play a factor. Did you know that they can also affect your premiums the same way that other personal information, such as your marital status and driving record can?

You might already know that in all states except for New Hampshire, the law dictates that you need auto insurance. You might also know that your credit score plays a role in what type of loan and credit cards you can obtain. But do you know the correlation between car insurance and credit scores?

However, according to the Insurance Information Institute, these scores don’t factor in other types of personal information such as your income, gender, or job. Instead, insurers use information such as your total debt and payment history to determine your risk level.

If you have a higher credit-based score, no claims filed, and stellar driving history, you usually qualify for lower rates. Keep in mind that the score is just one factor used to determine your premium, so if you have a spotty driving history, you might be considered a riskier driver.

According to Allstate, research shows that these scores can predict accident potential rather accurately. Those with a low score are more likely to file a claim, while those with a higher score cost insurers less since they get into fewer accidents.

Do Insurance Quotes Hurt My Credit

Nobody wants to be stuck with an insurance plan that costs them too much and covers them too little. But maybe youve heard the myth that getting an insurance quote will hurt your credit, leaving you hesitant to shop around for the right coverage. Weve got some good news no matter how many insurance quotes you get, your credit score is safe. Heres why you should be worry-free when youre shopping for insurance.

Also Check: How To Connect Phone To Car Without Bluetooth

How Do I Get A Car In Sims 4

Answered On Jan 17, 2023

· Answered On Jan 17, 2023

There are no functional cars in the Sims 4 in the traditional video game sense. They are more so part of the level or backdrop to enhance immersion rather than offer a driving minigame to go with the life simulator. Still, there is a way to get a car in Sims 4 âbut it involves cheat codes and navigating the debug menus.

The first thing to do is enter live mode and hold all the bumper buttons on the controller you are using , and the cheat menu will be brought up. This will allow you to type in âtestingcheats onâ and then âbb.showhiddenobjectsâ in order to pull up the selection of cars to add to your level. You can select the car youâd like while also scaling the size to whatever you desire. Larger cars are listed as buildings rather than vehicles in the menu.

There are several other better driving games out there than Sims 4. These kind of games are fun because they take away all the mundanity of owning a car and just focuses on the fun stuff, like speeding around without a care in the world. In real life, things like car insurance matter.

Donât make car insurance more complicated or expensive than it needs to be when you become a policyholder with Insurance Navy. We take a competitive and low-cost approach to even the most basic of coverage needs and the highest risk levels. Start today on our website with free quotes and see what cheap car insurance rates you qualify for today.

More: