Considering Paying Off Your Auto Loan Early

Most auto loan lenders allow borrowers to prepay on the principal balance of their loan without a prepayment penalty. .

If you can manage to either increase your payments, or apply a lump sum toward the principal balance, you can consider doing so by using this calculator by crunching some numbers. Paying off the auto loan early or adding a prepayment amount each month, shortens the period of time that the loan is in place and also decreases the total amount of interest that you will pay on the loan in the long run. While it may be difficult to part with a larger sum up front, or adding an additional amount each month to your payment, paying off your loan early can potentially save you thousands of dollars overall.

- FAQ: An auto loan early payoff calculator like this one can help you figure out how much.

What Are Loan Payment Calculations

The type of calculation you use will vary based on the type of loan. Here are three helpful calculations to know about when considering borrowing money:

- Interest-only loans: With interest-only loans, you dont pay down any of the principal in the early yearsonly interest.

- Amortizing loans: On the other hand, amortizing loans involve paying toward both principal and interest over a set period of time, such as with a five-year auto loan.

- When using a credit card, you’re given a line of credit that acts as a reusable loan so long as you pay it off in time. If you’re late on making monthly payments and begin to carry a balance, you’ll likely be charged interest.

Ways To Lower Insurance Costs

No matter if the buyer purchases new or used, the car will need to be insured. Unless the purchaser pays cash for the vehicle, they will be required to carry a full coverage policy in order to protect the lenders interests in the case of a collision, weather damage or if the vehicle is stolen or vandalized. If the buyer purchases with cash and no portion of the purchase price is financed, the new owner may carry liability only insurance. In most states, at least a liability policy is required. However, depending on the vehicle age, buyers who pay in full upfront may still want to consider full coverage. In at fault” states, liability covers only the other driver and vehicle in case of an accident. In no fault states, liability will cover only the minimum required for the policy for property damage and bodily injury. If the car is five years old or newer, the driver probably needs to carry full coverage insurance to make sure they are able to cover the cost of repairs in case of an accident or damage.

Also Check: How To Remove Paint From A Car

Use The Edmunds Auto Loan Calculator To Determine Or Verify Your Payment

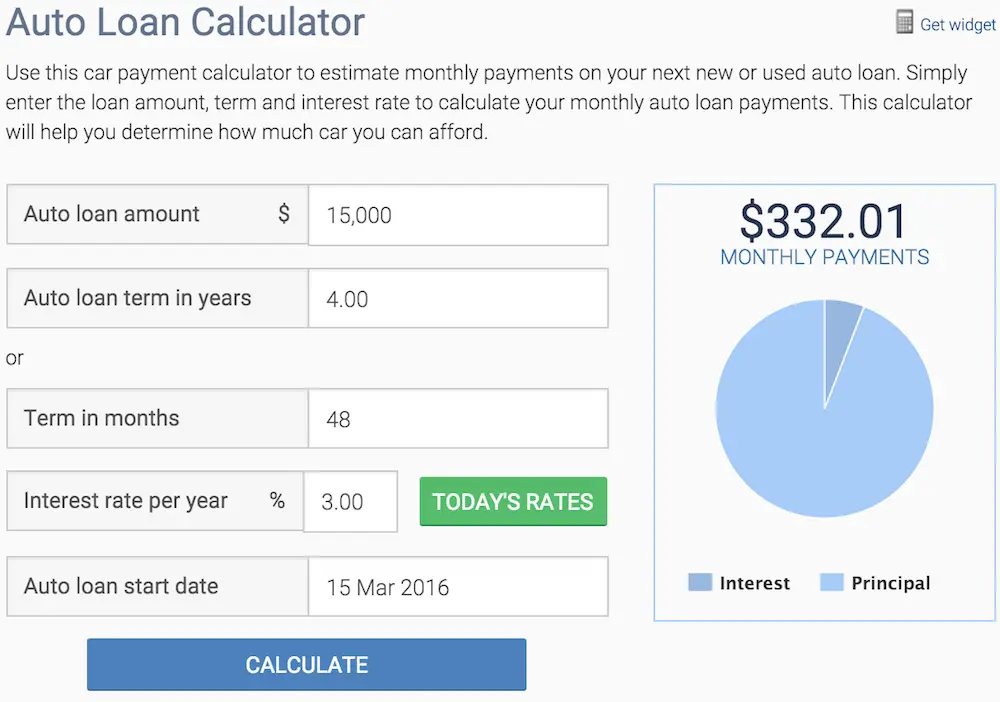

You’re gearing up to buy your next car but aren’t sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but the good news is that the Edmunds auto loan calculator will do the heavy lifting for you.

Let’s say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle’s price into the auto loan calculator. It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the compound interest, estimate tax and title fees, and display the monthly payment.

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some time to experiment with different values to find an auto loan setup that works best for your budget.

Calculating Auto Loan Payments

You May Like: How To Fix Cigarette Lighter In Car

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

You May Like: How To Sync Phone To Car

Early Auto Loan Payoff Calculator

Have an auto loan that you want to pay off sooner? Wondering how much faster you could pay it off by paying a bit more each month? And how much interest you could save in the process?

This Early Auto Loan Payoff Calculator has the answers.

Enter how much extra you want to pay each month, and the calculator will immediately tell you how many months you’ll shave off your loan and your total savings in interest. It can also show how quickly you’re paying down the loan, with the balance remaining for each month until the vehicle is paid off.

This is good information to have if you’re thinking of trading in the vehicle before it’s paid off and wondering how much to knock off the anticipated trade-in value.

Buying New Versus Used Vehicles

Buying new has its advantages, such as the fact that it has never been previously owned. It has that new car smell and everything about it is brand new. The engine is clean and the interior has no stains, burns or defects. However, the individual who purchases new pays a much higher price than if they had purchased the same make and model used.

Though purchasing a used car means that there may be imperfections left behind from the previous owner, the cost of ownership is typically lower. The advantages of purchasing used include:

There are several advantages for purchasing used instead of new. However, purchasing used does have a few disadvantages, too. For example, the vehicle typically will no longer be under any type of warranty & third party warranty services can be quite expensive. It may also have significant wear and tear on the engine and other vital drive train parts, especially if it has been used as a fleet vehicle or owned by an individual who traveled a great deal, such as a sales professional. When purchasing used, if you want to avoid expensive repair fees it is typically best to purchase something that is only two or three years old with low mileage. On average, cars clock about 12,000 miles per year. If a three year old vehicle which has over 100,000 miles on the engine is probably not a good bet.

How to Make Sure to Buy a Quality Used Car

How to Prevent Buying a Lemon

You May Like: How To Remove Tree Sap From Car

Amortized Loan Payment Formula

Calculate your monthly payment using your principal balance or total loan amount , periodic interest rate , which is your annual rate divided by the number of payment periods, and your total number of payment periods :

Assume you borrow $100,000 at 6% for 30 years to be repaid monthly. To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

- a: 100,000, the amount of the loan

- r: 0.005

- n: 360

- Calculation: 100,000//=599.55, or 100,000/166.7916=599.55

The monthly payment is $599.55. Check your math with an online loan calculator.

How Much Will The Total Loan Cost

It can be difficult to understand exactly how much you’ll pay when you have several competing loan offers. One might have a lower interest rate, while another offers lower fees. Figuring out which offer to choose means you’ll need to calculate the total cost of the loan including interest and fees. Calculators help with apples-to-apples comparisons. For example, some amortization calculators show you lifetime interest which you can use to compare interest costs from loan to loan.

Consider more than just your monthly payment amount when reviewing the terms of a loan.

In addition to your monthly payment, its crucial to focus on the purchase price, lifetime interest, and any fees.

APR is another useful tool for comparing loan costs. On mortgages, some APRs account for upfront costs in addition to the interest rate you pay on your loan balance. But the lowest APR isnt always the best loan. You might not even qualify for the lowest advertised APR. If the APR is low but closing costs and fees are high, and you don’t keep your loan for very long, you won’t see the benefits of that low APR.

With mortgages, you’ll also want to take into account other costs, such as property taxes, homeowners insurance and homeowners association fees. A good mortgage calculator can help you account for all of those costs to get the true cost of the house.

Recommended Reading: How To Get Out Of A Car Lease Early

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

The Open Road Starts Here

Estimate your monthly payments and how much you may be able to borrow, using the auto loan calculator below.

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affect our editors opinions. Our marketing partners dont review, approve or endorse our editorial content. Its accurate to the best of our knowledge when posted.

Recommended Reading: What’s The Trade In Value Of My Car

How To Get The Best Deals On Your Loan Payments

Your monthly loan payment is just a result of the loan amount, the interest rate, and the length of your loan. Salespeople and lenders can make a low monthly payment seem like youre getting a good dealeven when youre not.

For example, some auto dealers want you to focus solely on your monthly payment, which is why they often ask how much you can afford each month. With that information, they can sell you almost anything and fit it into your monthly budget by extending the life of the loan.

It is better to negotiate a lower purchase price than a lower monthly payment. Lowering the sales price decreases one of the three components of the total loan cost.

Stretching out your loan means youll pay more in interest over the life of the loan, increasing the total cost of the loan. Plus, longer-term loans might be riskier: When they’re used by buyers with lower credit to finance larger amounts, there’s a greater risk of default.

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Also Check: What Age To Stop Using Car Seat

How Much Interest Will I Pay On My Car Loan

Our car finance calculator works out the interest that you might pay as part of your car finance plan. It does this by taking your interest rate and compounding it over the course of the loan period. It is this compounding of interest rate that forms the basis of the effective annual rate we feature in our calculator. You may be interested to note that we have a compound interest calculator for compounding interest on savings.

Amortization Table And Interest

- Expanding the “Auto Loan Balances and Interest” section below the Auto Loan Payoff Calculator will display a graph illustrating the rate you will pay down your loan with and without any additional payments, plus your accumulated interest charges over time.

For the full amortization schedule, choose whether you want to see monthly or annual amortization then click “View Report” at the top of the page. You’ll then see a page showing how much you’ll shorten your loan by, the graph illustrating your amortization, a summary of the loan and a line-by-line table showing the amortization of the loan over time and comparing regular vs. accelerated payments.

- FAQ: Great tool to make positive decisions on budget planning and goals

If you’re looking to trade in your car at some point in the future, the amortization schedule is useful in that it lets you know exactly how much you’ll still owe on the loan at any point in time. You can then use this information, combined with the vehicle’s depreciation, to estimate what your trade-in value would be.

Don’t Miss: How To Change Ownership Of A Car

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

How Do I Calculate Car Loan Payments

Iâm going to finance a new Tesla. How do I calculate car loan payments on the vehicle so I can create a budget?

Answer

online car loan calculator

- Any bank or credit union website

- NerdWallet

- Bankrate

- Investopedia

- Interest rate

- Length of the car loan in months

- Total principal borrowed, including taxes, fees, and the price of the car after your down payment

calculate your monthly payment by hand

- Calculate the interest paid over the life of the loan by visiting Jerryâs guide to calculating your car loan payment.

- Add the principal to the total interest paid.

- Divide by the total number of months in your loan.

$625.81amortization schedulehow much of each monthly payment goes to your principal and toward interest

Did this answer help you?

Recommended Reading: What Kind Of Paint To Use On Car Interior

Estimating Your Monthly Car Payments

Luckily, you can very easily calculate your monthly payment, including interest, in Excel. There are many online payment calculators available as wellyou may want to double-check their work using these steps.

This formula does not include things such as tag and title fees, destination charges, etc. It is a tool to give you a basic estimate of the cost of your loan.

Follow these steps to calculate your monthly car payment in Excel:

1. Open a new Excel worksheet.

2. Enter the variables for your specific loan:

- Balancethe price of the car, minus any down payment or trade-in value of your current vehicle.

- Interest rate

- Periods

- Add a section for Monthly Paymentthis will be calculated soon!

3. Insert the correction function in the cell next to Monthly Payment.

- Insert a formula by clicking the Formulas tab at the top of Excel, then clicking Insert Function.

- Find the PMT Excel formula and insert it by clicking OK.

4. Plug in the information you entered in Step 2.

- Rate = Interest rate

- You dont need to enter anything for Fv or Type.

5. Hit OK.

- Prestothe monthly payment will be displayed in the correct field*. In this example, the monthly payment is $193.33.

If your credit has been negatively impacted by a loan or other credit account, contact our team today to learn more about your options.