Tips For Getting The Best Deal Possible On A Car

Ive been buying cars for clients for years. On average, I negotiate and save $3,100 on each car I buy. Dealerships have outright expressed their disdain for me, and their nasty texts and emails help me to sleep at night like warm tea.

You can read all of my secrets, as well as the best A-to-Z process for buying your first car, in my car buying guide.

In the meantime, here are some of my favorite and most effective tips Ive put together over the years.

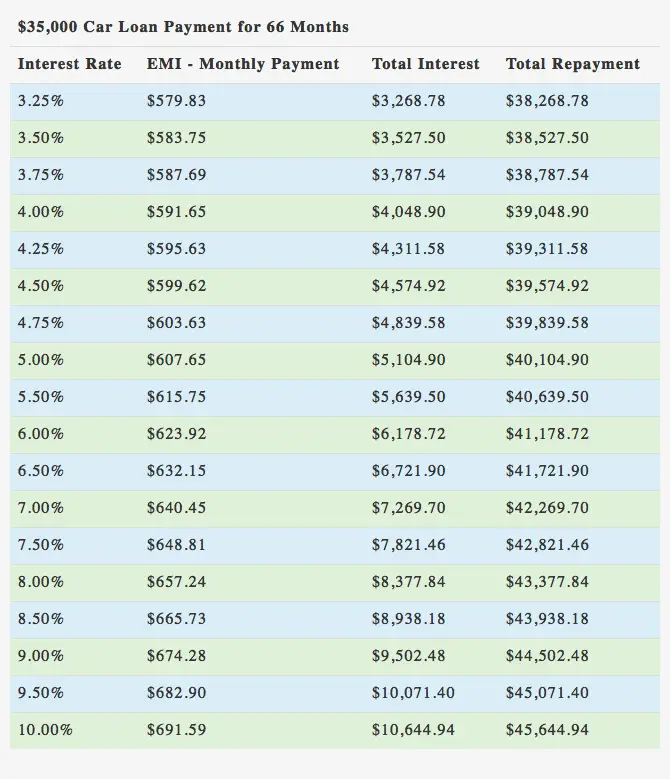

Can You Stretch Out Your Car Loan Term

But dont forget to consider the total cost of owning a car, which can include expenses like auto insurance, fuel and maintenance. And while it may be tempting, avoid stretching out your loan term to bring down your monthly car payment. You could end up paying thousands more in interest over the life of the loan.

Whats The Difference Between Fha And Usda Loans

FHA loans and USDA loans differ in the requirements needed to qualify for the loan. Both are government-backed, but FHA requires a down payment of 3.5 percent, or $3,500 for every $100,000 in your homes sale price, whereas the USDA requires no down payment.

FHA also has no specific location requirements, whereas the USDA loan requires that your residence is in a rural area.

FHA also has more lenient credit score requirements. They dont enforce minimum credit score requirements at all, though lenders typically require a 580 minimum, and you can get an FHA approval without a credit score.

Learn more about FHA loans.

Heres a quick look at the difference in the requirements:

| USDA Loans |

Also Check: Usaa Rv Buying Service

Don’t Miss: Can You Get Bed Bugs In Your Car

What Is A Good Interest Rate On A Car Loan

Currently, under 6% is considered a good interest rate for borrowers with a creditscore in the mid 600s.

If you have an excellent credit score, you may be eligible for lower interest rates ranging from 2 to 3%. Occasionally dealerships may offer a 0% interest car loan as a special promotion.

The interest rates could exceed 10 or 15% if you have a bad credit score. Interest rates are often lower on new cars than on used ones.

In the market for a new car? Our quick and anonymous car loan comparison tool will help you find a match:

Dont Miss: Usaa Rv Loan Terms

Heres Why Your Budget Is Lower Than You Were Hoping

If your reaction to the Car Affordability Calculator was:

Bruh thats it? Thats all I can spend on a car?

Well, you wouldnt be the first to feel that way.

I alsofelt that way back at my first job. Everyone I worked with was driving shiny new Mercedes-Benz and BMWs to work, while my budget calculations said I could only afford a used Mazda, at best.

I was making the same money as them, sowhat gives? Why cant I afford a new Hemi-powered Charger or Lexus crossover like seemingly everyone else on the road?

The reality is that most Americans are driving cars that they cant really afford. For the first quarter of 2022, Edmunds reported that the average new car loan term was a horrifying 70 months, with the average monthly payment reaching $648 for new cars.

This tells us that rather than considering a more affordable car, Americans are pushing out their car loan terms even farther, staying in debt longer, and simply paying way, way too much overall.

Remember, youre sticking to the 35% rule for several reasons:

You May Like: How To Check Tolls On My Car

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

Ways To Increase Your Chances Of Getting A Car Loan

Even if you think youll qualify, these steps can increase your odds of getting a good deal:

Is it easier to get approved for a personal loan?

Not necessarily. Personal loans usually dont require collateral, which is more of a risk to the lender. Thats one of the reasons why they tend to have higher rates and shorter terms than your typical car loan. While you can use a personal loan to buy a car, it might not be your best option.

Read Also: What Size Tires Do I Need For My Car

Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

Organize The Necessary Documents

Gather the following documents before you start your search.

- Personal information, like your name, Social Security number, drivers license, contact information and home address.

- Income, including your employer, its contact information and your annual income.

- The amount you want to finance and the preferred auto loan term.

- Information about the age and mileage of the vehicle if youre buying used.

- Trade-in information, if applicable.

Read Also: How To Get Deep Scratches Out Of Car Windows

The Monthly Payment Trap

Car salespeople like to ask you how much you’re looking to spend per month. Under no circumstances should you answer this question. This effectively gives permission to charge you as much as they want in interest , as long as the monthly payment is within your limit. The price of the vehicle, price of your trade-in, and the interest rate on your loan should be three negotiations.

Determine Your Down Payment

The bigger down payment you can make, the less you have to borrow, the less lenders risk by lending you money. Of course, if you have a big down payment, you can afford a more expensive car, generally.

Lets say your DTI calculation says you can afford a $450 payment.

For a 60-month loan, at 3.11%, not including taxes and interest, thats a $25,000 car.

But, if you have $5,000 to put down, you could afford a $30,000 car. Or, you could get a $20,000 car and have a lower payment every month.

You May Like: Why Is My Car Burning Oil

Business Is Always Personaltm

At Finance of America Mortgage, we dont see customers as numbers and paperwork. For us, doing business is about making human connections. We listen to the people we serve. We find the right mortgage solution for their specific needs. And we help them achieve their dreams of homeownership. Youll see it in everything we do.

©2022 Finance of America Mortgage LLC is licensed nationwide | | NMLS ID # 1071 | 1 West Elm Street, Suite 450, Conshohocken, PA 19428 | 355-5626 | AZ Mortgage Banker License #0910184 | Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act | Georgia Residential Mortgage Licensee #15499 | Kansas Licensed Mortgage Company | Licensed by the N.J. Department of Banking and Insurance | Licensed Mortgage Banker NYS Banking Department | Rhode Island Licensed Lender | Massachusetts Lender/Broker License MC1071. For licensing information go to: www.nmlsconsumeraccess.org

Loans made or arranged pursuant to a California Finance Lenders Law license.

A preapproval is not a loan approval, rate lock, guarantee or commitment to lend. An underwriter must review and approve a complete loan application after you are preapproved in order to obtain financing.

This information is provided by Finance of America Mortgage. Any materials were not provided by HUD or FHA. It has not been approved by FHA or any Government Agency.

Complaints? Email us at

How Much Of A Car Loan Can I Get With A 700 Credit Score

A 700 credit score puts you firmly in the prime range of credit scores, meaning you can get a competitive rate as long as you shop around, have good income, and have a solid debt-to-income ratio. A 700 credit score gets an average car loan interest rate of 3% to 6% for new cars and 5% to 9% for used cars.

Don’t Miss: What Is The Cheapest New Car To Buy

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

Make Loan Payments On Time

Credit scoring models take into account how reliably you pay all your bills, including auto loans. In fact, payment history is the most important factor in determining credit scores. By paying your car loan on time every month, you can help build positive credit history.

What’s more, when you finish repaying the loan, the lender will report the account as closed and paid in full to credit bureaus, and that will remain on your credit report and benefit your credit for 10 years from the closed date. That paid-up loan tells future lenders you know how to manage credit and repay your debts.

However, paying late or missing payments altogether can hurt your credit scores and make it harder to get credit in the future. Late or missed payments appear as negative information on credit reports, and remain for seven years. On the positive side, as the late payment ages over time, the less impact it will have on your credit score.

Missing too many payments may cause the lender to turn your debt over to collections or even repossess your vehicle. Both collections and repossessions remain on credit reports for seven years from the initial date of delinquency, and can negatively affect credit scores throughout that time.

You May Like: How To Junk A Car

Applying For The Car Loan

When you secure a car loan, the lender agrees to lend you the purchase price of the vehicle, and you agree to repay that principal with interest over a set period of months. It’s important to understand that the finance company technically owns the car until you pay off the loan.

As you’re applying for a car loan, you’ll encounter some important financial terms, including:

How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. Weve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

Dont Miss: What Loan Options Are Strongly Recommended For First Time Buyers

Don’t Miss: How To Charge Electric Car At Home

Why Is My Amount So Low

Cars may be necessary transportation, but their quick depreciation means spending more than you have to on a car is a fast way to make your hard-earned money disappear unnecessarily.

A bank or car dealer will likely approve you for much more than your result on our calculator. But what the dealer says you can afford and what you can actually afford are very different. Remember, if you stop paying your car loan, the bank repossesses the car. Either way, they win.

The result of our car affordability calculator shows you a sensible amount to spend on a car. And yes, it might be far lower than you might think. But remember that the more money you spend on a car, the less money you have available for everything else housing, food, travel, entertainment, paying off debt, and saving.

Your car is one of your largest monthly expenses the lower you can keep that expense, the faster youll be able to build wealth in other areas.

How Your Car Payment Can Keep You From Qualifying For A Mortgage

Under the above illustration, youd qualify for a house that costs $61,000 . Do you see the problem?

Its simple. There are very few places left in the United States where you can buy a house for $61,000. As of March 2020, the median sale price was $248,857, according to Zillow. A stiff car payment could be holding you back from qualifying for a larger mortgage. Without it, youd qualify for a mortgage payment of $1,565 per month . $1,565 minus property taxes, homeowners insurance, and private mortgage insurance, leaves $1,074 per month toward principal and interest payments. That means youd qualify for a house that costs approximately $169,000, which is much closer to the national median sales price.

Recommended Reading: Do Puppies Get Car Sick

What Do You Need To Get Pre

Lenders often ask for information about your income, credit history, employment and other debt payments when reviewing your pre-approval application. If you plan on financing with NMAC, don’t forget to bring the required documents with you. You can get a head start on the Nissan pre-approval process online.The requirements are:

- Be 18 years of age or older

- Have a valid Social Security Number

- Be a legal resident of the US

- Have verifiable income and/or employment

- Have an e-mail address

How Much Car Can I Afford

Fitting a car into your household budget is no easy task, and financial experts do not agree on how to determine its affordability. One school of thought holds that all your automotive expenses gas, insurance, car payments should not exceed 20% of your pretax monthly income. Other experts say that a vehicle that costs roughly half of your annual take-home pay will be affordable. Then some frugal personal-finance gurus say you should spend no more than 10%-15% of your annual income on a vehicle purchase. Pretax, post-tax, annual income these terms are enough to make a person ask: “How much car can I afford?”

There’s no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home pay. If you’re leasing or buying used, it should be no more than 10%. The reason for finding a vehicle that falls below 10%-15% is that the payment isn’t the totality of what you will be spending. You’ll need to factor in the costs of fuel and insurance, and many people overlook that. We put those costs at another 7% of your take-home pay. So, all in, you’re looking at a total budget that is ideally, no more than 20% of your monthly take-home pay.

While the 10%-15% rule may not work for everyone, it’s a good starting point for finding a target price that won’t leave you scrambling to pay your bills every month. Here’s how you can get a more customized number for yourself.

Recommended Reading: What Car Companies Own Who