Factor In Your Vehicle Expenses

Youll need gas to get from A to B, and youre also going need auto insurance to protect it. Youll also need to set aside some money for oil changes, tune-ups and other regular maintenance work.

According to a AAA report on the cost of owning a vehicle in 2017, the average new vehicle will cost you nearly $8,500 annually for the car payment, insurance, maintenance costs and gas. Thats about $706 per month.

Heres a breakdown of those car ownership expenses:

License, registration and taxes: $753 annually, which comes to roughly $63 per month

Maintenance and repair: $1,200 annually, or $100 per month

Fuel: $1,500 annually, or $125 per month

Full-coverage insurance: $1,194 annually, or $100 per month

Next Steps: Identify Cars Within Your Budget

Establishing an auto budget is an important first step in the car-buying process. Once youve landed on a number youre comfortable with, you can move on to identifying makes and models within your price range before heading to the dealership.

Check out our guides to buying a new car or used car for tips on finding a car and financing that fits your needs.

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

Don’t Miss: Transport Puppy In Car

How Much Money Should You Spend On A Car Based On Your Salary

The rule of thumb among many car-buying experts dictates that your car payment should total no more than 15% of your monthly net income, sometimes called your take-home pay . Your net income is the money you take home after federal, state and local income taxes have been deducted from your paycheck.

Note that this 15% is meant to cover just your car loan payment, and not ongoing car-related expenses like fuel, maintenance and insurance.

The idea behind the so-called 15% rule is that if you limit your monthly car loan payment sometimes called a car note to 15% or less of your net income, youll have enough money left over each month to cover the rest of lifes expenses, including the occasional financial curveball.

The Frugal Rule: 10% Of Income

For many people, I think that will be between 1015% of your income. So if you earn $25,000 a year, thats going to be a high-mileage used car for $2,500$3,000. If you earn $80,000, thats a used car for around $10,000 or $12,000. .

So heres the thing: Im not that frugal. I know thats weird coming from a personal finance blogger, but Ive always been honest about the fact that Im more of a natural-born spender than saver. Ive checked myself in a lot of ways and become better at making frugal decisions, but I dont have that driving passion for spending as little as I can at every turn .

I also value cars: I enjoy driving and taking care of vehicles, so Im willing to spend a bit morewithout going crazyon my vehicles.

Also Check: How To Connect A Car Amp In Your House

Wise Shoppers Buy Used Cars

Its OK to go against the crowd, to be sensible, and to make the wise choice of a pre-owned or used vehicle. Check out Consumerreports.org for their used car reviews and consider something 1-2 years old. The insurance will be cheaper, and the car will most likely still be under warranty. And most of all, you will miss the first year or two of depreciation. Edmunds.com is also a good place to do some used car research.

Put At Least 20% Down

According to Edmunds, a new car loses 9% of its value the second you drive it off the lot. By the end of the first year, its lost 19%. If you put less than 20% down, you risk becoming underwater on your car loan meaning you owe more on the car than its worth almost immediately.

If you need to sell the car before the loans paid off, youll have to come up with the difference between the cars value and the balance on your car loan. Ditto if you get into an accident and the car gets totaled.

Don’t Miss: Repair Clear Coat Peeling

How Much Car Can I Afford

Fitting a car into your household budget is no easy task, and financial experts do not agree on how to determine its affordability. One school of thought holds that all your automotive expenses gas, insurance, car payments should not exceed 20% of your pretax monthly income. Other experts say that a vehicle that costs roughly half of your annual take-home pay will be affordable. Then some frugal personal-finance gurus say you should spend no more than 10%-15% of your annual income on a vehicle purchase. Pretax, post-tax, annual income these terms are enough to make a person ask: “How much car can I afford?”

There’s no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home pay. If you’re leasing or buying used, it should be no more than 10%. The reason for finding a vehicle that falls below 10%-15% is that the payment isn’t the totality of what you will be spending. You’ll need to factor in the costs of fuel and insurance, and many people overlook that. We put those costs at another 7% of your take-home pay. So, all in, you’re looking at a total budget that is ideally, no more than 20% of your monthly take-home pay.

While the 10%-15% rule may not work for everyone, it’s a good starting point for finding a target price that won’t leave you scrambling to pay your bills every month. Here’s how you can get a more customized number for yourself.

Who Can Afford A New Car

Many buyers fret over the process of buying a new car, but you dont have to. Buying a new car can be a very exciting process! The most important thing to do, before you begin your car buying journey, is determine how much you have to work with.

If you craft a budget and stick to it, a budget that can accommodate a new car, the answer could be you!

Recommended Reading: Changing Car Interior Color

The Downpayment On Your Car Should Be At Least 20% Of The Purchase Price

If you put any less down, you could be paying more than what the car is worth by the end of the year, it is also known as negative equity. According to Edmunds, a car depreciates in value by 9% as soon as you drive it off the lot. By the end of the year, that same car has lost about 19% of its value.

Think about it, if you buy a $20,000 car with 0% down by the end of the first year your car is worth $16,200 through depreciation. However, assuming 4% annual percentage rate interest on a 5-year loan youâre paying about $370 per month your remaining amount owing is roughly $15,560, but this amount does not include applicable taxes, fees, and finance charges of the loan itself.

However, If you put 20% down, your car payments are $295 per month and your remaining amount owing is $12,460 . Still. you owe less, youâre paying less per month, and youâre nearly halfway to paying off the car completely.

A lower monthly payment makes affording gas, maintenance, and auto insurance a little easier on the pocketbook.

And If You Really Love Cars

To all you personal finance blog regulars out there, this probably sounds good so far. If this is your first time here , you might be thinking, These people are so cheap! Thats crazy. Theres no way I can get a car I want for that money!

To you, I would say: Ask yourself why youre saying that. Is it because youre a car guy and you value your car most out of all your possessions? Or is it because youve simply been conditioned by our culture, advertising, and car salespeople to think that you should buy a brand new car and that theres nothing wrong with spending a years worth of paychecks on a car?

If its the formerthat you love carscool. Theres nothing wrong with intentional spending on the things you value most. By intentional spending, I mean spending moneymaybe more than other people would think is sensibleon things that interest you.

So if you value your car, I dont see anything wrong with spending more than we recommend for most people, perhaps up to 50% of your income on a car. Chances areas a car personyoull care for the car more, enjoy it more, and get more money for it when you sell it than the average car owner. Again, you just have to remember that because the car will be a large expense, youll have to be extra vigilant about other expenses.

Don’t Miss: Which Of The Following Affects One’s Car Insurance Premium Apex

How To Calculate How Much Car You Can Afford

Our financial calculators are provided as a free service to our members. The information supplied by these calculators is from various sources based on calculations we believe to be reliable regarding their accuracy or applicability to your specific circumstances. All examples are hypothetical and are for illustrative purposes, and are not intended to provide investment advice. TDECU does not accept any liability for loss or damage whatsoever, which may be attributable to the reliance on and use of the calculators. Use of any calculator constitutes acceptance of the terms of this agreement. TDECU recommends you to find a qualified professional for advice with regard to your personal finance issues.

- Routing Number: 313185515

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Recommended Reading: What Commission Do Car Salesmen Make

How Much Car Can I Really Afford

Got your eye on a brand-new ride? Exciting, isnt it? Shopping for the vehicle of your dreams can be an exhilarating experience. Theres just something about that new car smell that revs up the engines and puts you in a buying mood. But getting caught up in the moment can make it easy to overspend. So before you fork over your hard-earned cash, take some time to think about what you can realistically afford.

Dont worry. Budgets dont have to be a bummer. With a little homework and some basic number crunching, you can get the car you want without emptying your pockets.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Read Also: How To Fix Cigarette Burns In Car

The Term Of Your Car Loan Should Be No More Than Four Years

The longer the term of your loan, the more interest you pay. The longer your loan term, the longer youll have to meet your lenders insurance requirements, which often means higher rates.

Plus, by the end of four years, your car will have lost a lot of its value, and you wont want to still be paying it off.

Four years is the maximum most personal finance experts recommend. If you can swing paying off your car in three years, thats even better. If you feel you absolutely must stretch your payments further, you could get a five-year loan, but never longer.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Recommended Reading: How To Test A Car Amp In The House

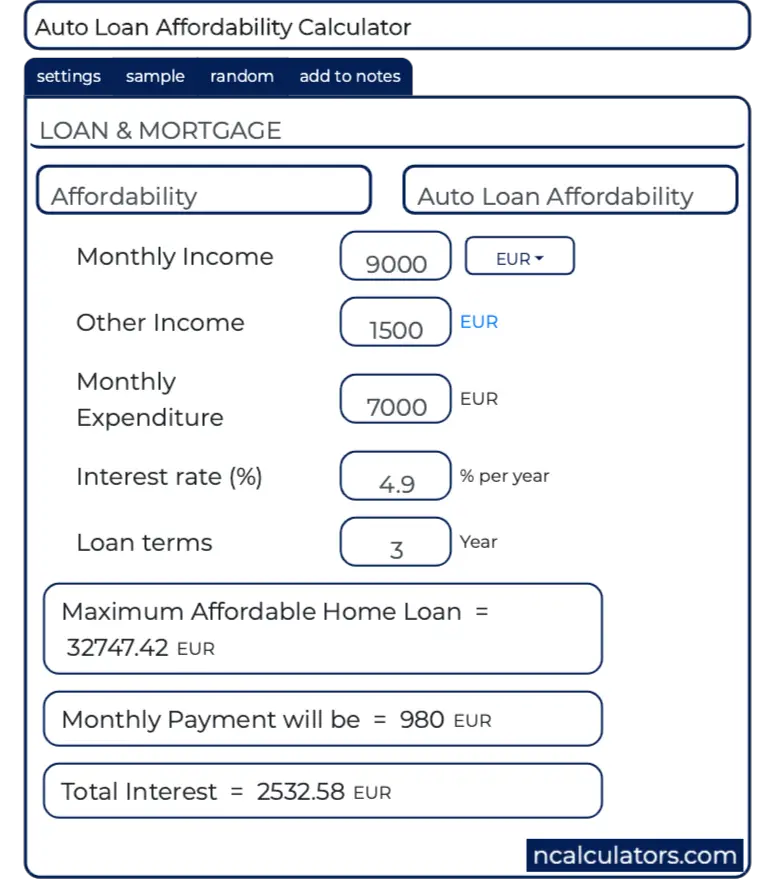

How To Use Our Car Affordability Calculator

Are you curious how much you can spend on a car? Try our car affordability calculator and find out. Using the calculator is simpler then you think.

All you need to do is to provide some basic information:

- Monthly payment you can afford is a maximum amount you can spend on a car loan each month. When establishing this value remember the rule of one third, which we presented in the previous section.

- Money you have is money you have and can spend on a car .

- Current car trade-in value is a value of your current car .

- Interest rate is the cost of a car loan (in our calculator it should be provided on a yearly basis â APY.

- Loan term is the term of your car loan. We suggest it to be no longer than 48 months.

- Sales tax is the car sales tax rate. It is different in each state .

After you fill in the last field, our car affordability calculator will immediately show you your results. The most interesting value is the maximum car value. It informs you what the upper limit of value is that you can afford to spend on a new car.

The car loan affordability calculator will also estimate the loan amount which is calculated on the basis of the monthly payment you can afford. Moreover, it will also compute the total sum of interest paid and the total value of sales tax .

Shop For Car Insurance

Keeping your monthly payment under 10% of your gross income is the most important thing. Thats whats going to keep you from feeling pinched and stretched. Here are some of the top insurance providers on the market today that are operating in your local area. Find the policy that best suits your needs.

If you prefer to work with an agent, can help you save money. If youre an excellent driver, this insurer may be a great option for you. Sign up for Drivewise and earn as much as 25% back for every six months you go without an accident.

Those who have multiple types of insurance may want to look at . You can save big by bundling your auto policy with your renters, homeowners, or condo insurance. Their website makes it easy to get a quick quote to find out if you can save money by switching to them.

Related: Tips for Saving on Your Car Loan

You May Like: My Car Makes A Grinding Noise When I Accelerate

Get An Initial Figure By Using A Car Loan Calculator

The interest rate you receive on an auto loan plays a big part in calculating your monthly payment amount. A higher credit score will score you a lower interest rate, which will ultimately lower your monthly payment and your total overall loan cost.

You can use a car loan calculator to determine how different interest rates will affect your monthly payment. Heres how:

- Pull a copy of your credit report and find out your .

- Get prequalified with a few lenders to determine the average interest rate you could be offered.

- Plug in your interest rate, desired repayment term length and car price to the calculator.