How Does Auto Theft Affect Your Insurance Costs

Auto theft can affect how much you pay for insurance. It costs drivers, companies and the government millions of dollars annually. Your insurance is impacted by many factors such as :

How Does Gap Or Shortfall Occur

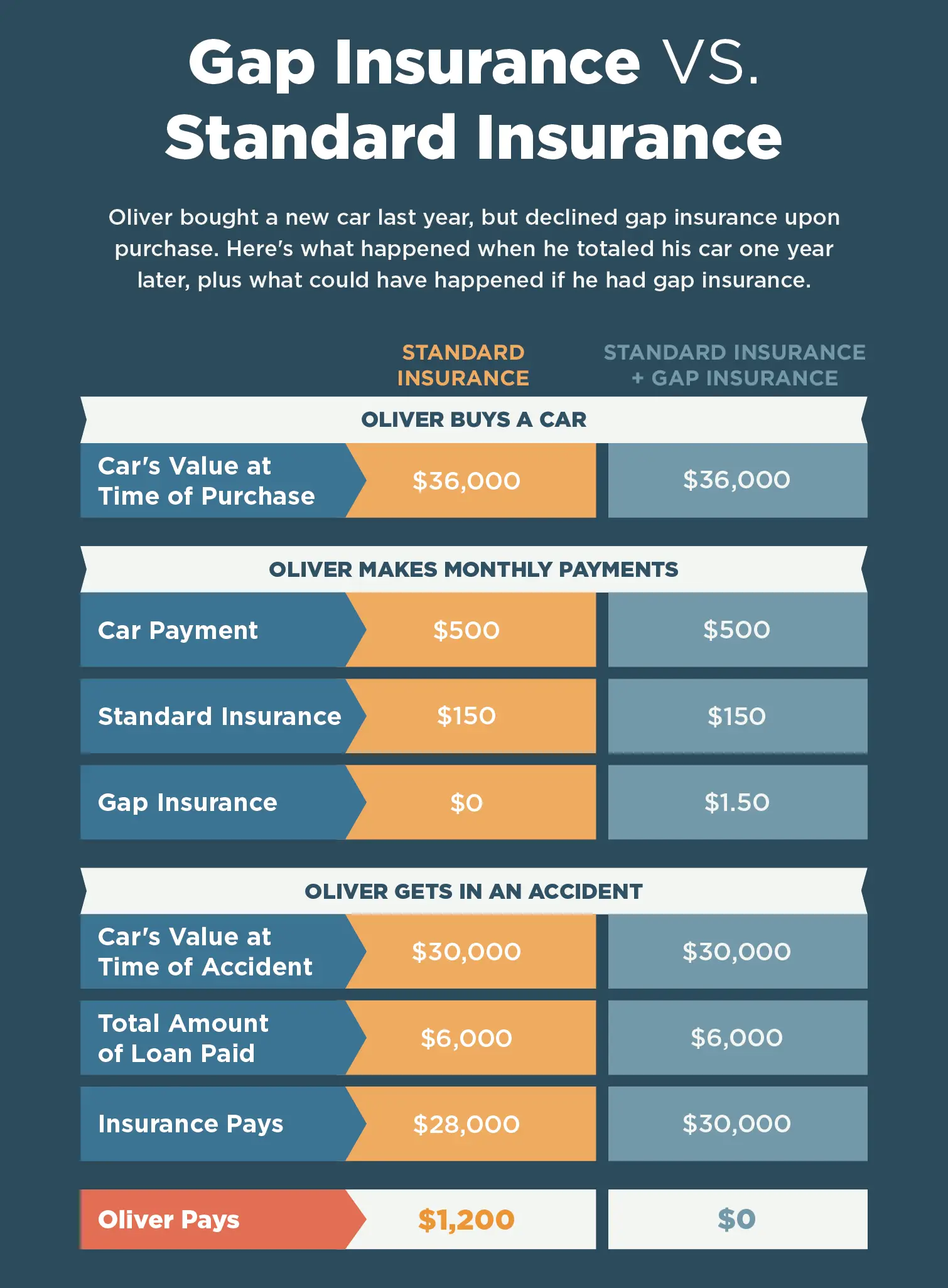

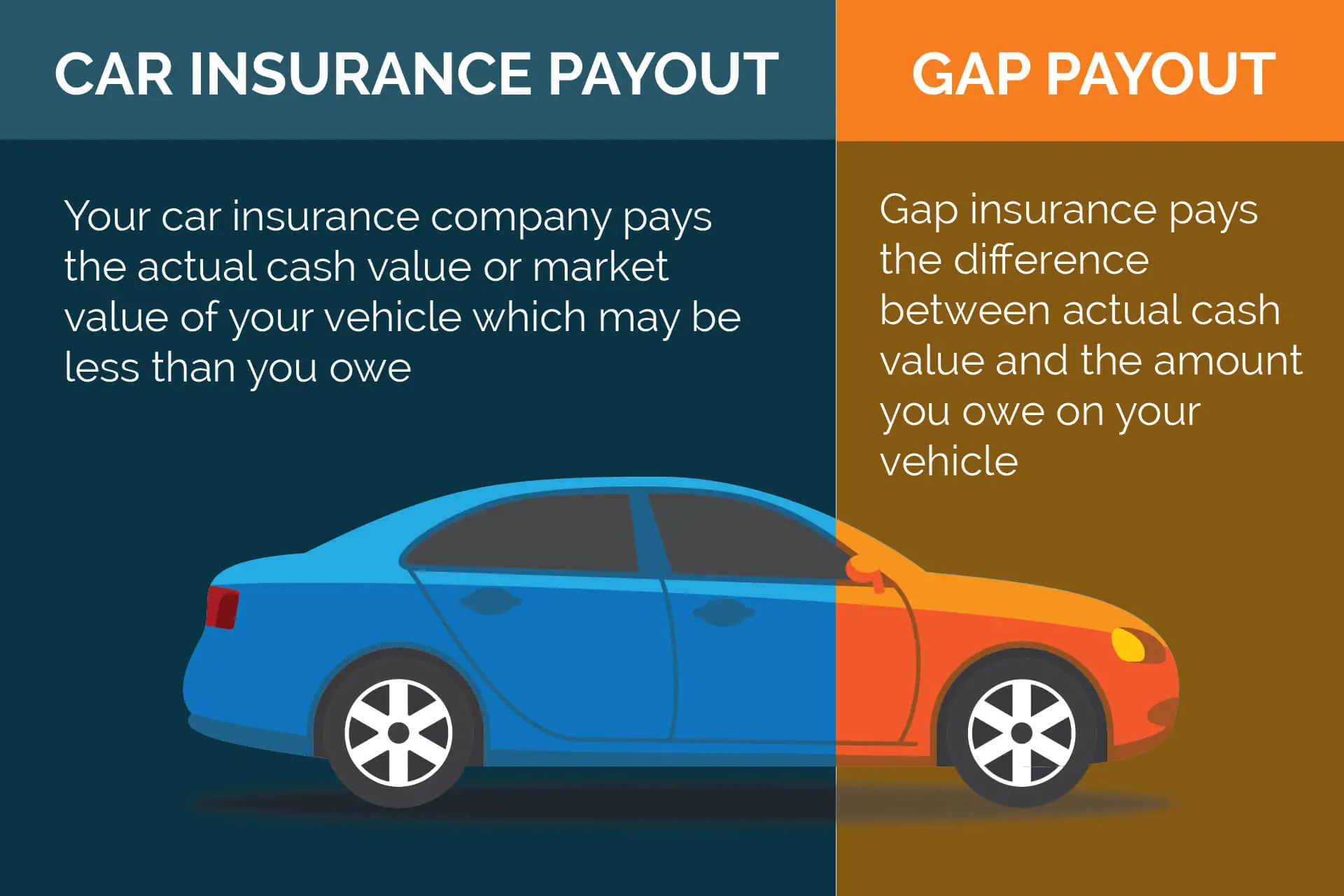

If your vehicle is written-off while your loan is still active, your financier will still require that you payout the remainder of your car loan. Your comprehensive car insurance policy will cover you for an amount at the time of the loss.

If the payout from your insurer is less than the financed amount owing, this creates a gap or shortfall. A GAP insurance or shortfall insurance policy will cover the gap.

The amount of the gap can be large because the value of your car often depreciates faster than the loan is paid out.

Benefits Of Financing A Car

- Ownership of the car;

- No more monthly payments after the loan is paid off

- Can sell or trade-in the car for equity

- No kilometer restrictions;

- Can drive the car long term

The biggest benefit to financing a car is that youll actually own the vehicle after the loan is paid off, and you wont need to worry about setting aside this money for month-to-month payments anymore. This also allows you to customize your ride freely, and sell or trade-in your vehicle for cash when needed. You can also drive as much as youd like and keep the car until it dies.;

Recommended Reading: Who Is The Best Home Insurance Company

Also Check: How To Clean Dirty Leather Car Seats

Where To Buy Gap Insurance In New York

Gap insurance is not offered through a typical insurance package. It must either be added on to an existing policy or purchased separately. Many gap insurance providers offer it as an add-on, but some dont. While youre searching for it, remember that gap insurance companies also call it loan/lease coverage. However, the coverage works the same under either name.

Buying gap insurance is also possible through most dealerships. However, when you do this, its often put onto the loan itself, which means youll pay interest on it. Unless offered as a standalone option, meaning you just pay for it upfront, purchasing gap insurance through a dealership may not always be your best option.

Driving Without Insurance On A Financed Car Is Possible But Very Risky

Every car owner knows that paying for and maintaining a vehicle is expensive. If you are financing a vehicle on a tight budget, you may wonder whether you can drive it without auto insurance, but we dont recommend driving with no insurance on a financed car.;

In this article, well explain the insurance requirements that keep you secure in your financed vehicle, and what you can do if you cant afford your insurance premium.

If youre looking for new car insurance, use our tool below or call;;to compare quotes from the best auto insurance providers.

Also Check: How To Remove Scratches From A Car

How Much Is Gap Insurance

You can get gap insurance from a few places primarily the dealership or lender that is financing your car, or directly from an auto insurance provider. Gap coverage is typically more expensive if you get it from the dealership or lender versus adding it to your car insurance policy.

That said, a few factors may impact your gap insurance cost. Your insurer will likely consider several factors, including your vehicles actual cash value , geographic location, age and auto insurance claims history. Ask your auto insurer if it offers gap insurance and how much it would cost based on your situation to understand if gap insurance is the right financial protection for you.

How Much Does Insurance Cost On A Financed Car

Since operating a financed car often requires full coverage auto insurance, the insurance cost is relatively pricey.

Your financed cars insurance cost depends on a variety of factors including your age, gender, and driving record. According to a 2019 AAA study, the average cost for full coverage insurance on a medium-size sedan was $1,251 per year.

As with all types of car insurance, higher deductibles are associated with lower premium costs.

So, if you would like a lower premium and you are confident that you could afford a roughly $1,000 deductible in case of an accident, you might consider requesting a higher car insurance deductible from your chosen car insurance provider.

Read Also: Can I Register My Car Online Florida

Do You Need Gap Insurance

You may have heard the term “upside-down” in reference to a home mortgage debt. The concept is the same whether the item financed is a house or a car: The thing financed is currently worth less than the balance of the loan that was taken out to acquire it.

This isn’t as dire as it sounds. If you put only a little money down on a purchase and pay the rest in small monthly installments spread over five years or more, you don’t immediately own much of that house or car free and clear. As you pay down the principal, your ownership share expands and your debt shrinks.

Gap insurance at least covers the shortfall so you’re not on the hook if the car is wrecked.

What Is A Totaled Car

A “totaled” car is one that a car insurance company decides is a “total loss.” Most states set a threshold for when an insurer must total a car. For example, state law might require an insurer to total a car when the cost to repair it is more than 75% of the car’s ACV. In another state, the threshold might be as high as 100% or as low as 50%. In states that don’t set a threshold, insurance companies typically weigh the cost to repair and salvage a car against the car’s ACV.

For example, let’s say you crash your car into a tree. Fortunately, you aren’t hurt, but your car is pretty messed up. Your mechanic estimates that it’ll cost $8,500 to fix. Your insurance company says your car’s ACV is $10,000. If the total loss formula in your state is set at 75%, your insurer will total your car because it’ll cost more than $7,500 to repair. But if a mechanic can fix your car for $5,000, your insurance company will likely reimburse you for the cost to repair it.

Get the basics on car insurance and repair options after an accident.

Read Also: How To Replace A Car Key

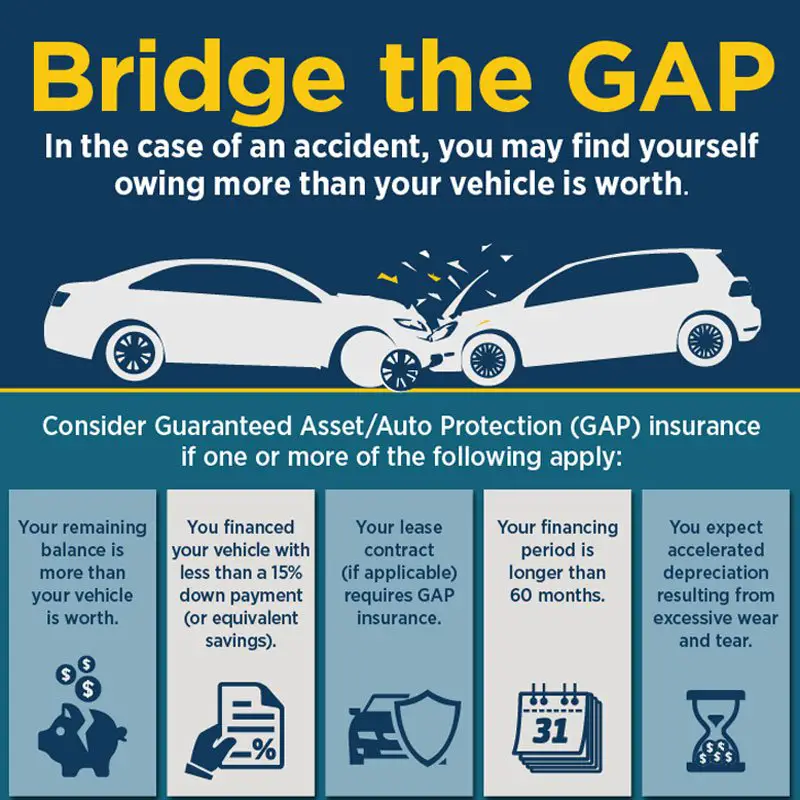

When You Might Need Gap Insurance

Its a good idea to consider buying gap insurance for your new car or truck purchase if you:

- Made less than a 20 percent down payment

- Financed for 60 months or longer

- Leased the vehicle

- Purchased a vehicle that depreciates faster than the average

- Rolled over negative equity from an old car loan into the new loan

How Do Insurance Companies Decide To Total A Car

Gap insurance will kick in when your car is declared totaled, but the definition of a totaled car varies from state to state. Many states set a percentage of a cars value as a threshold, and a car is considered totaled if the cost of repairs exceeds that percentage. Repair costs generally include both parts and labor.

Some states specify using NADAguides for determining the value of your car. Other states specify only that car value should come from a current edition of a nationally recognized compilation of values, including databases.

Other states use whats called a total loss formula . For example, in California the TLF is Cost of Repair + Salvage Value Actual Cash Value. If the sum of cost of repair and salvage value is greater than the ACV, then your car is considered a total loss.

You can find your states method for declaring total losses in the chart below.

| State |

|---|

Don’t Miss: When Was My Car Manufactured

Cars Lose Value Quickly

It is commonly said that cars are one of the worst investments. ;And for good reason. ;The moment you drive a car off the lot, it becomes used. ; You instantly devalue your car.

But what if you keep your cute new Civic for 5 years while youre paying it off? ;It was worth $18,702 new. ;By the end of the 5 years, you have paid $19,680 to the bank + your $2,056 down payment. ;So you paid $21,736 all in. ;Now that youre no longer a slave to the bank, you want to sell the car. ;What is it worth now?

Per Kelley Blue Book, most cars lose about 60% of their value in 5 years. ;If that was true of this car, your car would now be worth $7,480.80. ;Thats about 1/3 of what you paid for it.

Is it worth it? ;I think not.

How To Shop Around For Gap Insurance

As with standard car insurance, you can compare Gap insurance policies online to find the cheapest deal for you.

Whatever policy you choose, grasp the key features before you buy. The following are just some of the important elements you should look out for:

- Length of the policy

- The value of your vehicle

- How to claim on your policy

- How to cancel your policy if you no longer need it ;

Our cost comparison figures below show just how much you can save by shopping around.

Recommended Reading: Which Credit Cards Offer Rental Car Insurance

If I Bought My Car Outright Do I Need Gap Insurance

There’s no reason to buy this coverage if you bought a car with cash and own it without a loan. It is for when you owe more than the value of your vehicle. If you have the car paid off and its no longer financed, you dont owe anymore more than the car is worth, and so there would be no payout from gap coverage.

If The Other Driver Is At Fault

Let’s say a car rear-ends you at a stoplight. If the other driver is at fault for the accident, you might be able to file a claim with that driver’s insurance company . This is called a “third-party insurance claim.” Whether you’re dealing with the other driver’s insurance company or your own, an insurer will only pay out the ACV for a totaled car.

Recommended Reading: What To Do After A Car Accident Injury

How To Complain About Your Insurance Provider

The insurance industry doesn’t have the best customer-service reputation and while a provider may be good for some, it can be hell for others. Common problems include claims either not being paid out on time or at all, unfair charges, or exclusions being hidden in small print. It’s always worth trying to call your provider first, but, if not, then

Free tool to help you complain

This tool helps you draft and manage your complaint. It’s totally free to use, and it’s offered by Resolver, a firm we work with to help people get complaints justice.

Does Gap Insurance Cover Theft

Yes, gap insurance covers your car if its stolen and not recovered. It works with your comprehensive insurance to cover theft. Comprehensive will pay out up to the actual cash value of your car, minus your deductible if your car is stolen. This coverage would then pay the difference between that amount and what you owe on your loan.

Don’t Miss: Car Shakes When Idle And Accelerating

Is Gap Insurance Necessary & Required By Law

While you need gap insurance if you owe more on a vehicle than its value, gap coverage isnt required by any state as part of your car insurance policy.

Gap insurance coverage is optional coverage; however, its not uncommon for lease contracts to have gap insurance included in them. Sometimes it’s referred to as auto loan/lease coverage or loan/lease payoff coverage.

If a lender of leased cars requires gap insurance, they must include it within the lease’s cost itself. This means that the monthly price quoted by the dealer must include gap coverage when they mandate you carry it.

There are some financial institutions that may want you to have gap coverage as part of your auto insurance policy on the car you’re purchasing. If this is the case, your loan or lease papers should note this.

If you have declined gap insurance, a dealer shouldnt be able to add it on to your loan amount or charge you for it in another way. Even though it may be helpful if you owe more on the vehicle then its ACV and were to be in an accident, you should have the right to turn down this coverage and thus not be charged for it.

For example, the California Car Buyers Bill of Rights requires disclosure of the price of items commonly packed into loans, such as theft etching on windows and other car parts, gap insurance or extended service contracts.

Which Companies Offer Gap

These auto insurance companies offer stand-alone GAP insurance as standard policy add-ons:

- American Family

- Nationwide Insurance

- Travelers

Other insurance companies sell GAP coverage that is not part of an auto policy. If you finance your car directly through the insurer’s bank, you may be able to get coverage as part of your loan or lease agreement from:

- AAA

- USAA

Also Check: When Do I Get My Car Title

When Is Gap Insurance Is Needed

We think Gap insurance can be useful and is therefore worth thinking about – but it wont make sense for everyone.

Generally speaking, Gap is likely to be worthwhile in the following situations:

- You used a large loan to buy your vehicle

Gap insurance can offer a means of paying off outstanding finance on your car, which means if your cars stolen or damaged beyond repair you wont have to continue to make payments on it.;

- Youre concerned about the depreciation of your vehicle

The quicker your car loses its value, the less your insurer will pay after a total loss incident, compared to what you paid for it. Gap insurance means youll get more back.

- Your car is on a long-term lease

If you have a long-term rental agreement for a vehicle with a mileage allowance, a write-off could leave you without a car and a bill for thousands of pounds. Gap insurance can help protect against this.

Gap Insurance Covers What’s Owed On A Car After A Total Loss

Gap insurance supplements the payout you get from collision and comprehensive coverage if your car is totaled or stolen. Lenders typically require that you buy collision and comprehensive coverage for the length of your lease or loan, so youll typically need both to purchase gap insurance.

Comprehensive and collision insurance pay only what a car is worth at the time of a theft or accident. When you owe more on your car loan or lease than that, gap insurance comes to the rescue.

Although rare, some gap insurance can also cover your comprehensive or collision deductible, the amount subtracted from a claim payout.

Read Also: How To Lower My Car Payment

If You Have Insurance

Most lenders make you get car insurance when you finance a car. But the coverage your lender requires might not be enough when your car is totaled. Why? Because insurance companies don’t care about how much you owe on your loan. They only pay out for your car’s ACV at the time of the accident. Cars depreciate , so your insurance settlement might be thousands of dollars less than what you owe on your loan.

For example, let’s say you spin out and hit a stop sign. Your car is totaled. The insurance company says your car’s ACV is $8,000, but you still owe $10,000 on your loan. The insurer will cut your lender a check for $8,000. You still have to pay the remaining $2,000 on your loan, even though your car is wrecked. .

If your car’s ACV is more than you owe on your loan, the insurer will pay off your loan first and you will get to keep the rest of the settlement check. For example, if your car’s ACV is $8,000 and you owe $2,000, the insurer will pay your lender $2,000 and you $6,000.

For tips on what to do if you disagree with the insurer’s valuation of your car, check out The Insurance Company Says My Car is a Total Loss — What Now?

Who Needs Car Gap Insurance

A new car is typically the second-most expensive purchase most people will make. The average new vehicle loan is $34,635 with a loan term of 70 months. So, car gap insurance is a good choice for most new car owners. It is an especially wise choice for those who pay less than 20% down on a new vehicle.

It is not necessary to carry gap insurance for the life of the vehicle or the life of the loan. Gap insurance should only be maintained until the loan balance no longer exceeds the vehicles value.

You May Like: What To Wash Car With

What Isn’t Covered By Gap Auto Insurance

Gap insurance usually wont pay for:

- Overdue lease/loan payments

- Costs for extended warranties, credit life insurance or other insurance purchased with the loan or lease

- Carry-over balances from previous loans or leases

- Financial penalties imposed under a lease for excessive use

- Security deposits not refunded by the lessor

- Amounts deducted by the primary insurer for wear and tear, prior damage, towing and storage

- Equipment added to the car by the buyer, meaning that only factory-installed equipment is covered

- Mechanical issues, such as engine or transmission failures, or any other car problems that are not losses covered by your car insurance policy