How Do I Calculate The Depreciation

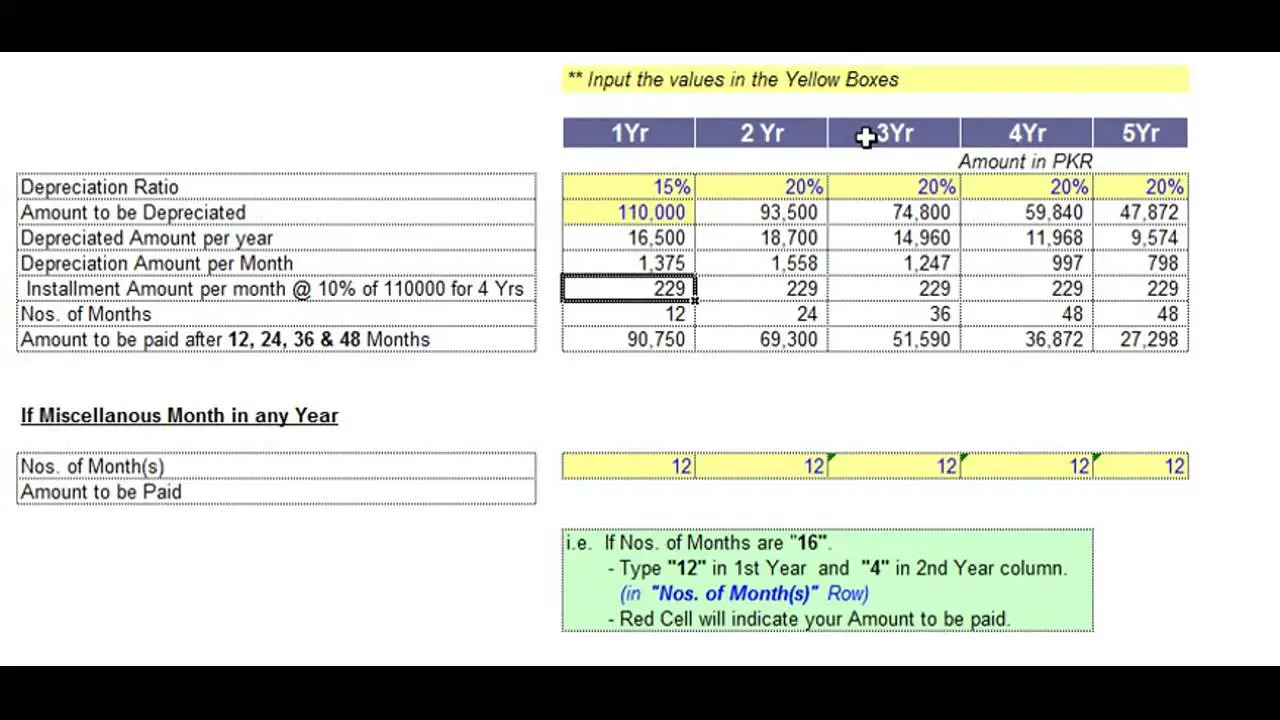

You compare the information on your car or motorcycle with the information on comparable cars and motorcycles registered in the Netherlands before in the pricelist. Then you take the actual value of the car or motorcycle at the date of registration in the Netherlands. You compare this value to the sales value in the Netherlands of the same car or motorcycle which was applicable when the vehicle was first put into use. Then you calculate an actual depreciation rate. You deduct this depreciation rate from the calculated gross amount of bpm. You must indicate the amount produced by this calculation.

Calculation Of Bpm To Be Paid

- Depreciation: purchase price purchase value according to the price list = 31,346 13,300 = 18,046

- Depreciation percentage: depreciation / = 18,046 / = 57.58%

- Bpm payable over the CO2 emission: x 124) + 1,938 = x 124) + 1,938 = 4,914

- Bpm based on CO2 emission : 4,914

- Diesel surcharge : 140 80 x 79.82 = 4,729

- Gross bpm : 9,643

- Bpm to be paid: / 100) x gross bpm = / 100) x 9,643 = 4,090

Why Does Fuel Economy Factor Into Depreciation

Fuel mileage isnt a direct component of factoring depreciation, but it has a place in this conversation. If you drive a vehicle that uses a lot more gas, youll only attract buyers that dont care about fuel mileage. Currently, were in a market where gas prices are sky high, and people are looking for ways to save on gas. If youve got a small hybrid or relatively efficient model to sell, youll have a much easier time selling it at the right price than you would a large pickup truck.

Don’t Miss: How Much Money Do Car Salesmen Make A Year

Car Depreciation By Brand And Model

Depreciation is the most influential factor in the long-term value and total cost of ownership of your car. But some cars hold their value better in the long run.

According to J.D. Power, the best brands for car depreciation in 2022 are Toyota, Chevrolet, Lexus, GMC, Mercedes-Benz and Subaru. These car brands were projected to have the highest percentage value of the original MSRP after a 3 or 4-year period.

Here are some of the slowest depreciating cars in 2020 according to the Canadian Black Book:

| Compact Car |

| Ford Focus |

Introduction To Car Depreciation

The purchase of a car is a big deal for most people. Its a huge investment for starters, and a major responsibility. Cars require regular maintenance. Because if you do not take proper care of your car, it will wear and tear very quickly and you might have to face a lot of problems on the road. Moreover, if you ever wish to sell your car, or are in the market for a second-hand vehicle, the factor of car depreciation matters also.

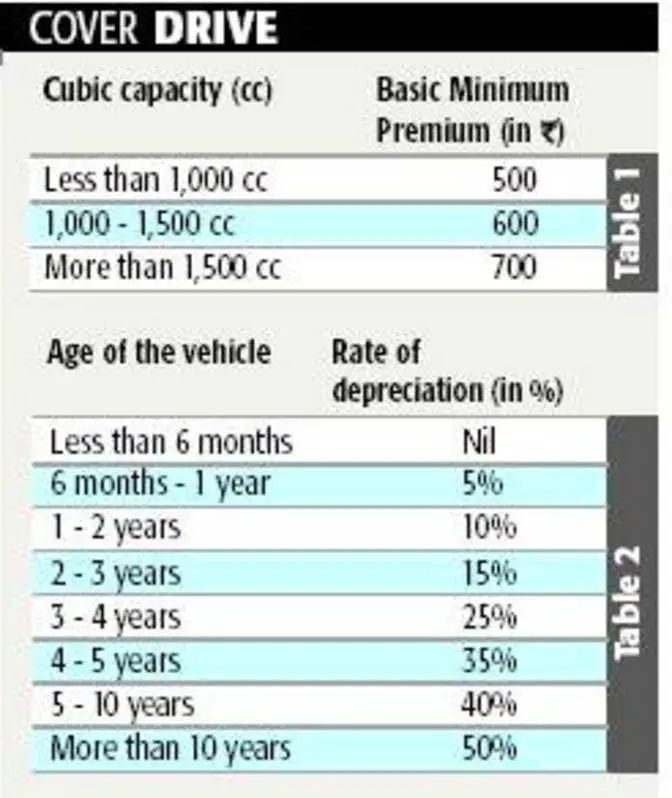

A decrease in your cars value that occurs over time is called car depreciation. Also known as used car valuation, it serves the purpose of identifying the current rate for your used vehicle. All cars depreciate as they get older, because of inevitable wear and tear. In the world of vehicle insurance, the IRDAI, or Insurance Regulatory and Development Authority of India, specifies the car depreciation rate of cars pertaining to depreciation that occurs due to age. Such specifications help insurance firms to determine the IDV or Insured Declared Value of a particular car.

Read Also: Where Do I Put Oil In My Car

What About Vehicle Taxes And Fees

Vehicle registration fees and taxes are also deductible along the same guidelines as other car-related expenses, meaning you are able to deduct the portion of these expenses that reflects the business use of your vehicle.

These expenses are deductible whether you use the actual expense method of calculation or opt for the standard mileage deduction instead. Youâll want to consider your individual circumstances when choosing your calculation method.

In many instances, the standard mileage rate will yield a more substantial deduction, but if youâre looking at taking a substantial vehicle depreciation deduction , the actual expense method may be more beneficial for you.

What Can I Do If My Car Is Worth Less After An Accident

- Make a claim for diminished value. If your state allows it, you could recover some of your cars lost value.

- Choose a payout over repairs. If your car isnt declared a total loss, which is when repairs would cost more than the car is worth, but its within 75% of a total loss claim, you can try to make an appeal for a total loss decision instead. Youll get paid cash for your cars pre-crash value instead of getting a car thats worth less after getting repaired.

- Drive your car into the ground. If you dont sell your car and instead keep it until it breaks down for the last time, you wont have to worry about diminished value.

- Avoid a salvage title. Youll typically have the choice to buy back your car on a salvage title if its declared totaled. But your car will be worth even less in this case since its not repaired and carries a salvage title. Some people consider keeping their salvaged car for nostalgia or to repair it themselves, but the car wont be worth much in this case.

You May Like: What Kind Of Car Columbo Drive

How To Reduce Car Depreciation

Tricks to reduce your cars depreciation exist and these aid in the maintenance of its value. Consequently, you can get an IDV and a resale value that is high:

-

Keep your car spruced up and maintained. This prevents wear and tear. Regular servicing is a must too.

-

Make sure you purchase cars with a high resale value. Specific brands and kinds of vehicles have more resale value than others.

-

You can buy a used car in mint condition. This means that even if it is a second-hand vehicle you are buying, it is already in good condition and its further resale value will be high.

-

Run your car on shorter distances. The more kilometres that your vehicle travels, the more it gets depreciated in value.

What Auto Depreciation Means For Your Taxes

The general idea behind car depreciation for taxes is to spread the cost of a car out over its âuseful life,â instead of writing off its whole cost the year you buy it.

Useful life describes the amount of time it takes for your vehicle to lose 100% of its original value. For tax purposes, the IRS generally considers five years to be standard for most vehicles. . There are two basic methods to depreciate your vehicle for taxes: mileage and actual expenses.

Standard mileage deduction

Most people are familiar with the term âbusiness mileage.â If youâre not, itâs exactly what it sounds like: the number of miles you drove for work in a given year. This is a great option for people who drive a lot for work, such as truckers or Uber and Lyft drivers.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle: gas, repairs, oil, insurance, registration, and of course, depreciation. For 2021, that rate is $0.56 per mile.

You can use this rate to calculate your tax deduction at the end of the year. For instance, letâs say you drive 12,000 miles in a year, 5,000 of which were for work. Your mileage write-off would be $2,800 . The only rule is that âbusiness mileageâ does not include commuting mileage. Commuting miles are the distance you drive from home to work.

This expense method allows you to claim your actual vehicle costs, such as gas, oil changes, repairs, insurance, and depreciation.

Don’t Miss: Does Walmart Make Car Keys With Chips

What Is Depreciation On A Car

Depreciation is a way of measuring how much value your vehicle loses over time.

Newer cars tend to depreciate at a faster rate than used ones. The typical new car loses between 40% and 50% of its value within the first five years.

In a sense, depreciation is one of the costs you pay to own a car. While you dont pay for it out of pocket the way you do insurance, maintenance or repairs, youll feel the financial hit from depreciation when you get ready to sell or trade-in your vehicle.

Average Depreciation Per Year

The average depreciation of your vehicle is significant. The average vehicle will lose $15,000 in the first five years of ownership. This indicates an average of between $2,000-and-$6,000 per year. Who knew the value of wear and tear on a car was so great? Small sedans and small SUVs tend to be at the lower end of the scale, whereas vans and electric cars are more often found at the higher end.

References

Don’t Miss: How Car Salesmen Make Money

How Does Mileage Impact The Value Of Your Car

When you calculate the depreciation of your vehicle, one of the most important factors is the number of miles driven. The more miles you drive, the less your car is worth that is a simple part of the calculation. The more you can keep the miles down, the more it will be worth when youre ready to sell. If youve used your old vehicle as a daily driver, expect to get less than someone that uses it only on the weekends.

Take Advantage Of The Current Demand

Before we get into the traditional factors in vehicle depreciation, you need to understand the market we are in right now. After the pandemic, the demand for new vehicles skyrocketed beyond the point of automakers ability to keep up with the demand. This caused more of a requirement for used vehicles to fill the void. Your used vehicle is likely to fetch a much higher price right now than once the market levels off again. If you sell your used car now, you should get more for it than you might otherwise, but if youre going to buy another vehicle, the same pricing strategy could be used against you during your purchase.

Also Check: Average Car Salesman Commission Percentage

Tracking Mileage For Tax Purposes

As of 2018, you are permitted to deduct mileage traveled for business purposes in your personal vehicle on your income taxes in most instances, but the cost per mile to drive varies. This is particularly true of 1099 employees, but those who are W2 workers may also be eligible depending on their circumstances. Careful record-keeping is key, however, to guard against any potential audit.

Any trip that is taken for business, including those to meet with clients, purchase office supplies or other non-commuting tasks, are eligible for mileage deduction. If you drive to and from an office each day, note that it is not possible to deduct those miles on your taxes.

The IRS states that your mileage log must include the dates of your trip, your purpose for the outing, where you drove and, of course, your mileage itself. It might be helpful to track your starting and ending odometer readings, in addition to the number of actual miles you drove. You may also be expected to report to the IRS the number of miles you drove for commuting or personal use, though you will not get reimbursed for them.

To track your mileage, its best to rely on one dedicated system to help you stay organized. An electronic document on your phone or laptop, a notebook or an app specifically designed to keep mileage records are good methods to ensure you wont miscalculate or misplace any records.

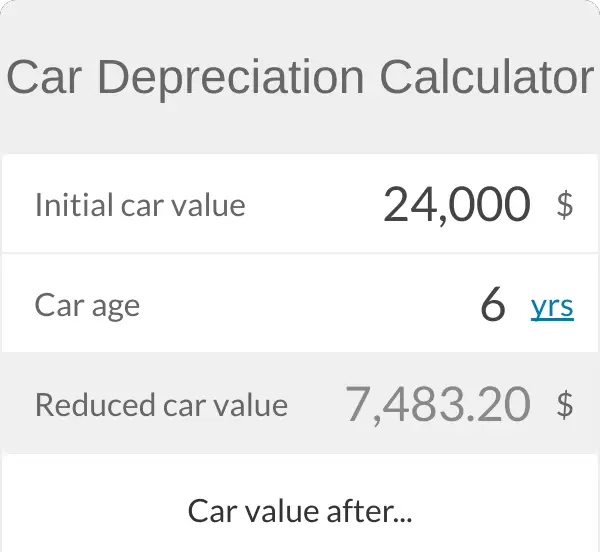

How To Calculate Depreciation

You can use this calculator in two ways:

Also Check: Used Car Salesman Commission

Top 4 Ways Car Depreciation Affects Car Insurance

Your cars value over time affects your car insurance rates in a few ways.

Car Idv Calculation Based On Current Selling Price

IDV always uses the current selling price of the brand and model of your car, not the price at which you originally bought it for. This cost includes the Basic Cost + Local Taxes + Duties/Cess,etc. and does not include Registration Cost. e.g. your Maruti Swift could have come at a cost price of 5,50,000 when you bought it 3 years back. However, if Maruti has increased the price to 5,60,000 today, the IDV will be calculated by using the depreciation value on 5,60,000 and not 5,50,000. Similarly, if the current price of the exact same model is reduced by the company, the depreciation rate will be charged on the reduced price and not on the price at which you bought it. Clear, right? Lets now look at the car depreciation rate for all the years.

Recommended Reading: How To Remove Scuff Marks From Car Door Panels

Using Depreciation To Your Advantage When Buying

While depreciation is the unfortunate reality of being a car owner, if you follow these tips, it can help you as a buyer to use depreciation to your advantage.

Colour of the car counts: As we discussed earlier, the colour of a car can affect the rate at which a car depreciates. Typically, grey, silver, black and white vehicles depreciate at the slowest rate so do your best to buy a car within one of those four colour palettes.

Look at market trends: For whatever reason, some vehicles have lower resale values than other cars so itâs important to consider this when buying.

Shop for a car with minimal wear: When youâre looking to buy a car, keep your eye out for a car that doesnât look like itâs been beaten up by the previous owner/owners. Ideally, you find a car that just finished a three-year lease term, because leases typically have low mileage limits, so itâs likely the vehicle should still be in good shape.

Drive it until itâs dead: If you donât want to have to worry about the rate of depreciation, whether you buy a new or used car, drive it until it wonât drive anymore. If youâre not worried about resale value, why would you be worried about the carâs value?

Whats The Formula For Depreciation

To estimate how much value your car has lost, simply subtract the cars current fair market value from its purchase price, minus any sales tax or fees. If youre considering buying a car, look up the fair market value of older versions of the make and model to get a sense of the cars value down the road.

You can find out a cars estimated fair market value by using online tools offered by Kelley Blue Book, NADA Guides or Edmunds.

If youre a Credit Karma member, you can use Credit Karma to get an estimate of your cars current value.

Don’t Miss: Who Is Eligible For Usaa Car Insurance

Understanding How Car Value Depreciation Works In Singapore

When you buy a new or used car, it is important to consider the annual depreciation of the vehicle. This depreciation will show you the true cost of owning and operating the vehicle on an annual basis, in addition to the costs of gas and maintenance. This concept is important to understand as it impacts the value of your car, and ultimately how much you can earn by selling your car in the used car market. The formula for calculating depreciation is shown below.

Annual Depreciation = / Number of Years in Service

For example, a vehicle which is purchased for S$10,000 and sold for S$2,000 in 10 years would have an annual depreciation of S$800.

/ 10 years = $800 annual depreciation.

In Singapore, however, the process of calculating vehicle depreciation is more complicated. There are significant taxes and fees associated with owning and operating a vehicle on the island. As a result, there are a number of other important costs to include in the Total Cost of the Vehicle calculation shown above. Our guide breaks down all the things you need to know about depreciation in Singapore so you can get the most value out of your car.

The Origins Of Car Depreciation

The concept of car depreciation as we know it has been around since the 19th century, when it rose to popularity among the major railroad companies of the era because it allowed them to show increased profits. In order to flesh out the concept, we need a brief history lesson:

Business leaders of the time discovered that, through a bit of accounting wizardry, they could allow the cost of things like building rail cars or laying track to be subtracted from their annual income over time .

To do this, the companies calculated how much of a product — in this instance, a train — was âused upâ at the end of each year and had, therefore, lost its value. This was accomplished by assigning a value to that use , and then using that lower amount to count against their annual income. Each year, the amount remaining would decrease until the value was down to zero.

Vehicle depreciation works in exactly the same way. In essence, car depreciation is a numerical representation of the portion of the total value of your vehicle youâve used. For tax purposes, this is calculated once a year.

Don’t Miss: What Kind Of Car Did Columbo Drive