Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

What Is A Finance Charge On A Car Loan

A finance charge on a car loan is the interest you pay over and above what you borrow. A finance charge typically includes your down payment and any other fees associated with obtaining financing for the consumer purchasing a new or used vehicle. Look into what credit score is needed to buy a car at Carmax if you are concerned about finance charges.

- On an auto loan, for example, if the lender offers four different rates: 5%, 6%, 7%, & 8%, its possible that you could borrow money at 5.5% by putting more money down , but still, be charged interest at 6%. This is because there would still be additional charges, in interest, to cover the cost of processing your loan.

Some of those extra costs for financing a car loan would include origination fees or the amount you pay to get the loan. Other costs could also be included in finance charges, including document fees, dealership prep fees, car delivery fees, and more.

If youre planning on financing a car purchase from a private seller rather than through a dealership, make sure that you know what rate they are charging you as well as any fees.

How Much Interest Will I Pay On My Car Loan

Our car finance calculator works out the interest that you might pay as part of your car finance plan. It does this by taking your interest rate and compounding it over the course of the loan period. It is this compounding of interest rate that forms the basis of the effective annual rate we feature in our calculator. You may be interested to note that we have a compound interest calculator for compounding interest on savings.

Recommended Reading: How To Repair Clear Coat On Car

Between Choosing A Make Model And Options Shopping For A Car Can Feel Overwhelming And Youre Not Done There Car Loan Shopping Is Just As Important And Knowing How To Calculate The Apr On An Auto Loan Can Help You Determine Whether A Loan Might Be Right For You

The more you know about how to calculate the APR on a car loan, the more informed youll be when its time to either sign on the dotted line or walk away if the loan doesnt fit your financial needs.

A car loans APR is the cost youll pay to borrow money each year, expressed as a percentage. It includes not only the interest rate on the loan but also certain fees. The interest rate, on the other hand, reflects only the annual cost of borrowing the money no fees included. When comparing loans, the Consumer Financial Protection Bureau suggests looking at APRs versus interest rates, because APR more accurately reflects how much youll pay to finance a car.

Lets take a look at how to calculate APR on a car loan using a computer spreadsheet program and some of the factors that could affect the APR youre offered.

Dcu Visa Credit Card Finance Charges

-

Interest is a fee charged on every Visa account that is not paid in full by the payment due date or on every Visa account that has a cash advance.

-

The Finance Charge formula is:

Average Daily Balance x Annual Percentage Rate x Number of Days in Billing Cycle ÷ 365

-

To determine your Average Daily Balance:

Add up the end-of-the-day balances for every day of the billing cycle. You can find the dates of the billing cycle on your monthly Visa Statement. Divide the total of the end-of-the-day balances by the number of days in the billing cycle. This is your Average Daily Balance.

Recommended Reading: Burn Mp3 Cd With Windows Media Player

How Does The Car Loan Payoff Calculator Work

Our calculator helps you work out the costs associated with purchasing a car on credit. Once you have entered the amount, the interest rate and the period of the loan, the calculator will return the total repayment amount, the total interest and the monthly payment figure, as well as full amortization.

Explore Your Financing Options At Westbrook Honda

Weve answered the question: What is a simple interest loan? Now, dont hesitate to contact us with any questions like what is MSRP and what is a good interest rate? Our finance specialists are standing by to help you secure a car loan and payment schedule that is the best fit with your budget. Planning on trading in your old car? Use our value your trade tool to get a quick estimate of how much your car is worth, and apply that towards your down payment. Were ready to put you behind the wheel of a new Honda or dependable pre-owned vehicle of your choice today!

Don’t Miss: How To Remove Car Door Panel

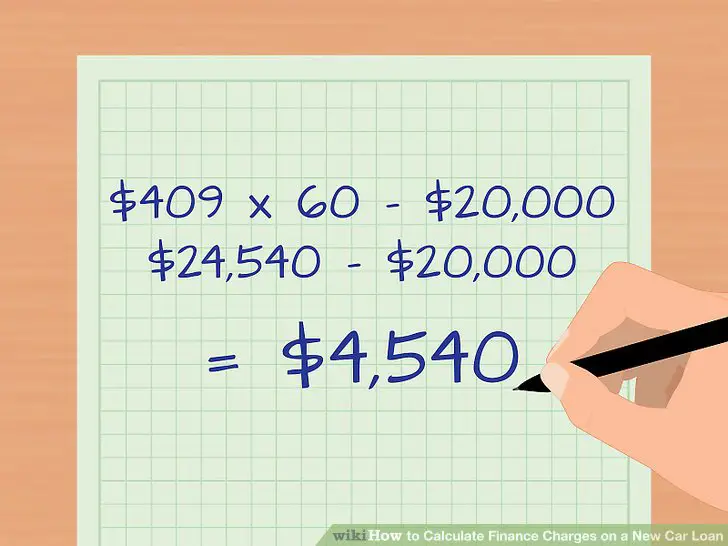

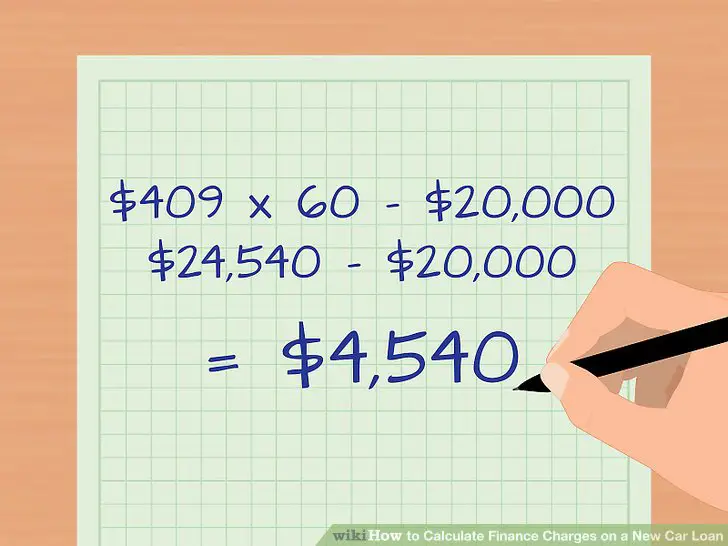

How To Calculate Finance Charges On A Car Loan

An individual may borrow a certain amount of money to buy a new or used car from a bank or other lender. The loan amount is commonly referred as the principal. Under the car loan agreement, the money is paid back in regular monthly installments over a designated period of time. Since the lender typically provides the money at a specified annual percentage rate , you will pay back not only the principal, but also a certain amount of the interest . As an example, calculate the finance charge for a $25,000 car loan given with APR of 6.0 percent for five years.

Calculating The Monthly Finance Charges For A New Car Loan

Materials Needed

- Pencil and paper

- Scientific calculator

In addition to knowing what you owe on a new car loan overall, having an idea how much you can expect to spend on a monthly basis is helpful as well. Knowing what you owe on a monthly basis allows you to better prepare a monthly budget.

Step 1: Calculate your monthly payment. Determine your monthly payment by using the following formula:

To figure out the “principal times the interest rate due per payment” part of the equation, you can start by converting the APR to a decimal by dividing it by 100. Then you should take that number and divide it by 12 to convert the monthly percentage rate into a decimal. Then, it is just a matter of multiplying the principal by the monthly percentage rate.

Calculate the other half of the equation by adding 1 to the the interest rate due per payment. Next, hit the x^y button on the scientific calculator and enter the number of payments. Then, subtract the figure obtained from the number 1.

Divide the first figure obtained by the second figure to get your total monthly payment, including finance charges.

Next, figure out how much principal you have to pay monthly. This is as simple as dividing the total amount of the loan by the number of payments.

Step 2: Figure out the monthly principle. Next, you need to figure out how much principal paid each month. To get the principal paid each month, divide the principal amount by the expected payments in months.

You May Like: What Gas Stations Accept Synchrony Car Care

Why Take Out A Car Loan

When it comes to financing a new car, there are a number of options available to you: outright purchase, personal loan, leasing, hire purchase or dealer financing. It’s advisable to read up on the pros and cons of each of these before deciding upon the best one for you. Should you be considering taking out a different type of loan, give our standard loan calculator a try.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Also Check: How Do I Get My Car Title In Florida

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Closed End Consumer And Mortgage Loans

Closed end loans are loans for a specific dollar amount, that you agree to pay back within a certain period of time . Usually you’re agreeing to pay the money back according to an ‘amortization’ schedule.

Amortization is simply the reducing of a debt through periodic payments. Basically, you’re dividing the total number of payments into the amount you’ve borrowed plus interest. Each month a portion of the loan payment you make will go towards reducing the principal amount borrowed, and a portion will go towards reducing the total finance fee. You will see this breakdown by the headings on the loan activity portion of your DCU statement.

The monthly payments and finance charges will always be disclosed to you up front when you close on your loan but here’s how to understand how these figures are calculated.

You’ll need:

- The amount you are borrowing

- The term of the loan

- The number of payments due each year

- The Annual Percentage Rate

Using these numbers:

- Determine how many monthly payments you will make over the term of the loan .

- Convert the APR to a decimal .

- Then calculate the interest rate for each payment .

Formula 1

To calculate your monthly payment amount:

To Calculate Total Finance Charges to be Paid:

Monthly Payment Amount x Number of Payments Amount Borrowed = Total Amount of Finance Charges

Plug each of the above into Formula 2 above:

- $298.44 x 60 $15,000.00 = $2,906.13

Don’t Miss: What Gas Stations Accept Synchrony Car Care

The Smart Trick Of How To Calculate Finance Charge On Car Loan That Nobody Is Talking About

If you like mathematics and are excited about the manner ins which it impacts business world, then you most likely learnt finance during your university years. Financing is an exceptional degree option that provides tough work in a variety of markets. While you understand that many finance-related professions featured generous wages, it’s great to assess a few of the highest paying careers for finance majors before you make any work decisions as a newly minted finance graduate. A financial manager primarily uses money management techniques and directs business investments to reach the company’s tactical and economic goals. You’ll routinely direct preparation of monetary reports according to business and market standards as a monetary manager. Besides your personal network of buddies and family, online task websites are a logical location to look for entry-level finance functions. Linked, In, Indeed, and Beast are good websites. Still, it may be more effective to search sites that focus on finance-industry jobs or resources, such as e, Financial, Careers, Broker Hunter, or 10X EBITDA . Monetary experts work for investment companies, insurance provider, consulting firms, and other corporate entities. Accountable for combining and examining budgets and income statement forecasts, they prepare reports, conduct service studies, and establish projection designs. Monetary experts research financial conditions, market patterns, and company basics.

How To Calculate Finance Charge

How to calculate the finance charge accurately depends on the individual lender or creditor. Finance charges are typically found on the invoice of a loan, often with an introductory rate of interest. The exact amount of these fees is usually dependent on the borrowers creditworthiness, typically based on their credit score at the time of application. This is also where errors can sneak in and cause massive financial damage.

Also Check: New Car Salesman Commission

How To Calculate Finance Charges

You can figure it out by applying the formula given above that states you should multiply your balance with the periodic rate. For instance in case of a credit of $1,000 with an APR of 19% the monthly rate is 19/12 = 1.5833%.

The rule says that you first need to calculate the periodic rate by dividing the nominal rate by the number of billing cycles in the year. Then the balance gets multiplied by the period rate in order to have the corresponding amount of the finance charge.

Finance charge calculation methods in credit cards

Basically the issuer of the card may choose one of the following methods to calculate the finance charge value:

-

First two approaches either consider the ending balance or the previous balance. These two are the simplest methods and they take account of the amount owed at the end/beginning of the billing cycle.

-

Daily balance approach that means the lender will sum your finance charge for each day of the billing cycle. To do this calculation yourself, you need to know your exact credit card balance everyday of the billing cycle by considering the balance of each day.

-

Adjusted balance method is a bit more complicated as it subtracts the payments you make during the billing period from the balance at the cycles beginning.

What Is A Grace Period

A grace period for a credit card is the period between when your billing cycle ends and your payment is due. You may be able to avoid paying interest on purchases if you pay your balance in full by the payment due date. Cash advances typically don’t have a grace period, and interest starts accumulating from the date of the cash advance.

You May Like: How Much Does A Car Salesman Make Per Car

How To Calculate A Car Loan Payment

If youre using financing to buy a new or used vehicle, you should already know that youll have to pay back that loan over several months or years. But just how much will you owe each month, and what costs are included in those payments?

When purchasing a car, it is nice to know how to calculate your car loan payment. Calculating total and monthly costs allows you to budget accordingly and figure out the total price of the carnot just the sticker price.

The math involved can be overwhelming if you do not use math often, but finding a good car loan calculator and having the right information handy can save you a lot of time.

Calculate Your Estimated Apr

To estimate your APR on the loan using a spreadsheet, enter the formula below into a cell. This formula assumes that your monthly payment was either calculated in step 1 or otherwise includes fees. If you didnt calculate your monthly payment in step 1 or arent sure whether the monthly payment youre using reflects fees, keep in mind that this formula may not be the best way to calculate your estimated APR.

=RATE*12

Using the monthly payment you calculated , heres what youd enter into the cell for this loan example.

=RATE*12

Entering the formula above would calculate your estimated APR at approximately 5.6%.

Read Also: How To Fix The Clear Coat On My Car

How Does A Simple Interest Auto Loan Work

First of all, Branford car shoppers need to know the difference between compound and simple interest. Compound interest is based on the principal, as well as the interest of the previous periods. This means that borrowers pay interest on the interest that has accumulated. Simple interest, on the other hand, is based on the principal only, which means that interest isnt charged on the interest already accrued to the loan.

Simple interest loans are among the most common for anyone looking to secure auto financing. The following will explain how to calculate a simple interest rate on a loan:

- Typically, car loan interest is calculated daily based on the amount of the principal.

- The daily interest is equal to the annual rate and then divided by 365 .

- Example: If you have a balance of $10,000 at a 3% interest rate, the daily interest would be about $0.82.

When financing a new car, your payments go toward the applied interest on your account first, and then the principal balance. Your monthly payments will factor in the calculated interest rate at the start of the loan, which means that more of the monthly payment is put toward interest. As the interest is paid down, more of the payment is put toward the actual principal balance. Feel free to use our convenient online payment calculator to determine what your monthly payments will be, and budget accordingly.