Driving In Brampton And Auto Insurance

Busy highways, intersections, commuter delays, construction and crashes are all part of a normal day driving in Brampton. So are higher car insurance rates. Does your policy give you the protection you need? Compare auto insurance quotes and options to find out. You never know what could happen on road. Make sure you are prepared to the right car insurance.

Here is some useful information for driving in the city :

Snow Days Per Year

What Does Car Insurance Excess Mean

The excess is the amount the policyholder has to pay towards a claim on their insurance. There are two elements to car insurance excess:

- Compulsory excess this is set by the insurance provider. You might have to pay an additional compulsory excess if you drive a high-performance car or if youre a young driver.

- Voluntary excess this is the amount you agree to pay in addition to the compulsory excess. Agreeing a bigger voluntary excess can reduce the cost of your insurance, but youll need to make sure you can afford to pay it if you make a claim.

What Does The Aa Do As An Insurance Broker

As a leading car insurance broker, we find the lowest quote we can by comparing car insurance prices from our panel of insurers. Each search for a car insurance quote is customised to find the insurance that’s right for you, and we’ll show you all of the policy benefits up front.

And if you do choose the AA for car insurance, we can find the best deal again when you come to renew your insurance with us.

You May Like: How To Keep Squirrels Out Of Car Engine

How Has Coronavirus Affected Car Insurance

The ongoing coronavirus pandemic has changed the driving habits of many UK drivers. The increased number of people working from home, plus restrictions on travel and activities means were driving less than we used to.

If youre going to continue using your car less, it might mean you pay less for your insurance. If youre renewing your policy, make sure to update your mileage and how you use your car as this will affect your price.

If your car insurance isnt up for renewal but your occupation has changed, for example youve become unemployed or if you now have a second job, you should let your insurer know. If youve been furloughed, theres no need to let your insurer know. But once the furlough scheme ends you should let your insurer know your current employment status. Find out more information on the impact of coronavirus on drivers.

Importance Of Car Insurance

More than 54 road accidents occur on the Indian roads every hour. Along with injuries to individuals, cars also suffer significant damages. What will you do if the repair costs are high and you don’t have the stomach to pay the expenses? Who will help you out?

Car insurance is the answer to it. The insurance provider will check the extent of damages and pay for the repairs without asking any questions. In case you run into a third-party or damage his/her property, your insurance provider will look after its expenses as well.

According to The Motor Vehicles Act, 1988, the Indian government also stresses the importance of car insurance and makes it mandatory to at least own third-party car insurance for your four-wheeler. If you decide to go against it, be ready to face the wrath of the Indian Judiciary system.

Don’t Miss: How To Burn Mp3 Cd For Car

What Types Of Car Insurance Can I Get In Australia

|

|

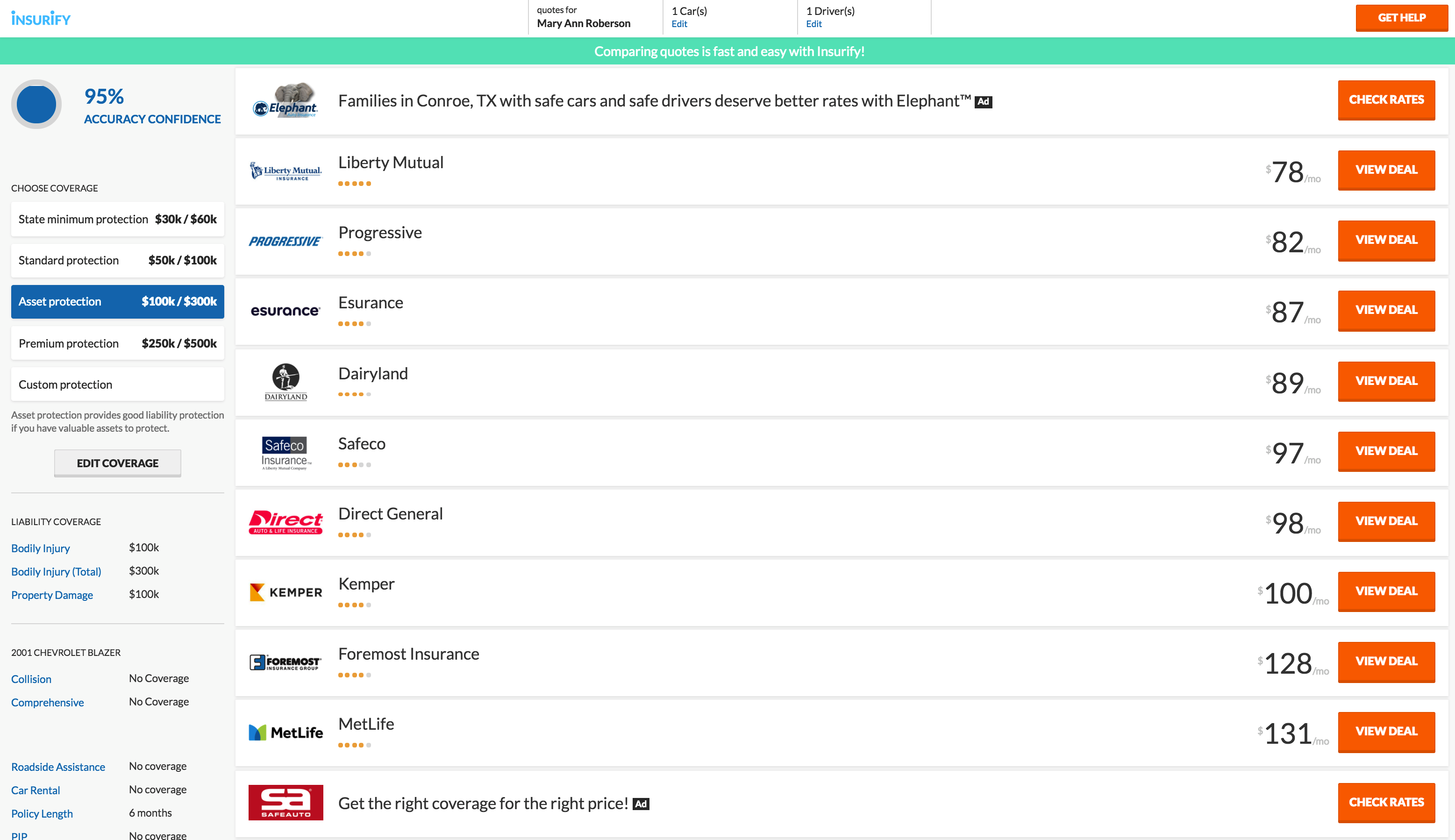

We collected real quotes from 12 well known Australian car insurance brands and found that the difference in the cost of car insurance can differ by up to $41 a month, or $414 a year! Insurer A is a budget car insurer, whilst Insurer B is a household car insurance name.

Whilst Insurer A is far cheaper than Insurer B, Insurer B actually offers far more cover, giving you benefits like hire car, new car replacement and emergency travel & repairs included in the cost of the policy. Insurer A does give you the option for these features, but you’ll have to pay more to get them.

These prices are just indicative of how you can’t just go off the cost of car insurance – you should also take into account what you’re paying for. It’s a good idea to not be tied to any insurer, and instead make your decision on cost and the kind of features available, depending on what’s most important to you.

Our quotes were based off a female Sydneysider born in 1980, driving a 2015 Toyota Corolla.

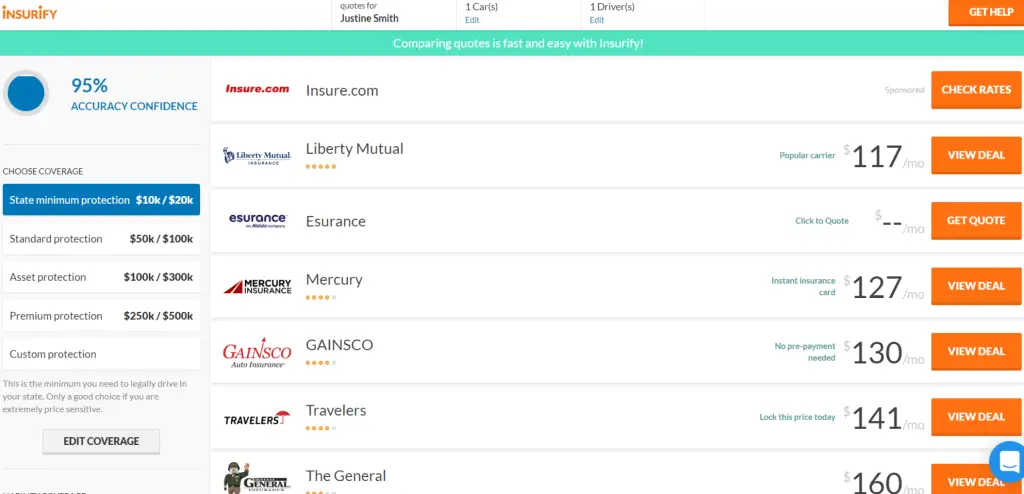

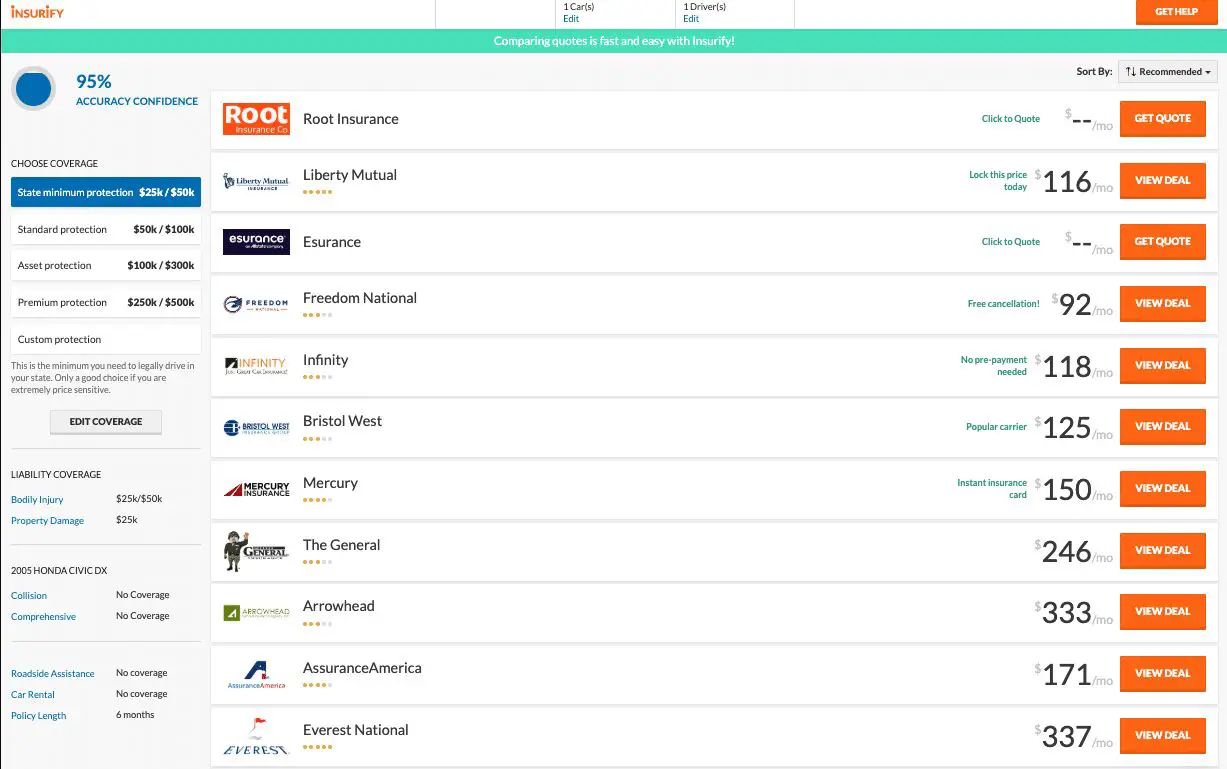

Why Are My Car Insurance Quotes So High

There are many car insurance factors that go into calculating your rate. If you’re male and young, you’re statistically at greater risk of getting into an accident and your rates reflect that. Other higher risk factors include your driving history and experience, living in a densely populated city, and the amount of car insurance fraud in a particular area with have detrimental effects on your auto insurance rate.

Don’t Miss: Florida Dmv Replacement Title

Buying Car Insurance Quotes Online Vs By Phone

When comparing insurance quotes, you may have a pretty big question: What is the best way to actually compare?

Most insurance websites can now provide quotes online. You simply provide certain information, click the button, and get your quote.

However, this process was designed to go fast, and the incomplete information the website asks you for may not consider all of the pertinent factors. Because of that, we often recommend that you get an insurance professional on the phone.

And to save time, you can always use online insurance quotes to narrow things down to your top five companies or so. Then you can call each one and see what kind of prices they have to offer.

Decide If You Need Full Coverage Car Insurance

Liability coverage doesnt pay for your car or injuries, or for any injuries your passengers sustain if you cause a wreck. This is why you may want full coverage car insurance, especially if your car isnt paid off yet. Note that this isnt actually a type of coverage, but typically refers to policies that include liability coverage, plus comprehensive and collision coverage.

In other words, you cant just click a full coverage button when comparing insurance quotes online or buy something called a full coverage auto insurance policy. Youll need to add collision and comprehensive coverage in the amounts you want.

Collision insurance pays for

Damage to your car in an accident you cause.

Damage to your car if you hit an object such as a fence or pole.

Damage to your car if someone else hits you. Another option in this case is to make a claim against the other drivers liability insurance.

Comprehensive insurance pays for

The value of your car if its stolen and not recovered, and damage from:

Weather such as tornadoes or hail.

Floods.

Crashes with an animal, such as striking a deer.

Riots and civil disturbances.

Auto insurance quote comparison tip: Whatever coverage you choose, make sure you compare the quotes for the same type and amount of coverage so you can find the best price.

Don’t Miss: How To Charge A Completely Dead Car Battery

Compare Car Insurance Costs

^ When comparing policies for our 2021 Finder Awards, we found an average difference of $1,773 for men and $2,543 for women between two car insurance policies.

We found that on an average, a 30-year old man paid anything between $612 and $2,385 annually, while a 30-year old woman paid between $426 and $2,969 for a comprehensive policy. Once we averaged everything out, the cheapest provider was $2,851 less than the priciest! So think you’re paying too much? You could be right.

Compare policies and see how much you could save.

These costs are based on an average of 36 driver profiles across 6 states in Australia. For our full methodology, head to our Finder Awards page.

For more insights on how much car insurance costs and a cost comparison between Australian companies, head to our dedicated page on car insurance costs.

How Do I Estimate My Mileage

You can estimate your mileage by working out how many miles you drive every day or week, then adding them up to work out your annual use. Alternatively, check your MOT certificate or car service record, which will show how many miles youve driven. You can use this as a basis to calculate your future mileage.

The number of miles you drive per year can affect your car insurance premium. This is because the more you drive, the more of a risk the provider considers you to be. Its important to be as accurate as you can when you estimate your mileage for your car insurance. If you guess and underestimate your mileage, it could invalidate your policy. If you overestimate you could end up paying more than you need to.

Don’t Miss: How To Fix Car Clear Coat

How Is Car Insurance Premium Calculated

The car insurance premium is the amount that you have to pay to keep your policy active. It usually varies from insurer to insurer & model to model. To calculate car insurance premium, you can use the below-stated formula.

Premium= Own Damage Premium â + Liability Premium as Fixed by the IRDA + Cost of Add-ons.

Based on the below-mentioned points, the company determines the car insurance premium-

- The manufacture year of the vehicle: This determines the age of the car. Older vehicles have low insurance rates in contrast to new automobiles.

- Vicinity of registration of the vehicle: Your residential place and the vicinity in which you got your vehicle registered also has an impact on car insurance premium.

- Model of the vehicle: If the vehicle has steeply-priced or uncommon spare parts, the coverage for the top class of the car might be higher as well.

- Use of the vehicle: Car Insurance providers offer personal and business coverage rules. If a vehicle is used for commercial purposes, it will attract higher coverage rates.

- Safety devices: Today, most of the vehicles are geared up with safety capabilities and anti-theft devices. You’re eligible to get a discount on the premium of up to 2.5% . Also, the devices must be approved by the Automobile Research Association Of India.

- Claims records: If you raise a claim against your vehicle insurance, the premium is likely to head up. If you abstain from raising claims, you may be rewarded with a No-claim Bonus .

| Car Variant |

| Rs.36,095 |

Whats The Difference Between Types Of Car Insurance

With several different types of car insurance out there to choose from, it can be hard to keep track of what each one may or may not cover. Of course, the inclusions, benefits and optional extras available may vary between the many providers out there, so you should always read the Product Disclosure Statement of any insurance policy before purchasing it.

To help you understand the types of car insurance, weve compiled the following table as a simple way to compare them however, the information in this table should be used as a guide only. Just so youre aware, the tables information is based on quotes for each type of insurance from Budget Direct, Virgin Money and Australia Post for a 2010 Mazda 3 sedan driven for personal use by a female driver born in 1985 with a Rating 1 NCD.

You can also compare policies and providers for your own car and driving history just by using our free, easy-to-use comparison service.

Read Also: Hail Protection Cars

Compare Ontario Car Insurance Quotes

In under five minutes, compare personal Ontario auto insurance quotes from some of Canada’s top providers, for free.

Car insurance in Ontario, and across Canada is a requirement for all drivers, but there are some provincial differences in coverage requirements.

To begin, Ontario operates in a no-fault insurance system. No-fault means drivers use their own insurance company regardless of who is at-fault in an accident.

Ontario auto insurance is provided by private insurance carriers and is regulated by the Financial Services Regulatory Authority of Ontario . FSRAO ensures rate increases are substantiated.

Available coverage is broken down into two categories – mandatory and optional.

Mandatory Ontario auto insurance coverageincludes

- Third-party liability

- Direct Compensation Property Damage

Optional Ontario car insurance coverage includes

- Collision insurance

- Specified perils

- All perils

There are also Optional Policy Change Forms which are endorsements you can add to your coverage. Here are 3 common Ontario endorsements.

- OPCF 20 – covers the cost of a rental vehicle while yours is being repaired or replaced

- OPCF 27 – Ports your existing insurance to a rental car or car you borrow

- OPCF 43 – Removes depreciation in calculating the value of your car when settling a claim

Is Car Insurance Mandatory In Canada

Yes, if youre operating a car in Canada, its mandatory to hold car insurance. However, you do not have to have insurance to buy a car . You just wont be able to drive it.

The penalties for driving a car without insurance can vary by province. In short, they are:

- A fine.

- Licence suspension of up to a year.

- Having your vehicle impounded.

If you get into a collision and you dont have insurance, you will be responsible for any damages. In most cases, its very rare for one person to be 100% at fault, so the chances of you needing to pay up are good.

Youre also denied the right to sue for any type of accident benefit. That’s money that can help cover any loss of income and hospital expenses

If you get into a collision in a borrowed car, the insurance premium belonging to the owner will increase.

Getting caught driving without car insurance will seriously impact your ability to get insurance and get it at a low rate.

Recommended Reading: Best Hail Blankets For Cars

Choose Appropriate Limits Of Liability When Comparing Insurance Prices Of Cars

Automatic liability coverage is required by law in most countries. Coverage can help you pay someone elses car repair bills or medical expenses if you cause an accident.

Liability insurance helps cover the cost of injuring another person if you are held liable for an accident. Liability insurance helps you pay for damages you may cause to another persons property.

Most countries set minimum liability limits that drivers must purchase. You may also be able to increase your automatic liability limits, which may be a good idea. This is because if the causes of the accident and the damage exceed the minimum limits of liability in your country, you may have to pay out of pocket for additional costs. Keep in mind that if you choose a higher liability limit, your insurance premium may increase. If you choose state minimums or increase your coverage, make sure the limits you choose to cover personal injury liability and property liability coverage are the same for each application you request.

Cheap Car Insurance For Younger Drivers

If you’re aged under 25, or are newly qualified to drive, getting insured can be an expensive business.

This means comparison is even more important, and you may find the cheapest quotes are for black box policies.

These could reward you for driving more safely than the average driver other policies may suit drivers with relatively low mileage.

Choosing a cheaper-to-insure car, adding an older named driver to your policy and adding a higher voluntary excess can reduce your premium although make sure you could still afford to make a claim or otherwise pay to repair your car.

- Find out more:black box car insurance explained

Read Also: How Do I Get My Car Title In Florida

What Is Car Insurance

Comprehensive car insurance can provide peace of mind, helping cover the cost of damage that may happen to your car due to theft or collision. Depending on your policy, car insurance can cover all or part of the cost of repairs or replacement, as well as the cost of damages to a third partys car or property.

How Does Comparing Car Insurance Help To Save Money On Your Premium Payment

When you compare insurance policies, they allow you to avail better deals and more comprehensive coverage. With better deals, you can avail a cheaper policy, reducing your premium payments.

When you compare insurance policies, they allow you to avail better deals and more comprehensive coverage. With better deals, you can avail a cheaper policy, reducing your premium payments.

You May Like: How To Connect A Car Amp To A Wall Plug

When To Buy Car Insurance

Since most states require insurance, you should get a policy before you purchase a new car so you can legally drive it off the lot. Here are a few more situations where you may need to buy a new policy:

- Before you register your vehicle. Most states require drivers to show proof of insurance to register their vehicle.

- When you move. Not all insurance companies provide coverage in all areas. If youre moving and your current insurer doesnt offer coverage in your new town, youll need to get a new policy.

- You need to file an SR-22 form. Some drivers who have serious driving infractions may be required to file an SR-22 or FR-44 form to show they have insurance. If you have to file one of these forms, youll need to purchase a policy.

Related Insurance Stories:

Compare Car Insurance Rates By Age

Your driving history isnt the only factor carriers look at when calculating your car insurance rate. Your age can have a big effect on what you pay. For example, you likely know teen drivers have some of the highest car insurance rates on average, but they arent the only ones. Drivers 75 years and older tend to have higher car insurance rates than most age groups, after teens and 20-somethings.

To get more insight, we compiled average annual rates from nine of the 10 largest private passenger auto insurers in the country based on market share data from the National Association of Insurance Commissioners.

Compare minimum and full coverage rates for 25-year-olds

Drivers around the age of 25 typically get higher car insurance rates because as a group they get into more accidents on average than older drivers.

Rates vary from company to company. For example, full coverage from Geico for a 25-year-old costs $1,420 a year, on average, while the average price from Allstate is $2,588.

Below you can compare annual rates for 25-year-olds by company and by state. Rates are averaged across the country separately for full and minimum coverage.

|

Company |

|---|

Get started on Insure.com

Compare minimum and full coverage rates for 40-year-olds

Allstate comes in the highest at $2,368, on average.

Compare national average annual car insurance rates for 40-year-olds by company and by state below. Keep in mind that not all of these companies are available in every state.

|

Company |

|---|

Don’t Miss: What Year Is My Club Car Golf Cart