What Happens To Your Credit Score If You Pay Off A Car Loan

by Matt Frankel, CFP® | Updated July 21, 2021 – First published on July 23, 2019

Paying off a car loan can affect different consumers differently, but heres an overview of what you need to know.Image source: Getty Images.

Are you about to make your last car loan or lease payment, or do you have some extra cash sitting around and are considering paying off your loan early? Or, have you already paid off your car loan and your credit score didnt exactly respond in the way you expected?

Many people expect that their will increase after paying off a car loan. This certainly makes sense — after all, isnt paying off a car loan a responsible credit behavior?

While this is certainly a sign of financial responsibility, a car loan payoff doesnt always have a favorable effect on the borrowers credit score. The reasons for this have to do with how the FICO credit scoring formula works, and how a paid-off loan affects the calculation. With that in mind, heres what you need to know about what to expect once your last payment is made.

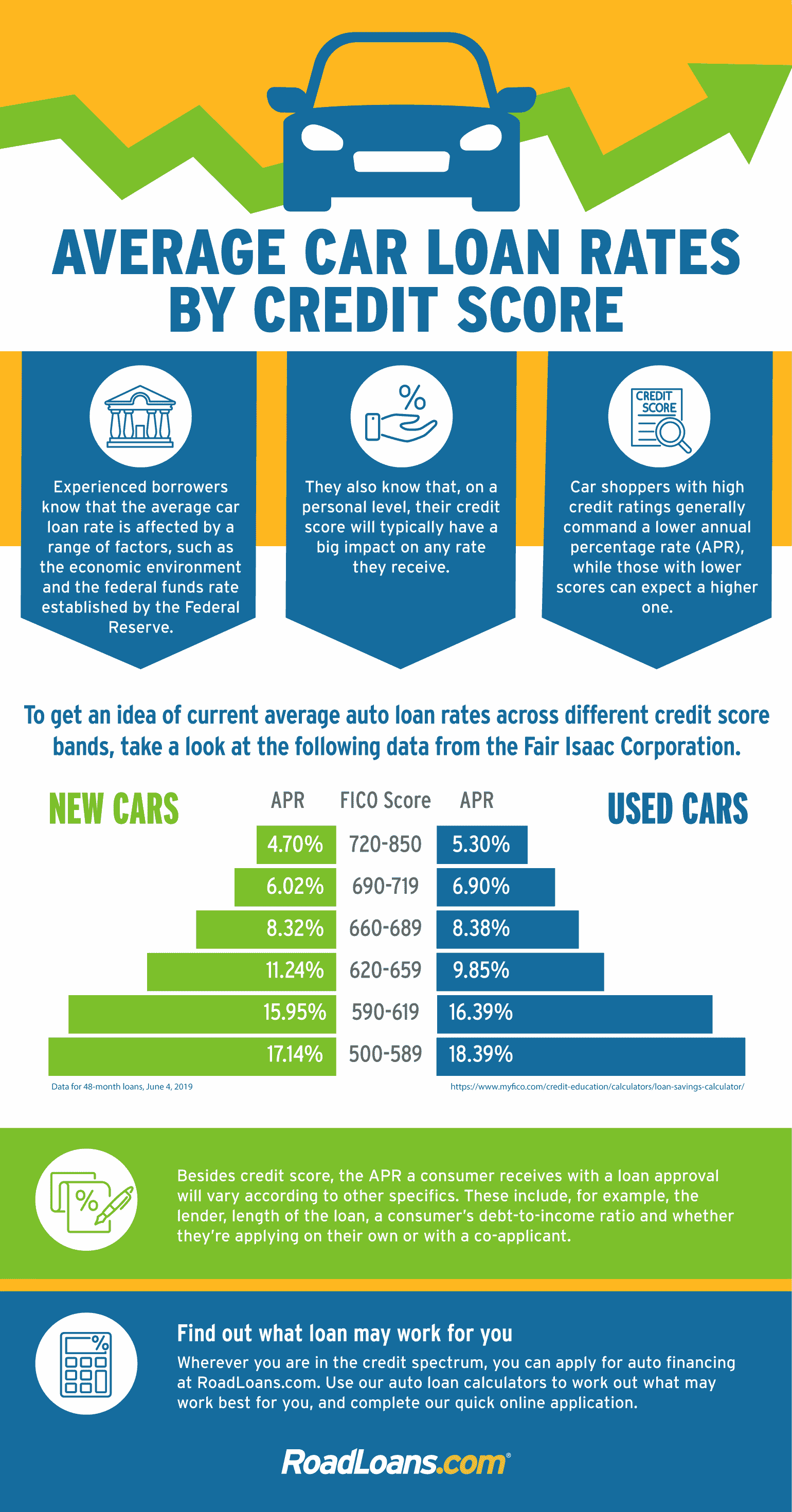

What Interest Rate To Expect With Your Credit Score

As weve discovered, your credit score gives lenders a clear picture of your ability to repay a loan. This, in turn, allows lenders to offer different borrowing capacities with varying interest rates to applicants based on their credit score. Exactly what interest rate you can expect with your credit score depends largely where you sit on the spectrum, and whether or not you score in the good to excellent range.

A credit score above 500 or above 650 will often be met with lower and more attractive interest rates, because the lender is confident in your ability to repay the loan. This means that if your credit score ranks somewhere in the good to excellent range, you are more likely to qualify for a loan with a lower interest rate attached, as the lender recognises that youre more likely to repay the loan than someone that ranks in the fair to weak range. This, depending on the loan amount and terms, could result in a several percentage difference in the interest rate attached to the loan, where applicants with a lower credit rating are likely to pay more interest over the course of the loan.

Paying Interest On Personal Loans

Interest rates on personal installment loans are known for being competitive. Its common for borrowers with both high and low credit scores to turn to personal loans when they need quick and efficient funding.

Like most loans, interest charges for a personal loan are broken up into each monthly installment. That means part of each installment will go towards paying off the principal balance, and the other part will go towards interest charges.

You May Like: How To Install A Hitch On A Car

A Low Score Wont Necessarily Bar You From A Loan But Higher Scores Can Land You Stronger Rates And Terms

Youve narrowed down the make and model, and now you need financing to drive your car off the lot.

You might wonder how much a role your credit score plays in the financing you ultimately get. But its not so much that a low score will keep you from qualifying. Even those with poor credit can find a subprime lender willing to extend financing.

Instead, like it is with most loans, the more solid your credit score, the better the rates and terms youll be offered.

Diversifying Your Credit Mix

Credit scoring models reward you for having a good balance between revolving credit accounts and installment loans . If you previously had no credit history, or if you only had credit cards, then adding a car loan to your credit profile will improve your credit mix.

Although your credit mix only has a minor effect on your credit score, adding a new type of credit to your credit file could be enough to give your score a small boost.

How long it takes: The positive effect will occur immediately, as soon as the auto loan is added to your credit report.

For quicker credit-building results, consider rapid rescoring

If youve been using so that you can get a new loan or credit card, you can request rapid rescoring. You cant do this yourselfyoull need to ask your potential lender. Theyll then get an updated version of your credit report and score within a few days instead of needing to wait until the next reporting cycle.

Don’t Miss: How To Read Car Tire Size

What Factors Affect Your Credit Score

The factors both FICO and VantageScore use to calculate credit scores are no secret. Moreover, they make perfect sense. However, they weigh each factor differently. Check out the list:

- Estimated Debt to Income This is the total of your minimum monthly payments on credit cards, loans, and leases versus your gross monthly income. That is, your income before expenses.

- Payment History Any late payments, collections of bad debts, and negative public filings fall into this category.

- Lenders like to see a credit portfolio made up of both installment loans and revolving credit accounts.

- This measure comprises the average age of all your credit accounts. The deeper the credit history, the more lenders like it.

- Recent Activity Somewhat different than credit history length, recent activity involves recent applications for loans and other pursuits indicating new accounts may be opening.

- Although creditors like to see several older accounts, they also want those accounts to have low balances. This measure evaluates your current credit balances against your total maximum credit limit. Having a total credit limit of $20,000 among all your accounts with total outstanding balances of $19,000 will subtract serious points from your credit score.

Where FICO emphasizes payment history and then estimated debt to income, VantageScore weighs estimated debt to income heaviest, followed by credit mix.

Buy A Car Now Or Work On Your Credit

The bottom line is that there is no set minimum FICO® Score to get a car loan. There’s actually a good chance that you can get approved for an auto loan no matter how bad your credit is.

Having said that, subprime and deep-subprime auto loans can be extremely expensive, so just because you can get a car loan with bad credit doesn’t necessarily mean you should. The savings from a moderate score increase can be substantial, so it could be a smarter idea to wait for a bit and work on rebuilding your credit before buying your next car.

You May Like: What Can I Sell My Car For

How Credit Scores Affect The Cost Of A Car Loan

Just because you can get an auto loan with a low credit score doesn’t mean that it’s always a good financial move to do so. Whether or not it’s a good decision depends on your unique situation.

For starters, lenders tend to offer significantly higher interest rates to subprime and deep-subprime borrowers. This can make a car far more expensive than its sticker price might lead you to believe. Here’s a look at the national average auto loan APRs as of Dec. 11, 2018:

| FICO® Score Range |

|---|

- If you have a FICO® Score of 720 or higher: You will likely pay a $560 monthly payment. That’s $3,574 in interest over a 60-month car loan.

- If you have a 675 FICO® Score: Your payment would likely be closer to $610. That’s $6,611 in interest alone over the life of the loan — you’d pay $3,000 more in interest than a top-tier borrower.

- If your FICO® Score is 600: You’d probably pay $728 per month. That’s $13,673 in total interest — for the exact same car.

In this case, the difference between fair and good credit scores could literally mean more than $10,000 in additional interest.

How Paying Off A Car Loan Could Affect Your Credit Score

With the categories of FICO information in mind, there are a few reasons why paying off yourcar loan could adversely affect your score.

The “amounts you owe” category is the biggest one that is affected. Specifically, your loans never have as much positive impact on this part of your credit score than when theyre almost paid off. In other words, if you only owe 1% or 2% of your original balance, its a major positive factor . After you pay the loan off, you lose this positive factor — the status changes to “paid loan” on your credit report.

Your length of credit history category could also possibly suffer, especially if your car loan was originated more than a couple of years ago. After all, paying off your loan can eliminate an established account from the calculation. Among other things, this portion of your score considers the average age of all of your reporting credit accounts, so if a paid-off loan causes your average to decrease, it could certainly be a negative factor.

Recommended Reading: How To Tow A Car

Adding To Your Record Of On

The main way that car loans build your credit is by contributing to your payment history. Each time you pay your car loan bill , the payment will be recorded on your credit report. These payments add up, gradually establishing a good track record that shows lenders that you can handle your debts.

How long it takes: Your car loan payments will begin boosting your payment history as soon as theyre added to your credit report. However, the longer you keep making your payments on time, the better youll look to lenders, so this effect strengthens over time.

What Is A Fico Auto Score

Its smart to have some idea what dealers will see when they check your credit profile by checking your credit score. Chances are, however, that your dealer might use a FICO automotive score instead of a traditional FICO score or VantageScore.

Your FICO auto score is a specialty score ranging from 250 to 900 that weighs past car-loan payments more heavily than the traditional FICO score does. It also gives more weight to any repossessions or auto-loan bankruptcies you might have previously filed. To check your automotive score, you can buy a full set of FICO scores at myFICO.com and then cancel the service rather than pay the fairly steep monthly fee.

Don’t Miss: How To Change Oil In Car

Consider Bringing Your Own Financing

While dealerships do provide financing, checking with your local bank or credit union is a good idea, too. You can even compare car loan rates online. Compare quotes from the top potential lenders and, once youve settled on your top choice, you can get preapproved to make the process run smoothly,

Keep in mind that getting financing results in a hard pull on your credit. It helps to cluster applications closely together when rate-shopping for a loan.

If you end up with a loan with a higher rate than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

Bad Credit Loans Offer An Alternative To Traditional Lenders

People with poor credit often have trouble finding loan approval through traditional avenues. When they manage to find an offer, most have sky-high APRs as compensation for the increased risk.

However, many lenders offer personal loans for bad credit to help people with little to no credit history or bad credit scores. Most people have poor credit scores because they have no credit history, delinquent accounts, maxed out credit cards, or late payments on their credit report.

Bad credit borrowers are more likely to receive approval from a company offering specialized loans for people with bad, poor, or fair credit. Most of these specialized lenders offer both secured personal loans and unsecured personal loans .

Secured loans require you to use collateral against your loan as security, such as your car or home, often resulting in a lower interest rate for the borrower. Conversely, unsecured personal loans have higher interest rates.

Ultimately, people who have experienced loan rejection through traditional means such as banks or credit unions may have better luck with a lender that specializes in loans for bad credit. Also, you can expect most lenders to charge borrowers penalties or fees, including origination fees, late payment fees, and NSF fees.

Also Check: What Is Esp In A Car

Car Loan Repayment Plans

A car loan is a type of financing that you can apply for through select lenders and dealerships across Canada. This financing exists to make a new or used vehicle more affordable over time through recurring payments with interest.

Depending on the policies of the lender you apply with, what kind of vehicle youre looking at, and how strong your finances are, this payment plan can last several years and, when necessary, be adjusted to suit your needs.

Generally, the majority of lenders and dealerships can offer you various payment frequency options, such as:

- Semi-monthly

Although the length, frequency, and overall cost of your plan will be arranged in advance, many lenders will also permit you to make accelerated payments so that you can pay down your debt faster through larger or more frequent installments. Just make sure you read your contract, as some lenders will charge a prepayment penalty.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Don’t Miss: How To Remove Scratches From White Car

Getting A Car Loan With A Low Credit Score

To be clear, you can get a car loan with a low credit score. Although the subprime mortgage market has virtually disappeared since the financial crisis about a decade ago, the subprime auto loan market has exploded in recent years. Roughly 1 of every 4 car loans made in the U.S. is made to a subprime or deep-subprime borrower.

While the exact definitions of these terms vary depending on who you ask, the Consumer Financial Protection Bureau, or CFPB, defines subprime as borrowers with credit scores of below 620 and deep subprime as borrowers with scores below 580.

Is 599 Good Credit Score To Buy A Car

You should be able to get a car loan with a 599 credit score without a problem. Truthfully, people can get a car loan with almost any credit scorethe difference will be what kind of interest rate you can secure. A score of 599 may get you an interest rate of between 11.92 percent and 4.68 percent on a new car loan.

You May Like: How Long Does Car Inspection Take

How Does Your Credit Affect Your Access To Car Loans

Your credit score affects 2 different elements of your car loan application:

- Your ability to get approved. Your credit score will determine whether you qualify for a loan. Most lenders will have a minimum credit score for a car loan in Canada that theyll require you to meet in order to qualify for financing.

- The interest rates youll pay. Youll generally get much lower interest rates if your credit score for a car loan sits above 660. Youll pay higher rates if your score sits below 660 unless you sign up with a cosigner or use an asset to secure your payments.

Onemain Financial: Best Personal Loans For Bad Credit Overall

For over 100 years, OneMain Financial has been a storied financial institution and reputable online lender catering to bad credit borrowers. The company has served over 10.3 million customers since 2010 with an 88% average satisfaction rating. Borrowers can apply for a secured or unsecured loan for a variety of uses, including:

- Home improvements

- Moving or relocation expenses

- Funeral and burial expenses

Secured loans require collateral, such as your car or home, but make it easier for people with poor credit to receive approval. Unsecured loans do not require collateral, but people with low credit scores may not qualify. In addition, this top-rated loan company offers installment loans, which are an excellent way for people to rebuild their credit scores, as long as they can make payments on time.

Loan Amounts and APRs

OneMain Financial offers a pretty good range of loan options for people who need to borrow money. Applicants can ask for a loan amount between $1,500 and $20,000. Similar to most of the top bad credit loan providers, OneMain Financial offers APRs from 18% to 35.99%.

Repayment Terms

OneMain Financial offers several repayment terms: 24, 36, 48, or 60 months. For a more accurate idea of your estimated monthly payments and APR, use the free personal loan calculator on the OneMain Financial website. Heres a quick example: If you borrowed $6,000 for a 60-month term at an interest rate of 24.99%, your monthly payments would be $176.07.

Key Features

Recommended Reading: Where Is The Car Dale Died In

Does Credit Score Matter Differently If Buying A New Vs Used Car

Whether youâre buying a brand new car or a used car, your credit score will have a similar impact. Loans for new cars sometimes have better interest rates than used cars, but a borrower with good credit will typically get a good interest rate regardless of the type of car they choose.

For example, according to Experian, borrowers with a credit score of around 700 would pay about 4.68% for a new car compared to 6.04% for a used car.

If you buy a reasonable, reliable used car with a slightly higher interest rate, youâll still probably save a bundle compared to buying a brand new car with a lower interest rate. New cars cost more than used cars and lose most of their value when you drive them off the lot. Even with higher interest rates, buying a used car is typically a better financial decision.

In either case, you are usually better off buying a car with a loan than choosing a car lease. With a lease, you are effectively renting the car and have to give it back and the end of the lease unless youâre willing to make a big payment to buy it outright. When you buy with a loan, you own the car in the end and can choose to sell it or keep it for years to come.