What Is Collision Coverage And What Does It Cover

Collision coverage typically covers damage to the insured driverâs car in an at-fault accident with another vehicle. Usually, it also covers damage in a collision with an object, like a guardrail, pole or tree. In some states, like Massachusetts, collision insurance may even apply regardless of fault and may apply in hit and run situations.

Which Car Insurance Company Has The Cheapest Full Coverage Rates

Car insurance rates vary widely among insurance companies for the same coverage. Thats true whether youre looking to buy your states minimum requirements or full coverage. The best way to find a good policy at a decent price is to compare car insurance quotes.

Here are the average rates for full coverage car insurance.

| Company | |

|---|---|

| USAA | $1,141 |

| Methodology: To find full coverage rates by company, we averaged rates from 10 large insurers using data from Quadrant Information Services, a provider of insurance data and analytics. Rates are based on a 30-year-old female driver with a clean record insuring a Toyota RAV4 with $100,000 in bodily injury liability coverage per person, $300,000 per accident and $100,000 in property damage liability, uninsured motorist coverage and any other coverage required in the state. The rate also includes collision and comprehensive with a $500 deductible. |

As you can see, you could potentially save hundreds of dollars each year by shopping around. The best cheap car insurance companies have competitive rates for a variety of drivers, like good drivers, drivers with poor credit, drivers with a speeding ticket and drivers with an at-fault accident on their driving record.

And dont forget to ask about car insurance discounts. You can often qualify for additional savings such as safe driver discounts, bundling your auto and home insurance, anti-theft features and vehicle safety features.

How Much Does Car Insurance Cost

If youre wondering, How much does car insurance cost? weve got answers. The national average cost of car insurance is $1,202 for full coverage or $644 for liability.2,3

But remember, thats just the average. Lots of factors can affect what you paylike the type of coverage you buy, the car you drive and even where you live. Why is that?

Well, car insurance companies make money by charging you a monthly premium. When they have to pay for the costs of an accident, they lose money. So if auto insurers think youre unlikely to file a claim, theyll charge you lower premiums. If they think youre likely to file a claim? You guessed ithigher premiums.

The good news is that if you know what the insurance companys looking for, you can actually do things to get a lower rate.

Read Also: How Much Do Car Salesmen Get Paid

Average Auto Insurance Cost By Car Types

Just like how driving record, age, gender, and state of residence are factors that determine auto insurance prices, car models are no exception and play a role in your auto insurance rates as well. Different car brands and models have varying values and safety levels, especially when it comes to car repair and car parts. Please find a chart of few of the most popular car models: BMW, Ford Mustang, Dodge Charger and Honda Civic as well as their respective average auto insurance costs for 2017, 2018, and 2019 model years, all for 30 year old drivers.

How Much Is Car Insurance For A 20

For a 20 year old male, the cost is $1,159 per year and for a female driver, the same policy could cost an average of about $1,058 per year for the state minimum policy. Heres a breakdown of insurance rates for various coverage levels:

Car Insurance for 20 Year Old Male and Female| Age |

|---|

- Your credit history

- Your annual mileage

Each of these rating factors, along with the type of coverage you choose, deductibles and discounts, influences the rate you’ll pay for your car insurance policy.

To get an idea of how much you can expect to pay, you can start with an estimate of car insurance costs by using the average rate tool at the bottom of the page. It shows rates for six age groups and three coverage levels by ZIP code.

Finally, the car insurance company you choose makes a difference in your car insurance rates because companies assess risk differently, and each uses its own formulas to calculate the price you pay.

Whatever age and whether male or female, you can save hundreds of dollars if you compare car insurance companies and find the one that offers the best rates for you. Our guide to the best cheap car insurance for seniors shows how much drivers aged 65, 75 and 85 can save.

Don’t Miss: 2.5 Car Garage Size

The Cheapest Full Coverage Car Insurance Of 2022

State Farm has the best cheap full coverage policy that’s widely available, with an average rate of $1,310 per year or $109 per month.

Full coverage car insurance is more expensive than policies that only include liability insurance. The average cost of a full coverage car insurance policy is $2,058 per year or $171 per month. That’s more than double the average price of liability-only car insurance. But you can still find savings with the right insurer.

Depending on where you live, the cheapest companies for full coverage policies can differ. And because the cheapest company isn’t necessarily the best, compare recommendations for the best full coverage car insurance companies to help you shop around for cheap full coverage auto insurance near you.

Collision And Comprehensive Coverage

Collision and comprehensive coverage are important for covering damage to your own car. Your liability insurance wont pay for any of your car damage. If you own your vehicle outright then this coverage is optional. Expect to have to buy them if you have a car loan or lease.

Collision insurance pays for damage to your car from crashes with any object, such as a pole or guardrail. Comprehensive coverage pays for car theft and repairs due to weather, animal damage, vandalism, fire, flood and falling objects.

For example, lets say your car tires slipped on ice and you and ran into your neighbors fence. Collision coverage would pay for the repairs to your vehicle. Liability insurance would pay for the neighbors fence.

If you drove across a flooded street without realizing how deep it was, comprehensive coverage would pay for car damage.

Collision and comprehensive coverage both have a deductible, such as $500 or $1,000. Thats the amount of money deducted from an insurance check if you make a claim.

Don’t Miss: How Much Do Car Washes Make A Year

Buy Only The Coverage You Want

You cant drive legally without the state-required coverage. But if you own your car outright without a loan or lease, and your car is already on its last leg, you may want to consider foregoing comprehensive and collision coverage.

The maximum amount your comprehensive coverage will pay you is the market value of the car which decreases with each passing year minus your deductible. If this amount is more than your premium, then it will be useful. If not, you would be better off saving the money you would have otherwise spent on the premium for repairs.

We suggest using the Kelley Blue Book or Edmunds.com car value pricing tools to determine how much your car is worth and decide if what you pay for your comprehensive coverage is actually worth it.

How To Make Full Coverage More Affordable

Full coverage is expensive but can be more affordable. There are several things you can do that can save you on your yearly bill. The first is to control your deductible on your collision and comprehensive coverage. As we mentioned above, the lower the deductible, the more you will pay every month. If you set aside some money in your savings account for your deductible, perhaps you can raise it a bit and thus have easier monthly payments.

The next thing you can do is make sure you apply for any discounts you may qualify for. Insurance companies, especially the large ones, have well over 20 discounts for a variety of different reasons. Whether you’re a proven safe driver, a good student, have taken a drivers education course, or you can bundle your car policy with another insurance policy, the combined discounts can save you well over 20% on your yearly bill.

The last, and possibly best advice to make full coverage cheaper is to shop around. Quotes comparison shopping can save you thousands every year on your car insurance bill. In any area, there are numerous companies competing for your business, and they’ll most likely differ in price by several hundred dollars. You will never know if you are getting the best car insurance if you are not comparing quotes from several companies. We have always found a company in any given area offering a price well below other competitors â you just need to be diligent enough to find them as well.

Recommended Reading: Car Interior Scuff Remover

How Much Does Full Coverage Cost

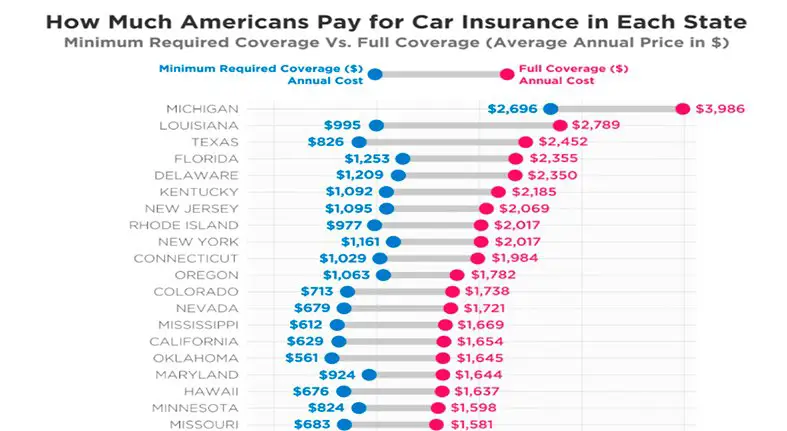

The average annual cost for full coverage ranhoges from $950 to $2,500 or between $80 and $250 a month, depending on the state in which you live. Costs also depend on the kind of deductible you have, how much coverage you choose to purchase, the kind of vehicle you have, and your driving history.

Some experts disagree on whether or not buying full coverage is worth the price if you have an older car. Financial coach Joshua Crum of Rebuild Repair Credit said he avoids buying it for his cars, which are typically more than 10 years old.

Unless its required by a car loan I would avoid the expense, he said. The last insurance broker I discussed this with told me it was only worthwhile on a vehicle under two years old. On the other side of that, Ive heard people who cant drive well wreck their cars and get new ones, so it may be worth it if youre a bad driver.

But consumer savings expert Teresa Mears said she keeps full coverage on her 1999 Honda CRV and that dropping collision would not save me enough to do it. At the end of the day, its all about your risk tolerance. If youre comfortable paying out of pocket in certain scenarios, theres no need to be fully covered. If that potential makes you uncomfortable, you should consider comprehensive coverage.

How Much Does Car Insurance Cost For Drivers With Good Credit

We found that drivers with an excellent credit history received an average discount of 20% on annual car insurance rates compared to drivers with average credit history.

Drivers with good credit are considered lower risk by insurance companies and, as a result, can receive substantial savings on their auto insurance costs.

State Farm offered the best overall rate and largest discount for drivers with very good credit. Famers had the highest rates, while Farm Bureau had the smallest percentage discount for those with very good credit.

| Company |

|---|

Rates are an annual average for our sample driver with a full-coverage policy.

Having poor credit causes your rates to increase by an average of 59%, as compared to having average credit. Nationwide had the smallest increase in rates , while Farm Bureau had the lowest rates for those with poor credit.

Don’t Miss: Car Salesman Pay Plan

What Qualifies As A Full Coverage Policy

Not every insurer will define full coverage the same way. But it usually refers to policies that add comprehensive and collision insurance to the minimum liability insurance requirements mandated by your state. Comprehensive and collision insurance protects you against the cost of damages to your vehicle, on and off the road. Liability insurance protects you against the cost of damages to others when youre at fault. Full coverage

How Much Car Insurance Rates Cost By Age And Gender

For example, an 18-year-old driver pays more than three times as much as a 25-year-old driver for auto insurance, with all other factors equal. Average rates gradually decrease each year until a driver reaches age 25.

Auto insurance quotes also vary depending on the driver’s age and years of experience. Young and inexperienced drivers tend to get in more accidents behind the wheel, which is why young drivers have higher auto insurance rates.

Also Check: How To Get Cigarette Burn Out Of Car

Usaa Auto Insurance: Best For Military

USAA provides the cheapest full coverage insurance if you are eligible. It is important to note that USAA only provides coverage to military members, veterans, and their families.

If you are eligible, we highly recommend USAA. On top of full coverage insurance, USAA also provides further perks, such as roadside assistance, accident forgiveness, rental car coverage, and car replacement assistance . If you are looking to bundle insurance, USAA also providers life insurance, homeowners/renters insurance, health insurance, and more.

USAA auto insurance might be right for you if:

- You are part of the military, are a veteran, or a family member

- Want the cheapest full coverage insurance

To learn more about this cheap auto insurance provider, check out our review of USAA auto insurance.

Compare Car Insurance Quotes

No two insurance companies have the same pricing formula, which is why one of the best ways to get the cheapest full coverage insurance is by comparing quotes from multiple providers.

However, comparing auto insurance quotes by price alone may not always be the best idea. In some cases, cheap auto insurance could come with less coverage and fewer benefits. Always make sure that all your quotes offer the same coverage limits and benefits, and have the same deductibles.

Read Also: Texas Auto Registration Fee

Average Cost Of Full Coverage Auto Insurance

We found that car insurance costs an average of $1,732 per year nationwide for full coverage. The cheapest overall providers for car coverage are typically USAA, Erie Insurance, Auto-Owners, State Farm, Geico, and Progressive.

That being said, the average cost of full coverage car insurance depends on several factors:

- Your insurance provider

- Your deductible, with higher deductibles leading to lower rates

- Your driving record and age

- Your state

Car insurance rates are not standardized, so each provider is free to set its own rates. But why should your vehicle, driving history, and state affect your insurance premium?

Its all about risk. Think of it like this: if you total a Tesla Roadster, its going to be far more expensive to replace than a Kia Rio. That means your car is a lot riskier to insure, so insurance providers need to hike up your premium to cover themselves for that risk.

Similarly, your state and driving history influence how much of a risk you are to your insurance company. If youve been driving for 20 years without so much as a traffic violation, youre a lower risk to your insurance company. But if youre a brand-new driver who has no history to back them up, and youre living in Texas, the state with the highest number of crashes per year, your insurance company is going to need to charge you more.

What Is The Average Cost Of Monthly Car Insurance

How much is car insurance for a 20-year-old? Twenty-year-olds pay an average of $3,795 per year for full coverage car insurance. Although this is less than 18- and 19-year olds pay, it is still far more than the national annual average cost of full coverage, which is $1,674 per year.

Read Also: How To Transfer A Car Title In Arizona

How To Shop Around For Full Coverage Insurance

The goal of shopping around is to find equivalent insurance protection for a lower price. When comparing policies with different insurers, you should make sure that you:

- Select consistent liability limits. If you shop with an insurer and select $25,000 in bodily injury liability per person, $50,000 in bodily injury liability per accident and $25,000 in property damage liability per accident, you should select the same with comparison insurers.

- Choose the same deductible for comprehensive and collision insurance. Increasing your deductible lowers the cost of your policy and vice versa.

- Set the same coverage limits for all other coverages, such as uninsured/underinsured motorist coverage, personal injury protection and more. Additional protections cost more money.

If you follow these steps, you’ll find that different insurers will offer the same coverage for varying prices. The best and cheapest car insurance company for your neighbor may not be the same as the best one for you.

The Best Full Coverage Car Insurance Companies

Of the insurance companies available to almost all drivers across the country, State Farm is the cheapest. The company, which is the largest insurer in the United States, has lower rates than every other large insurer, as well as many regional insurers.

In addition to its affordability, State Farm has a good customer service reputation, with a low rate of customer complaints and high marks for claims satisfaction from J.D. Power.

The combination of affordable rates and strong customer experience makes State Farm a great â and widely accessible â option for full coverage shoppers.

Also Check: What Car Dealership Use Equifax

What Is Full Coverage Car Insurance

What is considered full coverage insurance to one driver may not be the same as even another driver in the same household.

There is no such thing as a full coverage insurance policy it is simply a term that refers to a collection of insurance coverages that not only includes liability coverage but collision and comprehensive as well. In general, most drivers consider full coverage auto insurance to mean that you have purchased not only mandatory state coverages, such as liability insurance which is required virtually everywhere and pays for the damage you inflict on other people and property but comprehensive and collision as well.

Ideally, full coverage means you have insurance in the types and amounts that are appropriate for your income, assets and risk profile. The point of all types of car insurance is to keep you from being financially ruined by an accident or incident.

If you want to go above and beyond what a normal full coverage policy entails, you can buy a policy with every conceivable car insurance option available. If you so feel like shelling out the money you can get a lot of protection. A fully loaded policy may look like this if you went for nearly every option available: