Can You Refinance A Car With The Same Bank

Why you can trust Jerry

In most cases, you can refinance a car loan with the same bank that you have your loan. But refinancing with the same institution isnât always the right decision and shopping around will ensure youâre getting the best rate.

Waiting Too Long To Refinance

If you run the numbers and you determine that it makes sense to refinance, waiting can cost you. Rates are typically lowest on new vehicles, and some lenders wont refinance loans for cars over a certain age . You might even get a new car rate if you refinance immediately after purchasing from a dealer and taking advantage of dealer incentives. Used car loan rates are typically higher than new car rates.

You Have To Pay Refinancing Fees

Exactly how much youll have to pay in fees when refinancing your car will vary. But youll definitely have to end up paying something.

From early termination fees to title transfer fees, application fees, and more, this can all quickly add up. And it may affect how much you hope to be saving in the long run from refinancing.

You May Like: How To Program A Car Computer

Is It Easier To Refinance With My Current Lender

Can I refinance my car with the same lender? Can I refinance with a new lender? These kinds of questions are common among auto owners who are considering refinancing.

When you buy a car, you either shop around with different lenders for a loan or ask the auto dealer that you buy from to set up a loan for you. When you refinance, it is smart to engage in the same process of shopping around for the best possible option for you.

You are not locked into using the same lender that currently holds your loan. Your priority should be finding the most favorable loan terms possible, which typically means finding a lender that will offer you the lowest interest rate. In some cases, that may be your existing lenderin other cases, it will be a new lender. Rate shopping will give you a broader sense of the market and what constitutes a genuine deal.

While it may seem easier to stay with the same lender, any lender willing to give you a refinancing loan will work with you to make the process as seamless as possible. Theres no reason to be worried that switching to a new lender will make your journey with a loan more complex.

Improve Your Cash Flow

If you currently owe less than what your vehicle is worth, you may be able to access more cash by refinancing. For instance, lets say you have owned your vehicle for three years. Your vehicle is currently worth $8,000, and you still owe $5,000 on your auto loan. You need money for a small home improvement project. One option would be to refinance your vehicle for $6,500. You will still owe less than what the vehicle is worth and have $1,500 of new money available to spend after the new loan pays off your previous $5,000 balance. The $1,500 can now be used for your home improvement project.

Be careful, though. A car, unlike a home, is always a depreciating asset that can lose more than 10 percent of its value within the first month of ownership and more than 20 percent within the first year.

You dont want to risk going underwater on your loanthat is, owing more on your car than the car is worth.

Also Check: What Do Car Dealers Use For Credit Score

A Refinance May Not Make Sense If:

Youll lose money. Each state charges a title fee when a new loan is made. Plus, each lender may charge different fees, such as origination fees and processing fees. If you save $500 on interest by refinancing but the fees for refinancing add up to $550, then youd lose money.

Add-ons are another way lenders may try to make money on your refinance loan. Extended warranties or guaranteed asset protection can be expensive in the hundreds or thousands of dollars but may appear reasonable when spread out over several years. Ask for the total cost and make sure you understand what these products do and do not cover.

Your car is too old or has too many miles. At a certain point in your cars life, it may no longer be eligible for refinancing. Most lenders have age and mileage requirements for the vehicles theyll consider. Requirements vary, but 10 years or 100,000 miles is often the end of the road.

Myautoloan: Most Popular Marketplace

Starting APR:1.89%Loan terms: 24 to 84 monthsAvailability: 48 states Minimum credit score:575

Rather than a direct provider of auto loans, myAutoloan is an online marketplace where you can compare offers from a number of lenders in one place. After you enter your personal information, lenders will provide loan offers for you to choose from.

The myAutoloan marketplace can help borrowers looking to refinance their auto loans find rates as low as 1.89%. Those with less-than-ideal credit history can refinance their vehicle loans through the site, which can find loans for people with credit scores of 575 and above. However, the lowest rates are reserved for people with the highest credit scores.

Also Check: Which Credit Bureau Does Car Dealerships Use

How Many Times Can I Refinance My Car

If you have already refinanced your car, you may be wondering if you can refinance again. What if your timing wasnt great the first time around? What if your credit score has improved a lot and youre certain you can get a better rate this time around? Dont fret were here to answer all of your refinancing questions.

Your Auto Loan Has A Steep Prepayment Penalty

When you refinance a car loan, your old lender misses out on interest it otherwise would have gained in future months. To combat these losses, some lenders add prepayment penalties to loan contracts. If the prepayment penalties mentioned in your current contracts disclosures are high, you may lose money even if refinancing gets you a lower interest rate.

Read Also: How To Notarize A Car Title In Az

Applying To Refinance Your Vehicle Loan

When it comes to refinancing an auto loan, the application process is relatively quick and painless. In fact, you’ll likely find it much easier than when you applied for your original loan. Many lenders, banks and credit unions among them, allow customers to apply for refinancing online, often with same day approval. You may even be able to finalize the loan online with an e-signature, or by printing out the loan documents and returning them by mail. Having said all that, it is always helpful to speak with a loan officer in person to ensure that you fully understand the terms of the agreement, and in order to negotiate the best deal possible.

Whether you decide to apply online or in person, you will need to have some specific information at your fingertips in order to complete your application. The following checklist should help ensure that you have all of the necessary documents at hand when it comes time to contact a lender.

Keep in mind that while you are researching lenders, and applying for a refinance loan, you must maintain your current repayment schedule. Should you miss any payments, you will not qualify for refinancing. Your responsibilities to your original lender will remain in force until the refinance agreement is finalized and your new lender has resolved the original debt.

Bank Of America Reviews

Bank of America has a strong standing within the industry, holding both accreditation and an A+ rating from the BBB.

When it comes to customer reviews, the company doesnt fare as well. Bank of America has almost a 1.1 out of 5.0-star rating from consumers on the BBB website and a 1.4-star rating out of 5.0 from customer reviews on Trustpilot.

However, it is important to note that reviews are for the company overall and are not specific to its auto loans division. Even though a number of Bank of America customers complain about high fees and frustrations with phone support, many also report positive experiences with the company, usually pointing to user-friendly online interfaces and supportive customer service.

Our team reached out to Bank of America for a comment on its negative reviews but did not receive a response.

You May Like: How To Burn Mp3 Cd For Car

Benefits Of Refinancing A Car Loan

There are a few reasons to consider refinancing your car loan with a different lender. Here are some benefits to keep in mind:

- Lower interest rate: If your credit has improved since you first bought your vehicle or market interest rates have decreased, you may be able to get a lower interest rate than what you have right now.

- Lower monthly payment: If you keep the same repayment term, a lower interest rate will typically translate into lower monthly payments. If you want to lower your monthly payment even more, though, you may be able to get a new loan with a longer repayment term. This may mean higher interest charges over the life of the loan, but it can be worth it if your monthly budget is tight.

- Choose to pay off debt sooner: On the flip side, you could also choose a shorter repayment term. Shorter terms typically correspond with lower interest rates, which means you’ll save more money and eliminate the debt sooneralthough your monthly payments will be more expensive.

- Get cash from your equity: Some auto lenders offer cash-out refinance loans that allow you to refinance the original loan and get some cash to pay for other expenses. This option is typically limited to people who have a lot of equity in their vehicle.

As you consider these benefits, think about whether refinancing is right for you and take steps to refinance your auto loan.

Consider If Refinancing Makes Sense For You

Before you start the application process, it’s important to determine if refinancing is the right move for you right now. Here are some factors to consider:

- : To qualify for the best terms on the new loan, your credit history typically needs to be in great shape. If you’re not quite ready, consider waiting and improving your credit score first.

- Prepayment penalty: Some lenders will charge you a fee if you pay off your auto loan earlier than agreed. Check your loan terms to see if you have a prepayment penalty and how much it’ll cost you compared with the potential savings you expect to get from the new loan.

- Origination fee: Some lenders may charge an upfront fee when you refinance. This fee can vary from lender to lender, but it’s important to compare it with the potential savings to see if it’s worth the hassle.

- Length of repayment period: If your new repayment term is longer than your current one and you don’t necessarily need the lower payments, it may not be worth it simply because you may end up paying more in interest over the life of the loan.

Recommended Reading: What Credit Report Do Car Dealers Use

Has Your Credit Improved

If your credit has improved, refinancing could result in a lower interest rate, which could save you money in interest over the life of the loan. But if your credit hasnt improved, getting a lower rate may be difficult unless interest rates have dropped since you got your current loan.

If youre not sure, check your credit to get an idea of where your credits at. Checking your credit reports can also help you identify any potential errors that may be impacting your credit scores and work on disputing them.

Consider Applying For Prequalification

Take some time to shop around and see which offers you may qualify for. Applying for prequalification can be a good place to start. To get prequalified, the lender will look at certain information, like your credit and type of vehicle. Prequalification is typically considered a soft inquiry, which wont hurt your credit all on its own. But prequalification is not a guarantee of approval, and if you decide to apply for the loan, youll ultimately have to apply for it and face the hard inquiry that goes along with it.

Check around with several lenders and compare the interest rates, loan terms and total cost of borrowing available to you. Find out if any of the loans qualify for an autopay discount. Opting into this feature may lower your interest rate and help ensure you dont forget a payment a win-win for you.

You may be tempted to choose an offer with a longer loan term, which could result in a lower monthly payment. But keep in mind youll end up paying more in interest and increase your risk of becoming upside down.

Above all, consider the main reason you want to refinance and whether each loans terms address that need.

Also Check: What Percent Commission Do Car Salesmen Make

How Soon Can You Refinance Your Car Loan After Purchase

There aren’t specific rules about how soon you can refinance after taking out an initial loan to purchase your vehicle. However, you may at least need to wait until you receive your title showing the original lender as the lienholder. Your credit may have taken a dip after the original loan, too, so it might be helpful to wait a few months for it to rebound.

What You Need To Refinance

To refinance an existing loan, you need the following :

Recommended Reading: Cigarette Burn In Car

When You Should Refinance An Auto Loan

If youre thinking about refinancing your car loan, it makes sense if:

- You have great credit. The higher your credit score, the lower your potential new interest rate will be and the more likely you are to qualify for the best repayment terms.

- The interest rate is low. For refinancing to make sense, the interest rate should be lower than what youre paying now. This will also lower what you pay over the life of the loan and, in some cases, might reduce your monthly auto loan payment.

- You meet eligibility requirements. Not all lenders have the same requirements, so to refinance, you should make sure youre eligible first. In addition to having a good credit score, you should also make sure you meet any other qualifications.

When Can You Refinance A Car Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you recently bought a car, you may wonder when you can refinance your car loan to reduce the interest rate or lower the payment.

Strictly speaking, you can refinance your auto loan as soon as you find a lender that will approve the new loan. That may be a challenge since most lenders wont refinance until the original car loan has been open for at least two to three months.

Delayed lender approval can be an obstacle to refinancing your car loan, but there are potential benefits to waiting.

Don’t Miss: Repair Cigarette Burn In Car Seat

What Does It Mean To Refinance A Car Loan

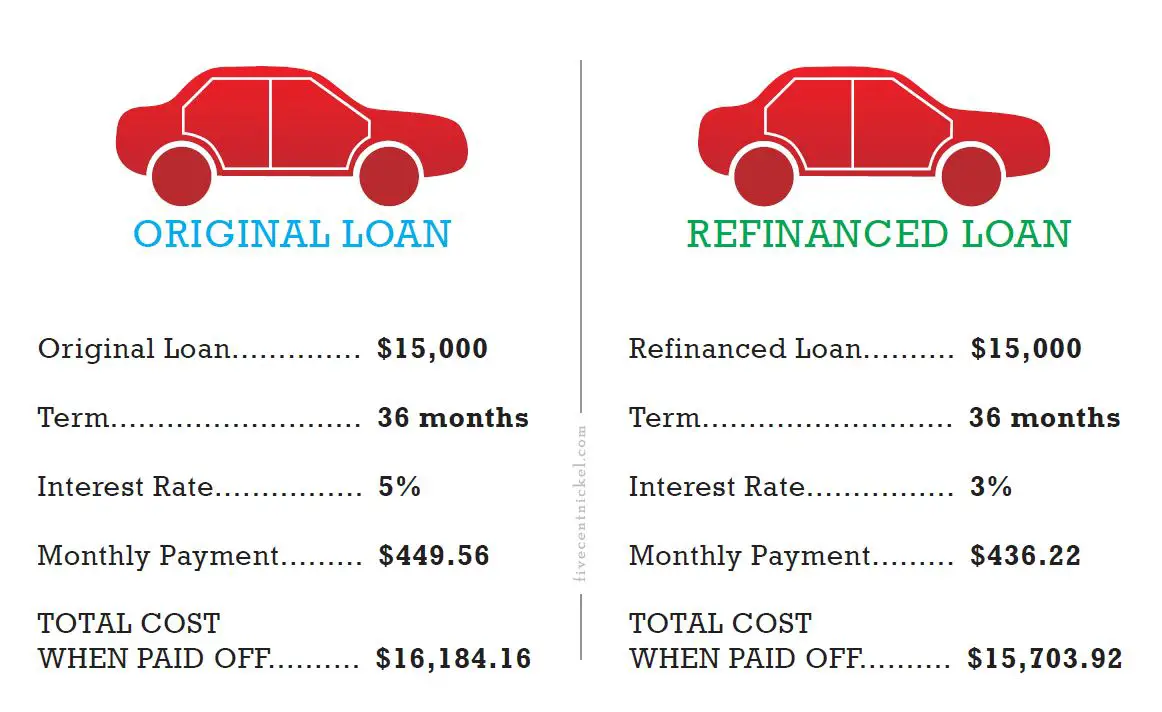

Refinancing a car loan means youre taking out a new loan to cover whats left on your existing one. Its typically used by borrowers who want to get a lower interest rate.

Those who refinance car loans often save money on their monthly payments. However, even if they secure lower rates, they may end up paying more overall if they choose longer terms. Thats because extending a loan term means the borrower will pay more in interest over the life of the loan.

Many drivers keep more money in their savings accounts when they refinance a car loan, but using an auto loan calculator can help you determine if its right for you. Well explain when refinancing may be a solid option and when it may be better to keep your current car loan.

Pay Off Your Old Loan And Start Making New Monthly Payments

Depending on your lender, much of the transition from your old loan to your new one can be taken care of by the lender. For example, your new lender might pay off your old loan. But be sure to reach out to your previous lender to get confirmation that its been paid in full before you stop making payments on that loan.

Once your original loan is paid off, you can focus on making on-time payments on your new loan each month, which may help boost your credit.

Don’t Miss: Where To Charge Car Ac

Collect All The Necessary Documents

To refinance your car, you need documents showing the following:

- Personal information

- Current car information

Personal information

Refinance lenders will ask for a form of identification, such as a drivers license, your Social Security number, previous addresses, and monthly mortgage or rent payments.

Proof of income or employment

You must let the lenders know that you can repay your loan. In that case, presenting a pay stub or tax return is needed. In some cases, lenders might also ask about your employment history.

Proof of auto insurance

Lenders dont want to get in trouble for you. This is why they will need your auto insurance card or at least other proof of insurance.

Current loan information

If you want better offers, then showing your current loan information is a wise idea.

Here is what you can show to your lender:

- Current monthly payment

- Loan term or the remaining period left in repaying the loan

- The interest rate

Side note: its important to check if your original loan contract has no prepayment penalties. The prepayment penalty is a fee youll get if you pay off your loan early.

If you cannot find your contract, your current lenders customer service can help you with the information needed. They can even email you a copy of the contract.

Current car information

Lenders are also looking for information about your vehicle.

So make sure you provide information about the cars make, model, mileage, and vehicle identification number .