What Is The Value Of Your Vehicle

Expensive vehicles cost more to insure. In this case, a high deductible might make sense because you would have higher savings on your premiums.

On less valuable cars, you may not want a high deductible because the cost to repair damage might not equate to your deductible. For example, if you have a $1,000 deductible and your used car needs a total repair of only $600, you would pay that entire amount out of pocket. Your insurance wouldnt pay for anything.

Additionally, a lower value car will have a lower cost of insurance. In this way, the price difference between a $500 deductible and $1,000 deductible wouldnt offer significant premium savings.

What Factors Affect Your Premium

Every auto insurance company uses their own method to decide how much to charge drivers for insurance. However, most generally look at the same set of variables. According to the Insurance Information Institute, these factors are most likely to affect your auto insurance premium:

- Your policy, including the type of coverage, limit and deductible.

- Your personal information, such as your age, gender and marital status.

- Your location, since some geographic areas have higher rates of theft and accidents.

- Your vehicle, including the make, model, year and any custom equipment.

- Your commute, namely the number of miles you drive to work or school every day.

- Your credit, as credit scores are generally correlated with responsibility as a driver.

What Car Insurance Coverage Types Do Not Require A Deductible

Liability coverage is required in most states and helps cover injuries and property damage for the other party or parties if you are at fault in an accident. When you buy liability coverage, you will choose a specific amount of coverage. These coverage limits are the maximum amount the insurance company will pay the other party for a covered claim. Because liability coverage extends to others to whom you injure or cause damage, there is no deductible.

If you choose optional coverages like roadside assistance or rental car reimbursement, there is generally no deductible, though there may be coverage limits and caps on the amount of claims you can file for these add-ons.

Don’t Miss: How To Fix Burn Holes In Car Upholstery

Paying Your Car Insurance Deductible

Now that weve covered all the types of coverage that can have deductibles, lets go over how car insurance deductibles work once youve had a car accident.

Like health insurance, car insurance deductibles are paid to your service provider and not to your insurance company. What will happen is your insurer will issue payment to your body shop and subtract the amount of your deductible from the payment. This should be clearly stated on your payment and your repair estimate to confirm it has been fulfilled.

Unlike medical insurance, your deductible isnt due until the repairs are complete. When you accept your cars delivery from us after its repair, we will take your payment for your deductible.

In the event the accident wasnt your fault, you will still need to pay your deductible. However, your insurance company will attempt to return your deductible to you from the at-fault drivers insurance. This process is called subrogation. Many reputable insurance companies will pre-pay the deductible for repairs their customers are responsible for. If youve been in an accident thats not your fault, you should ask the at-fault persons insurer if they will agree to pre-pay your car insurance deductible and use your own insurance for the repair. Well cover why you might want to do this in another article soon.

What Is Your Risk Of Making A Claim

You may be more likely to file a claim if you:

- Have accidents on your record

- Drive on busy roads

- Live in a city where cars are commonly stolen

When choosing your deductible, consider the likelihood of having to pay itperhaps even repeatedly.

Filing a claim could lead to an increase in rates for up to five years depending on the circumstances, state, insurer, cost, and a number of other claims.

Also Check: How To Make Multi Color-car Freshies

Progressive Insurance: Best For High

Progressive auto insurance is also available nationwide and is a great option for high-risk drivers. The insurer has full coverage options, plus add-ons like roadside assistance, gap insurance, and rideshare coverage.

There are many available discounts, including those for safety features on your car, going paperless, and paying your premium in full. Progressive has an easy quote process, which allows you to compare other auto insurance companies right on its website. Progressive received 4.5 stars in our in-depth review.

Read more in our full review of Progressive insurance.

Finding Help For Your Car Insurance Tax Deduction

When its time to calculate your expenses and complete your forms, we understand you might want some help. Thats why H& R Block is here to help.

Whether you choose to work with one of our knowledgeable tax pros or file your taxes with H& R Block Online, you can count on H& R Block to help navigate your car related deductions.

Related Topics

Can you claim education credits if you don’t claim a child as a dependent? Learn more from the tax experts at H& R Block.

Also Check: How Much Is Registration For A Car In Texas

Is It Worth Going Through My Car Insurance For A Repair

Additionally, some things arent really worth going through your car insurance because of your deductible. For example, lets say you have a $250 repair bill for your car. If you have a $500 deductible, you would have to pay out-of-pocket for the total amount of the repair anyway. Because the repair isnt more than the deductible, it might not be worth it to file a claim for something youd pay for out-of-pocket anyway.

Similarly, if you had a $600 repair and a $500 deductible, you may just want to take care of the repair yourself instead of making your insurance pay the extra $100, potentially raising your rates next policy term. However, if you have a much higher repair bill than your deductible, by all means, let your insurance help you out!

Should I Use My Insurance Deductible Or Just Pay For The Damage Myself

There are situations where you may be better off paying for damage to the car yourself rather than filing a claim. Here is an example :

If you get into an accident and have $550 worth of damage to your vehicle and your deductible is $500, is it worth filing to have your insurance provider pay the additional $50?

Remember, when you file regardless of how much you are responsible for paying it. Since filing could increase your payments upon renewal, you are better off paying for the damage yourself.

Also Check: Replace Clear Coat On Car

How Does The Deductible Work

Your deductible, typically around $750 will be first applied to any damages. For example, if you are in an accident where your collision coverage would apply and the car you were driving suffered damage requiring $3,500 in repairs, you would be responsible for paying $750 of those costs. The remaining $2,750 would then be covered through the collision coverage by your insurer.

In some cases where another driver is at fault for the accident you may wish to file a third-party claim against their property damage coverage. Under these circumstances your insurer may pursue a process called subrogation to recoup the amounts they have already paid. In the process they may also help to reclaim any amount that you paid through your deductible. You can learn more in our article on How Does Car Insurance Work?

Does My Auto Lease Require A Certain Deductible Amount

You may have a required deductible amount if you have a loan or are leasing your vehicle. Some lease agreements require low deductibles of $500 or less to ensure that youre able to pay if the car is damaged.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions.All content and services provided on or through this site are provided “as is” and “as available” for use.QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site.You expressly agree that your use of this site is at your sole risk.

Also Trending

Recommended Reading: How To Remove Cigarette Burns From Car Seat

Road Rage: Definition And Consequences

Unfortunately, there has been an increase in road rage incidents causing injuries and death more often than ever. Road rage can create dangerous situations for the aggressive driver, their passengers, and the others on the road around them. And having a black mark on your driving record will affect your car insurance rates. You must…

Unfortunately, there has been an increase in road rage incid…

How To Choose A Car Insurance Deductible

To choose a car insurance deductible, youll need to determine how much you are willing to pay out of pocket in the event of an accident and how likely you are to have to file a claim. Youll also want to figure out how much a higher deductible may save you in premiums and compare that to how much youd save in an accident with a lower deductible. The most common deductible amount is $500, but companies usually offer deductibles ranging from $100 to over $2,000.

Read Also: Carvana Lease Deals

Do You Pay A Deductible If You Hit Another Car

There are a few different coverages on your policy that could respond to you hitting another vehicle when you are at-fault for the accident. Your bodily injury liability and property damage liability will pay for the damages to the other party, and those coverages do not have a deductible. But if you have collision coverage and you want the insurance company to step in to cover the repairs to your vehicle, you will have to pay your collision deductible.

High Deductible Car Insurance

Save money on your premiums by opting for high deductible car insurance. The downside is that if an accident occurs, you must pay more out of pocket for repairs than if you carried a lower auto insurance deductible.

Weigh the pros and cons of a high versus a low deductible by figuring out how much you can afford to pay in a worst-case scenario. If you have the means to pay more out of pocket without seriously impacting your lifestyle, choosing a high deductible might be the best way to go. If your budget is very tight, you will probably be better off with a lower deductible albeit with higher premiums. That arrangement offers you more financial protection in case your car is wrecked in a crash.

Read Also: Sell Leased Car To Carvana

How Long Does Deductible Recovery/subrogation Take

The deductible recovery process time depends on the circumstances of your accident after all, each claim is unique. But on average, it can take about six months to recover your deductible. If both sides are cooperative and provide the necessary information, itll make everything much smoother. You could get your deductible money back in as quickly as one to two weeks!

No matter the situation, American Family is your advocate. Were prepared to help you through the process every step of the way and well work diligently to do whatever we can during the deductible recovery process to help you get reimbursed. Have more questions? Connect with an agent to learn more.

What Is An Insurance Deductible

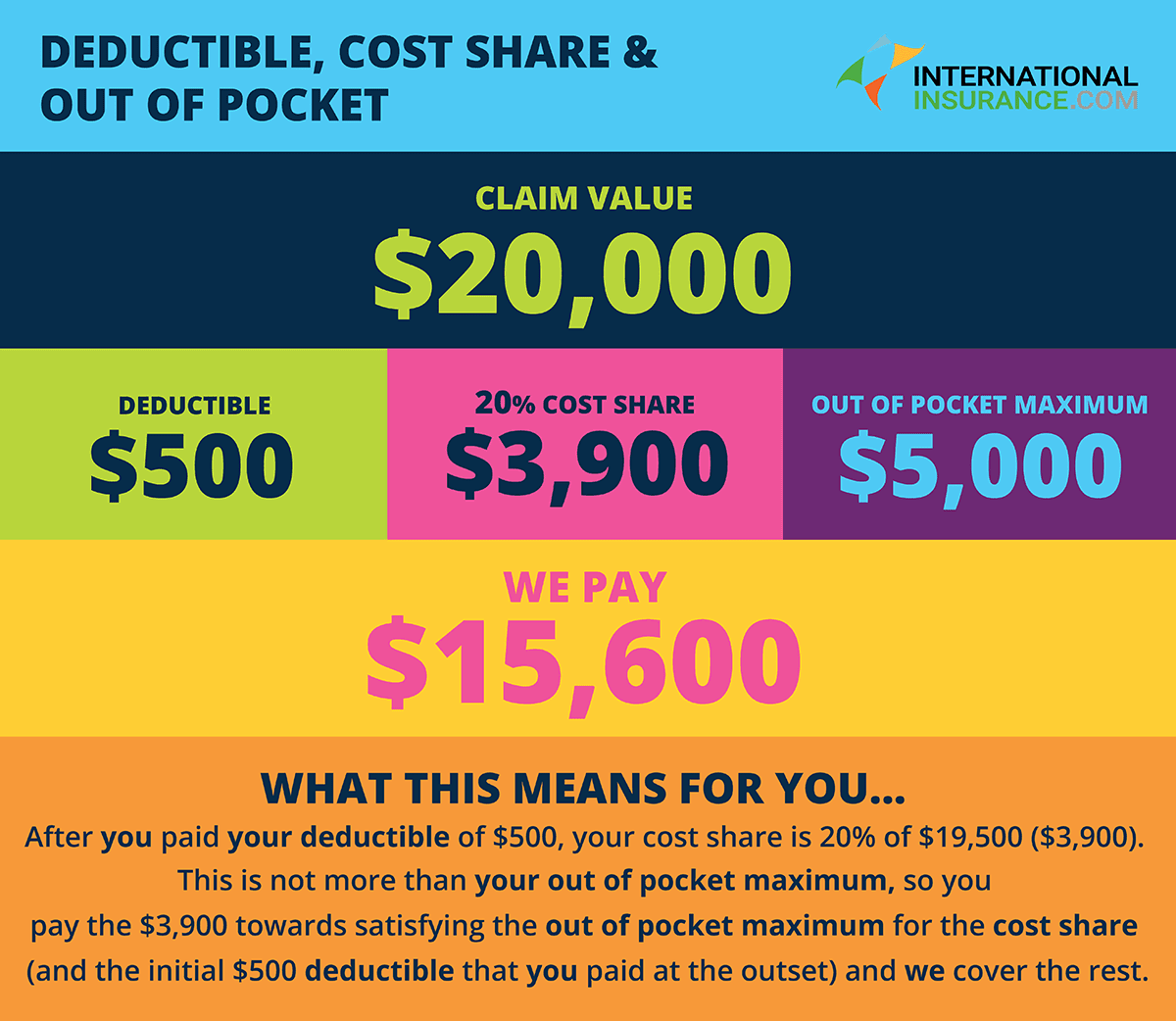

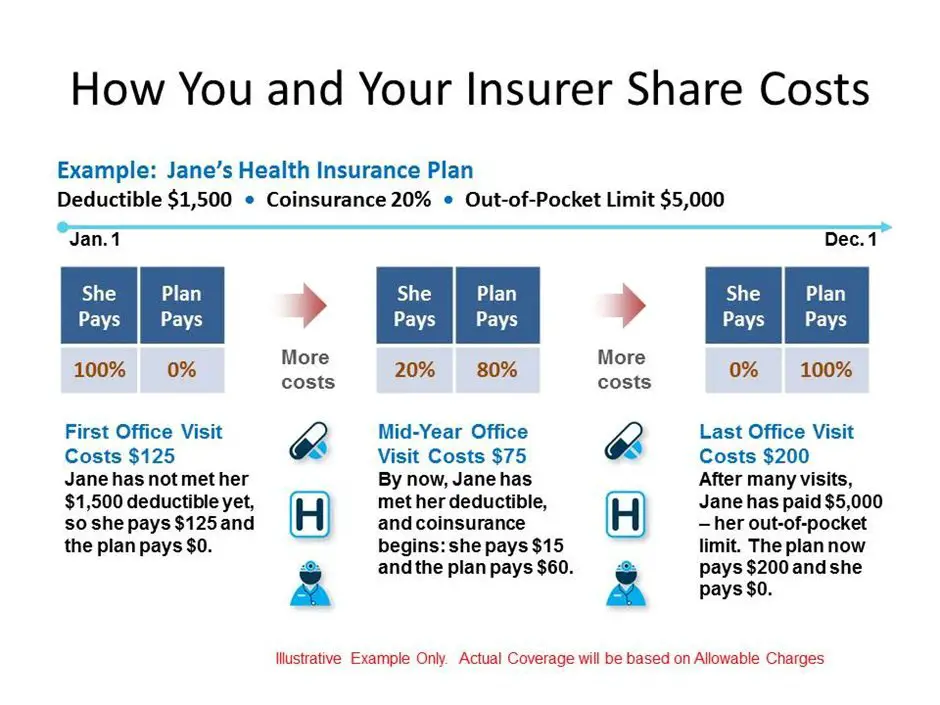

When you make a claim, your insurance deductible is the amount you have to cover yourself before your insurance company will chip in.

Insurance deductible amounts are typically written into your policy in one of two ways:

-

As a specific dollar amount.

-

As a percentage of the policys total insurance amount.

Different types of insurance apply these deductibles in different ways. With homeowners and car insurance policies, for example, youll pay a separate deductible for each individual claim. With health insurance, on the other hand, one deductible covers all claims within a calendar year.

Regardless of how the deductible is applied, your insurance will start to contribute once you reach your deductible.

Recommended Reading: How To Get Internet For Your Car

Factors To Consider When Choosing A Deductible

- Likelihood of filing a claim

- Your savings

- How much a higher deductible will lower your premiums

- How much a lower deductible will cost per month

- Deductible amounts for different types of coverage that you may need to use in an accident, such as PIP, collision, and comprehensive and whether the total amount is affordable

- Whether or not your loan or lease requires a specific deductible

What To Take Into Consideration

According to Geico, another popular nation-wide insurance agency, there are two major factors to take into consideration when selecting your deductible. The first is how much money you are able to pay out of pocket in case of an accident. This shouldnt be set so high that you will be uncomfortable making the deductible payment.

The second is to check out how the amount of the deductible will affect your policy premium. Your insurance policy premium is directly affected by the deductible you select, where a higher deductible will lower your insurance premium, and going lower will result in a higher insurance premium.

Recommended Reading: Florida Paper Title

How Does Car Insurance Deductible Work

A car insurance deductible is an out-of-pocket fee that you are responsible for when you get into an accident. Youll need to pay your deductible before insurance will start paying for any necessary car repairs. In the event that you need to file an insurance claim, you will be required to pay a deductible.

This deductible can be high or low depending on your car insurance plan. Traditionally, higher deductibles are associated with lower monthly payments, and lower deductibles are associated with higher monthly payments.

If you own a car, then youll want to familiarize yourself with auto insurance and deductibles. Lets take a look at how car insurance and deductibles work!

Do I Pay My Auto Deductible When Im Not At Fault

Cell phone down, two hands on the wheel and your full attention on whats ahead you do everything you can to stay safe on the road. But no matter how safe of a driver you strive to be, youre still vulnerable to not at fault accidents caused by other drivers.

Dealing with a car accident can be stressful and time-consuming especially when its an accident thats not your fault! Thats why American Family Insurance makes it a priority to help you get things back to normal as quickly and smoothly as possible.

Weve highlighted some key information about who pays your deductible after an accident that isnt your fault. Well highlight the deductible recovery process, too, so you know exactly how your insurance will work to get you reimbursed.

Recommended Reading: How To Make Car Freshies Last Longer

If Another Driver Causes A Crash And Their Insurance Pays

In most states, a driver who is responsible for causing a crash is obligated to pay for all damages associated with the collision. For example, if Driver A is at fault for an accident that damaged Driver B’s car, Driver A’s insurance should fully pay for Driver B’s repairs. Driver B shouldn’t owe a deductible.

Sometimes, however, the driver who should cover the costs has no insurance or too little coverage. If that’s the case, another motorist may need to make a claim under their uninsured or underinsured motorist coverage. A deductible may apply in this situation.

When You Pay Car Insurance Deductibles

You have to pay your car insurance deductible if you cause an accident that damages your vehicle and you file a claim using your collision insurance. If youre at-fault for an accident and are injured, you will have to pay a PIP deductible, too. Most situations where you use your own insurance, youll need to pay a deductible, sometimes even when youre not at-fault.

Recommended Reading: Aaa Member Car Transport

When Do You Have To Pay A Deductible

You only pay a deductible when there are covered damages to your vehicle, not when there are damages to another person’s car. That said, it can be difficult to understand every situation in which youll be required to pay a deductible. Here are a few scenarios to help you understand, but be sure to check with your insurance agent to verify what your specific coverages include.

When Do You Pay A Deductible For Car Insurance

You pay your car insurance deductible if you file a claim with your insurance company under a coverage that includes a deductible. This most often applies to damages to your own car, but it can sometimes apply to personal injury protection or underinsured motorist coverage.

After filing a claim, your insurance provider will write you a check for how much the repairs would cost, minus your deductible. For example, if your car has $2,000 in damages and you have a $500 deductible, your insurer will pay you $1,500.

| Coverage | |

|---|---|

| Personal injury protection | Sometimes |

Read Also: Making Car Freshies With Aroma Beads

When Repairs Cost More Than The Deductible

Insurers will only provide coverage if the repairs cost more than your deductible.

If the cost of repairs exceeds the amount of your deductible, you may still want to pay out-of-pocket to prevent adding a claim to your policy.

Any major damage that you cause to your car should be reported regardless of claims.

You can most likely get away with cosmetic damage, but if you repair damage on your own without reporting it and it causes issues later on, a claim for the new damage could be denied as the insurance company may judge the claim to be part of the original damage you fail to file for.