Uninsured Or Underinsured Motorist Coverage

Sometimes included in a liability policy package, but also available as a separate part of a policy, is uninsured or underinsured motorist coverage. If someone without their own liability insurance coverage hits your car, this type of insurance pays for your bodily injuries and physical damage to your car.

What Does Not Car Insurance Cover

Car insurance generally doesnt cover damage to your vehicle if its not the result of a collision. So, if you wreck your car by driving under the influence or speeding, your car insurance wont pay for the damage. You may be able to get coverage for this type of damage through other types of insurance, such as your homeowners policy.

Car insurance doesnt cover routine maintenance, such as oil changes or tune-ups. Some policies will include roadside assistance, which can be useful if you get a flat tire or run out of gas, but this is usually an add-on that costs extra.

Most car insurance policies will also exclude coverage for custom parts or modifications. So, if youve made changes to your car that increase its value or performance, youll likely have to pay for repairs yourself if theyre damaged in an accident.

How To Buy Car Insurance

You can buy car insurance directly from an insurance company, through an agent, or by using an online marketplace like Policygenius. No matter where you choose to buy insurance, there are several steps you should take:

Figure out how much car insurance coverage you need

Fill out an application, including your age, your ZIP code, and your driving history

Get your quotes and compare coverage options and rates

Pick a car insurance company and get insured

Cancel your old car insurance policy

If youre switching car insurance companies, you should make sure you have your new policy in place before canceling your existing one. That way, you can avoid a lapse in coverage, which could raise your rates significantly when you go to apply for insurance.

While there are a few ways you can get car insurance, we recommend comparing rates from multiple companies to get the best rate in your area. We can provide you with quotes from a variety of companies and help guide you through the insurance buying process.

You May Like: How To Repaint Your Car

Do I Need Business Insurance For My Car

Car insurance is crucial to protect yourself financially in case of theft, accidental damage or loss. Whether you need business vehicle insurance orpersonal auto coverdepends on how you use your car.

For this reason, you need to understand the difference between using a car for business or for personal use.

When you use a vehicle for business, it contributes to the functioning of your workplace.

If you use your car for purposes such as attending meetings outside your place of employment, you need commercial vehicle insurance.

On the other hand, if you use your car only to travel to and from work and for personal purposes, you need to have personal vehicle insurance.

Having the wrong insurance can result in your claim being rejected in the event that you cause an accident or if your car is stolen or lost.

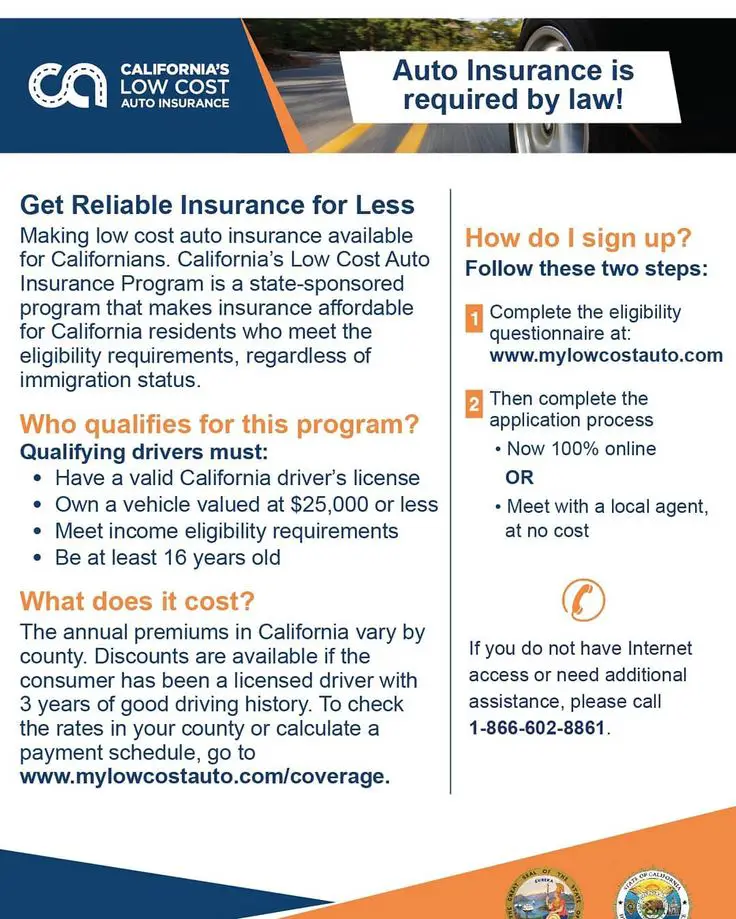

State Minimum Car Insurance Requirements

States mandate liability car insurance, which is what helps pay for damages caused by at-fault drivers to other people or property. This is so those affected in an accident wont suffer financially as a result of an at-fault driver not being able to pay them for the loss that theyve caused. Sure, you pay a fee to your insurance company and may never have to file a claim, but if the unexpected does occur, youll be glad you dont have to pay entirely out of pocket.

Did you know that each state has slightly different insurance requirements? This means there are types of insurance that may be required by your state and not required in another state. Its best to contact your insurance agent to find out whats required in your state, so you get the right insurance protection before hitting the road.

Remember, even if a coverage isnt state-mandated, you may want to add more protection for your car, your passengers and yourself.

Also Check: How To Find Car Paint Code

What Is A Car Insurance Deductible

Your deductible is the out-of-pocket expense you pay before your insurer will cover your claim.

For example, you have a $500 deductible, hit a telephone pole, and your car repairs cost $2,000. You’ll pay $500, and your insurer pays the remaining $1,500. You can choose your deductible amount from the options offered by your insurer.

The higher your deductible, the more of the claim expense you’re responsible for. That means your out-of-pocket costs will be higher, but you’ll have a lower overall rate, and vice versa.

How Insurance Companies Manage Risk

Like all insurance, car insurance rates are assessed based on risk. This means that the insurance provider:

- Calculates your likelihood of making a claim.

- Bases your premium on that level of risk.

Car insurance carriers have found that certain factors statistically affect your chances of getting into an accident, so they use those factors to determine your premiums. They include :

Also Check: When To Replace Car Tires

How Much Auto Insurance Is Required In Your State

With the exception of two states, every state requires you to get a minimum amount of auto insurance and imposes penalties for drivers without insurance. The exceptions are New Hampshire, which requires you to pay a certain amount if you decide to forego insurance, and Virginia, where you have to pay an annual fee if you want to go uninsured.

What Is Business Car Insurance

Vehicles have a number of important functions in many workplaces, including transporting employees, moving equipment and goods, and driving to business networking functions.

If you have such a car, its worth getting business vehicle insurance from a reliable and reputable insurer.

Any vehicle travelling on South Africas roads is exposed to various risks, including collisions, theft and accidents.

Its estimated that about 70% of cars in South Africa are uninsured, meaning a lot of drivers and businesses are running a risk on the roads.

Few people have saved enough money to finance the loss of or damage to their business vehicles.

If your vehicle has business car insurance, itll be covered against unfortunate events such as damage, theft or loss due to fire.

Moreover, business vehicle insurance may provide cover for any employees who unfortunately incur injury while driving a business car.

You May Like: When Was The First Car Built

Tips For Lowering Your Auto Insurance Premiums

Take the highest deductible you can afford. If you choose to buy comprehensive and collision coverage, be aware that collision pays for physical damage to your car as a result of collision with another object, while comprehensive pays for damage from most other causes, including fire, vandalism, flood and severe weather. Also, always remember to drive safely, doing your best to maintain a good driving record.

How Does A Car Insurance Deductible Work

If the time comes to put in a claim, youll most likely have to pay a deductible first. The deductible for car insurance works in a similar way to that for medical insurance. Its the amount of money you will pay out of pocket on a claim before your policy picks up the rest up to the limit you agreed to.

If you sign up for a high deductible, then your policy payments will be lower. A policy with a $1,000 deductible will not cost as much every month as a policy with a lower deductible. But if you find you need to put in a big claim to have your car fixed, youll have to come up with that $1,000 up front. If that is too big a hit for your bank account, then you may want to consider a lower deductible.

Most deductibles range from $100 to $2,000.

Recommended: 5 Steps to Switching Your Car Insurance

You May Like: Which Rental Car Companies Pick You Up

Whats The Best Commercial Vehicle Insurance For Trucks

The logistics industry makes South Africas economic wheels turn in various sectors, including agriculture, retail and manufacturing.

Exports to neighbouring countries contribute to the countrys revenue and help support the creation of jobs.

Trucks handle the movement of goods that smaller vehicles, like vans and bakkies, cant handle. Transporting goods does come with its own set of risks.

Truck drivers may experience collisions, theft and hijacking this makes its good sense to have truck insurance.

The best commercial vehicle insurance for trucks depends on your businesss requirements and finances.

Auto & General offers three types of truck insurance plans: comprehensive, combined comprehensive and all-risk, and combined comprehensive and goods-in-transit insurance.

Comprehensive truck insurance covers risks such as fires and explosions, theft, hijacking, storms and windscreen damage.

What Do I Need To Buy Car Insurance

If you are looking for how to get car insurance for the first time or have not set up a new policy in a while, you might be wondering, What do I need to buy car insurance?

You may need to provide several pieces of information before purchasing a new car insurance policy, all of which provide a better idea of you and your vehicle. These include your:

- Drivers license

- Vehicle registration

Read Also: How To Get Wifi In Your Car

Make Your Car More Secure

Making it as hard as possible for someone to steal your car reduces the risk and, in the process, is likely to reduce the insurance cost too. You can make your car secure by:

- checking with your insurer what security devices it offers discounts for

- fitting an approved alarm or immobiliser

- parking in a garage or driveway if possible

- using Thatcham-approved security devices.

Find out more on the Thatcham Research website

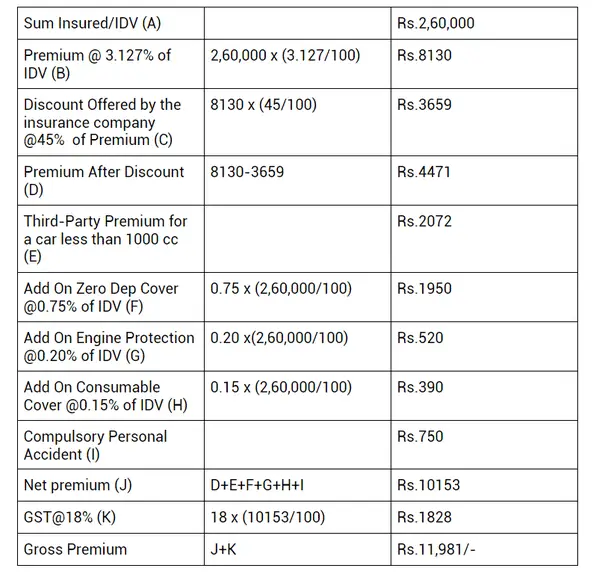

How Is The Insurance Price Calculated

A number of factors are considered by insurers when they work out your insurance premium. Broadly speaking, the higher the risk, the more you will pay. They will ask your age, occupation, where you live, the make and model of your car, and whether it has any modifications or security features. They will give you a discount if you have no claims bonus entitlement, and if you have not had an accident, your premium is very likely to be less.

For example, someone in their 50s who works in an office, lives in a rural area, drives a car that belongs to a low insurance group, and has never had an accident or made a claim is likely to get a very good price. By contrast, someone under 25 who lives in a city, drives a fast car, and has recently had an accident will pay far more.

Don’t Miss: How Long Does A Car Battery Take To Charge

What Car Insurance Doesnt Cover

Though there are many different types of car insurance coverage, there are still certain situations that car insurance wont cover such as:

-

General maintenance for your vehicle like oil changes and mechanical repairs.

-

Personal items that are stolen from your vehicle.

-

Injuries you cause to others or damage you cause to their property that exceeds your liability coverage limits.

-

Damage that you intentionally cause to your vehicle.

-

Damage from previous owners if you purchase a used vehicle.

-

Electrical wear and tear only electrical damage related to a crash is typically covered.

Some situations are only covered by car insurance if you purchase additional coverage. If you have state minimum car insurance you arent covered for:

-

The cost of a rental car if your vehicle breaks down unless you purchase special coverage.

-

Roadside assistance, unless you purchase separate coverage.

-

Natural disasters, theft or falling objects, unless you have comprehensive insurance

-

Driving your car for Lyft or Uber, unless you purchase rideshare insurance.

-

Damage to modified or custom parts you added to your vehicle unless you purchase separate coverage.

-

The full value of a classic or antique car, unless you purchase special coverage.

-

Frequently using your vehicle for commercial use or business purposes, unless you purchase business auto insurance.

How Car Insurance Works

How Car Insurance Works

Car insurance is designed to protect drivers and their passengers from financial hardship after an accident or other vehicle-related incident. Auto insurance, or other proof of financial responsibility, is mandated in every state.

Insurance can be confusing, but it can help you to find the right coverage at the best price to understand more about how it works and why it’s required.

You May Like: How To Get Bad Smell Out Of Car

Comprehensive And Collision Coverage

Comprehensive insurance covers repairs to a car that is damaged outside of an accident or stolen. Damage could be things like vandalism, a broken windshield, a fallen tree on your car, or other occurrences out of your control.

Collision coverage will pay to repair or replace your car if its damaged in an accident with another car or even an object such as a fence or tree.

These two coverages are sometimes listed together as comp and collision on a policy, but they are available as separate purchases in most cases. Both may be required by a lender if youre leasing a car or still paying on an auto loan. Theyre the most common types of car insurance to include in a deductible.

How Does Car Insurance Excess Work

If you make a claim on your insurance policy, car insurance excess is the amount you will pay towards that claim. There are two types of car insurance excess one compulsory, the other voluntary. The compulsory excess that your insurance company sets is the amount you must pay towards any repair done to your vehicle if you cause an accident. The voluntary excess is an optional amount on top of this which means youll pay more towards repairs but your annual premium price will come down in exchange.

Also Check: How Many Volts In A Car Battery

How To Shop Around From Comparison Sites To Insurance Brokers

Take some time to research the market and compare quotes and you should be rewarded with a better deal, this could mean cheaper prices, or more cover for your money.

This applies especially to:

- any other drivers that insurers might consider higher risk.

It can particularly pay to shop around at the first-year renewal. Simply letting your policy roll-over for another year could mean you pay higher premiums.

Your provider will get in touch three or four weeks before the renewal date, giving you a chance to decide if you want to stick with it or find a cheaper option.

What Happens When You Get Into An Accident

If you get into an accident, the first thing youll need to do is call the police so they can document the incident.

Then, youll need to decide whether you want to file a claim with your provider. When you file a claim, it means you believe the damage or injuries sustained in the accident are covered under your policy, and youre requesting that your provider cover the costs.

Most insurance providers offer a few different ways to file a claim, including:

- Through a mobile app

In all cases, you will need to describe the incident to your provider, who will then assign an investigator or adjuster to the case. The adjuster will investigate the incident and determine whether its covered under your policy and if it is, how much your insurance will cover.

Read Also: Can I Pay Car Insurance With Credit Card

Can The Insurance Company Tell Me Where To Have The Repair Work Done Under Either Homeowners Or Auto

It is always your option to go to the repair shop of your choice. Your insurance company may only be obligated to pay for the lowest estimate therefore, you would be responsible for any additional costs. Your insurance company may suggest vendors/contractors that are in their preferred vendor list. If the company dictates where you should get the work done, they should be willing to guarantee the repairs.

How Does Car Insurance Work If Youre An Uber Or Lyft Driver

Even if your car is insured, dont assume you are covered when you use the car for work.

Most personal auto policies do not provide protection when using a vehicle for business purposes such as pizza delivery, Uber or Lyft services, Jacobs says.

So, if you engage in these types of activities, check with your insurance company to find out whether business coverage is available.

Read Also: How To Check Car Vin

Additional Kinds Of Coverage

- You can buy insurance for extra equipment, such as stereos, CD players, custom wheels, navigation systems, and cell phones that are permanently installed.

- You can buy insurance for towing and road service.

- You can buy rental reimbursement insurance for renting a car when your car is being repaired after a covered accident.

What Will Car Insurance Pay For

Different car insurance policies will pay for different things. Liability insurance, for example, will pay for any damages or injuries you cause to a third party in an accident, while comprehensive coverage will pay for non-collision-related damages to your vehicle. When purchasing an insurance policy, you will have to decide for yourself what level of coverage you want.

Also Check: How Do I Find Out The Value Of My Car

Does Insurance Cover Hit

A hit-and-run accident is one where the driver leaves the scene without providing contact information. It could be a driving accident on a highway or hitting a parked car.

Several types of insurance might apply to a hit-and-run accident, including collision insurance, uninsured and underinsured motorist coverage, and liability insurance. Different states have different rules. Collision insurance might cover a policyholders parked car thats damaged by someone else, if, say, another car side-swiped the insured car and pulled off the mirror or damaged the door.

While all states require drivers to have car liability insurance or a proof of financial responsibility , that doesnt mean all drivers actually have it or accept responsibility when they cause damage. In some states, uninsured motorist coverage is mandatory, while in others, insurers are required to offer the coverage, but a driver does not have to purchase it. Only a handful of states require drivers to purchase underinsured motorist coverage.

While its not ideal for policyholders to have to pay a premium for uninsured and underinsured motorist coverage to ensure payment for damage caused by someone else, its much better than having to pay out-of-pocket. These policies cover the driver and passengers bodily injury as well as car repair. They even cover pedestrians, if theyre hit by someone without adequate insurance.