Cars For A Cure Vehicle Donation Program

One out of three people will face a cancer diagnosis in their lifetime. Rather than selling or trading in your used car, truck, SUV, motorcycle, RV, or boat on a trailer, consider donating it to the American Cancer Society. Your car donation will help save lives that might otherwise be lost to the disease by funding lifesaving cancer research, education, advocacy, and free patient service programs.

Dodge Charger 57l Hemi

Its hard to believe Dodge has been building Hemi-powered Charger cop cars for 15 years now, and they are everywhere. The first-gen cars had the 340-hp early version of the third-gen Hemi, but the 2011-to-current version has the 370-hp 5.7L Eagle Hemi and is the one currently in service. The midcycle face-lift in 2015 brought an upgrade from the five-speed NAG1 automatic to the eight-speed TorqueFliteboth of which are solid performers. We are, however, fans of the earlier 2011 to 2014 nose. Also of note is that two wheel styles were availablethe standard passenger-car 18-inch alloy five-spoke and the 18-inch cop-car steelie.

Years ago, we spent a week driving a 2015 Charger Pursuit and discovered its AWD setup to be a bit buzzy relative to the RWD version. The AWD variant does suck up some power, which you can feel in the seat of your pants, and the mandatory NAG1 five-speed transmission is shifted from a column lever so that the console is left barren for the installation of police gear . Our advice would be to search for the RWD model since its simpler, lighter, and faster.

You May Like: How Can I Rent Out My Car

Where Can I Donate My Car

When donating your car to charity, you have a few different options. Most organizations have a simple donation form you fill out online. From there, most organizations will come to you to pick up your vehicle free of charge. Its important to know, however, that you shouldnt just blindly donate your vehicle without doing your research. This article will explore three car donation tips to consider before choosing which organization or charity to donate your car to this year.

Don’t Miss: How To Color Match Car Paint

How To Vet Car Charities

When donating your car to charity, take precautions to avoid being scammed or contributing to a questionable charity. If you donate your vehicle to an organization that isnt qualified by the IRS to receive tax-exempt donations, or if you dont get the proper paperwork, you wont be able to claim a tax deduction.

Cheapest Car Rental Company Analysis

In our analysis of average rental car prices across different companies, weekly car rentals ranged in cost from $480 to nearly $700 a difference of more than $200.

The prices analyzed in this study were based on rentals over a mix of dates throughout the next three months, and for both downtown and airport locations in regions that host the nations 10 largest airports. Rental types were the cheapest possible option that allowed you to pay at the counter , and include taxes and fees.

The cheapest and most expensive rental car companies belong to the same parent company. Enterprise Holdings owns and operates the Enterprise Rent-A-Car, National Car Rental and Alamo Rent A Car brands, which together comprise a fleet of nearly 1.7 million vehicles through a network of more than 9,500 rental locations worldwide.

The Hertz Corporation, which is the parent company that operates the Hertz, Dollar and Thrifty vehicle rental brands, was a little more consistent across all of its brands in terms of pricing their average weekly rental car prices were within about $18 of each other.

Don’t Miss: How To Remove Deep Scratch From Car

Police Auction Cars: Police Impound Auto Auctions In The United States

Police Auctions

Many of the vehicles bought and sold at police auto auctions are amazing values theyre often everyday drivers taken directly from the road to the auction block. Some are older cars needing a bit of work while others are nearly new and still under warranty. If youve never been to a police auto auction, be sure to read our Police Auctions FAQ

Police auctions for cars are a great way to get a used car for very cheap. Many locations offer police auctions online to the public for easier online bidding. Police auctions for motorcycles are a bit more rare, but you will occasionally see motorcycles listed in addition to cars and trucks, boats, SUVs, RVs, and ATVs. One will occasionally find used police cars for sale at police auctions. Auctions also include government surplus auctions from various federal, state, and local governments.

Choose a state to find police auctions, tow impound auctions, government surplus auctions, and also dealer and public auto auctions:

Unbelievably Low Prices

Police and government surplus auto auctions offer cars for sale ranging from just a few hundred dollars to thousands of dollars, depending on the vehicle and the buyers present. The quality of the cars for sale can vary greatly, but thats what makes these auctions so interesting.

Many police car auctions are open to the public again and allow bidding in person. However, there are also many online car auctions that allow viewing and bidding on auction cars online.

Donating A Car To Charity You Might Want To Pump The Brakes

- Donating a car could be one of the least cost-effective ways to aid a charity, says industry expert.

- The car-donation industry is riddled with fraud and deception, with multiple states investigating outfits for false advertising and self-dealing.

- These eight tips can help donors protect themselves while trying to help out others.

Thinking of donating your clunker to charity for a nice tax deduction? Proceed with caution.

The gifting of used cars to “charities” has become a favorite way for Americans to dispose of unwanted vehicles. And why not? You can avoid the headache of selling or junking the car, help a charitable cause and lower your tax burden all at the same time.

Unfortunately, the experience is rarely, in reality, such a win-win situation. Not only do charities typically see little of the proceeds from a used car sale, but donors can run afoul of the taxman if they’re not careful.

“At the end of the day, donating a used car could be the least cost-effective way to give to a charity,” said Stephanie Kalivas, an analyst with CharityWatch, an organization that monitors the charitable giving industry.

“They’re not transparent about what they do,” Kalivas said. “A lot of these organizations mislead the public, and people need to be careful.”

More from Smart Investing: What investors should do before market gets gored

When donating a car, here are eight key things you should consider to maximize the benefits to charity and minimize the risk to yourself.

Don’t Miss: How To Register A Car In Indiana

The Irs Allows The Taxpayer To Claim A Charitable Tax Deduction As Follows:

- We make it easy to get the maximum tax deduction for your vehicle donation! Simply filling out the quick form to the right and we take care of the rest. Your vehicle is picked up, sold, and proceeds benefit your local Make-A-Wish®, but you also get a tax deductible receipt.

- If the donated vehicle is sold for less than $500, you can claim the fair market value of your vehicle up to $500 or the amount it is sold for if less than fair market value.

- If the donated vehicle sells for more than $500, you can claim the exact amount for which the vehicle is sold.

For any vehicle sold for more than $500, the exact amount it is sold for will be stated on your notification mailed to you, which in turn will be your charitable tax deduction. For additional information, the IRS provides A Donor’s Guide to Car Donations , which details the determination of the value of your donated vehicle. As always, we help people donate their cars every day, and we would be happy to help you do the same. Feel free to call us at with any questions you might have and one of our representatives will help you.

How Do I Donate A Car

Donating your car to Wheels For Wishes is easy! Donate almost any vehicle, from almost anywhere in the U.S.

There’s no better time to donate a car to benefit Make-A-Wish kids. Start your car donation today!

You May Like: How To Get Dog Hair Out Of Car Carpet

What Type Of Car Can I Donate

We accept vehicles in any condition. Cars, trucks or other donated vehicles that need moderate repairs are ideal, but we also accept cars that are not running and even some vehicles you may think are junk.

We have auto mechanics on staff who work alongside program participants to repair donated vehicles before we gift them to successful program graduates. Repairing donated cars provides an opportunity for New Life Program participants to learn practical job skills while providing needed transportation for program graduates.

Cars that cannot be repaired and/or gifted for any reason can still be used to support Mission programs and services, so please contact us with any questions.

Still wonder if your vehicle is good to donate? Dont worry. Contact us today at 303.331.2938 to see how you can donate your car.

How Much Is The Tax Deduction For A Vehicle Donation

That depends on what the vehicle is worth and how the charity intends to use your car. If the vehicle is worth less than $500, you can claim its FMV.

If the car is worth $500 or more and the charity intends to use the vehicle in its operations, you can deduct the FMV. However, if the charity sells the car, your tax deduction is limited to the organizations gross proceeds from the sale.

Don’t Miss: What Size Tires Fit My Car

Four Simple Categories For A Car Donation:

A tax write-off for a car donation is a way that you can a benefit from the non-cash charitable donation of a motor vehicle.

According to the American Jobs Creation Act of 2004 there are specific documents and record keeping required when donating non-cash items. Here is a chart to help you with the filing of your car donation tax write off:

Image Source: https://www.irs.gov/pub/irs-pdf/p4303.pdf

Cons Of Donating A Car

The biggest drawback to donating a car is that you won’t get money for it. That can increase the actual cost of buying a new car since you won’t have a trade-in or as much cash for a down payment. That can result in a bigger loan and more money paid to interest in the long term. Another potential drawback of donating a car involves more complicated paperwork and record-keeping than a private party sale. Many charities will help you with this aspect, but if they don’t, it can be a hassle to handle on your own.

Some people see tax benefits for their donation, but whether your donation will impact your taxes in a meaningful way depends on your income, how you file, and many other factors. The process for claiming a tax benefit is complicated, so you should talk with a tax professional first to see if your situation merits the time and effort involved in getting the tax deduction.

One final, unfortunate drawback to donating a car is that it may not benefit the charity as much as you’d like. In some cases, a charity may use the car for transportation or give the vehicle to people in their community who need reliable transportation. The charity may sell the car at auction to raise money. In these cases, they may not get the vehicle’s fair market value and have to go to the expense and trouble of selling the car. If you want to make the biggest donation possible, you might consider selling the car yourself and donating the money to the charity.

Pro tip:

Don’t Miss: How To Change My Car Oil

Donate Your Vehicle In Birmingham Today

Car donation in Birmingham is changing lives one vehicle at a time. If you’re looking to donate your car, we’ll help you get started with these easy steps:

More Reasons To Choose Wheels For Wishes

Hearing from Wheels For Wishes why to choose us, and how to get rid of a non running car may not be convincing when you hear it from us. So take it from our reviews and ratings!

- Our Trustpilot reviews are spectacular! Of over 4,000 reviews, 94 percent gave Wheels For Wishes a great or even better rating, with 83 percent giving us the perfect excellent rating.

- When you read our reviews, youll find most talk about how the experience was fast, convenient and easy!

- Wheels For Wishes has the Guidestar 2019 Gold Seal Of Transparency.

- Wheels For Wishes is a nonprofit 501 organization. We are transparent, trustworthy and we provide an exciting new way to benefit a great charity like Make-A-Wish and, as a result, your community.

Also Check: What Happens If Your Car Gets Towed

Should I Sell My Car Or Donate It

In the end, that’s up to you. Think about why you’re considering donating the car: If it’s because you want to help a charity while getting rid of your old vehicle quickly, donating is a great option. If you want to help the charity as much as possible and are willing to do a bit of leg work, selling the car online or by yourself and then donating the proceeds may be a better fit. If you’re looking for financial benefits, speak with a tax professional to assess your situation many people are better off selling a car than donating it for a tax write-off.

Related articles

Youll Need To Collect Certain Documents

After you hand off your car to the charity, you should get a written receipt right away. Depending on what the charity does with your car, youll also get either a written acknowledgement or a Form 1098-C at some point. Keep a hold of this document, as you may need the information to file your taxes, and you may even need to send the document itself in if youre deducting more than $500 from your taxes.

In addition, if youre donating a car worth more than $5,000 and the charity doesnt plan to sell it for cash, youll need to get an official written appraisal at least 60 days before you donate the car as well.

Read Also: What Car Is Best On Gas

Canine Companions For Independence

Canine Companions for Independence provides service dogs to adults, children and veterans with disabilities, and facility dogs for professionals working in health care, criminal justice and education.

CharityWatch gives Canine Companions a B grade, saying that it uses 68% of its budget for programs and spends $20 on fundraising for every $100 in contributions.

The organization accepts donations of cars, trucks, boats, planes, motorcycles and other vehicles, running or not. You can start your donation either online or by calling 866-398-4483.

Find Out How Much The Charity Sold The Car For

Use the price the charity sells your car for as the amount of your deduction. For example, if the charity sells the car at auction for $3,000, your deduction is limited to $3,000, even if the fair market value is $4,500.

However, if the charity sells the car at a significant discount to a needy individual, or keeps the car for its own use, then you can claim a deduction for its fair market value.

If the charity sells your car sells for $500 or less, you can deduct $500 or your cars fair market value, whichever is less. For example, if your car is valued at $650 but sells for $350, you can deduct $500.

Charities are typically required to report the sales price of your car to you on Form 1098-C.

Also Check: Are Used Car Prices Dropping

S To Take Before Donating Your Care

Have your motor vehicle appraised by a qualified professional appraiser if it is worth more than $5,000.

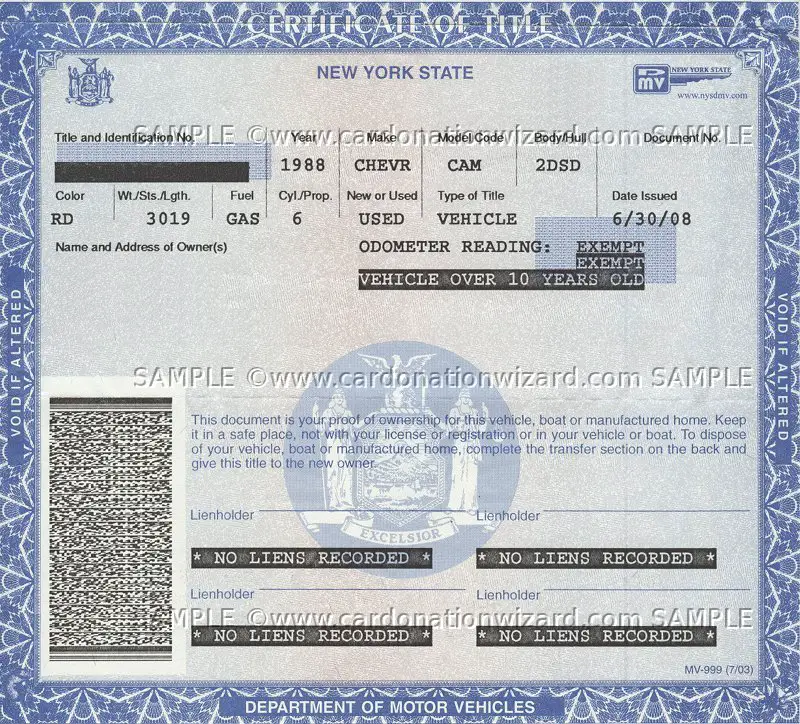

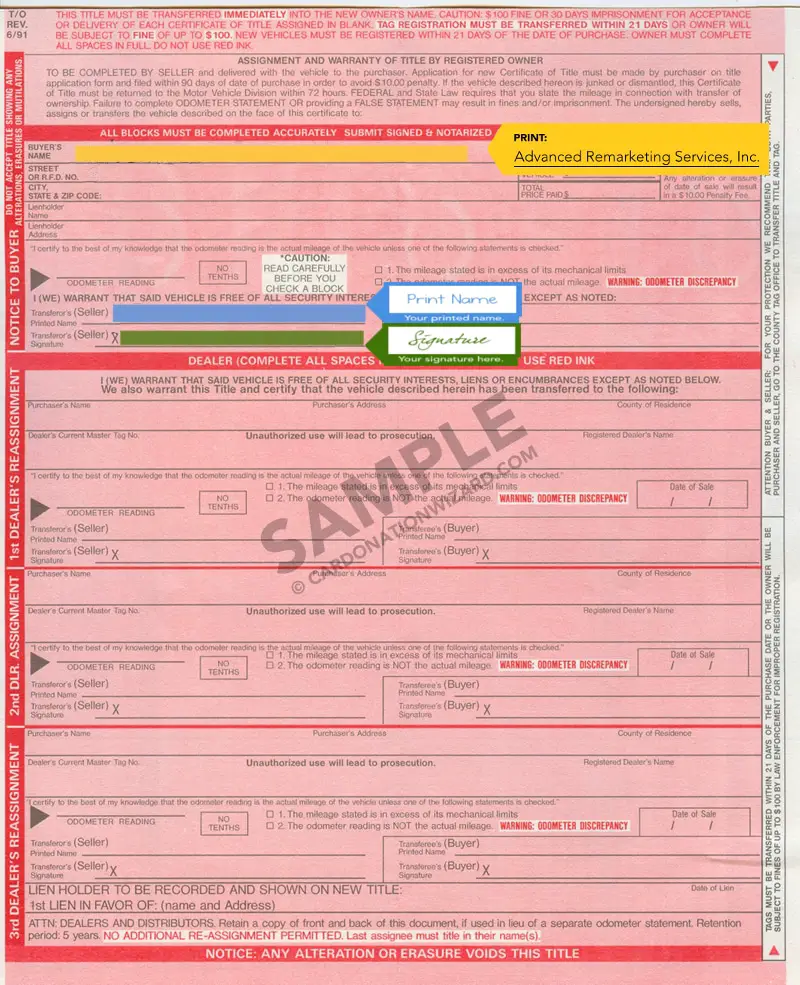

Make sure you have the title to your vehicle. A charity should not accept your donation without a title. To obtain a duplicate title, visit your local Registry of Motor Vehicles branch or visit the Registry’s website.

Take responsibility for transferring the title at the time of the donation. An assignment of title should be made only to the charity or an authorized private, for-profit agent of the charity. The for-profit agent of the charity should be subject to the charitys oversight in order for the agency to be valid for tax-deductibility purposes. The IRS has published “A Charitys Guide to Vehicle Donations” , which details the required terms of the agency relationship.

On the back side of your title, you should assign the title to the charity or an authorized agent of the charity, enter the correct mileage from the odometer, and sign and date the form. Be sure to make and keep a copy of both sides of your title.