Does Refinancing A Car Loan Hurt Your Credit Score

When you apply for refinancing, you will most likely need to submit another credit application. This can affect your credit score, especially if youre submitting multiple applications as mentioned above. However, if you manage your new loan effectively, refinancing shouldnt hurt your credit score.

Do Auto Loans Improve Credit

Like most student loans, mortgage loans, and personal loans, auto loans are a type of installment loan. The account should gradually raise your credit score as long as you pay at least the minimum amount by the due date each month.

In order to establish credit, you shouldnt purchase a car or take out a car loan.

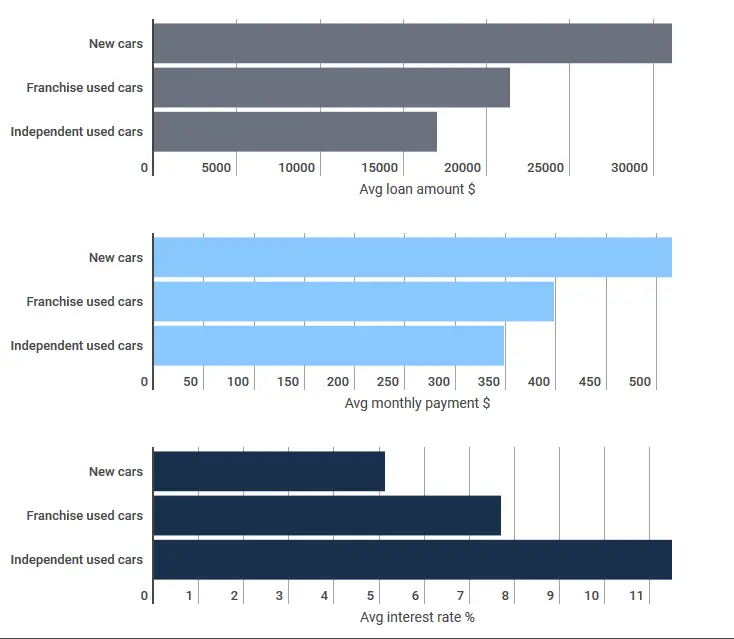

Automobile loans can be pricey. The interest charges add up. The interest rates and total charges for longer-term loans are typically higher.

If you find yourself in the situation of wondering, Is it a good idea to refinance a car? or does refinancing a car hurt your credit?, there are several considerations such as an extended loan term and how this will affect your interest rate and credit score.

Avoid being seduced by a longer loan term with lower monthly payments because the interest will likely cost you more in the end. If you can afford a higher monthly payment on a loan with a shorter term and a lower interest rate, you will probably pay less for the car overall.

Your credit score can be improved further while you lower your interest costs by paying off your car loan sooner by making extra payments or larger monthly payments.

Keep An Eye On Your Credit Score

Once you’ve bought your car, make sure to pay your loan instalments on time. Schedule automated payments or put the due date for your payments on your calendar – just make sure you have enough money in your bank account to cover them.

Consider enrolling in a free credit monitoring service to track the impact your auto loan is having on your credit score. You will receive monthly credit reports, alerts when your credit score changes, and notifications of any action on your record.

When it comes to your credit, maintaining control is the best approach.

Company

Read Also: How Long To Pay Off Car Loan With Extra Payments

How To Get Your Credit Ready To Buy A Car

Whether you’re in the market for a new or used car, chances are you’ll need a car loan. To get the best possible loan terms, make sure your credit is in good shape before heading to the dealership to purchase a car.

Start by getting a copy of your and reviewing closely. Next, check your to see where you stand. If you have a good credit score , you’re more likely to qualify for desirable loan terms. If your score is in the exceptional range , you might even qualify for sweet deals such as 0% APR financing.

Lower credit scores generally translate into higher interest rates on your auto loan over the course of the loan, this can really add up. If your credit isn’t where it should be, improving your credit score before you go car shopping could save you thousands of dollars in interest costs.

Manage Your Credit Like An Executive

Lenders and credit card companies are often blamed for poor credit scores.

However, for most people, you are the most influential person in your credit score. By committing to pay the minimum amount on or before the due date, you are taking smart steps towards improving credit scores.

Responsible credit management will make it easier to ask how credit score car dealers use to approve applications and set interest rates.

Green Day Online is a tool that can help you increase your savings and build credit. This will enable you to reach larger goals, such as purchasing a car. You can manage your credit like a boss and take control of it.

Tags

Recommended Reading: How To Get Rid Of A Car Loan Illegally

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Many Points Will A Car Loan Raise My Credit

We cant tell you how much your score will rise. Its all situational.

People with a high credit score of like a 750, you may not see a huge boost. But someone with a 500, will definitely notice a jump.

Remember, your car loan will not be the only factor. Making on-time payments on your car but failing to pay your mortgage, you will not see a boost.

Also, if you already have negative items lingering it will be hurtful to your credit.

You can get companies like Ovation Credit Services By Lending Tree or Lexington Law Credit Repair to help with that. Here are three

Get Consultation From These Credit Repair Companies

- Lexington Law or Call For Free Consultation Now: 838-5600

- Ovation or Call For Free Consultation Now:

- Creditrepair.com or Now:

Also Check: Can I Have Two Car Loans

How To Increase Your Credit Scores Immediately

Join millions of Canadians who have already trusted Loans Canada

When it comes to getting approved for a loan that too at a lower-interest rate, your credit will generally have a big impact. High credit scores can not only help improve your odds of getting approved for a loan, but they will also help you access lower interest rates and better terms, thus making your loans more affordable. If you have poor credit and are looking to quickly improve your credit, there are certain actions you can take to increase it.

How Long Will Having A Car Loan Affect Your Credit

A car loans effects on your credit score begin with the initial inquiry.

Your credit will be affected by the auto loan for the remaining term plus an additional ten years. For instance, a car loan with a five-year term will have an overall 15-year impact on your credit.

Its crucial to pay on time each month because payments for credit card debt and other borrowing appear on your credit report for such a long time. Even though one late payment may not have a significant impact on your credit, it will still be reported for more than ten years.

Starting out with a good credit score is much simpler than trying to repair bad credit.

Also Check: What Is A Rebate On A Car

How Does A Car Loan Impact Your Credit

Before we can discuss how to raise your credit score by getting a car loan, we need to understand how exactly a car loan impacts your credit in the first place. There are actually several different ways that bringing a new loan onto your credit report can change your overall number.

First, youll be diversifying your credit mix. Your credit score takes several factors into account, including loans like student loans, car loans, credit card debt, and more. Having several different types of loans on your credit report and paying them back successfully can help prove to creditors that you are a safe bet when it comes to loaning money.

Youll also be adding a new line of credit to your account. Though you may experience a small dip in your credit score at first, you will soon see that your score increases as you continue to make your payments on time.

Ways Buying A Car Can Impact Your Credit

Whether buying a car negatively or positively impacts your credit will depend on how reliably you make your loan payments. When you first get an auto loan, you may see a slight dip in your credit scores because you’re taking on a hefty new debt. However, as you begin making on-time payments on the loan, your credit score should bounce back.

Buying a car can help your credit if:

- You make all of your payments on time. Because payment history is the biggest factor in your credit score, making payments on time and in full should improve your credit score over time.

- It improves your . Lenders like to see a mix of revolving credit and installment credit in your credit history. Successfully managing a wide variety of credit accounts helps prove that you’re creditworthy. If you currently have only revolving credit accounts, credit cards for instance, adding installment credit in the form of an auto loan could help boost your credit score.

However, buying a car could end up hurting your credit if:

Also Check: How To Clean The Inside Of Your Car

How Long Does It Take For A Car Loan To Improve My Credit Score

Your credit score is a three-digit number that lenders use to assess the risk of lending you money. The higher your score, the more likely you will be approved for a loan with favorable terms. A low credit score could result in being denied or offered a loan with unfavorable terms, such as a high-interest rate.

If youre looking to finance a car, you may wonder how quickly a car loan can raise your credit score. The answer depends on several factors, including your current credit score and payment history.

Generally speaking, taking out a car loan and making your payments on time can help improve your credit score. If you have a low credit score, you may see a more significant increase in your score after taking out a car loan and making on-time payments. However, you may not see as much of an increase if you have a high credit score.

Ultimately, the speed at which your credit score improves will depend on your circumstances. If you want to improve your credit score quickly, make all your payments on time and keep your balances low. You can significantly improve your credit score with a bit of time and effort.

A car loan can take a few months to a few years to improve your credit score.

It all depends on the factors we mentioned before: how much you owe, your payment history, and your loan type.

If you keep these things in mind, you can use a car loan to improve your credit score.

Does A Car Loan Build Credit

Consumers looking to purchase a new car often want to know how it’s going to effect their credit. Does a car loan build credit or does it cause it to drop?

Consumers looking to purchase a new car often want to know how it’s going to affect their credit. Does a car loan build credit or does it cause it to drop? Ultimately, a car loan does not build credit however, you can use the car loan to help increase your score.

A car loan has two common effects on credit:

- It causes a hard inquiry to be added to your credit report, which could temporarily lower your credit score by a few points.

- It increases your credit history. Provided you don’t have any late or missed payments, this increase can help build your score.

You May Like: How To Remove Duct Tape Residue From Car

Adding To Your Record Of On

The main way that car loans build your credit is by contributing to your payment history. Each time you pay your car loan bill , the payment will be recorded on your credit report. These payments add up, gradually establishing a good track record that shows lenders that you can handle your debts.

How long it takes: Your car loan payments will begin boosting your payment history as soon as theyre added to your credit report. However, the longer you keep making your payments on time, the better youll look to lenders, so this effect strengthens over time.

How Fast Does It Take For A Credit Score To Raise Using A Car Loan

The first time you apply for a car loan, your credit score will be affected. This negative effect is temporary.These are the implications for your credit rating when you apply for a car loan.

- Before opening a credit account, you will be sent a rejection letter. Before you apply for a credit card, the lender will likely ask for a copy of your credit report and credit score. Any inquiry related to credit applications is called a hard inquiry. These inquiries can have a negative impact on your credit score. Hard inquiries remain on your credit report for two years.

- Create a new credit card. This will add a credit account to your credit report with no payment history. This will temporarily affect your credit rating.

- An older account average is a less critical credit score factor. This is how long youve had credit lines. If you open a new credit account, your credit score will decrease for a while.

Personal experience has shown that there are approximately 10-20 negative points to opening a bank account. There are also two to four points for inquiries.

The impact of opening credit accounts will depend on your credit history. Credit scoring models may consider multiple inquiries about car loans as one inquiry if you are short on time.

After paying your bills on time for several months, you will be able to establish a payment history. Your new on-time payment history may start to show positive results.

Recommended Reading: How To Get Mouse Smell Out Of Car

When Are Car Payments Reported To The Credit Bureaus

The answer to this question depends on the credit bureau. Some credit bureaus will report car payments as soon as they are made, while others will not report them until after the loan is paid off. It is important to check with the credit bureau you use to get an accurate timeline for how car payments are reported.

Round Up Your Car Loan Payments

Another way to slightly increase your payment schedule is to round up your payment to the nearest $50. For example, if you borrowed $13,000 at a 5% interest rate for 72 months, your monthly payment is $209. On a regular payment schedule, youll pay $2,074 in interest over the life of the loan.

If you round that payment up to $250, youll pay the loan off at least 13 months earlier and save at least $395 in interest.

You May Like: How To Lower Interest Rate On Car Loan

Make Sure Your Credit Is Ready

Whether you’re looking to buy a new vehicle or a used one, you will probably need to get a car loan. But before going to the dealership to apply for financing, make sure your credit is in good shape to get the best loan terms.

Get a copy of your credit report first, and carefully analyse it. Next, find out where you stand by checking your credit score. Good credit increases your chances of getting approved for favourable loan terms.

If your credit score is excellent , you can even be eligible for great rates like financing with a 0% APR.

Higher interest rates on your auto loan are typically associated with worse credit scores over the length of the loan, this can add up significantly.

If your credit isn’t up to par, improving it before you shop for a car could save you thousands of pounds in interest payments.

Other Ways To Improve Your Credit Score

The most important action you can take when youre trying to build or raise your credit score is to make on-time payments for any loans or debt you have. Skipping payments or making late payments not only results in high penalty fees and added interest on your balances, non-payment and late payments can dramatically hurt your credit score and possibly prevent you for getting credit and good loan rates on future loans. For more details read,

Read Also: Where Can I Get Tags For My Car

It May Take Time But An Auto Loan Can Raise Your Credit Score

You may see a quick credit score drop when you initially take out an auto loan. This is normal. As the life of your loan progresses, your on-time monthly payments could raise your score and start you on the track of building credit and developing a high FICO Score.

Want more personal finance tips and tricks delivered straight to your inbox?.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 to $300.

Installment Loans Help Diversify Your Credit Mix

Buying your new car can also have the added benefit of diversifying your credit mix. If your credit profile consisted of revolving credit accounts before getting your car loan, the new loan payments could contribute to how lenders score your credit mix.

When lenders review your credit report they want to see different types of credit with good payment histories and a good credit score. A good credit mix can include:

- Other revolving debt

A healthy credit profile with various types of credit proves to a lender that you can responsibly manage multiple payments and due dates simultaneously.

Installment loans can also help you improve poor credit by consolidating high-interest credit card debt to one low monthly payment.

If you originally got your car loan at a higher interest rate due to low credit, you could refinance your auto loan to lower your monthly payments once your credit score has improved.

Read Also: Who Made The First Car