Average Car Insurance Costs By Gender

On average, car insurance costs differ little by gender compared with differences we see by company, state, credit score and driving history. That doesnt mean that a cost difference due to your gender would be insignificant, however, just that its not a pricing factor well-illustrated by national statistics. Gender-based pricing is banned by law in seven states: California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania.

In general, young adults have a much wider price discrepancy based on gender than older drivers. Men pay more than women across all age groups we analyzed.

For example, in states where the practice is allowed, we averaged full coverage insurance rates for men and women separately and found that on average:

-

At age 20, men pay about $434 more than women per year.

-

At age 30, men pay around $30 more than women per year.

-

At age 35, men pay about $13 more than men per year.

Note: In this article, NerdWallet uses the term gender. We recognize that this is different than sex. Gender is how you identify within society, while sex refers to certain biological attributes.

Some insurers dont recognize this distinction and use the terms interchangeably. This means when applying for car insurance, they may ask for your gender, when they really mean sex.

Car Insurance Rates By Occupation

Your choice of career may also come into play when shopping for car insurance coverage. The industry considers some jobs more âhigh-riskâ than others. According to Car Insurance Comparison, professions considered to be risky include professional athletes and those who work social scenes like DJs. Those considered to be low-risk are medical professionals and school teachers. Your occupation may also be a positive factor as some companies could offer discounts for people of certain professions. If you believe you would fall into a category as such, it may be useful to hunt around.

Review Auto Insurance Coverage Quotes

One way to lessen the expense of insurance policies for motor vehicles For brand new drivers is to scale back the amount of protection you will need. There are many insurance policy providers offering discounts for anyone who is a best student or when you are at present getting drivers teaching. However, decreasing your coverage could result in big out-of-pocket Charge for anyone who is linked to a collision. So, ensure you Appraise the risk of this determination carefully, and constantly remain to the choice of discovering much better protection for the value.

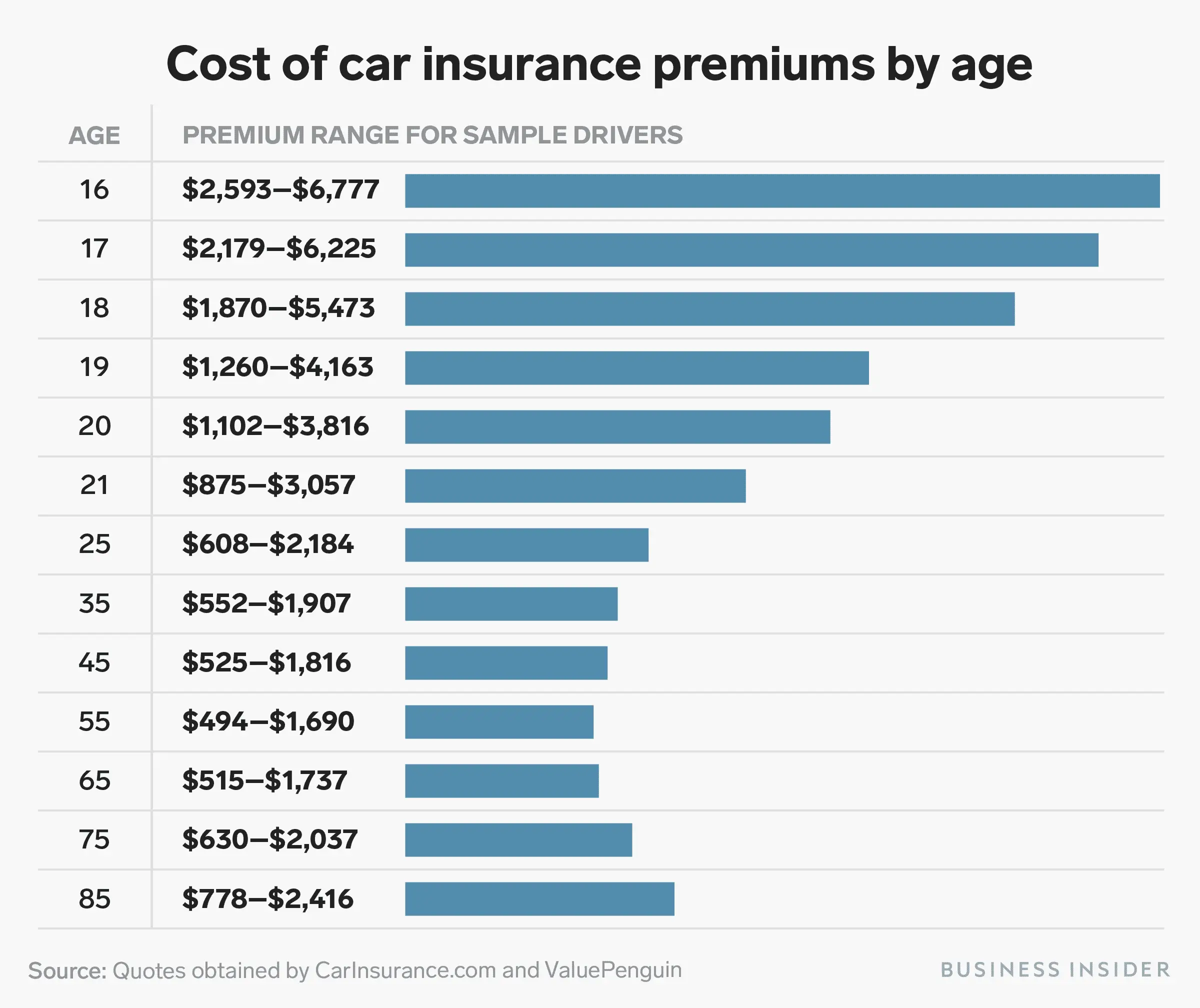

Youngsters have issue obtaining very affordable car insurance coverage. Even though the cost of a plan for the driver whos sixteen is drastically bigger than that of the Grownup, it is feasible to lessen the associated fee by adding a teen to any present protection. The option can increase costs by a mean of $1,461 a calendar year, nonetheless is mostly less expensive than obtaining a separate policy. Also, if younger driver, check for discount rates together with other techniques to save cash.

Also Check: What Do I Need To Junk My Car

Car Insurance From State Farm

In the study referenced, State Farm falls as the third most affordable insurance company, second-most affordable for customers of any background.

A 25-year-old female may see an average coverage rate of around $1,260 per year. A 25-year-old male under State Farm insurance may have an annual average rate of $1,400. On the opposite end of the age range studied, a 60-year-old may see an average rate of around $1,038 per year.

When it comes to credit history, those with poor credit applying with State Farm may have an average rate of $2,800 per year. For drivers with good credit, they may see an average rate of somewhere around $1,165 per year.

In regards to driving history, those with clean records under State Farm may have an average rate of $1,170 per year. After just one DUI conviction, the number can jump to $1,568 per year. One accident raises it from a clean record rate to an average of $1,400 per year.

Best Price Car Insurance: Recommended Providers

The cost of car insurance is an important thing to consider when choosing a provider. Of course, youll also want to pick a reputable insurer that offers good coverage and has a simple claims process. There are several insurers that fit that description in the U.S.

To find the best option for you, request and compare car insurance quotes from a few companies.

Compare Auto Insurance Policies

Don’t Miss: How To Track Car Location

Car Insurance And Zip Codes

As mentioned prior in this piece, a state average sometimes isnât enough to get an idea of how much is car insurance based on where you live. Your city ZIP code can be very influential in presented rates. Typically, this can be assumed to be a telling factor about vandalism or theft in your neighborhood, or maybe it is just a place where a lot of accidents happen. But some interesting studies have come out regarding what may also be factored into your rates when it comes to ZIP codes.

A 2018 report from The Consumer Federation of America found that car insurance companies will charge seemingly identical drivers with different, usually exaggerated rates, based on what ZIP code they possess.

In this study, CFA pulled quotes from a variety of ZIP codes for major cities in different states. Everything about their fictional drivers was the same except for what ZIP code they resided in. In the ten different cities they analyzed, they found that ZIP codes attached to lower-income, less-white neighborhoods were quoted significantly higher premiums. Good drivers in lower-income areas could see, on average, annual insurance premiums $410 higher than their neighbors.

It is still best to remember that what has been outlined is not always set in stone. ZIP codes and car insurance may relate based on more significant, quantitative facts such as crime rates and accidents reported.

How To Buy Car Insurance

The national average for car insurance with liability, collision and comprehensive insurance is $1,190, according to the most recent data from the National Association of Insurance Commissioners. But you shouldnt focus strictly on cost when youre looking for a car insurance policy.

Thats because auto insurance companies all calculate their rates differently, resulting in a wide range of pricessometimes by thousands of dollars a year. Its smart to compare car insurance quotes from multiple companies. You can get free quotes online or by calling an independent agent in your area.

Make sure you ask about car insurance discounts. Insurance companies offer many types of discounts to attract customerseverything from good driver discounts, car safety discounts, multi-policy discounts, and even discounts for paying in full or going paperless.

Finally, consider a companys customer service. The best car insurance companies pair competitive prices with good customer service. If you get into a car accident, you want to be sure your insurance company will make the insurance claim process go as smoothly as possible.

Don’t Miss: How To Clean Inside Of Car

How Much Is Car Insurance For 20

For a 20-year-old male, the cost is $1,159 per year and for a female driver, the same policy could cost an average of about $1,058 per year for the state minimum policy. Heres a breakdown of insurance rates for various coverage levels:

Car Insurance for 20 Year Old Male and Female| Age |

|---|

- Your credit history

- Your annual mileage

Each of these rating factors, along with the type of coverage you choose, deductibles and discounts, influences the rate you’ll pay for your car insurance policy.

To get an idea of how much you can expect to pay, you can start with an estimate of car insurance costs by using the average rate tool at the bottom of the page. It shows rates for six age groups and three coverage levels by ZIP code.

Finally, the car insurance company you choose makes a difference in your car insurance rates because companies assess risk differently, and each uses its own formulas to calculate the price you pay.

Whatever age and whether male or female, you can save hundreds of dollars if you compare car insurance companies and find the one that offers the best rates for you. Our guide to the best cheap car insurance for seniors shows how much drivers aged 65, 75 and 85 can save.

Does A 16 Year Old Have To Have Full Coverage Insurance

There is no law requiring teen drivers to have full coverage. However, if the car being driven is leased or financed, the lender will mandate that you have full coverage, including comprehensive and collision insurance.

To drive legally, you need state-required liability insurance, which pays for the damage and injuries of others in accidents you cause. However, because teens are inexperienced, and as a demographic, have more accidents than experienced drivers, its wise to have full coverage on the car your teen drives.

Recommended Reading: How To Find Out The Value Of My Car

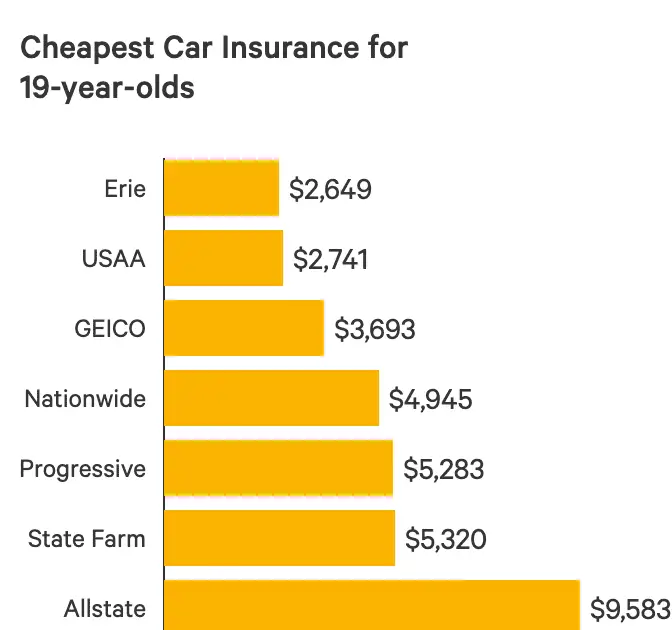

More About Usaa Car Insurance

USAA sells insurance for cars, motorcycles, ATVs, motorhomes, boats and classic cars. And, for those who fly to their destinations, aviation insurance. Optional coverage types include roadside assistance and rental reimbursement.

Current and former U.S. military members, and spouses and children of U.S. military members are eligible for USAA insurance.

For drivers concerned about a rate increase after they cause an accident, USAA offers accident forgiveness insurance. If you remain accident-free for five years, your premium wont go up after one at-fault accident.

USAA also offers rideshare coverage for drivers with Uber, Lyft and other services.

Erie Auto Insurance Discounts

Erie offers several auto insurance discounts, especially for safe drivers. If you have a driver under age 21on your policy, look for Eries discount for young drivers. If you dont use your car for an extended amount of time, you could benefit from the reduced usage discount. Other discounts include:

- Safe driving discount: This is for safe drivers with a clean driving record.

- Car safety equipment discount: You can get a discount if your car has safety features like factory-installed airbags, passive restraint, or anti-theft devices.

- Multi-car discount: Drivers who insure two or more vehicles under the same policy may be eligible for this discount.

- Multi-policy discount: Look for this if you bundle other insurance types with your Erie auto insurance.

- Reduced usage discount: If you dont use your car for at least 90 consecutive days during your policy period, you could be eligible for this discount.

- Young driver discount: Do you have a driver who is under age 21, unmarried and lives with you? If so, you could save on your auto insurance policy.

- Annual payment plan: Look for savings if you pay your annual auto premium in one lump sum.

- College credit: If your college driver is away at school without access to your car, you may be eligible for a discount.

| What type of car insurance pays if your car is damaged by a flood? | Comprehensive coverage | 56% got it wrong |

Many drivers also think they have car insurance coverage that isnt actually available. For example:

Read Also: Why Does My Dog Throw Up In The Car

How To Reduce Your Car Insurance Premium

There are several ways to cut your car insurance premiums. Here are some tips that can help you save:

- Shop around at least once per year to compare car insurance rates. Most providers let you get a quote online.

- Check for car insurance discounts. There are quite a few ways to save money, including safe driving discounts, low-mileage discounts, and vehicle safety feature discounts.

- See if you can pay less by bundling your homeowner’s insurance and your car insurance.

- Think about how much car insurance you need and consider adjusting your coverage. It may be worth reducing coverage if you have an older vehicle or raising your deductible if you have a solid emergency fund.

- Take steps to increase your credit score. A high credit score can get you cheaper car insurance in most states.

Most importantly, practice safe, defensive driving habits. If you have a clean driving history, it can help you qualify for the lowest insurance rates for your age group and location.

Cost Of Auto Insurance Premiums Compared To Other Goods

Auto insurance has gotten more expensive over the course of the last decade. The Consumer Price Index, a measurement that the U.S. Bureau of Labor Statistics uses to track the average change over time in consumer prices, shows that the cost of car insurance has gone up by an average of 3.9% per year since 2011.

The largest year over year change came in 2017, when the CPI shows that the cost of auto coverage increased by 7.7% nationwide. Only in 2020, when drivers stayed off the roads during the height of the COVID-19 pandemic, were prices lower compared to the previous year.

For comparison, according to the CPI the prices of all goods rose by an average of 2% per year during this time.

|

Year |

|---|

Senior Editor & Licensed Auto Insurance Expert

Andrew Hurst is a senior editor and a licensed auto insurance expert at Policygenius. His work has also been featured in The New York Times, The Wall Street Journal, Forbes, USA Today, NPR, Mic, Insurance Business Magazine, ValuePenguin, and Property Casualty 360.

Expert reviewer

Certified Financial Planner

Kristi Sullivan, CFP®, is a certified financial planner and a member of the Financial Review Council at Policygenius. Previously, she was a regional consultant at Fidelity Investments for nine years.

Questions about this page? Email us at .

32 Old Slip, 30th Fl New York, NY 10005

Read Also: How To Get A Title For A Car

How Much Is Car Insurance For A 17 Year Old: Average Car Insurance Cost For A 17 Year Old Driver Per Month/year

Car insurance for a 17 year old costs $521.5 per month or $6,258 per year on average across the states.

Please find below the average car insurance cost per month and per year for a 17 year old driver for full coverage.

| State | Average Full Coverage Cost Per Month for a 17 Year Old | Average Full Coverage Cost Per Year for a 17 Year Old |

|---|---|---|

| Alaska |

What Kind Of Car Insurance Do You Need

Sometimes, this simple question can make or break the bank when it comes finding out how much is car insurance. How much car insurance you are looking for can be a great starter to figuring out your financial comfortability in the industry.

Every state in America, minus New Hampshire and Virginia, has a mandatory minimum liability insurance coverage that drivers must carry.

Liability insurance covers the bodily injury liability and property damage liability costs of the other person in the wreck. This is where the general monthly cost price ranges begin. While states have its own minimum coverage requirements, it is always ideal to buy beyond the minimum coverage mandate as they are, most of the time, not enough to cover big accidents.

While this is a good start, you may still want to protect yourself and/or your car a little better. You can always opt for âfull coverage.â

Full coverage includes not only liability insurance minimum coverage but also collision and comprehensive coverage. Collision coverage pays for, as implied, repairs needed after a collision. Comprehensive insurance covers damages that happen when your vehicle is not in use. Some of this may include extreme weather, fires, vandalism, or theft.

Read Also: How To Get Out Of A Car Loan Contract

Does My Cars Body Type Affect Insurance

Yes, the specific trim and body type can also raise or lower your rates.

Convertibles, sports cars and SUVs tend to be more expensive to insure. Soft top convertibles are easier to break into. Its too tempting not to drive fast in a sports car, and this gives them a higher risk of being involved in a crash.

If you opt for an upgraded trim or a few extra features, changes are that raised your cars MSRP. Springing for heated seats or a fancy sound system wouldnt typically be enough to change insurance rates significantly, but insuring a car with several thousand dollars in upgrades might raise your rates enough to matter.

Car Insurance Rates By Marital Status

Research from the CFA in 2015 found that some major insurance companies were increasing the state-mandated minimum liability coverage rates for widows. Some all of the time, others periodically. Only one company out of the six that were studied was not increasing rates based on marital status. In general, the report found that rates are almost always higher for single, separated, and divorced people in comparison to married people.

Don’t Miss: What Tow Company Has My Car

How To Find The Best Car Insurance Prices

Buying car insurance doesnt have to mean breaking the bank there are ways to save. Discounts are one of the best ways to lower your premium. Most major car insurance carriers offer discounts. Here are some of the most common insurance discounts in the U.S.

Because every auto insurer offers a different suite of discounts, speaking with your insurance agent or company representative may be the best way to learn about savings opportunities.