What Happens At The End Of My Car Lease

When a lease is up, you have two options.

Alternative Ways To Buy A Car

If you canât afford traditional financing to buy a car, donât qualify to lease a vehicle, and donât want to lease to own, you still have some options. The first is to get a subprime loan. These loans often come with high-interest rates, getting one can help you get a vehicle if you really need one.

Another option is using a family member or friend as a co-signer. Having a co-signer can help you get a loan with a better interest rate than a subprime loan. Finally, you can shop for a used car from a private seller if you have the cash on hand.

Difference Between Financing And Lease To Own

The main difference between a lease to own car and an auto loan is that you dont get your name on the title of a lease to own vehicle until youve made the last payment. This seems odd, but its done in part for the dealership and in part for you.

If youre driving a lease to own car, and decide that you no longer want it, you can typically return the vehicle with no strings attached your name was never on the title to begin with. This varies depending on the language in your loan contract, so be sure to read it thoroughly and ask about the consequences of returning the car early.

To qualify for a lease to own at a BHPH dealer, expect to need your check stubs to prove your income and a down payment. What you qualify for depends on what you make, and the down payment amount required often depends on the selling price of the vehicle. Youre also not financing a lease to own car, so there isnt an interest rate to be concerned about.

Read Also: What Is My Used Car Worth

How Do You Buy Out Your Lease

Many finance companies offer drivers lease buyout options they can exercise once their lease is up, sometimes sooner.

The lease contract should detail your lease buyout options and the price, or method for determining the price, that would have to be paid to exercise the lease buyout.

Your leasing company may communicate to you your lease-end options toward the end of the lease. Before deciding to buy out the lease, you may want to check out other car buying options. Though it can be convenient to buy out a car you’ve gotten used to, you may be able to save money on the same make and model at a different dealership.

If you’re wondering how to buy your leased car or how you plan to pay for it, get in touch with your dealer or lessor. There are finance options in the market designed specifically for lease buyouts that may work for you.

Cons Of Buying A Leased Car

- If the buyout amount is higher than the market value, you may be overpaying for the car.

- Financing a lease buyout may come with higher interest rates.

- Excessive wear, tear, and mileage may reduce the value of the vehicle.

- You may end up paying more for the car than you would have if you bought it originally.

Recommended Reading: What Age To Stop Using Car Seat

Get A Quality Novated Lease From The Team At Easi

Easi is a finance company with 20 years of experience in the industry of car leasing meaning we can use our knowledge to deliver effective business car solutions every time. Our wide range of vehicle lease options come under flexible contract terms ranging from utes, to large SUVs, to hatchbacks and more.

To find out more about how Easi can assist with your novated leasing or business car leasing needs, .

Jump to section

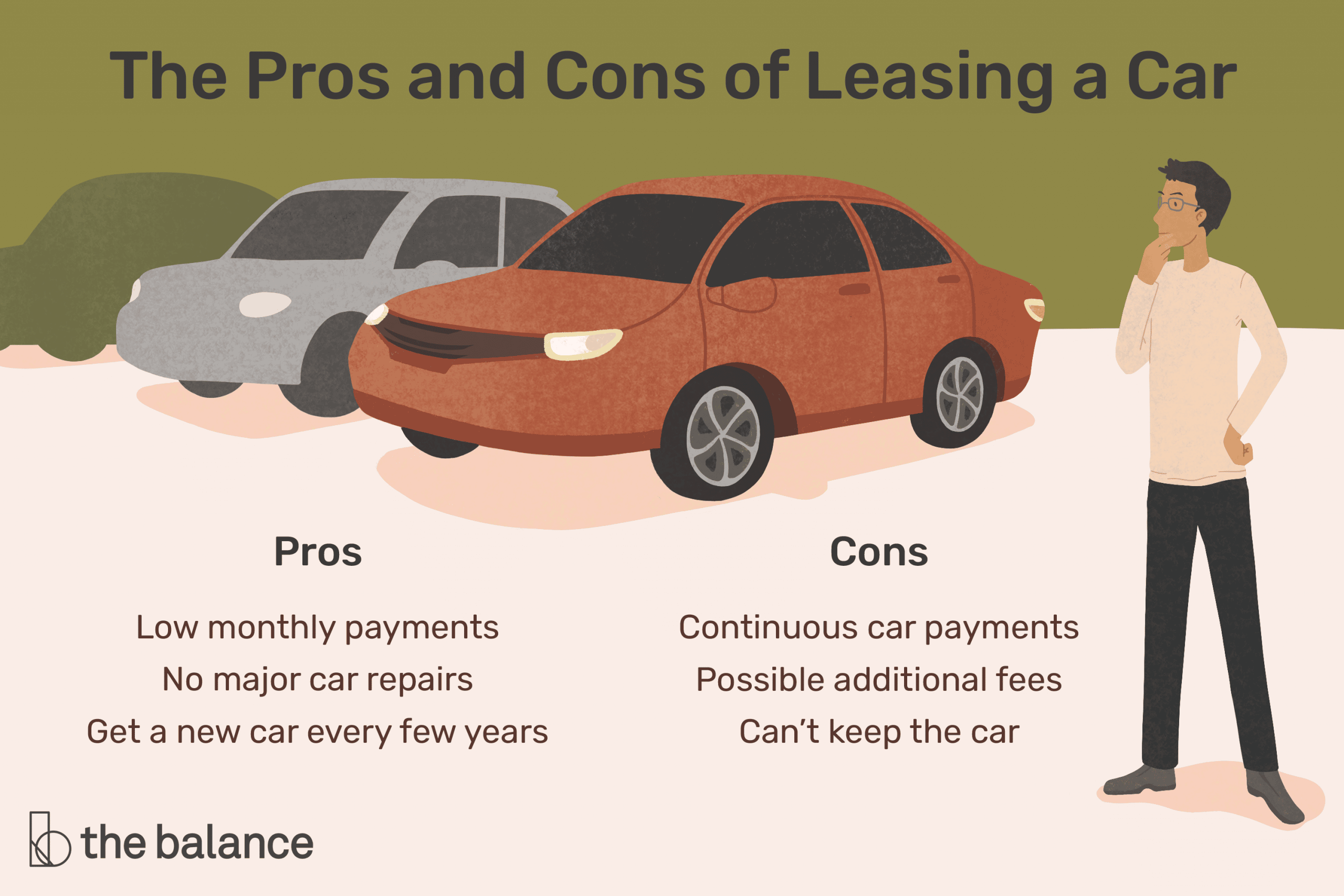

Drawbacks Of Leasing A Car

Before signing off on a lease, make sure to consider these drawbacks.

- Mileage restrictions. Most leases come with annual mileage restrictions, typically ranging between 10,000 to 15,000 miles. If you exceed those limits, youll pay a premium typically around 30 cents per mile.

- Additional costs. There are also fees for any wear and tear thats considered excessive, This includes anything beyond small scratches and dings.

- You wont own it at the end. Unless you choose a lease buyout which will likely involve financing anyway your monthly payments will continue when you either renew your lease or lease a new vehicle. This means you are never without payments and never fully own the car.

Read Also: Where Do I Get My Car Inspected

What Are The Future Values

- LEASING: With leases, you will have mileage limits and wear and tear guidelines. If exceeded, this could cost extra money when the lease is turned back in. In some cases, the value of the leased vehicle is worth more than what the manufacturer had thought in your contractual agreement. In this case, you would be able to put that equity towards another leased unit.

- BUYING: When you purchase a vehicle, it will be worth whatever the market deems at that time. Many factors go into the value of a vehicle, including how well it was maintained, state of the economy, mileage, and more.

What Is Vehicle Financing

When you finance a vehicle, you borrow money from a financial lender. When you finance an auto loan, you have entered an agreement to make monthly payments. You will pay more per month compared to leasing. Once the loan is paid, you will own the vehicle.Auto dealers have relationships with several lenders. You can choose one of their lending partners or get financing independently.

Recommended Reading: How To Repair Car Dents

Condition Of The Product

Ask your rent-to-own company if the product you are getting is new or used. Some rent-to-own companies may offer products that are slightly used or refurbished. Rent-to-own companies may also offer products that are discontinued and no longer offered by a manufacturer. These products may be more difficult to replace or repair if something goes wrong.

Check your rent-to-own companys policy on repairs and replacements.

How Does Car Leasing Work

Coronavirus and car payments

Find out more about payment holidays if youre struggling with car finance payments

Leasing a car is effectively long-term rental you pay a fixed monthly fee to use the car for an agreed time period and number of miles.

You might need to pass a credit check to secure your agreement. You can check your credit score for free with:

Car leasing credit checks wont assess your other outgoings, so make sure you can afford the payments. This means you need to make sure the costs are within your budget.

Recommended Reading: Can I Buy Car Insurance Online

When Is It Best To Lease A Car

Ownership costs can quickly add up, and drivers continually search for ways to reduce those costs. For some people, leasing is one significant way to reduce the monthly costs.

Studies show that people who lease are as satisfied as those who finance an automobile. According to CTV news, 66% of people who lease were very satisfied compared with 69% who were very satisfied with financing or buying.

When you lease, you enter an agreement with a leasing company that gives you the right to drive the vehicle of your choice – leasing is like a long-term rental. Your payments dont build equity as an automobile loan, and payments do.

You can still negotiate the terms of the deal, including the length of the lease, monthly payment, rate of interest, and kilometre limits. Consider negotiating a buyout price at the end of the contract if you decide to buy it.

How Does Our Lease To Own Process Work

A lease-to-own car is one that you agree to rent for a certain length of time in addition to making monthly payments toward the purchase of the car. These payments go toward both the rental and ultimate purchase of the automobile. Sign the paperwork stating the duration of the lease and the payment plan accordingly. Once you complete the term, you become the rightful owner of your desired car with an easy payment plan. If you wish to settle the agreed-upon arrangement before the period mentioned in the contract, it’ll be done so without any additional charges. To get more details regarding this arrangement, get in touch with our customer support.

Read Also: Who Made The First Electric Car

How Does Leasing A Car Work

You are probably already familiar with how to go about buying a car using loans or other financing methods. But leasing is a lot different from buying. You basically rent a car for a certain length of time, usually 2 to 4 years. Once the lease period expires, you can renew or extend the lease, purchase the vehicle at its residual value, or trade it in for a newer model.

The car dealer or car finance provider only asks for a monthly lease payment, which depending on the lease agreement can be paid by your employer, your business, or from your pocket.

Keep in mind that you have to be eligible for car leasing. Some of the qualification factors include your credit score, income, and employment history.

Advantages Of Rent To Own Cars

There are many benefits to rent to own car financing programs when you have bad credit. These loans are designed for people who need a vehicle but are struggling with the challenges of getting approved from regular and subprime lenders. With a rent to own car, these worries melt away. Here’s why:

- Vehicles on rent to own lots typically cost less than cars that can be financed from a traditional dealership.

- Payments are usually due in person on a weekly or bi-weekly basis at the dealership, which means a receipt and the peace of mind that your payments are being made on time. It also means payments are flexible for just about any budget.

- There’s usually no credit check required on rent to own cars, which makes getting approved easier.

- If you meet all the requirements, you can usually drive away in a vehicle the same day you visit the dealer.

Recommended Reading: What Does Liability Car Insurance Cover

What Is A Lease

A lease-to-own or rent-to-own program allows buyers to make installment payments on a car over the term of the lease. Once you make all the payments due under your lease, you assume ownership of the vehicle. The dealer holds title to the car in a lease-to-own agreement while you, the lessee, make your payments.

Lease-to-own contracts may be better than getting a conventional car loan for borrowers with bad credit. If you find yourself in this situation, you may discover that you only qualify for expensive subprime loans with high interest rates. If this is the case, your monthly payment may be too high.

Leasing companies that offer rent-to-own agreements target borrowers with bad credit. These lenders donât require a credit check for approval. So even if you have a low credit score or negative entries on your credit report, you can still be approved. You may only be required to provide proof of identity, proof of residency and citizenship, and a regular source of income. Some dealerships may also require proof of insurance. This isnât the case with traditional car financing or leasing. These lenders usually run a credit check as part of the approval process.

What Is A Rent

Many companies offer rent-to-own plans for purchases such as furniture, appliances, electronics and cars. These plans are also called lease-to-own, rent-to-buy, option leases and consumer leases. With this type of plan, you can spread the payment of your purchase over a predetermined period of time.

A rent-to-own plan is typically an agreement for the rental of an item. You will not own the item until you have met the conditions in your rent-to-own agreement. In addition to your monthly payment, you may have to pay fees. These can include an additional amount to pay if you want to purchase the item. If you change your mind, or if you dont want to purchase the item, you can return it to the company.

Rent-to-own options are also offered for the purchase of a home. These are not the same as rent-to-own plans. They are often referred to as rent-to-own homes.

For information about rent-to-own homes, contact your provincial or territorial consumer affairs office.

Recommended Reading: How Much To Replace Brakes On Car

Lease To Own Car: How To Buy Out Your Lease

If you are enjoying your leased vehicle and dreading the thought of returning it to the dealership, a lease buyout may be a good option to consider. What is a lease buyout? A lease buyout, sometimes referred to as a purchase option, allows you to purchase the car at the end of the lease instead of turning it in if your lease contract permits it.

Whether or not buying out a leased caris the right move depends on a lot of factors.

Mainly, you should consider the costs associated with a lease buyout and compare them with the cost of purchasing or leasing a different vehicle.

Wear, tear, and mileage can affect the value of the car, which you should keep in mind when considering a lease buyout. It may not be a good idea to buy out your lease if it’s going to cost you more than the car is worth, which can happen if the car’s actual value falls below the amount that would be required to buy out the lease.

You may be able to purchase the same year, make, and model for less elsewhere. Or, you may find the same car for the same price, but in better condition. That being said, buying a leased car can be a more streamlined and simpler way to owning a car, since the vehicle is already in your possession and you won’t have to spend time shopping around or test driving.

Drawbacks Of Buying A Car

Car ownership isnt without its downsides.

- Higher monthly payments. When you buy a car, you are probably going to spend more each month. For example, the average monthly payment for those who bought a Honda Civic was $476 $113 more than an average monthly payment for leasing it, according to Experians State of the Market report for the second quarter of 2022.

- A bigger down payment is required. If you put more money down, of course, you can reduce the size of how much you need to borrow and by extension those monthly payments, but it will take a bigger chunk of your savings.

- Long-term maintenance costs. Lastly, owning a car means you have to pay to fix it when something breaks. The warranty may cover some things, but once that runs out, youll be fully responsible

Recommended Reading: Does Navy Federal Have Car Insurance

What Are The Different Types Of Car Leases

Another component to leasing a vehicle in Ontario is the type to move forward with. The most common option is a closed-end lease which allows consumers to return the vehicle at the end of the term. Heres a look at other options :

- Lease to own vs financing : When leasing to own, you will own the vehicle like when you finance. The main difference is that the vehicle owner will hold onto the vehicle title when you lease to own until its paid off. When you finance, the title is transferred over right away.

- Finance lease vs operating lease : In a finance lease, ownership is transferred to the lessee at the end of the lease term. In an operating lease, ownership is retained by the lessor during the term.

Lease To Own Car Programs

Despite the name, a lease to own car program isn’t another name for leasing a new vehicle with the option to buy at the end. Lease to own car programs are actually more like rent to own programs, where you agree to make payments for a set term and gain ownership once the final payment is made.

Also Check: How To Keep Rats Out Of Your Car

Other Bad Credit Auto Loan Options

If a lease to own car doesnt seem like the right choice for you, youve still got other options if you have less than stellar credit.

There are dealerships with special finance departments that are signed up with subprime lenders. These lenders specialize in assisting borrowers in all types of credit situations, including: bad credit, no credit, and bankruptcy borrowers.

However, finding a dealer thats in touch with subprime lenders can be hard to pinpoint. We want to help with that! Here at Auto Credit Express, we have connections with dealerships all over the states, including BHPH and special finance dealers. To begin the search for a dealership that can work with you, fill out our free auto loan request form.