Protect Yourself When Buying From A Private Seller

Finally, protect yourself when you go to check out a used car being sold by a private seller. While most advertisers just want to sell their car, some people set up phony used car listings to lure in victims to rob them.

Never go to a meeting by yourself. Insist on meeting in a neutral public place during daylight hours. And never bring a large wad of cash with you when you go. For transactions like this, a check or money order is safest.

For loads more advice on buying a used car, check out the Federal Trade Commission website.

Insurance For Your First Car

Car insurance tends to be quite high for those under the age of 25. This is especially true for those who are 16 to 21 years old as they present the highest risk in terms of getting into an auto accident. When you reach the age of 26 and you do not have an accident on your record, the auto insurance premium goes down considerably. There are ways to help mitigate the cost of auto insurance such as the following.

- Driving School

- Obtaining a Vehicle Recognized as Safer

- Driving Under a Pre-Set Number of Miles Each Week

- Getting Liability & Uninsured Motorist Insurance Only

Many insurance companies will take 5% to 10% off if you attend and pass a recognized driving school. Besides, some vehicles are determined to be lower risk, so focusing on them may lower your rates a little. But one of the best is keeping your driving under a pre-set limit each week. That may lower your insurance considerably, although you may have to demonstrate that you do drive less each week.

Finally, getting insurance that meets the state minimum requirements which are usually liability and uninsured motorist can save even more. However, if you are taking out a car loan, you will have to get comprehensive insurance that covers the damage to your vehicle. If you purchase the vehicle outright, then you choose the type of insurance.

Special Requirements

Now that you know what you can afford in terms of price, the next step is choosing between the new and used car markets.

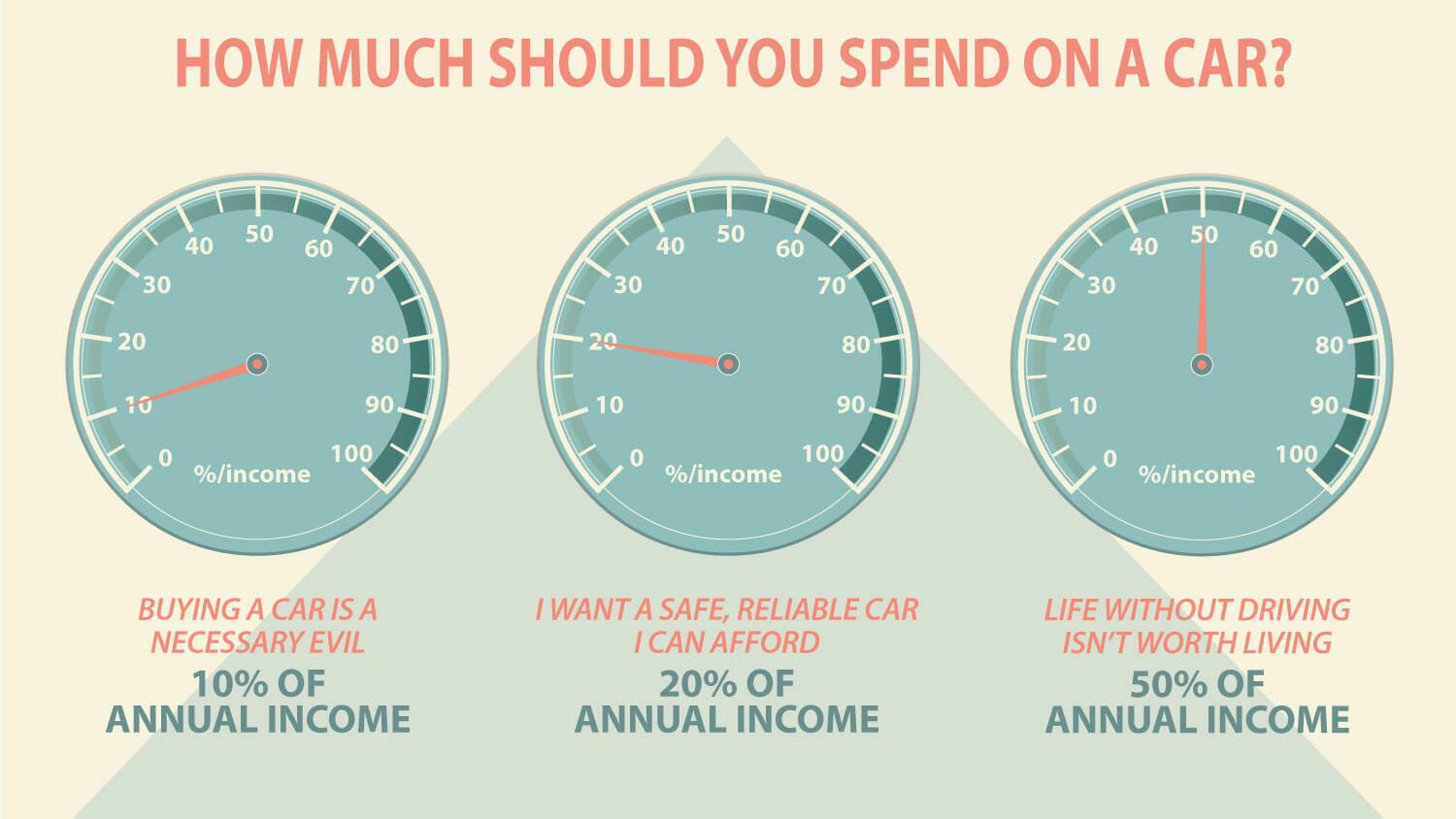

Is There A Certain Percentage Of Income You Should Spend On Your First Car

When youre trying to figure out how much to spend on your new car, there are some rules you can follow. If youre super cautious, you may want to stick to no more than 10% of your income. So, if you make $40,000 per year, you dont want to spend more than about $4,000 on a car. This means you wont be able to get a new car.

However, you could get a decent used car. If you have the cash, then you can shop privately. This opens up the idea of negotiating. So, if you find a car you really like thats $5,000 you may be able to talk the owner into selling it for less. This isnt really possible when financing a car through a car dealership.

If you are a bit more comfortable with your money, you can probably afford to spend about 20% of your annual income on your first car. If this is the first time youre buying a car, you are probably young. That means your income may not be as high as other people shopping for cars. And, theres nothing wrong with that. Youll have your whole life to buy second and third cars. You only get one chance to buy your first car

. So, if you make about $30,000 per year, you wouldnt want to spend more than about $6,000 for your first car. This would buy a decent used car. Or, you could put a couple of thousand down and then make monthly payments.

Don’t Miss: Is Faxvin Legit

What Else Should I Consider When Buying A First Car

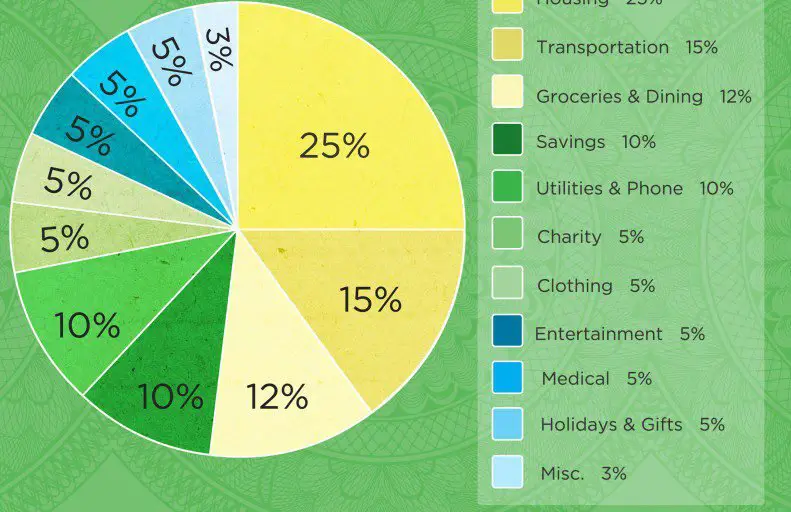

Now, before you go out and spend your R4 000 monthly budget on a new car, there are some other things you will need to include in your R4000 monthly budget.

Buying a car for the first time is great. Just make sure at the end of the day that you can afford it and that it is not going to leave you stretched thin at the end of the month.

How Much Should You Spend On Your First Car Here’s How To Tell

When youre figuring out how much you should spend on your first car, the cost of your car goes beyond how much you pay for the car. Theres also the cost of maintenance, fuel, insurance, and unexpected repairs. If you dont have a good driving record, your insurance could account for a large chunk of your car cost for each month.

Read Also: What Year Is My Club Car Golf Cart

Using Savings To Buy Your First Car

Now you have a car budget, do you have savings that could pay for it?

Using savings will mean you wont pay interest as you will with a loan but, of course, you might be using up savings that you could need later for other expenses.

For example, do you have savings in a rainy day fund?

You might want to prioritise this over buying a car but it depends on whats more important and urgent for you right now.

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

Also Check: Which Of The Following Affects One’s Car Insurance Premium Apex

Calculating The Monthly Payment

Once you know how much you can afford to spend, it’s time to work out how much you’d pay for the car you want. New car ads and review sites generally list only the total MSRP , so you’ll need to convert that to a monthly figure. Most carmakers offer a loan calculator on their consumer websites. Simply input data like your potential down payment and interest rate, and the site’s calculator will tell you approximately how much the loan would cost per month.

We’ve also got a loan calculator available on the Roadshow website. Enter how much you want to pay per month, as well as details like your expected loan length, interest rate and other details, and our calculator will help you figure out how much car you can afford to buy. You can also go the other way with our basic loan calculator, inputting a car’s sale price and other data to figure an approximate monthly payment number.

Bear in mind that interest rates will vary considerably based on your credit history, down payment, and whether you finance through a carmaker directly, or through your bank or credit union. Rates remain generally low right now, but obviously, this can vary significantly from person to person.

You can use online calculators like this one from Roadshow to get an idea of how much you can spend per month.

How Much Should I Save For My First Car

Want the best deal on your new car? Moneyshake saves you time and money, simplifying your search for a brand-new vehicle.

You should have £4,000-£6,000 saved up for your first car if you plan on buying it. Otherwise, most finance deals only require an upfront payment in the form of a deposit of around £1,000, but youll need to put money aside for the monthly payments.

Getting your first first car should be as cost-effective as it is exciting, which is why weve put together this guide to show you exactly how much you should save for your first car.

Read Also: How Much Does A Car Salesman Make Per Car

What Car Should I Buy New Vs Used

The biggest question you might ask yourself to start is “What car should I buy?”, and it makes sense. Of course, buying used cars will save you money upfront but owning a new car has other advantages. So, which one is better?

The simple way to answer this question is to look at the money you would save over time by buying a used car. Think that on average, a person will own 13 cars in a lifetime, each car’s price averaging around $30,000. Another thing you must keep in mind is depreciation.

Indeed, your car will lose its value over the years. It is estimated that by the end of the first year of owning your car will lose approximately 30% of its original value.

The impact of depreciation will affect you differently depending on whether you have a new car or a used car. Imagine you bought a new car for $30,000 and then you sell it after 3 years for $15,000. In this case, depreciation costs you $15,000. But if you instead bought a used car for $15,000 and sold it 3 years later for $10,000, the cost of depreciation only amounts to $5,000.

There are some disadvantages to buying a used car. First of all, there is the problem of maintenance and reliability. However, a used car will have lower car insurance rates and lower costs to register.

How Much Should You Spend On Your First Car

In 2016, about 17.6 million cars were sold to people, which was a record number for one year.

If youre planning on buying a car soon, you may be looking at your budget and wondering how youre going to end up making it work. You may be wondering how much room you should leave in your budget to pay for the car.

Are you wondering how much should you spend on your first car? If yes, you should read here for the important things to know.

Read Also: How Do I Get My Car Title In Florida

What To Do Before During And After Taking A Test Drive

Finally, its time to take the car out on the road! If possible, use an Internet mapping service to plan a route ahead of time that includes city and freeway driving, curved and inclined roads and roadways with different kinds of traction. That way, youll have a chance to see how the car handles in different environments. Let the salesperson know about your plans so he or she can help you have the best experience possible.

During the test drive, be alert for any performance issues that might signify a serious problem. Only by testing the cars performance can you find out if it will handle well when you really need it to. You may be tempted to proceed with an abundance of caution out of fear of damaging the car, but you wont learn as much with this approach. This is your chance to find out how quickly the vehicle accelerates and how it responds when you have to brake hard, so dont be shy about putting the car through its paces.

With that in mind, dont do anything illegal or make sudden maneuvers. When youre test driving a car remember to:

When youre taking a test drive, its a good idea to treat the salesperson as a resource. After all, he or she probably knows about the features of the car as well as anyone and would be happy to demonstrate them for you. Consider asking the salesperson to take the wheel for part of the drive so you can have time to look over the car and discuss it without it distracting you from the road.

You Need A Car Thats Comfortable Functional And Brand New

Youre in the market for a new car thats comfortable, built to a high standard and affordable. You dont want something thats already been used instead, you want your car to be completely new.

If this sounds like you, its best to spend about 20 to 25 per cent of your total annual income on a new car. Using the average UK salary of £26,000 per year, this gives you about £6,500 to spend on a new car.

Around this budget, youll be able to afford some small city cars such as the Suzuki Alto or the Kia Picanto, both of which are available for under £8,000. If your budget extends slightly beyond this limit, the Citroen C1 is available from £8,245.

If you need a larger or more powerful car, its worth looking at the used market. A wide range of cars are available for 20-30% off their new price after just one or two years of light use, making them great low-cost comfortable choices.

Also Check: Florida Duplicate Car Title

How Much Car Can I Get For $500 A Month

What Does Your Financial Picture Look Like

Before you decide how much to spend on your first car, you need to look at your finances. There are several things you need to think about, including:

- How much do you make? Look at how much you clear every week or two weeks. Does a good portion of your pay come in the form of tips or commissions? If this is the case, its not guaranteed income. Look at what youve made on average for the last 6-12 months.

- Do you live on your own or with your parents? If youre living at home, you have more money to spend on your monthly car payment. However, you may not be living at home forever. Odds are, in the next few years, you may want to move out on your own. If this is the case, you dont want a really big car payment holding you back. This is something to keep in mind when you decide on what kind of car to buy and how much to spend.

- What are your other expenses? If youre paying things like rent and student loans, you wont have all that much to spend on a car payment. This is something to keep in mind when car shopping.

Don’t Miss: How Do I Get My Car Title In Florida

Where To Find Car Listings

While you can find car listings in the newspaper and other free local guides, most of the same listings can be found online with more detailed information. Plus, its easier to save and share online listings for later reference.

Many online car searches typically provide each sellers price, so as you review your options, be sure to determine what a fair price to pay is for each model. Some of the most important factors you should be looking at include:

-

Safety

-

Typically costs significantly less than comparable new cars

-

Insurance rates are usually lower

-

Greater variety of choices that arent limited to the current model year

-

Can offer better value than a new car

-

Depending on the models, a used vehicle can have just as many safety features

-

Can get high-end finishes for a better price

Most first-time car buyers are on a budget, which is one reason why these drivers typically opt for a used car. Another factor to consider is that, with a used car, you can get upgrades that might not be affordable on a new model.