How Much Should You Spend On A Car Payment

And If You Really Love Cars

To all you personal finance blog regulars out there, this probably sounds good so far. If this is your first time here , you might be thinking, These people are so cheap! Thats crazy. Theres no way I can get a car I want for that money!

To you, I would say: Ask yourself why youre saying that. Is it because youre a car guy and you value your car most out of all your possessions? Or is it because youve simply been conditioned by our culture, advertising, and car salespeople to think that you should buy a brand new car and that theres nothing wrong with spending a years worth of paychecks on a car?

If its the formerthat you love carscool. Theres nothing wrong with intentional spending on the things you value most. By intentional spending, I mean spending moneymaybe more than other people would think is sensibleon things that interest you.

So if you value your car, I dont see anything wrong with spending more than we recommend for most people, perhaps up to 50% of your income on a car. Chances areas a car personyoull care for the car more, enjoy it more, and get more money for it when you sell it than the average car owner. Again, you just have to remember that because the car will be a large expense, youll have to be extra vigilant about other expenses.

How To Apply The 20/4/10 Rule To Car Leasing

20/4/10 is a simple rule to follow when considering financing a car. However, you may consider other car purchasing options, such as leasing or paying cash. You can apply the 20/4/10 rule to the leasing scenario in two ways:

- You can put down a 20% down payment, have a four-year lease contract, and have your total payments equal 10% of your monthly income.

- Alternatively, you do not have to have a down payment when you lease a vehicle. Therefore, when considering leasing a new car with no down payment, you can still use the 10% rule. You could have all car-related expenses, and your car lease payments equal 10% of your monthly income.

Read Also: Aaa Member Car Transport

The Three Rules Of Car Financing

The rule of thumb when it comes to smart auto financing is the 20/4/10 ratio.

According to this rule, when buying a car, you should put down at least 20%, you should finance the car for no more than 4 years, and you should keep your monthly car payment at or below 10% of your gross monthly income.

Why is the 20/4/10 ratio smart? Heres why:

What Are People Actually Spending On Cars

Weve given you a lot of options for how to choose how much to decide on a purchase price for a car. But what are people actually doing?

According to the U.S. Census Bureaus American Community Survey, the median household income was $61,937 in 2018, the latest available data. If using any of the three rules of thumb above, here is the maximium you would theoretically spend:

- Dave Ramseys 50% rule: $61,937 / 2 = $30,968.50

- 36% DTI rule: $61,937 x 0.36 =$22,297.32

- 10% rule: $61,937 x 0.10 = $6,193.70

These figures are for the total cost for all the cars in your household, not just one.

We can also see the costs of different types of car purchases cost thanks to a 2019 Experian survey, including:

- The average new car purchase was for $32,797.

- The average used car purchase was for $22,267.

- The average used car purchase was for $18,058.

If youre trying to keep your debt under control, it seems that the best type of car to buy is a used car from an independent party rather than a dealership.

Remember, though: personal finance is personal. No one aside from yourself can tell you what exactly you should or shouldnt do. It all depends on your own situation.

Recommended Reading: Does Aaa Ship Cars

Calculate The Car Loan Amount You Can Afford

Now that youve calculated your affordable monthly car payment amount, you can start to get a sense of how much you can borrow. This will depend on several other factors, including:

-

Your credit score, which will in part determine your annual percentage rate, or APR, on the loan.

-

Your loan term: how many months you have to pay off the loan.

-

Whether you buy new or used. New car loans tend to have lower APRs.

With a monthly payment, an estimated APR and loan term, the car affordability calculator works backward to determine the total loan amount you can afford.

How Much Do People Spend On Car Insurance And Maintenance Per Year

Based on the top 10 auto insurance providers in the United States, the average cost of auto insurance is just shy of $4,000 annually, or about $330 monthly. Add another $150-$200 to your monthly car budget for gasoline and repairs, and your total monthly auto budget drops even lower.

One thing’s for sure: The longer you use your car, the more money you will ultimately wind up needing to spend to keep it in good working order. Be it a car, truck or SUV, automobiles are literally made up of thousands of parts. Something is eventually bound to give out and require replacing, and it usually happens after the warranty window has closed. Not only will you have to pay for the vehicle’s upkeep, you’ll also have to shell out cash for gas, insurance, registration, most likely the occasional parking and speeding ticket or two and oh, yeah interest on your auto loan, too.

The novel excitement of showing off your new or semi-new vehicle usually wears off after a few months, but making those hefty monthly car loan payments will be an ongoing chore for years to come.

Read Also: Fix Burn Holes In Car

Buy New Car On Discount

It is always better to buy cars on discounted rates. One way to do it, is discussed in #2 . But if one has decided to buy a brand new car, what can be done to get some discounts?

In this case the question to be asked is, when to buy car? Which part of the year is suitable for buying a car?

To boost sales, car dealers offer discounts. Best time to buy cars in India is between December/January or March/April. Dealers try to get rid of last year models in these months. Hence these months could be a best time to buy new cars.

One can also compare price of same car offered by different dealers. Due to competition one dealer may give better on road pricing than the other. Always remember, car is not an asset, it is a liability. Every penny saved in buying a new car is worth the effort. Read more about building assets.

Calculate How Much You Should Spend On A Car

Your budget isnt just the car or monthly car payment. Your budget includes the car payment, fuel costs, service costs, car insurance, etc. All of these should be factored into how much you spend when you buy a used car.

Income | How Much Should I Spend on a Used Car

Ideally, youll want to stick to spending around 10-15% of your monthly take-home income on transportation costs. If your take-home is $5000 a month, then your total transportation budget is $500 to $750. But $500 to $750 isnt just your car payment, it is your TOTAL cost for the month, which includes everything from monthly payment to insurance.

You also have to factor in the cost of your other monthly bills. If you live in an area that has high housing costs then you might have to adjust your car budget to account for the higher rent or mortgage costs.

Debt | How Much Should I Spend on a Used Car

If you have any existing debt like medical bills, personal loans, student loans, or credit card balances then you must account for those in your budget, as well. Debt will factor into the likely hood of being approved for a loan by the bank. The more debt you have the higher the chances the bank may hesitate on approving the auto loan.

Financing | How Much Should I Spend on a Used Car

Taxes & Fees | How Much Should I Spend on a Used Car

Car Insurance | How Much Should I Spend on a Used Car

Maintenance | How Much Should I Spend on a Used Car

Fuel | How Much Should I Spend on a Used Car

Also Check: Car Freshies Recipe

How Much Should Your Car Cost Compared To Your Salary

Figure Out How Much Total You Can Afford To Spend On Your Car

The first step is to look at your budget. If you dont keep up with one regularly, dont worry! Youre not alone. Most Americans dont budget.

Instead, at the very least, you can make a list of your monthly take-home pay and expenses each month. Thats all a budget really is, anyway.

Pro tip: Remember to include things you dont pay every month, like insurance or registration. If you only pay a bill every so often such as once every six or 12 months just divide the total by six or 12. For example, if your renters insurance costs $600 every 12 months, youll need to set aside $50 per month for it. If you need to jog your memory, you can look back over old bank statements.

Once youre done with the list, take a look at your budget. How much extra do you have left over after paying for everything you need, not counting car-related expenses? If you dont have anything, youll need to find things to cut, or find ways to earn more money. In any case, decide on how much total you can afford on a car.

Recommended Reading: What Do You Need To Make Car Freshies

How Much Car Can I Afford

Fitting a car into your household budget is no easy task, and financial experts do not agree on how to determine its affordability. One school of thought holds that all your automotive expenses gas, insurance, car payments should not exceed 20% of your pretax monthly income. Other experts say that a vehicle that costs roughly half of your annual take-home pay will be affordable. Then some frugal personal-finance gurus say you should spend no more than 10%-15% of your annual income on a vehicle purchase. Pretax, post-tax, annual income these terms are enough to make a person ask: “How much car can I afford?”

There’s no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home pay. If you’re leasing or buying used, it should be no more than 10%. The reason for finding a vehicle that falls below 10%-15% is that the payment isn’t the totality of what you will be spending. You’ll need to factor in the costs of fuel and insurance, and many people overlook that. We put those costs at another 7% of your take-home pay. So, all in, you’re looking at a total budget that is ideally, no more than 20% of your monthly take-home pay.

While the 10%-15% rule may not work for everyone, it’s a good starting point for finding a target price that won’t leave you scrambling to pay your bills every month. Here’s how you can get a more customized number for yourself.

How Much Can I Afford To Spend Every Month

Set on financing your car? You need to know what you can spare every month after all, your normal costs are deducted and a little extra put aside for savings and to cover any unexpected bills. Fail to work this out and you may find yourself overstretched and unable to meet the payments if you encounter any surprise bills, which could cause you big financial problems.

To work this out, think about your typical monthly take-home pay and then deduct your mortgage payments or rent and the amount you spend on household bills every month. Then take off how much you spend on other monthly commitments like food, mobile phone bills and any other regular spending – including travel, leisure and entertainment costs.

Since car finance contracts can last up to five years – and your financial situation could change dramatically over this time – its wise to save as much as you can every month, to give you a financial safety net. So set yourself a target of how much you want to save every month.

If you can manage to save 20% of your take-home pay – putting this in an instant-access ISA will earn you interest and let you access the money if you need to – this should quickly add up and give you a little extra security in case you suddenly lose your job or your boiler blows up, for instance.

You May Like: How To Fix Burn Holes In Car Interior

Compare Car Loan Offers

The last thing you want is to be pressured into an expensive loan by a dealer when purchasing your car. Car salesmen are masters of the deal, and you may find yourself paying much more than you bargained for, or locked into a loan with unfavorable rates and terms if youre not careful.

To prevent that scenario, you should be sure to come prepared and armed with as much information as you can. Comparing offers from several different lenders can help you to figure out what rates you qualify for, and will allow you to make informed decisions about financing your purchase. Comparing rates from multiple lenders will also help to ensure that youre getting the best rate possible, which can save you a lot of money over the long term.

Loan comparison tools like are a great way to compare different lenders for free online. Monevo lets you look at loan offers from over 30 different banks and lenders in order to find one that works for you and your budget. The process only takes a minute all youll need to input is how much youre looking for, what the loan is for, and what your estimated credit score is. Then youll have a list of lenders organized in an easy-to-read list. Plus, this whole process doesnt affect your credit score!

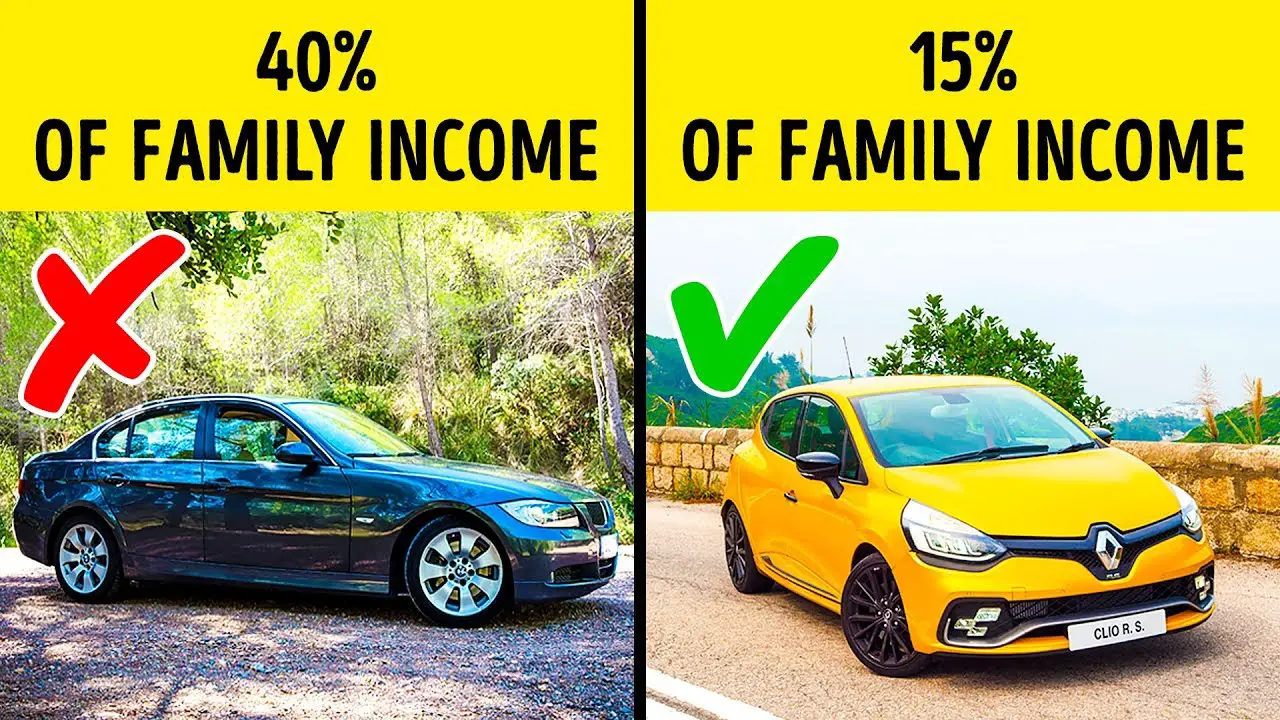

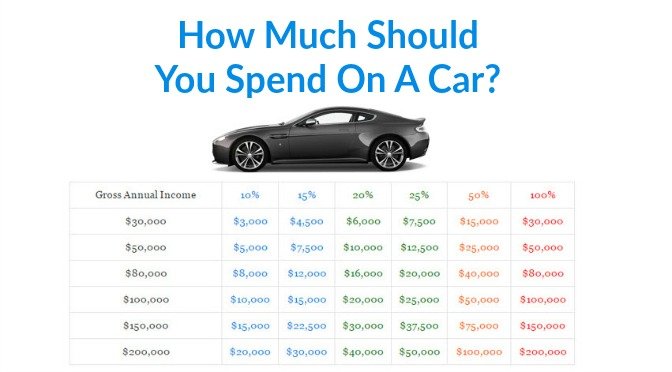

How Much Should You Spend On A Car Based On Your Income

As a rule of thumb, you should never spend anything more than 100% of your income. Generally, it is advisable to spend between 10-15% of your annual income, and if you want to buy the car of your dream you can consider spending 15-30% of your income.

Here’s an example for you. Let’s say that your annual income is around $60,000. Then you should spend around $9,000 on buying a car. This kind of rule helps you in limiting your finances and prevents you from borrowing more than you need.

Also, because purchasing the car is not the only cost involved in owning a car , not spending too much on it will leave you some kind of buffer to afford such costs.

You May Like: How To Keep Squirrels Out Of Your Car Engine

What Buying Options Suit Best

If you can buy a car outright, and therefore own the asset and not pay any interest, then this in theory is best. However, if it feels safer not to pay a lump sum upfront, or you dont have the means to do so, then buying on finance, or long-term hire might be a better choice for you.

Many manufactures offer 0%APR deals, and other packages, which require a smaller outlay, and suit customers better. Explore all of your options, but just be clear on the length of contracts and what your obligations will be, and any other payments you might need to make , to understand the total cost of these packages too.

You may wish to invest your savings instead, or have the possibility of various life expenses on the horizon, which makes it hard to know how much savings you will need . If so, then hire purchase, PCP, or PCH is worth considering, and monthly payments can feel like a more straightforward and thus safer option for many.

How Does My Term Length Affect My Loan Payments

Your term length will vary depending on how much you can afford to pay per month, as well as how long youd like to pay off your loan. The average term length is between 3 and 5 years. That said, term lengths are extending more often to 7+ years, which means youll pay more interest over the course of your loan.

Examples of monthly payments for different loan terms

In the example below, well look at how much your monthly payments will be for the same loan amount based on the length of your term. Well also look at how much youll pay in interest over the course of your loan.

|

Loan amount |

|

|---|---|

|

$556 |

$6,620 |

As you can see, the cost of your monthly payments will go up as your term length goes down. That said, youll pay less interest over the course of your loan with a shorter term.

Recommended Reading: Florida Title Copy