Ways To Lower Insurance Costs

No matter if the buyer purchases new or used, the car will need to be insured. Unless the purchaser pays cash for the vehicle, they will be required to carry a full coverage policy in order to protect the lenders interests in the case of a collision, weather damage or if the vehicle is stolen or vandalized. If the buyer purchases with cash and no portion of the purchase price is financed, the new owner may carry liability only insurance. In most states, at least a liability policy is required. However, depending on the vehicle age, buyers who pay in full upfront may still want to consider full coverage. In at fault” states, liability covers only the other driver and vehicle in case of an accident. In no fault states, liability will cover only the minimum required for the policy for property damage and bodily injury. If the car is five years old or newer, the driver probably needs to carry full coverage insurance to make sure they are able to cover the cost of repairs in case of an accident or damage.

How To Use This Calculator

The APR calculator determines a loans APR based on its interest rate, fees and terms. You can use it as you compare offers by entering the following details:

- Loan amount: How much you plan to borrow.

- Finance charges: Required fees from the lender, such as an origination fee or mortgage broker fee. Situational fees, such as a late payment fee, generally arent included in APR calculations.

- Interest rate: The interest rate that the lender charges on the loan.

- Term: The number of years you have to repay the loan.

Often, the Federal Truth in Lending Act requires lenders to tell you the APR, so you wont have to calculate it on your own. In some cases there are even templates that lenders must use, such as the Loan Estimate form for mortgages. When reviewing that form, you can find the interest rate on the first page and the loans APR on page three.

However, if youre comparing loan offers from different lenders, its sometimes helpful to look into the details and do the APR calculations on your own. For example, mortgage lenders might be able to exclude certain fees from their APR calculations, and you want to make sure the APRs you’re comparing are based on the same financing charges.

Ways To Negotiate Sales Prices And Online Alternatives To Haggling

Many Americans do not like to haggle for a better deal. However, haggling is commonplace in some cultures. If a buyer will haggle over the price of a new or used vehicle, they stand a chance of obtaining a better purchase price for the vehicle. Haggling simply means that the purchaser makes a counter-offer to the dealer or seller once they have presented the purchaser with a selling price. Haggling is simple negotiation. Dealers in particular have some bargaining leeway when it comes to the purchase price of their new and used vehicles. When shopping, the purchaser has nothing to lose. They should attempt to negotiate a lower selling price. Even a $500 break is often equivalent to a monthly payment. Buyers should always attempt to gert a better price than the asking price of the seller.

For those who are uncomfortable with the prospect of haggling for a better price, some websites offer services that allow users to comparison shop for the same make and model of vehicle. Sites such as CarsDirect and TrueCar allow users to search for a specific make and model in their geographical area. The search results provide the asking prices of various sellers and dealers. The site user may then contact the seller or dealer and even offer a lower price, if the so choose.

Don’t Miss: How Much Does A Car Salesman Make Per Car

Calculating Apr For A Car

You’ll need to know the amount you’re financing, any additional fees you must pay, your interest rate and the loan term before you start.

First, calculate the total interest you’ll pay over the life of the loan based on your interest rate, and then add to this any additional fees associated with the loan. Now divide this number by your loan amount. Divide this number by the number of days in your loan term and multiply the result by 365 to find your annual rate. Finally, multiply by 100 to get the annual rate as a percentage.

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Recommended Reading: California Register Car

Limitations Of The Apr

While the APR serves as an excellent indicator for loan comparisons, the listed fee structure presumes that the loan will run its course. For any borrower planning to pay their loan off more quickly, the APR will tend to underestimate the impact of the upfront costs.

For example, upfront fees appear significantly cheaper spread out over a 30-year mortgage compared with a more accelerated 10-year repayment plan. In the U.S., borrowers usually pay off 30-year mortgages early due to reasons such as home sales, refinancing, and pre-payments. Therefore, when comparing loans with the same APR, the loan with lower upfront fees is more favorable to borrowers intending to pay off a mortgage early.

What Determines My Auto Loan Apr

Your APR is based in large part on your , and the higher your credit score, the more likely youll be to receive the most competitive rates. In the fourth quarter of 2019, borrowers with the lowest credit scores received an average APR of 14.25% on new car loans, while those with the highest credit scores received an average APR of 3.82%, according to Experian.

Recommended Reading: Can I Get My Pa Car Inspected In Another State

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Why Do Credit Cards Have Different Aprs

You might notice that your credit card has an that shows more than one APR in the fee disclosures or your credit card statement. Credit card companies often charge a variable APR, according to the type of transaction.

The most common credit card APR categories apply to:

- Balance transfers usually at a lower fixed rate for a limited time

- Cash advances often higher and more expensive than the standard APR

- Introductory usually available for a limited time after sign-up

- Penalty or late payment often more expensive than the standard APR

- Standard purchases the main APR for store and online purchases

You May Like: How Much Commission Do Car Salesmen Make Per Car

What Factors Determine The Total Cost Of A Car

When youre choosing a loan, the length of the loan term and the APR you receive will determine how much you pay in total. So will the down payment you make, and any money you receive for trading in your previous car. Youll also need to pay for state taxes, title fees and potentially dealer-specific fees upon purchase, plus ongoing driving expenses.

How Are Auto Loans Calculated

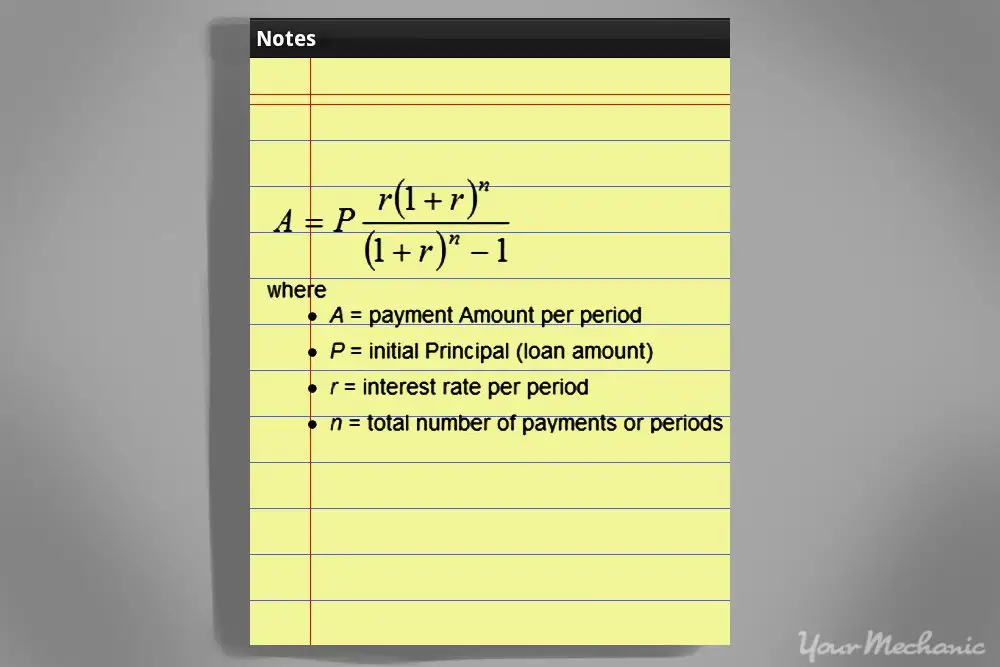

Calculating the cost of an auto loan involves following a mathematical formula. It might not be as simple as 1+2=3, but the concept is the same!

If you take the factors listed in the previous section and plug them into the right spot in the equation, you will get your monthly auto loan rate. There are auto loan calculators that can give you an idea of this amount, but understanding the how behind the calculations is essential as well.

First, it’s important to note that an auto loan is an amortizing loan. This means that you pay back the amount of your loan plus interest. Your payments are the same each month and include the principal balance plus interest. Each payment you make will be the same however, as you make more payments, you will pay more towards the principal and less toward interest.

Again, you can choose to use a calculator or rely on your lender to calculate your auto loan payment, but it’s good to understanding the mechanics behind how and why auto loans are calculated the way they are.

Also Check: How To Remove Hail Dents From Car

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

What Is A Balloon Payment

A balloon payment is a large, lump-sum payment made at the end of a long-term loan. It is commonly used in car finance loans as a way of reducing monthly repayment figures. Be aware that once you reach the end of your loan period, the balloon amount becomes payable. You can learn more about balloon payments in our article, What is a balloon payment?.

If you have any problems using this car loan payoff calculator then please contact me.

Recommended Reading: Adding Bluetooth To A Car

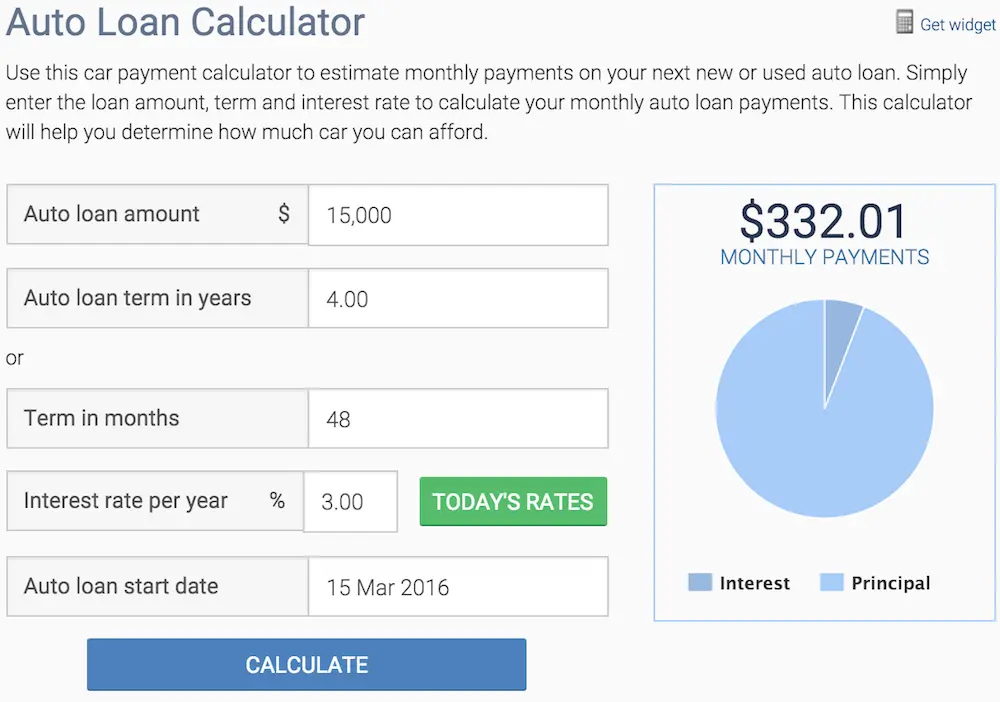

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

The Annual Percentage Rate On A Car Loan Is The Annual Cost Youll Pay To Finance A Vehicle Including Fees Shown As A Percentage

How to calculate apr car loan. You need three numbers. For installment loans such as personal auto student and mortgage loans the APR and interest rate may be the same if there are no finance charges. You can also calculate the estimated APR yourself using loan amount interest rate and fees and loan term.

Enter a car price and adjust other factors as needed to see how changes affect your estimated payment. Calculator Use The Advanced APR Calculator finds the effective annual percentage rate APR for a loan fixed mortgage car loan etc allowing you to specify interest compounding and payment frequencies. Estimate how much you can get approved for based on income debt and credit factors.

To illustrate lets calculate the APR on a 1000 loan with a 400 finance charge and a 90-day term. Lenders are required to disclose the APR theyre charging you before you finalize a loan. Americans have over 1 trillion in motor vehicle credit outstandingThe following table from Experian shows how much people with various credit ratings typically are charged for loans.

You will get a note rate of roughly 6 6 8388913978. Create a loan amortization schedule and payment tables for loans. The amount borrowed the total finance charge and the term length of the loan.

And if you want to estimate the APR you can divide the 90502 by the average balance of the amount financed over the first year which is 13888. Dont include utility bills. Calculating the APR of a loan is simple.

Don’t Miss: How To Set Up Siriusxm In My Car

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

How To Calculate Auto Loan Interest For The Coming Months

To calculate future auto loan interest payments, you will need a different calculation:

- Subtract the interest from your current debt. The amount left is what you owe towards your loan principal.

- Deduct the above amount from your original principal to get your new loan balance.

The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline it may not be the same amount you receive.

Recommended Reading: What Does A Car Thermostat Do

Why Is Apr Important

Knowing the APR on a car loan is important because it helps you understand how much borrowing money from that lender will cost you. The lower the APR, the less youll pay to finance your car.

When comparing loans side by side, pay attention to the APRs to help identify the least expensive loan. The difference of even just one percentage point can add up over time.

For example, lets say youre comparing two $23,000 loans, each with a four-year term. One loan has a 5% APR and the other has a 6% APR. Youd end up paying $503 more in interest on the loan with the 6% APR than you would on the loan at 5% APR.

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Recommended Reading: What Does Srs Mean