Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this tool, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. Full disclaimer. This tool is here purely as a service to you, please use it at your own risk.

Making The Calculation With The Pmt Function

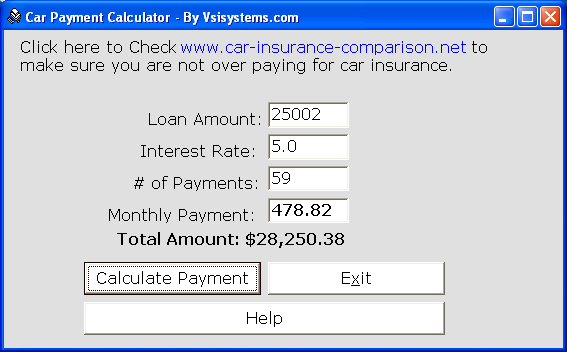

The key question for most people when taking out a car loan is What will my monthly payment be? Fortunately, Excel has been around the block a few times with this kind of question, and there is a special function just for this calculation, called PMT. The basic syntax for PMT is as follows:

=PMT

Lets break down the inputs:

The rateinput is the amount of interest collected per period. Important: This is NOT the APR! The APR is an annual rate, but car loans are paid monthly. Because of this, you need to divide the APR by 12. If your interest rate variable is in the same place as mine, the input will be C6/12.

The nperinput is the number of periods the loan will be paid back over. Most car loans are 3-5 years. My loan term is already specified in months, but if you decide to use years, dont forget to multiply by 12 to get the number of payments! My input for nperis going to be C7.

The pvinput stands for present value, which is finance code for how big the loan is. Finance types are kinda weird, so they Excel likes to assume that the loan amount is negative. Since we usually like to see the loan as a positive number, well change the sign right in the function. My loan amount is in C5, so my input will be -C5.

The remaining inputs, fvand typeare for more complicated calculations and we dont need them for our project, so well leave them alone for now. If you are building your model exactly like mine, the formula for the monthly payment will look like this:

=PMT

=SUM

Calculate Auto Loan Payments In Excel

Want to know how much that new car will cost? Just crack open Excel and load this spreadsheet.

It calculates your car loan payments and generates a payment schedule. You can also investigate how changing your loan conditions affects the payment.

The spreadsheet is easy to use and navigate required parameters are highlighted, and drop-down menus let you change the payment frequency and compounding period.

Just enter the loan amount, interest rate, loan term, first payment date, payment frequency and loan compounding period

AAfter you click a button, the spreadsheet calculates your

- interest rate per payment

- the date of the final payment

- and the total interest and principal paid at the end of the loan

Watch me use the spreadsheet in this video.

This tool also generates a payment schedule, giving the date of each payment .

So what this this auto payment calculator do better than the other calculators you can find littering the Internet? Well, you can change the compounding period of the loan.

- US loans are compounded monthly

- Canadian loans are compounded monthly or sometimes semi-annually

- UK loans are compounded yearly

- Australian loans are compounded monthly

This alters the amount of each payment, and the total interest paid at the end of the loan. This flexibility means that you can use this calculator internationally. Just change the compounding period to suit!

This article describes how this spreadsheet calculates interest payments .

You May Like: Cost To Have Car Painted

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

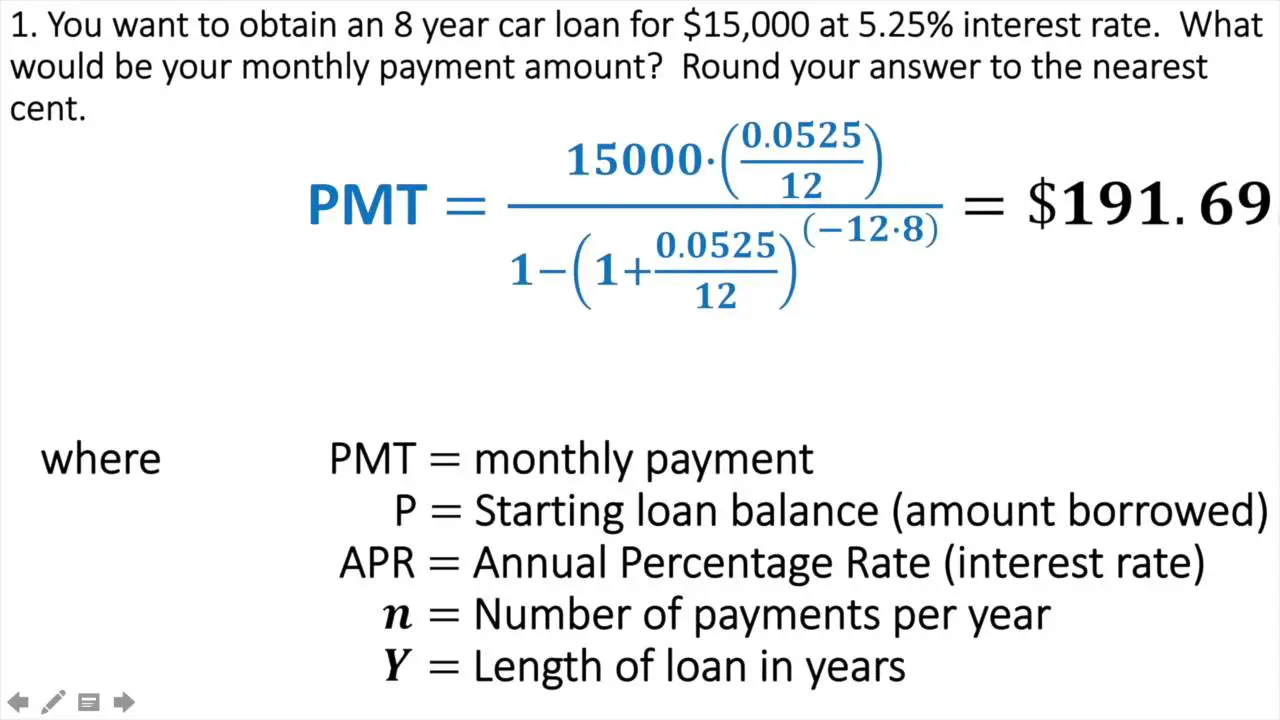

How To Calculate A Car Loan Payment

If youre using financing to buy a new or used vehicle, you should already know that youll have to pay back that loan over several months or years. But just how much will you owe each month, and what costs are included in those payments?

When purchasing a car, it is nice to know how to calculate your car loan payment. Calculating total and monthly costs allows you to budget accordingly and figure out the total price of the carnot just the sticker price.

The math involved can be overwhelming if you do not use math often, but finding a good car loan calculator and having the right information handy can save you a lot of time.

Also Check: Suspend Car Insurance Geico

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Where To Get A Car Loan

If youre looking to take out a loan to finance your auto purchase, you have plenty of options to choose from. When it comes to financing your vehicle, you should be sure to come prepared in order to ensure that your negotiation with a car dealership is successful and you dont wind up paying more than you bargained for.

Online rates comparison tools like can help you to learn more about what rates you qualify for. Monevo lets you compare loan offers from different lenders for free. If you see a loan that meets your needs, you can apply quickly and easily online, and have the funds available to you in as little as one business day.

You May Like: Zte Mobley Hack

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Don’t Miss: How To Remove Hail Dents From Your Car

Monthly Interest Rate Calculation Example

To calculate a monthly interest rate, divide the annual rate by 12 to reflect the 12 months in the year. You’ll need to convert from percentage to decimal format to complete these steps.

Example: Assume you have an APY or APR of 10%. What is your monthly interest rate, and how much would you pay or earn on $2,000?

Want a spreadsheet with this example filled in for you? See the free Monthly Interest Example spreadsheet, and make a copy of the sheet to use with your own numbers. The example above is the simplest way to calculate monthly interest rates and costs for a single month.

You can calculate interest for months, days, years, or any other period. Whatever period you choose, the rate you use in calculations is called the periodic interest rate. Youll most often see rates quoted in terms of an annual rate, so you typically need to convert to whatever periodic rate matches your question or your financial product.

You can use the same interest rate calculation concept with other time periods:

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

Read Also: How To Remove Car Door Panels

Using Microsoft Excel To Calculate Auto Loan Payments

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all – it’s identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, you’ll then be able to figure out the types of loan payment calculations you’ll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance – the loan itself. While this does mean a smaller monthly payment, eventually you’ll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

Read Also: Selling Leased Car To Carvana

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

How To Calculate Monthly Interest

The Balance 2020

Calculating interest month-by-month is an essential skill. You often see interest rates quoted as an annualized percentageeither an annual percentage yield or an annual percentage rate but its helpful to know exactly how much that adds up to in dollars and cents. We commonly think in terms of monthly costs.

For example, you have monthly utility bills, food costs, or a car payment. Interest is also a monthly event, and those recurring interest calculations add up to big numbers over the course of a year. Whether youre paying interest on a loan or earning interest in a savings account, the process of converting from an annual rate to a monthly interest rate is the same.

Read Also: What Kind Of Car Did Columbo Drive