Find The Right Vehicle For You

Once youve established how much you can spend on a used car, its time to find the right one for you, or at least a list of several candidates. There are hundreds of different vehicles out there, and the pool of contenders only grows when you consider models over a range of years. This may seem daunting, but the good news is that with such a variety, there is a vehicle thats right for you, whether its a small SUV, large pickup truck, midsize sedan or a sporty convertible .

If youre reading this, you already know that most of the browsing and research of your next vehicle can be done online. KBB.com has extensive and deep information on every major make and model of vehicle. From expert and unbiased reviews from our editors to finding the horsepower and length of the car , all the information you need is at your fingertips. Its also helpful to read consumer reviews of the vehicle you are interested in. Those can also be found here at Kelley Blue Book.

As with any vehicle purchase, consider not just your present needs but your future ones, too. If youre planning to grow your family, now is probably not the time for that 2-seat sports car. And if youre planning on a third child, wed recommend a 3-row SUV or minivan over a smaller 2-row SUV.

Get The Best Rate On Your Loan

The sellers below let you estimate your monthly car payment so you can shop for vehicles with a bottom-line price in mind. Some sites work with partners who set terms that dealers will honor. Others, such as CarMax and Carvana, have their own financing arms.

Going through the prequalification process is a good way to get a general idea of rates available. If you end up at the dealer, ask if you can get a better deal on financing. Also, check bank and credit union rates. Recently, 60-month used-car loans averaged about 4.2%, according to Bankrate.com.

Best Bank For Auto Loans: Bank Of America

;Bank of America

- As low as 2.39%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

Don’t Miss: Is Car Warranty Worth It

Realize Each Used Car Is Unique And Investigate Its Past

Each car will have a unique history, current condition and number of miles on the odometer.

For this reason, its important to thoroughly investigate any used car you may buy. Get a vehicle history report using a service like Carfax to see how many previous owners the car has had, whether its been in any accidents, and what maintenance or other work has been done on the car. These factors are important in both choosing a used car and negotiating its price.

How Much Is A Used Car

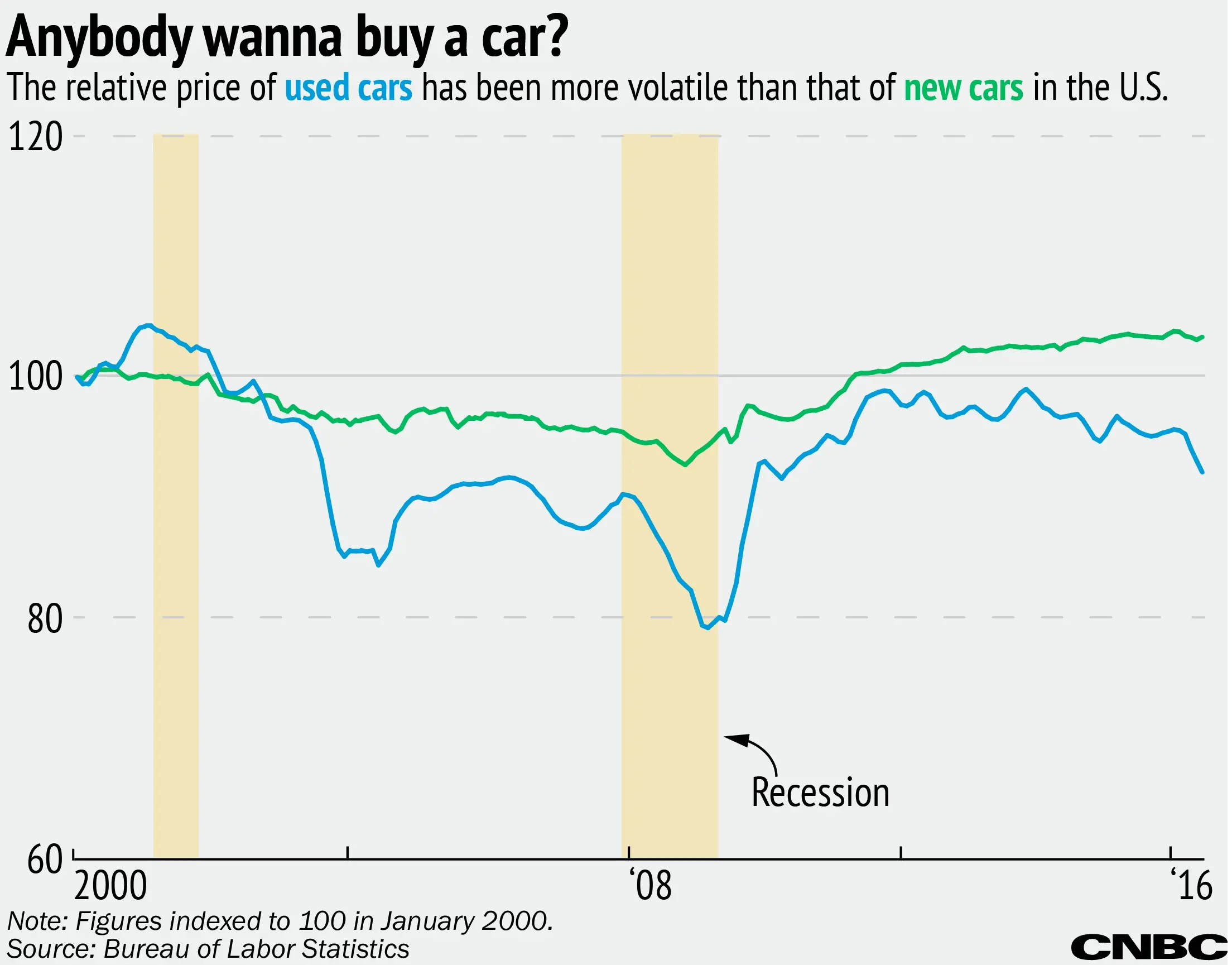

When negotiating prices on used cars, it’s helpful to know how much they typically sell for. On average, the typical used vehicle sold for $21,558 in 2020. Prices for used vehicles and new cars rose during 2020 thanks in part to a wave of consumer spending triggered by the release of economic impact payments. Decreased supply of used vehicles paired with more consumers having ready cash to spend in the form of stimulus checks helped raise used car prices year over year.

In terms of how much should you pay for a used car, that depends entirely on your budget. If you’re paying cash for a used vehicle, then the amount you have on hand will likely determine how much you can spend. If you’re planning to get an auto loan, then you may have a larger used car buying budget to work with. Remember to check the best car loan rates to compare financing options.

Also Check: How To Set Up Siriusxm In My Car

Review A Vehicle History Report

Some information to review in the report is:

- Accident history. Look for any major accidents.

- The total number of previous owners. Typically, its best to opt for used cars with few owners, as cars that change hands frequently may have an underlying problem. The report also tells you if the car was used as a fleet or rental car, which will help your negotiating position.

- Mileage. Confirm that the mileage in the report matches that of the listing.

- Manufacturer recalls. It will tell you if recalls exist and if they have been addressed or not.

- Title status. Its crucial to confirm the status of the title. If the car was in a serious accident or faced flood/fire damage that rendered it totaled by the insurance company, it may have a salvage title. The salvage title drastically lowers the resale value. You should also ensure the title matches the name of the person/ entity trying to sell the vehicle and that there are no liens on the vehicle.

- Maintenance. Some reports show maintenance history for required maintenance as well as where the work was performed.

If something turns up when you run the report, you can avoid a costly mistake and skip making an offer. But if you still want the car, before you make an offer show the seller a printed copy of the report, and point out any issues that will help you justify a lower price.

For more information, learn how a vehicle history report works.; And we’ve found that VinAudit has the cheapest reports at $9.99 each.

Negotiating With Private Sellers

Buying a used vehicle from a private seller may be an option if you plan to pay cash. But consider how much a private seller is likely to charge for a vehicle versus a dealership.

Depending on the seller, it’s possible that you may be able to negotiate them down on the price if they have a fairly urgent need to sell. On the other hand, if a seller claims there’s no pressing reason for the sale, other than wanting to get rid of the car, you may have a tougher time talking them down.

In terms of where to set your negotiation starting point, it may be helpful to choose a set dollar amount that represents the absolute maximum you’re willing to pay. Then you can set your starting price below that amount so you have room to work your way up.

For example, say you only have $5,000 to spend on a used car. You come across a great car that’s priced at $5,500, which is just out of your price range. If the seller gives you an opportunity to make an offer, you could start at $4,500. From there, you and the seller can continue bargaining until you reach the $5,000 mark that you’re comfortable paying.

Don’t Miss: How To Set Up Siriusxm In My Car

Are The Wheels And Tyres In Good Condition

Kerbed wheels are an inevitable fact of life, particularly for city drivers. If the damage is superficial and the rims themselves arent cracked or bent, then it neednt be a reason to discount a car.

The condition of the tyres is of more concern.;

- Tyres need to have a minimum of 1.6mm tread depth to be road legal. Factor this into your offer if theyre close to needing replacing.

- The tyres should also be free from any cuts or bulges. If you notice either on the tyres sidewall, its likely the current owner has previously hit a kerb.

- The tread on each tyre should also be evenly worn.;Overinflated tyres tend to wear more in the middle, while uneven wear can indicated that the wheels or suspension are misaligned. This can reduce tyre performance and increase wear and fuel consumption.

Find out more about tyre construction, labelling and how to choose the correct tyres for your car ;how to buy car tyres.

Know That Everything Is Up For Negotiation

Many people dread negotiating at a car dealership, but it’s one of the best ways to get the car and features that you want at the right price. At the dealership, you can negotiate on several factors beyond the price.;

Milchtein says that you should negotiate to get what’s important to you. “You can also negotiate for things like maintenance services, the set of tires the car needs, a free detail in the future, and even a remote start installation,” she says.

Your car loan’s interest rate is often negotiable at the dealership, too. Getting pre-approved by banks or lenders before shopping and taking that offer with you could create a starting point for negotiating on your car’s interest rate, and help you know what’s a good deal for you.

Also Check: How To Transfer Car Title In Az

Check And Try Before You Buy

Before you agree on a car, its crucial to test drive and check its history. If a deal seems too good to be true, it probably is. Theres always a chance that the car has been involved in an accident, has hidden faults, or;outstanding finances. Test driving can help settle these doubts, and websites like the;AA;and;RAC;can easily run vehicle checks. If you have a friend or family member that knows a fair bit about cars, it might be a good idea to go to the dealership with them so they can look over the car, too.

Contact The Internet Sales Manager Or Fleet Sales Manager

Once you have lined up two or three vehicles that you believe could be the right car for you, contact the Internet Sales Manager or the Fleet Sales Manager of the dealerships with the individual cars in stock. People in these two positions are typically experienced in online vehicle sales. They can cut through much of the back and forth you would get if you dealt with a traditional car salesperson at the dealership.;

You can initiate contact by email, by chat on the dealer’s website, or by telephone. Just by seeking contact with the Internet or Fleet Sales Manager, you have separated yourself from the average car buyer, and you can cement that impression by being straightforward in what you say.

You can start by telling them you noticed a particular vehicle the dealership has in stock, that you are strongly interested in buying it, that you are a “cash-buyer” , and that you are willing to listen to the dealer’s financing options.;

Again, you can do this by email, chat, message/text, or telephone. No matter which of these communication methods you choose and there is no reason not to use several you avoid the face-to-face sales pressure you’d experience in the dealership.;

After you initiate contact, be patient as you wait for responses. You might get a very enthusiastic and helpful response from some and no response at all from others. That alone should guide your search.;

Recommended Reading: How To Get Internet In Your Car

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

How To Negotiate A Car Price

You’ve set your budget. You’ve done your research and you’ve found a used car that you’re interested in buying. Now what? It’s time to negotiate. Make a deal. Some may even call it haggling. But angling for the best price doesn’t have to make for an uncomfortable, combative car-buying experience. Making a strong case for the number you have in mind is your best chance of getting it.

You May Like: My Car Battery Keeps Draining

Negotiating With A Private Seller

Car dealers know how to negotiate when buying trade-ins, so it’s smart to use some of their tactics. First, don’t show any emotion when checking out a vehicle. Make sure to point out all the flaws such as scratches, dings, weird noises, stains, etc.This puts psychological pressure on the seller to devalue their vehicle, making it easier to get concessions later.

Negotiation works best if you are easily able to walk away from a deal . This is why it’s important to have alternative vehicles on your shopping list.

Part of a good negotiation strategy is to always get the other party to make the first offer. Some consider the asking price to be a first offer, but you can do better. Always start off by asking the seller what they really need to do the deal. What’s their rock-bottom price?. Sometimes you’ll get an eager seller who will lower the price considerably with no effort on your part.

Negotiating price on a used car is usually a back and forth process. With each counter-offer, you need to bring up flaws such as the vehicle’s condition or the price compared to others on the market. Devalue the car, then raise your offer slightly each time until you reach your maximum price.

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Also Check: How To Transfer A Car Title In Az

Find Several Options To Choose From

Pay a visit to a handful of dealerships and private sellers that are selling the kind of car you want and get some offers on the table to pick from. The more options you have, the more power you have in a negotiation. You wont feel boxed in to take a bad deal because you have other options available.

Lets say youre looking at two used trucks that are in similar condition. One is being sold at a dealership and the other by a private seller. After you meet the private seller and kick the tires on the truck, the seller says they want $9,000. You tell them youll sleep on it. The next day, you go to the dealership and the sales guy says they want $10,000 for their truck.

You can tell the dealer, Thats not good enough, since you have a better offer on the table. Maybe the dealer will counter with a new offer thats under $9,000. If not, thats okay. You can just go back to the private seller. Either way, you win. Thats the power of having options!

Where Is A Good Place To Find Used Cars For Sale

Also Check: How To Get Sap Off Car

Negotiating The Best Price: The Which Haggling Script

Remain cool, calm and polite and make an effort to be friendly. Its good to smile, use the salespersons name and chat about subjects other than the deal. When it comes to figures, though, it pays to be firm.

Above all, let the dealer know youre a serious buyer and theyll do everything they can to secure a sale.

You say:Im ready to do a deal today at the right price or Im a cash buyer, as applicable. This will let them know youre a serious buyer.;

Show a printout of a deal youve previously researched and ask: Can you match this deal I found online? If not, how close can you get to it?

They say: I really cant match that quote or get close to it.

You say: I appreciate you have a profit to make, but I want a good deal and I know I can get one elsewhere. What sort of deal can you do to persuade me to buy today?

They say: Ill have to go and check this deal with my manager. This is often a ploy to make you think youre getting the best deal possible, whereas theres almost certainly more of a discount to be had.

You say: If your manager is the one deciding the deal, Id like to speak to her/him.

They say: We dont make any profit on this car, or I dont get any commission on sales, or Theres so much demand for this car that we cant offer discounts. These are fictions designed to put you at a disadvantage. Dont accept them.