How To Refinance Your Car Loan

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Refinancing a car loan can help you save money by lowering your interest rate. The process involves replacing your current car loan with a new one, typically with a different lender. Your car will act as collateral on your new loan, just as it did on the original loan. Here’s how the auto loan refinance process works and what to think about before you apply.

Your Current Loans Balance And Remaining Payments

Your existing loans balance and remaining payments can also be a factor. A lender might not want to refinance a loan if it has too lowor highof a balance, or if youre close to paying it off. With LendingClub Bank, you can refinance auto loans if you have at least 24 months of payments left and your balance is between $5,000 and $50,000.;

It Doesnt Make Sense For Everyone

Refinancing your auto loan makes sense if you can save money, but itâs not right for everyone. If youâre almost done paying off your current auto loan, refinancing to a loan with a lower rate wonât save you much money since youâve already paid most of the interest.

Lenders may also place some restrictions on refinancing. For example, some banks and other lending institutions wonât refinance your loan if your vehicle has above a certain number of miles or is more than ten years old.

Also Check: How To Jump Start My Car

Look Into Multiple Types Of Financing

When you first borrowed money to buy a car, it may have been through dealer-arranged financing. However, many banks, credit unions and online lenders offer direct financing to car buyers and owners.

In general, its best to start with the financial institutions you already work with. In some cases, you may qualify for a loyalty discount based on your existing relationship with the bank or credit union.

Dont stop there, though, even if the terms are excellent. Take some time to compare that quote with rate offers from other banks and lenders. This process can take some time, but the more options you compare, the higher your chances will be of getting the best auto loan terms available to you.

Things To Consider Before Refinancing

Don’t Miss: Why Do I Fall Asleep In The Car

Is My Credit Pulled When I Apply For An Auto Loan Refinance

Yes, any time you apply to refinance your current auto loan, you are creating a hard inquiry. All this means if the lender will review your credit report as part of their decision-making process for your new loan.

Keep in mind, the hard inquiry may cause a small dip in your credit score because a new loan often means added debt to the credit reporting agencies. With added debt, the chances of a borrower missing a payment increases, thus lowering your overall score.

However, once the credit reporting agency sees the old loan paid off, the amount of debt decreased and a few monthly payments made on time, your credit score should increase again.

Mistakes To Avoid When Refinancing Your Auto Loan

Refinancing your car loan doesnt always make financial sense. The main mistake you can make when it comes to refinancing is timing. If any of the following scenarios apply to you, it may be worth it to stick with your current loan.

- Youre far along in your original loans repayment: Through the amortization process, your interest charges gradually decrease over the life of the loan. As a result, a refinance has more potential to save money when youre in the earlier stages of repaying the original loan.

- Your odometer is hitting big numbers: If youre driving an older car with high mileage, you may be out of luck. Most auto lenders have minimum loan amounts and wont find it worthwhile to issue a loan on a car that has significantly depreciated in value.

- Youre upside-down on the original loan: Lenders typically avoid refinancing if the borrower owes more than the cars value .

- Your current loan has a prepayment penalty: Some lenders charge a penalty for paying off your car loan early. Before you refinance your loan, investigate the terms of your existing loan to make sure that there are no prepayment penalties.

Also Check: What Is The Safest Car For Teenage Drivers

How To Refinance Your Car Loan In 7 Steps

Modified date: Jun. 8, 2021

Has your credit score improved since you took out your first auto loan? Are you seeking a lower interest rate? Or do you just have a gut feeling that you can find a better deal with a new lender?;

If you answered yes! to one or more of the above questions, refinancing your auto loan might be a smart money move. Put simply, refinancing an auto loan involves taking out a new loan to pay off your old loan and starting over with a new lender.;

If youre ready to explore the possibility of refinancing, you probably have a new set of questions:;

- How can you determine that refinancing is right for you?;

- Do you and your car qualify for refinancing?;

- What documentation will you need to prep?

- How will refinancing affect your credit score?

- What are some common pitfalls to avoid when refinancing an auto loan?;

Ill answer these questions and more as I explore how to refinance your car loan in seven steps.;

Whats Ahead:

Waiting Too Long To Refinance

If you run the numbers and you determine that it makes sense to refinance, waiting can cost you. Rates are typically lowest on new vehicles, and some lenders wont refinance loans for cars over a certain age . You might even get a new car rate if you refinance immediately after purchasing from a dealer and taking advantage of dealer incentives. Used car loan rates are typically higher than new car rates.

Read Also: Which Is The Fastest Car In The World

Benefits Of Auto Refinancing When You Have Bad Credit

- Lower Your Monthly Dues Refinancing your car debt could mean youll get a lower interest rate or it extends the life of the loan, which gives you more time to pay. Either way, youll get to pay lower amounts every month, which could help you save money and manage your budget.

- Improve Your Credit Rating By paying consistently and timely, you will notice improvements in your credit history.

- Get A Chance To Save Getting a lower rate or amount due each month can help you save money a little. Unexpected expenses such as medical costs, come when you least expect them. Its best if you have some savings to help you get by.

What Are Some Reasons Why I Should Refinance My Current Auto Loan

Car owners will generally refinance their auto loans for three different reasons.

Depending on your current situation, an auto refinance could achieve any of these results or even all of them.

For example, let us assume you are one year into your current auto loan. Your original loan amount was for $35,000, at an annual percentage rate of 9%, on a five-year term and a monthly payment of $726.

Loan amount: $35,000

Loan term: 5 years

Monthly payment: $726

Total interest paid over the life of the loan: $8,600

After a year of making regular payments, you decide to refinance your existing auto loan. You qualify for a loan amount of $29,000, a new lower rate of 1.74% APR* and a lower term of four years. This lowers your monthly payment to $626.15 per month, pays the loan off within the original five years, and saves you just over $4,600 in total interest.

New Loan amount: $29,000

*Interest rate of 1.74% APR includes a 0.25% discount for having a Benefits Checking account.

Loan term: 4 years

Monthly payment: $626.15

Total interest paid over the life of the loan: $3,969.89**

**Interest paid first year of original loan $2,915 plus total interest of new loan of $1,054.89.

Read Also: How To Remove Hard Water Stains From Car

How Can Auto Loan Refinancing Affect Your Finances

When you refinance a car, you replace your current car loan with a new loan of different terms. In practice, auto refinancing is the process of paying off your current car loan with a new one, usually from a new lender. This process can have varying outcomes for car owners.

Most people refinance their car in order to save money, but this goal can take multiple forms. For example, some refinance to lower their monthly car payments, others want to reduce their interest rates or adjust the length of their loan term. And still others have more personal reasons to refinance, such as removing co-signers from their loan. No matter what your goal is for refinancing your car, its important you understand the possible outcomes. If you want to know when it may make sense to consider refinancing your car, this article may help: When can I refinance my car loan?

Refinancing A Car Loan

Home \ Blog \ Auto \ Refinancing a Car Loan

Join millions of Canadians who have already trusted Loans Canada

Every year, you go through long-term budget arrangements and try to find new ways to save. Car refinancing has the potential to improve your monthly budget. Those who entered into a subprime auto loan and have since gotten a raise, reduced debt, or improved their credit, may be eligible for refinancing. To learn whether refinancing is the right step, its important to learn the options available to you. Armed with this information, you can make an informed decision and choose the best possible refinancing arrangement.

Also Check: What Gas Stations Accept Synchrony Car Care

Shop For The Best Deal

With any type of loan, it’s important to get quotes from multiple lenders. You can start by getting quotes from online lenders like LendingClub and CarsDirect. But you may want to check with small local banks and as well.;

In general, you shouldn’t worry about multiple inquiries showing up on your credit report. In many cases, auto loan lenders can use a soft inquiry to give you a rate quote and wait to perform a hard inquiry until you actually apply for a loan.;

And even multiple hard pulls will usually be viewed as one hard credit inquiry as long as they take place within a 14-day span.

Youre Having Trouble Keeping Up With Bills Each Month

Even if youre not able to secure a lower interest rate, it may still be worth trying to find a loan with a longer repayment period in order to reduce your monthly car payments.

If you cant find a suitable loan, you may also be able to renegotiate the repayment period on your current loan. But keep in mind that more time spent paying back your loan is also more time spent paying interest. In general, youll pay more interest overall if you have a loan with a longer term.

Recommended Reading: How To Wash Ceramic Coated Car

How Do You Refinance An Auto Loan

Refinancing an auto loan is a much faster process than, say, refinancing a mortgage. You should have all the necessary info on hand, including info about your current loan, like your monthly payment, your interest rate, and your loan term. Youâll also want to check with your current lender to see if youâll have to pay a prepayment penalty.

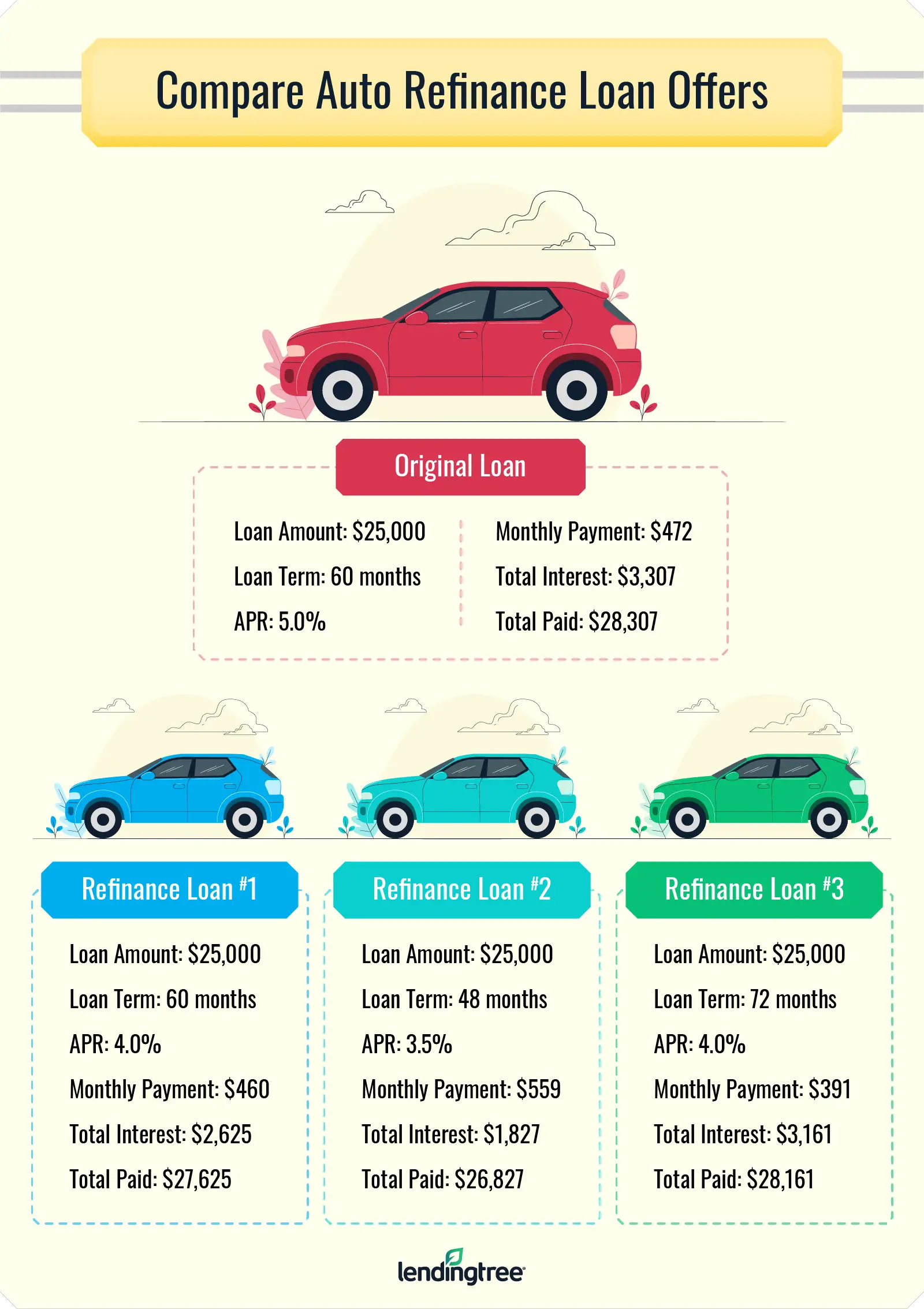

Just like any time you apply for a loan, you should apply with multiple lenders and then compare loan offers to see which is the best one . If youâre looking to save money, make sure youâre considering loan term as well as interest rate.

Once youâve crunched the numbers and decided on the loan thatâs right for you and your bank account, youâll sign a new loan agreement. Your loan will pay off your own loan and then youâll start making your new monthly payments.

Gather The Necessary Documents

If you decide that refinancing your auto loan is right for you, you’ll want to start collecting the documents that lenders will need. Here are the types of documents that you’ll probably need to track down.

- Personal information like your social security number and driver’s license

- Income information like your last few pay stubs and tax forms from the last two to three years

- Car information like the title, registration, proof of insurance, VIN number, and mileage;

- Loan information like the lender’s name and your current balance

Once you’ve gathered the necessary documents, it’s time to start the loan-shopping process.

Also Check: Can I Register My Car Online Florida

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

How To Refinance A Car

This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects , and consumer class action cases. He holds a BS in Biology from the University of Southern California . Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 252,994 times.

Don’t Miss: What Is My Car Worth Nada

Details Of Your Existing Loan

Lastly, your new lender may want to hear details about your relationship with your current lender. They may ask about your existing interest rate, your loan amount remaining, and other terms.;

Now, your new lender also may not ask about this stuff at all. It could be because they dont care, or it could be because they plan to look it up themselves.;

Either way, however, you might as well gather this info for your own benefit. Having your interest rate, remaining loan amount, prepayment penalties, and other key details on hand will help you cross-shop, do fast math, and ensure youre getting a better deal on a refinance.;

Once you have all the things ready, its time to start window shopping.;

Pay Off Your Old Loan & Start Making New Monthly Payments

Once you close your new loan, the lender will use the funds to pay off the old loan. Youll then make payments to the new lender according to their instructions.

Many lenders offer an autopay discount, so ask your lender if they offer this. You could lower your interest rate by 0.25% 0.5% for setting up regular payments.

Also Check: What Kind Of Car Did Columbo Drive

Applying For An Auto Refinance Loan

If refinancing still seems to make sense after running your calculations, it’s time to dig into all of the details.

Question the banks that you’re considering about any fees that you’ll be expected to pay. A small fee to transfer the title and re-register the vehicle is to be expected, but some banks may also tack on a processing fee.

Also, ask if there is a pre-payment penalty built into the loan. If so, avoid itâit will penalize you for paying off your loan early.

Once you’ve compared all of your options, submit your loan application to the bank with the best deal.

Is A Refi The Right Choice For Me

If you have a high interest rate on your car loan, and current market rates have dropped, you may want to consider refinancing. Interest rates are at near-historic lows right now, and you may qualify for a better rate.

Borrowers whose credit has improved significantly since they first took out the loan may also be eligible for a better rate. For example, if you had a bankruptcy or default fall off your credit report, your credit score may be much higher now.

If you can refinance with a co-signer or co-borrower, then you may receive better rates if you were the only borrower on the original loan.

Don’t Miss: What To Use To Clean Car Windows

Benefits Of Refinancing A Car Loan

There are a few reasons to consider refinancing your car loan with a different lender. Here are some benefits to keep in mind:

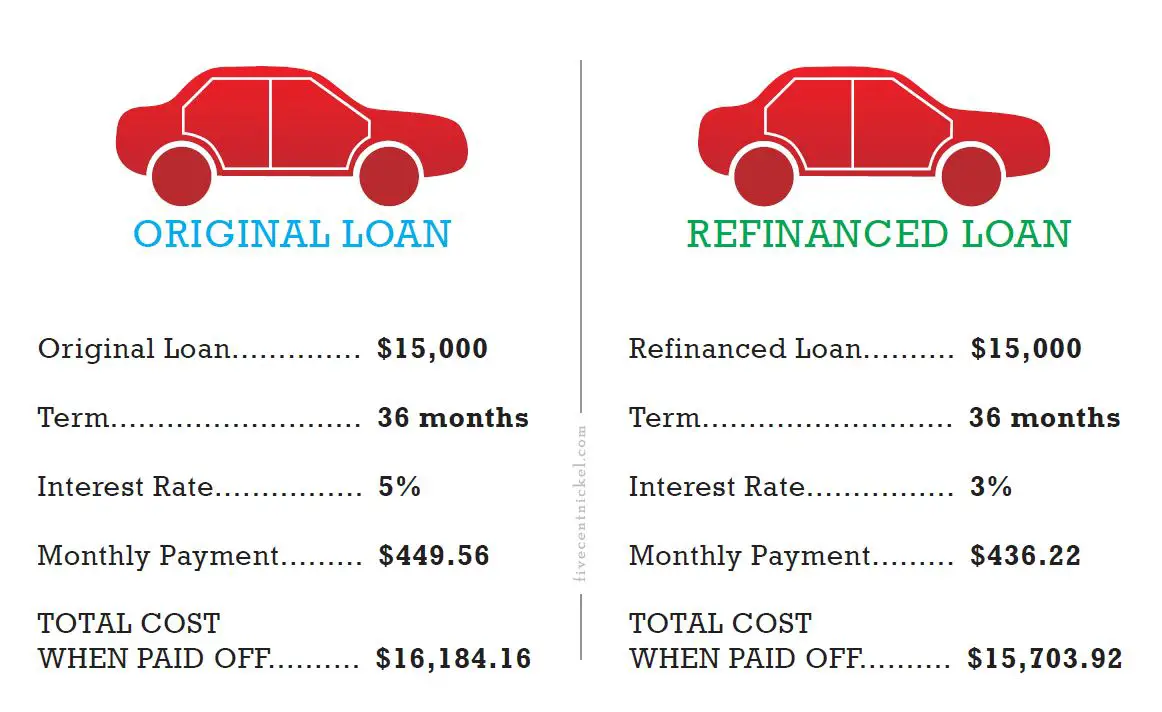

- Lower interest rate: If your credit has improved since you first bought your vehicle or market interest rates have decreased, you may be able to get a lower interest rate than what you have right now.

- Lower monthly payment: If you keep the same repayment term, a lower interest rate will typically translate into lower monthly payments. If you want to lower your monthly payment even more, though, you may be able to get a new loan with a longer repayment term. This may mean higher interest charges over the life of the loan, but it can be worth it if your monthly budget is tight.

- Choose to pay off debt sooner: On the flip side, you could also choose a shorter repayment term. Shorter terms typically correspond with lower interest rates, which means you’ll save more money and eliminate the debt sooneralthough your monthly payments will be more expensive.

- Get cash from your equity: Some auto lenders offer cash-out refinance loans that allow you to refinance the original loan and get some cash to pay for other expenses. This option is typically limited to people who have a lot of equity in their vehicle.

As you consider these benefits, think about whether refinancing is right for you and take steps to refinance your auto loan.