What Car Can I Get For 150 A Month

First unveiled at the NAMPO agricultural show in 2017, the Bajaj Qute has set social media alight more recently with stories, memes, jokes and videos about this compact little ‘car’. The story goes that you can buy it for only R5 000, that it will only cost you R150 per month and that you can insure it for only R1. 20.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Makes You Feel Stupid

Deep down, you know that if you cant pay cash for your car, you cant afford the car. Each payment you make is a reminder how foolish you are with your money. Why would you want to be reminded every single month of being dumb? The thrill of owning a nice car fades after about six months. But the payment stays the same for years.

Also Check: What Year Is My Ezgo Golf Cart

I Make $60k Per Year What Car Can I Afford

What are some cars that I can afford on my $60k salary? I donât want to buy something that I canât afford, but Iâve never bought a car on my own before and I donât really know whatâs in my budget.

no more than 35%$21,000 or less

The Bottom Line: The Price Of A Ride

As the markets reflect, many consumers opt for less expensive cars in the easily affordable $15,000-$20,000 range.

At $60,000 per year, the sweet spot for a great brand new car payment falls somewhere in the area of $25,000 range, which are affordable for this type of purchaser, coming in at around 10-15% of living expenses, and delivering a better quality car.

Purchasers who feel that the bigger price tag is worth the comfort or style will uncomfortably stretch their budget in the $40,000-$50,000 range, or hit the high end at $50,000 plus.

Fun Fact: Ive been driving a 2006 Nissan Pathfinder for the last 3 years, I paid $2,500 for it and I love it. Hopefully that didnt throw you for a loop, but if youve read my blog much before, you know I hate debt!

Thanks for driving folks! I mean reading! Come back any time.

Geek, out.

Noel Moffatt is a former collegiate and professional basketball player who now works in Saas based sales. When Noel’s not at work or writing in his Financial Geek blog, you can find him at the hockey rink, a golf course or a Crossfit class.

You May Like: How Much Is A Car Registration In California

Consider Your Annual Income

According to MoneyUnder30 the recommended range for a vehicle budget spans from 10% of annual income to 50%. For example, lets assume earnings of $50,000.

The 10% rule

One rule you may wish to follow if youre more on the frugal side is spend no more than 10% of your annual income on a car. Lets say you make $50,000 annually.

10% of annual income: $5,000, the amount to spend on a vehicle.

Now, $5k isnt likely to net you a new vehicle, but you could find a great used car under $5,000 with our helpful guide.

The 50% rule

Income: $50,000

Vehicle purchase price: $25,000 = 50% of $50,000

According to Kelley Blue Book vehicle valuations, the average midsize car fits perfectly with a 50% vehicle budget. But remember, youre going to need gas, maintenance, vehicle registration and more. Can you safely fit that into your budget?

The 30% rule:

A more modest and generally affordable cap would be 30% of your annual income. This gives you ample room to budget gas, insurance, maintenance and other car related expenses as needed.

Income: $50,000

Vehiclepurchaseprice: $15,000 = 30% of $50,000

How Much Car Can I Afford Its A Question Asked By Many Car Shoppers And Its Easy To Understand Why For Many Of Us A Car Purchase Is A Big Expense Second Only To Purchasing A Home

In September 2020, the estimated average price of a new vehicle in the United States was $38,723, according to Kelley Blue Book. But whats a comfortable fit for your budget?

To answer this question, you have two choices: You can follow conventional wisdom, or you can take a more customized approach to budgeting.

Read Also: How To Repair Burn Hole In Cloth Car Seat

How Much Car Can I Really Afford

Got your eye on a brand-new ride? Exciting, isnt it? Shopping for the vehicle of your dreams can be an exhilarating experience. Theres just something about that new car smell that revs up the engines and puts you in a buying mood. But getting caught up in the moment can make it easy to overspend. So before you fork over your hard-earned cash, take some time to think about what you can realistically afford.

Dont worry. Budgets dont have to be a bummer. With a little homework and some basic number crunching, you can get the car you want without emptying your pockets.

Is 700 Too Much For Car Payment

According to experts, a car payment is too high if the car payment is more than 30% of your total income. … Make sure your car payment does not exceed 15%-20% of your total income. This will ensure you have enough cash in hand to make payments for other loans, utility bills, and household expenses.

Don’t Miss: Transport Puppy In Car

Get An Initial Figure By Using A Car Loan Calculator

The interest rate you receive on an auto loan plays a big part in calculating your monthly payment amount. A higher credit score will score you a lower interest rate, which will ultimately lower your monthly payment and your total overall loan cost.

You can use a car loan calculator to determine how different interest rates will affect your monthly payment. Heres how:

- Pull a copy of your credit report and find out your .

- Get prequalified with a few lenders to determine the average interest rate you could be offered.

- Plug in your interest rate, desired repayment term length and car price to the calculator.

How Does The Car Affordability Calculator Works

The above car affordability calculator uses a conservative but solid assumption about how much cars you can afford. Whether youre paying money or financing, the purchase price of your car should be no more than 35 percent of your annual income.

If youre financing a car, the total monthly amount you spend on transportation your car payment, gas, car insurance, and maintenance should be no more than 10 percent of your gross monthly income.

The calculator doesnt ask for gas and insurance values but will begin to reduce the purchase price you can afford if the terms of your loan make your monthly payment exceed 10 percent of income.

You May Like: Diy Car Freshie

Calculate Fuel Usage And Insurance Costs

In addition to a monthly car payment, your monthly automotive budget must include the cost of filing up the gas tank and paying for insurance. Both of these costs can fluctuate depending on where you live, your driving habits, and the vehicle you choose.

For fuel expenses, refer to the EPAs FuelEconomy.gov website. It has a detailed listing of fuel economy figures, annual fuel cost estimates, and other tools for new and used vehicles.

Contact your auto insurance company with information about the vehicle or vehicles youre considering and obtain quotes. A newer car generally means higher insurance premiums for the owner.

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

You May Like: Car Cleaning Putty Autozone

Is 60k A Year Good For A Single Person

60k as a single male is plenty enough to have a used car, rent your own 1BR apartment in a good part of town, put away some cash in 401k/roth ira, go out every weekend eating/drinking without having to sweat it. but you wont be buying new cars, living like a baller, or impressing any of your friends with money.

Who Can Afford A New Car

Many buyers fret over the process of buying a new car, but you dont have to. Buying a new car can be a very exciting process! The most important thing to do, before you begin your car buying journey, is determine how much you have to work with.

If you craft a budget and stick to it, a budget that can accommodate a new car, the answer could be you!

Don’t Miss: Can My Sister Join Usaa

What Is A Good Salary Per Year

This depends on your specific situation. According to the Bureau of Labor Statistics, a 60k annual income is the median US income. This means that half of all workers in the US make more than 60k per year, and half make less.

However, 60k per year is generally considered to be a good salary. This amount can provide you with a comfortable lifestyle while also leaving room for savings. There are many things that you can do with $60,000. For example, you could use the money to pay off debt, save for retirement, or invest in yourself by taking courses and learning new skills.

How Much Should Your Car Cost Compared To Your Salary

Also Check: What Do You Use To Keep Car Doors From Freezing Shut

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

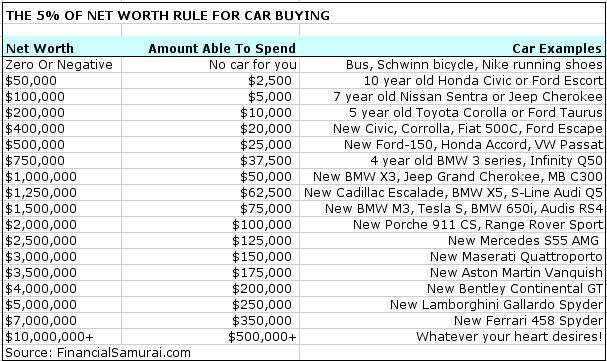

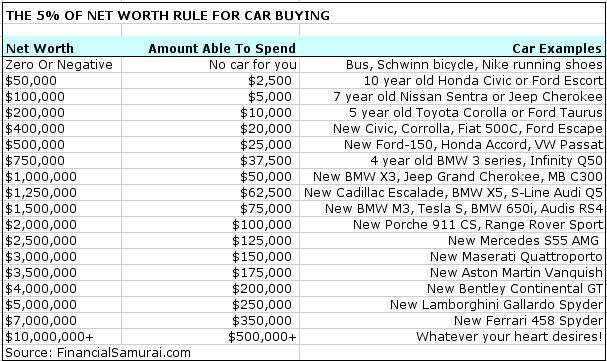

The Car Buying Rule To Follow: The 1/10th Rule

The #1 car buying rule to follow is my 1/10th Rule for car buying. The rule states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. The car can be new or old. It doesnt matter so long as the car costs 10% of your annual gross income or less.

If you make the median per capita income of ~$42,000 a year, limit your vehicle purchase price to $4,200. If your family earns the median household income of $68,000 a year, then limit your car purchase price to $6,800. Absolutely do not go and spend $39,950, the absurdly high median new car price today!

If you absolutely want to buy a car that costs $39,950, then shoot to make at least $399,500 a year in household income. You might scoff at the necessity to make such a high amount. However, it takes at least $300,000 a year to live a middle class lifestyle with a family today.

Also Check: What Commission Do Car Salesmen Get

Determine Your Fuel And Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you’ve chosen. Even though it takes a little work to come up with these estimates, you shouldn’t overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up others might have a higher cost to insure.

The EPA’s Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you’re interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you’re OK.

Is 60k A Year Good If Youre Just Out Of College

A recent study by Payscale found that the average salary for a person with only a bachelors degree is $60,000 per year. This seems like a good amount of money, but when you break it down, its not as impressive.

So is 60,000 a good salary? If youre just starting out, its definitely acceptable. However, if youre already established in your career or have years of experience under your belt, 60k may not be enough.

Read Also: Carmax How Much Is My Car Worth

Qualifying For A Mortgage With A $60k Income

Lets imagine a family of three, the Smiths, with a total annual household income of $60,000. Their combined income will help them qualify for a mortgage.

-

Terry works in a department store and makes $25,000/year.

To keep matters simple, lets assume the Smiths have no other regular sources of income such as investment income or commissions. They are W2 employees receiving paychecks on a bimonthly basis.

The Downpayment On Your Car Should Be At Least 20% Of The Purchase Price

If you put any less down, you could be paying more than what the car is worth by the end of the year, it is also known as negative equity. According to Edmunds, a car depreciates in value by 9% as soon as you drive it off the lot. By the end of the year, that same car has lost about 19% of its value.

Think about it, if you buy a $20,000 car with 0% down by the end of the first year your car is worth $16,200 through depreciation. However, assuming 4% annual percentage rate interest on a 5-year loan youâre paying about $370 per month your remaining amount owing is roughly $15,560, but this amount does not include applicable taxes, fees, and finance charges of the loan itself.

However, If you put 20% down, your car payments are $295 per month and your remaining amount owing is $12,460 . Still. you owe less, youâre paying less per month, and youâre nearly halfway to paying off the car completely.

A lower monthly payment makes affording gas, maintenance, and auto insurance a little easier on the pocketbook.

Read Also: Where Is Columbo’s Car Now

How Much Do You Care About Your New Car

Are you a car person? While some people buy cars in order to get to and from their workplace, other people buy cars because theyre passionate about driving or like a certain make and model.

The amount you should spend on a car as a percentage of your salary really depends on how much you care about cars. Are you buying a car just to get to and from work or are you buying a vehicle youll use for road trips and weekend drives?

MoneyUnder30 recommends using one of three percentages to work out how much you can afford to spend on a new car based on your needs:

- If youd like a cheap, affordable and simple vehicle thats good enough to get to and from work, budget about 10 to 15 per cent of your annual income.

- If youd like a safer, more reliable and more comfortable car for travelling to and from work and on using on weekends, budget about 20 to 25 per cent of your income.

- If youre a car person and you view a car not just as a means of getting to and from places, but as a lifestyle item, budget about 50 per cent of your annual income.

Sound a little too simple? Dont know which category you fall into? These rule are designed to make budgeting for a car easier, but theyre not set in stone. Read on to work out how much you should spend on your next new car.